https://t.co/jEePNYKZP4

https://t.co/jEePNYKZP4

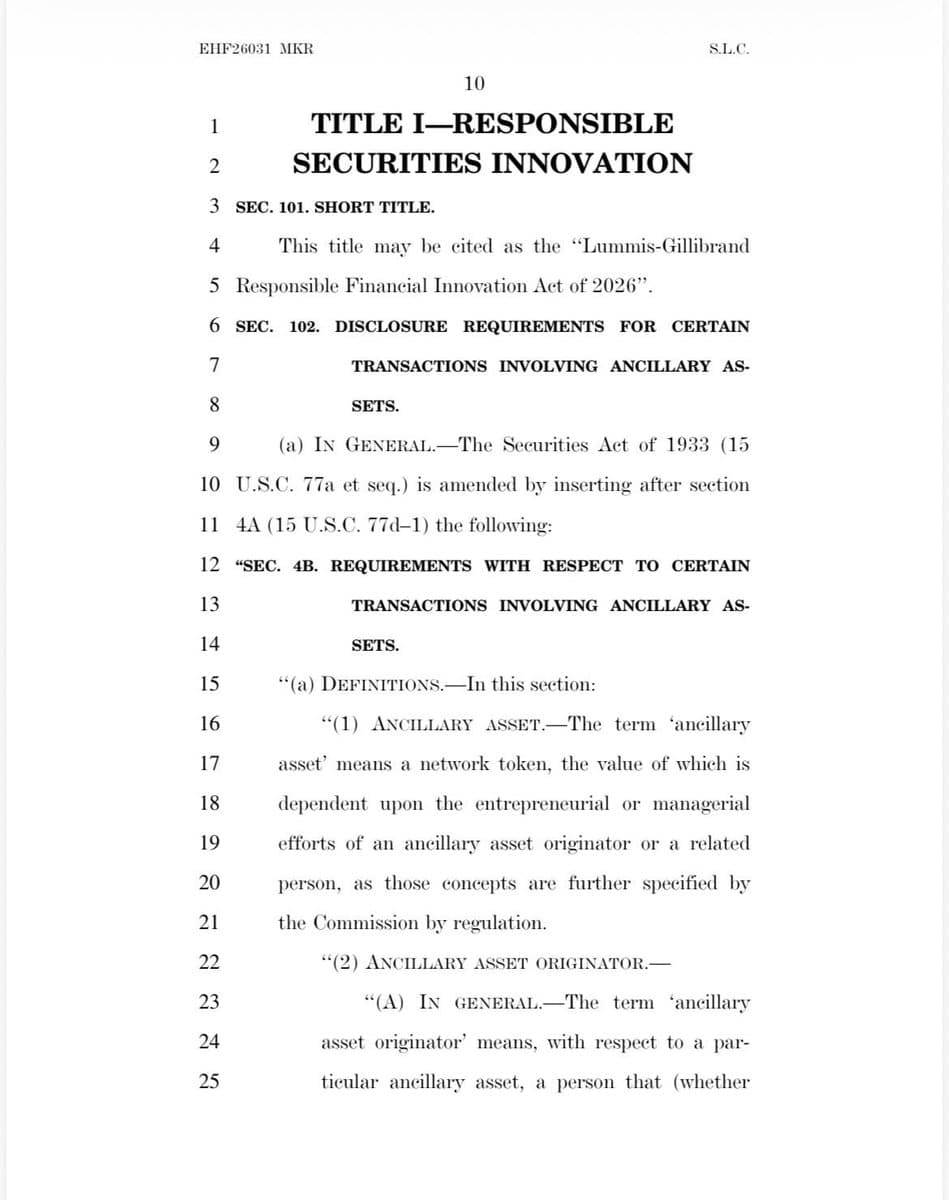

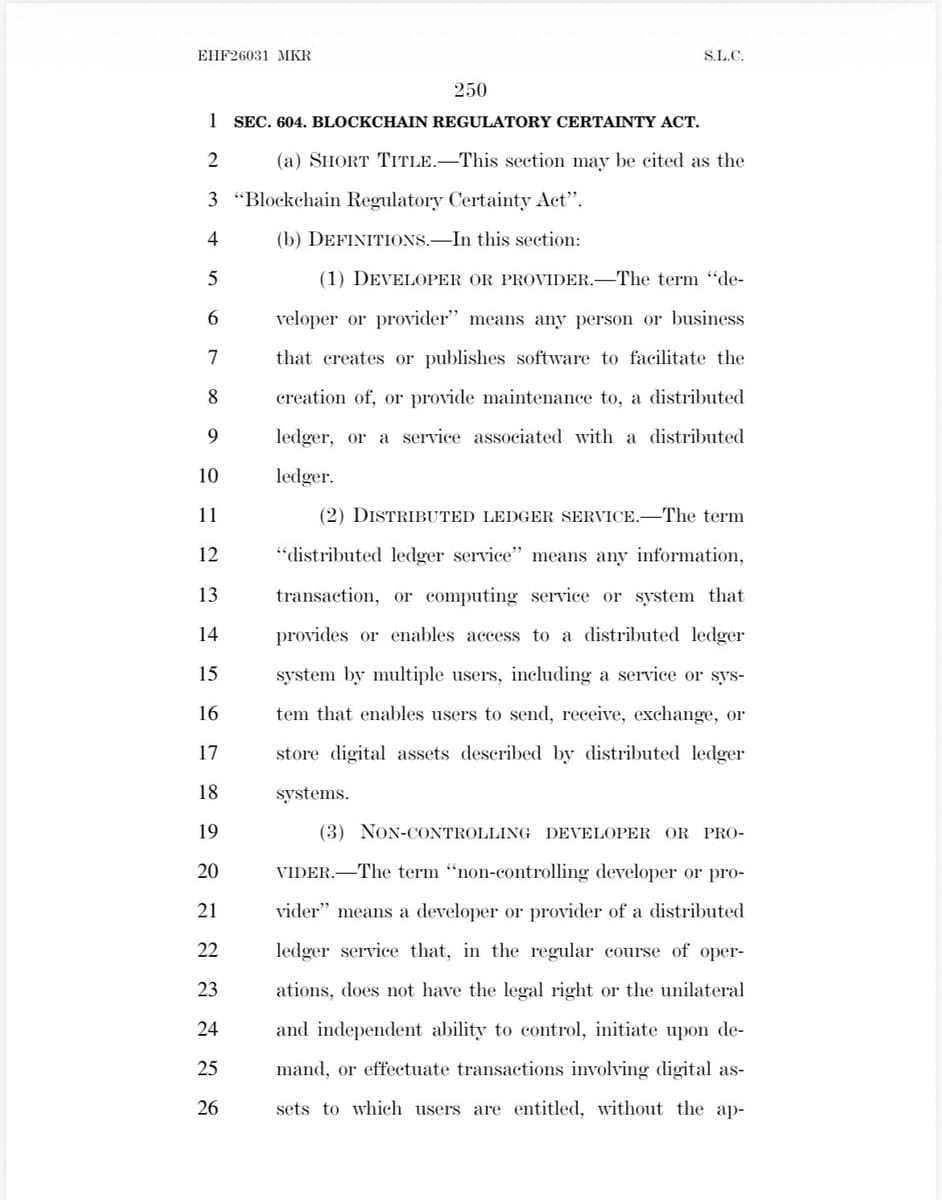

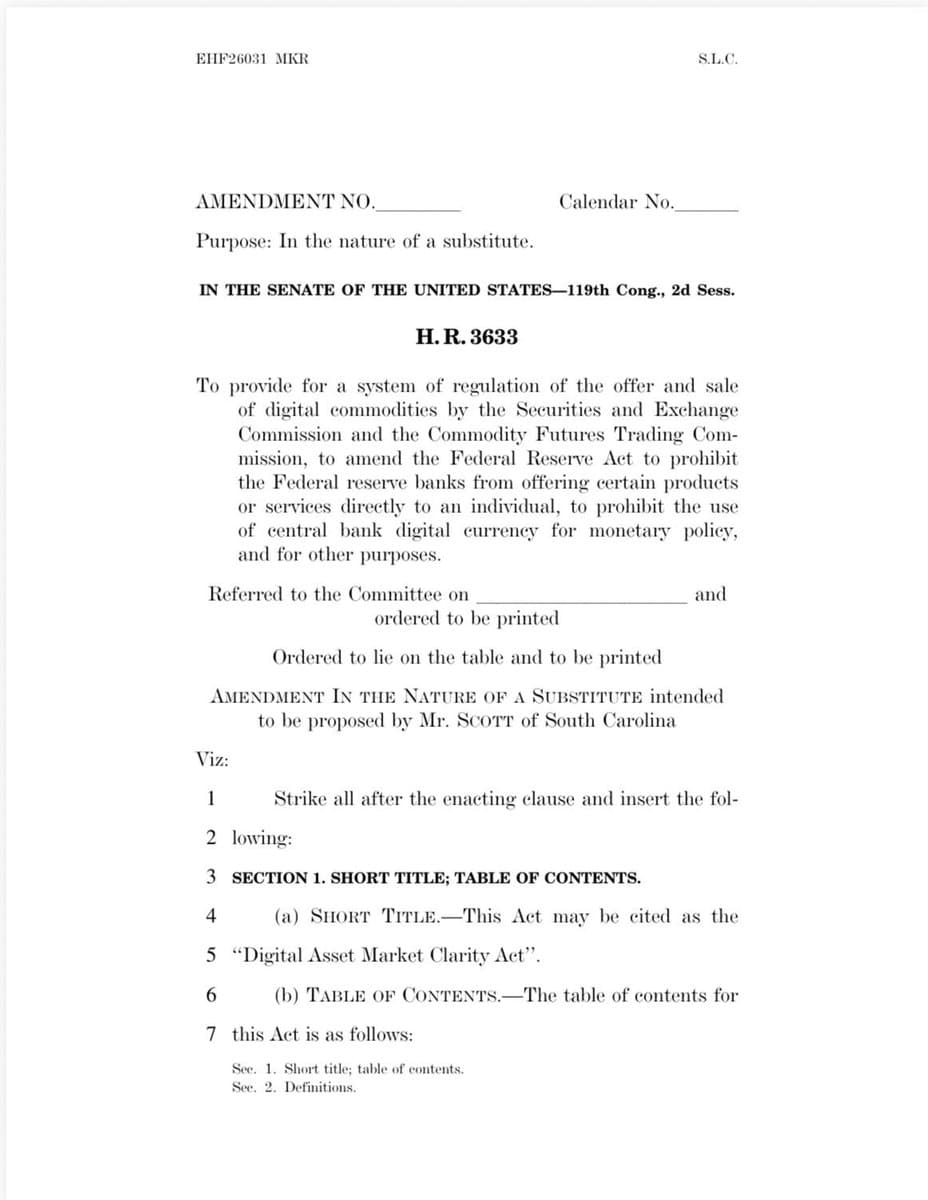

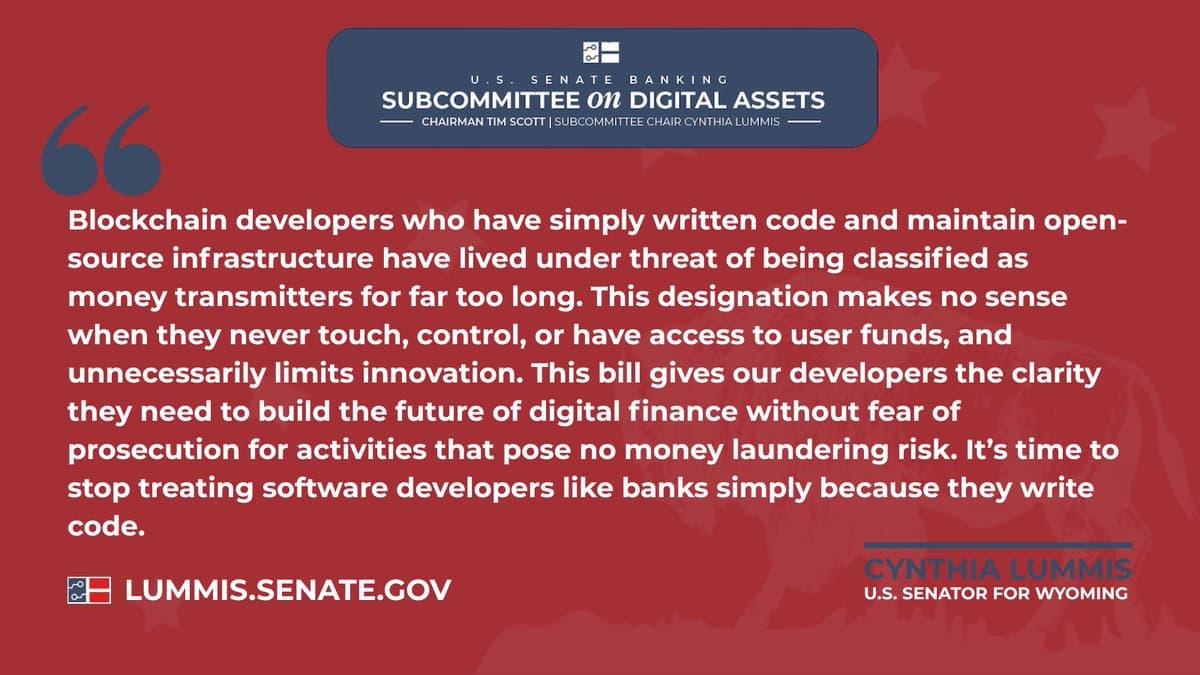

Freedom — Developing, publishing, and administering code is not a crime

Freedom — Developing, publishing, and administering code is not a crime

Clarity — Network tokens and collectible NFTs are not securities

Clarity — Network tokens and collectible NFTs are not securities

Market Access — ICOs are legalized

Market Access — ICOs are legalized

Transparency — Builders can openly discuss what they're building rather than operating in shadows

Transparency — Builders can openly discuss what they're building rather than operating in shadows

Fairness — Insider trading and rug pulls are outlawed

Fairness — Insider trading and rug pulls are outlawed

Alignment — Builders can drive value to tokenholders

Alignment — Builders can drive value to tokenholders

Integration — TradFi can access and use permissionless DeFi

Integration — TradFi can access and use permissionless DeFi

Tokenization — U.S. financial infrastructure (securities, brokers, etc.) can move onchain

It isn't perfect. But the legislation empowers builders to create an open and decentralized future — one that's more resilient to corporate extraction, government censorship, and algorithmic distortions.

Nothing like it exists today and we must seize this opportunity.

Freedoms are not easily won, but they are easily lost.

Tokenization — U.S. financial infrastructure (securities, brokers, etc.) can move onchain

It isn't perfect. But the legislation empowers builders to create an open and decentralized future — one that's more resilient to corporate extraction, government censorship, and algorithmic distortions.

Nothing like it exists today and we must seize this opportunity.

Freedoms are not easily won, but they are easily lost.

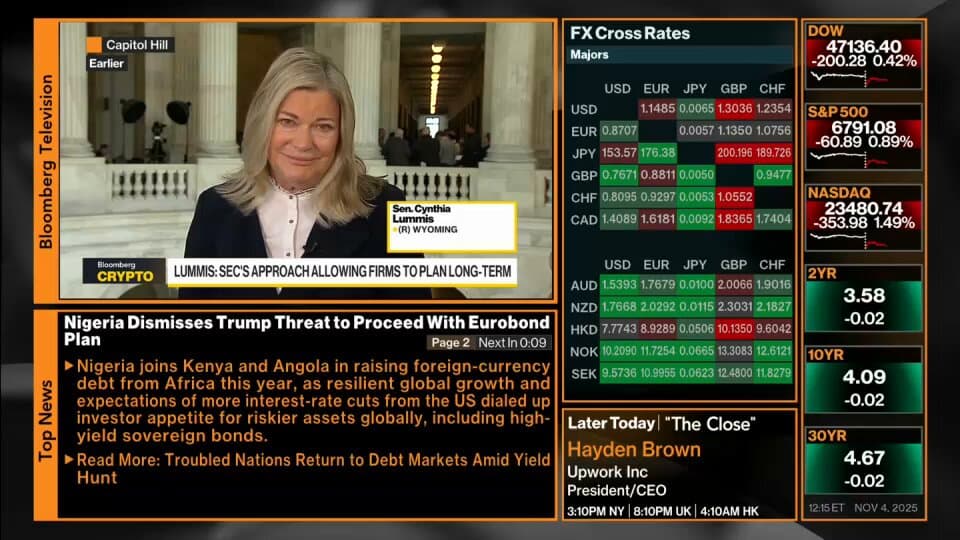

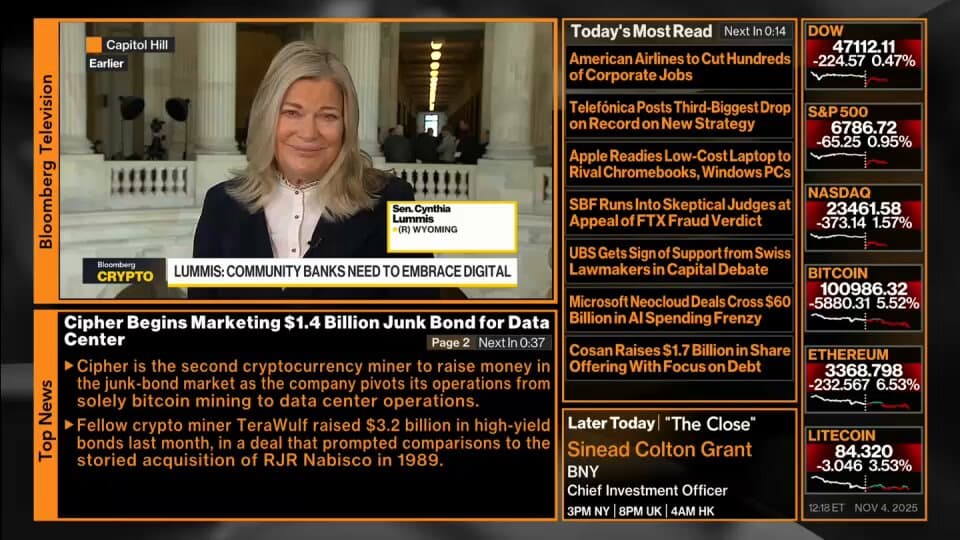

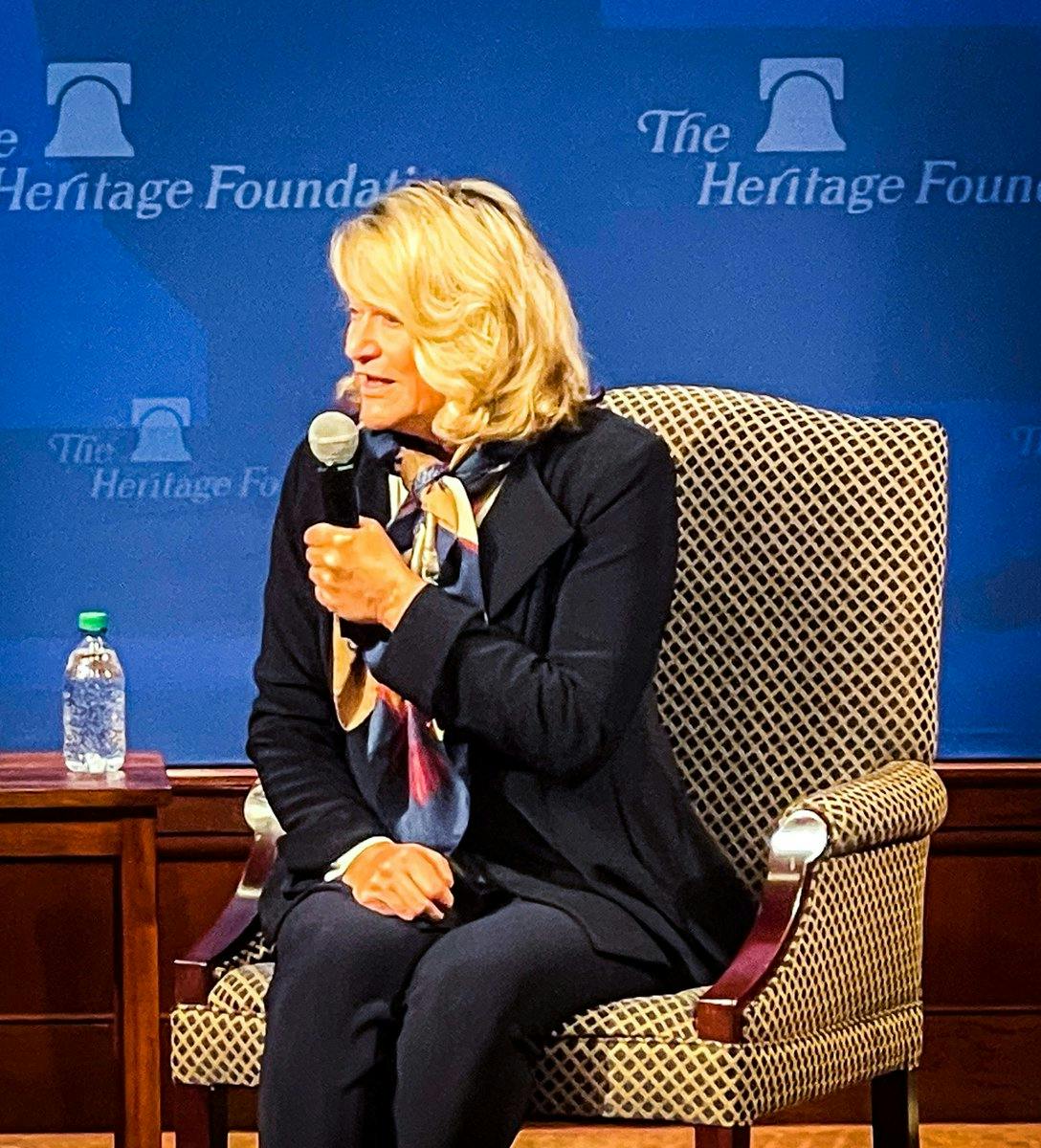

BTS from earlier today, as I answered questions about tomorrow’s markup of the Digital Asset Market Clarity Act.

BTS from earlier today, as I answered questions about tomorrow’s markup of the Digital Asset Market Clarity Act.

Draws the line between digital asset securities and commodities

Draws the line between digital asset securities and commodities

Protects Americans with clear safeguards and regulations

Protects Americans with clear safeguards and regulations

Secures the U.S. as the digital asset capital of the world

Secures the U.S. as the digital asset capital of the world

NEW: It seems that the SDNY/DOJ has sold the bitcoin that the Samourai devs paid it as part of their plea deal even though Executive Order 14233 mandates that forfeited bitcoin be held in the U.S.’s Strategic Bitcoin Reserve.

And this wasn’t the first time in the Samourai case that the SDNY acted in defiance of federal guidance.

bitcoinmagazine.com/news/did-doj-p…

NEW: It seems that the SDNY/DOJ has sold the bitcoin that the Samourai devs paid it as part of their plea deal even though Executive Order 14233 mandates that forfeited bitcoin be held in the U.S.’s Strategic Bitcoin Reserve.

And this wasn’t the first time in the Samourai case that the SDNY acted in defiance of federal guidance.

bitcoinmagazine.com/news/did-doj-p…

businesswire.com/news/home/2025…

businesswire.com/news/home/2025…

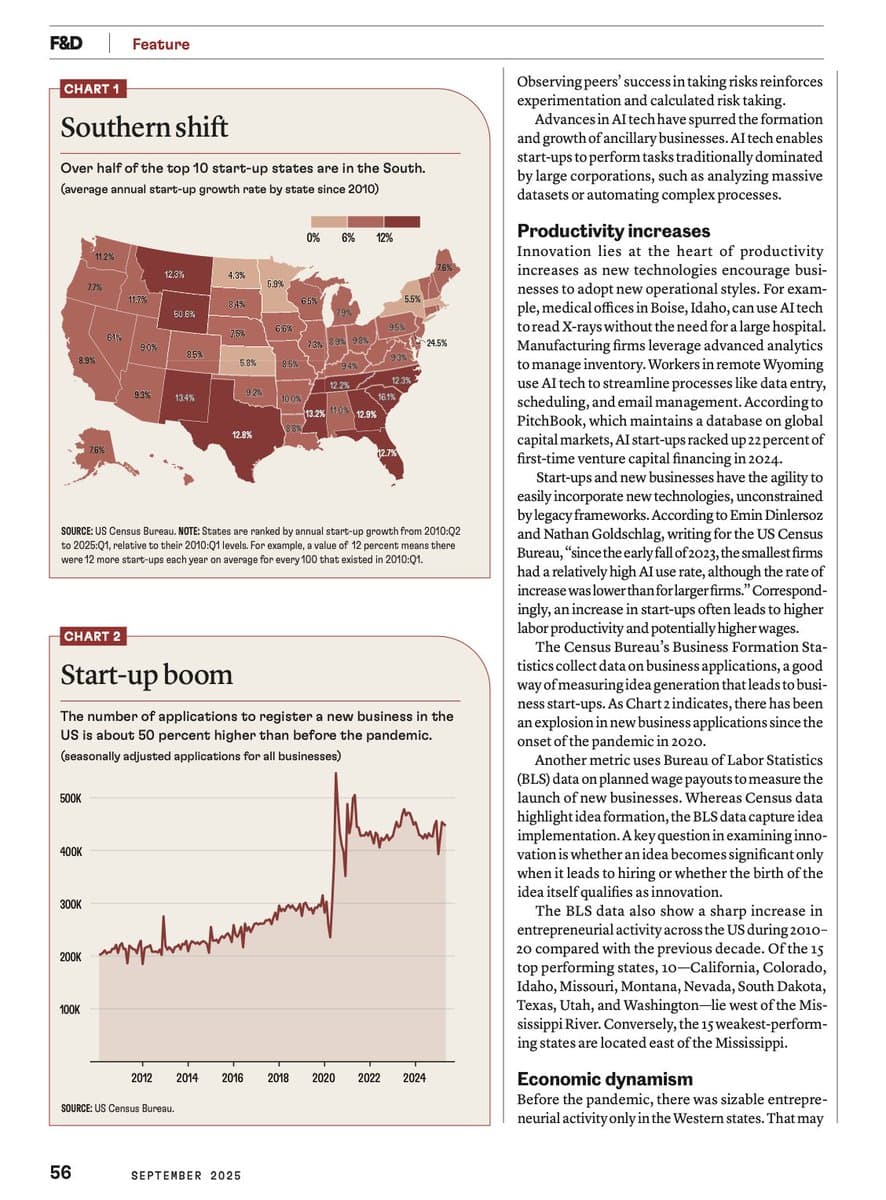

imf.org/-/media/Files/…

imf.org/-/media/Files/…

Regulation that enables innovation and capital formation.

Regulation that enables innovation and capital formation.

Regulation that ensures fairness, equality and protection.

It’s not one or the other. It’s both.

This balance is critical not just for the health of our economy but for the inclusivity of our financial future.

When I was at @TIME, @JanellRoss wrote an incredible piece titled “Inside the World of Black Bitcoin, Where Crypto Is About Making More Than Just Money.”

This piece captured a growing movement where crypto is not just about speculation, rather about empowerment and access.

Leaders like @johnhopebryant have long spoken about financial inclusion through this same lens pointing to the millions of Americans who remain outside the existing financial system, not because they lack ambition, but because they lack access.

Access is opportunity; and opportunity is what America has always stood for. That is why bi-partisan support matters so much.

This technology already exists.

The access already exists.

What is missing are the guardrails that ensure innovation can flourish while people are protected as they navigate new financial frontiers.

This should not be a partisan issue. And, I have seen leaders from both sides of the aisle recognize this truth. @SenatorTimScott, @SenLummis and @berniemoreno speak eloquently about it last week during the Senate Banking Committee hearing. @SenAlexPadilla, @RitchieTorres and others have also shown deep interest in this very issue as well. I am highlighting just a handful of many Republicans AND Democrats who care about this holistically. There are way more supporters on both sides than opposers.

When we work together - across parties and perspectives - we can ensure the United States remains the global leader in innovation, job creation and financial inclusion.

Crypto isn’t red. It isn’t blue. It’s the next great technological infrastructure layer; one that can make our systems faster, more transparent and more equitable.

Regulation that ensures fairness, equality and protection.

It’s not one or the other. It’s both.

This balance is critical not just for the health of our economy but for the inclusivity of our financial future.

When I was at @TIME, @JanellRoss wrote an incredible piece titled “Inside the World of Black Bitcoin, Where Crypto Is About Making More Than Just Money.”

This piece captured a growing movement where crypto is not just about speculation, rather about empowerment and access.

Leaders like @johnhopebryant have long spoken about financial inclusion through this same lens pointing to the millions of Americans who remain outside the existing financial system, not because they lack ambition, but because they lack access.

Access is opportunity; and opportunity is what America has always stood for. That is why bi-partisan support matters so much.

This technology already exists.

The access already exists.

What is missing are the guardrails that ensure innovation can flourish while people are protected as they navigate new financial frontiers.

This should not be a partisan issue. And, I have seen leaders from both sides of the aisle recognize this truth. @SenatorTimScott, @SenLummis and @berniemoreno speak eloquently about it last week during the Senate Banking Committee hearing. @SenAlexPadilla, @RitchieTorres and others have also shown deep interest in this very issue as well. I am highlighting just a handful of many Republicans AND Democrats who care about this holistically. There are way more supporters on both sides than opposers.

When we work together - across parties and perspectives - we can ensure the United States remains the global leader in innovation, job creation and financial inclusion.

Crypto isn’t red. It isn’t blue. It’s the next great technological infrastructure layer; one that can make our systems faster, more transparent and more equitable.

The seizure of 127,000 bitcoin underscores two urgent priorities for Congress: first, passing clear digital asset market structure legislation to ensure law enforcement can act decisively against bad actors while protecting innovation.

The seizure of 127,000 bitcoin underscores two urgent priorities for Congress: first, passing clear digital asset market structure legislation to ensure law enforcement can act decisively against bad actors while protecting innovation.

Second, codifying how seized bitcoin is stored, returned to victims, and safeguarded for future generations. Turning criminal proceeds into assets that strengthen America’s Strategic Bitcoin Reserve shows how sound policy can turn wrongdoing into lasting national value.

Second, codifying how seized bitcoin is stored, returned to victims, and safeguarded for future generations. Turning criminal proceeds into assets that strengthen America’s Strategic Bitcoin Reserve shows how sound policy can turn wrongdoing into lasting national value.

Thank you @USTreasury & @realDonaldTrump.

Thank you @USTreasury & @realDonaldTrump.

JUST IN: 12 Senate Democrats unveiled a detailed framework for market structure legislation this morning, signaling the minority party’s readiness to work across the aisle on comprehensive crypto reform.

The group, made up of @SenRubenGallego, @MarkWarner, @SenGillibrand, @SenBooker, @CortezMasto, @SenatorLujan, @SenatorHick, @SenatorWarnock, @SenAdamSchiff, @SenatorAndyKim, @SenLBR and @Sen_Alsobrooks, lays out seven key pillars they believe market structure legislation should include.

They say the framework is meant to act as a roadmap to guide what they hope will be ‘robust, fruitful, bipartisan negotiations’ with Republicans.

JUST IN: 12 Senate Democrats unveiled a detailed framework for market structure legislation this morning, signaling the minority party’s readiness to work across the aisle on comprehensive crypto reform.

The group, made up of @SenRubenGallego, @MarkWarner, @SenGillibrand, @SenBooker, @CortezMasto, @SenatorLujan, @SenatorHick, @SenatorWarnock, @SenAdamSchiff, @SenatorAndyKim, @SenLBR and @Sen_Alsobrooks, lays out seven key pillars they believe market structure legislation should include.

They say the framework is meant to act as a roadmap to guide what they hope will be ‘robust, fruitful, bipartisan negotiations’ with Republicans.

K

K

NEW BONUS EPISODE: We interviewed @SenLummis in her home state of Wyoming

We chat about her crypto journey, the new Wyoming stablecoin, how much Bitcoin the U.S. holds, whether it'll buy more and the Senate Banking Committee's goals for market structure.

TIMESTAMPS:

0:00 - Welcome Senator Cynthia Lummis To Crypto In America

00:27 - What Crypto In America Means To Senator Lummis

01:50 - Cynthia's Journey into Digital Assets

04:45 - Wyoming's Stablecoin & why more states will follow

08:38 - The latest on Bitcoin - Will The U.S. Buy Bitcoin? How much does the U.S. have?

11:11 - Crypto Market Structure Legislation Completed By Christmas?

13:06 - Thank You Senator Lummis For Joining! Like & Subscribe!

NEW BONUS EPISODE: We interviewed @SenLummis in her home state of Wyoming

We chat about her crypto journey, the new Wyoming stablecoin, how much Bitcoin the U.S. holds, whether it'll buy more and the Senate Banking Committee's goals for market structure.

TIMESTAMPS:

0:00 - Welcome Senator Cynthia Lummis To Crypto In America

00:27 - What Crypto In America Means To Senator Lummis

01:50 - Cynthia's Journey into Digital Assets

04:45 - Wyoming's Stablecoin & why more states will follow

08:38 - The latest on Bitcoin - Will The U.S. Buy Bitcoin? How much does the U.S. have?

11:11 - Crypto Market Structure Legislation Completed By Christmas?

13:06 - Thank You Senator Lummis For Joining! Like & Subscribe!

Federal Reserve to scrap program devoted to policing banks on Bitcoin, crypto, and fintech activities.a

Federal Reserve to scrap program devoted to policing banks on Bitcoin, crypto, and fintech activities.a

Z

Z

President Trump signs executive order to allow Bitcoin and crypto in 401(k)s.K

President Trump signs executive order to allow Bitcoin and crypto in 401(k)s.K

B

B

https://t.co/CM1H3PHhrE

https://t.co/CM1H3PHhrE

https://t.co/O1dXUoWRKz

https://t.co/O1dXUoWRKz

NEW: Chairman @RepFrenchHill statement on the release of the Senate's digital asset market structure discussion draft.

NEW: Chairman @RepFrenchHill statement on the release of the Senate's digital asset market structure discussion draft.

W

W

US Marshalls reveal the government now only holds 28,988 Bitcoin worth $3.4 billion, instead of the estimated ~200,000 BTC

US Marshalls reveal the government now only holds 28,988 Bitcoin worth $3.4 billion, instead of the estimated ~200,000 BTC  c

c

https://t.co/nrAXauyyUb

https://t.co/nrAXauyyUb

https://t.co/1Wo6zjY8wY

https://t.co/1Wo6zjY8wY

I am working on an OBBB amendment to ensure Americans can use digital assets without fear of tax violations. More to come soon!

I am working on an OBBB amendment to ensure Americans can use digital assets without fear of tax violations. More to come soon!

https://t.co/CGd8jVYcol

https://t.co/CGd8jVYcol

Subcommittee on Digital Assets hearing happening NOW: Exploring Bipartisan Legislative Framework for Digital Asset Market Structure

Subcommittee on Digital Assets hearing happening NOW: Exploring Bipartisan Legislative Framework for Digital Asset Market Structure

NEW: @SenatorTimScott, @SenLummis, @SenThomTillis, & @SenatorHagerty unveiled principles for digital asset market structure legislation. These will guide bipartisan efforts to bring regulatory clarity, foster innovation, & protect investors.

Read more: banking.senate.gov/newsroom/major…

NEW: @SenatorTimScott, @SenLummis, @SenThomTillis, & @SenatorHagerty unveiled principles for digital asset market structure legislation. These will guide bipartisan efforts to bring regulatory clarity, foster innovation, & protect investors.

Read more: banking.senate.gov/newsroom/major…

u

u

K

K

Looking forward to Bitcoin 2025 in Las Vegas next week, who’s going to be there?

Looking forward to Bitcoin 2025 in Las Vegas next week, who’s going to be there?

https://t.co/V7pwAUqRc4

https://t.co/V7pwAUqRc4

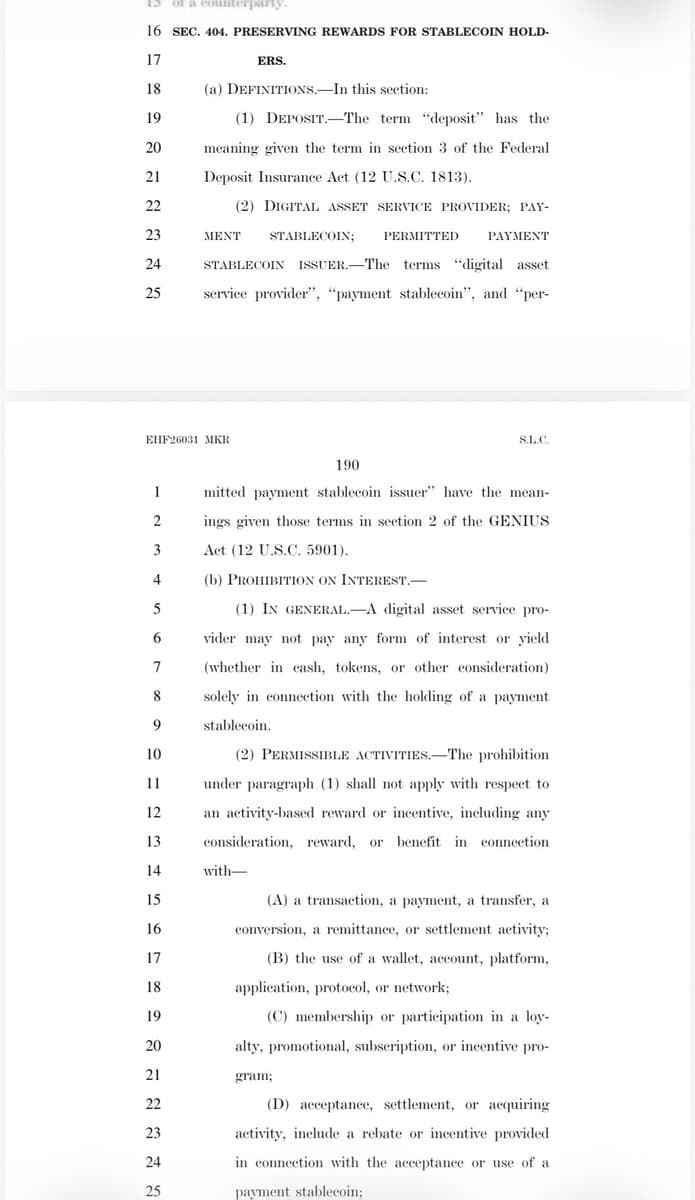

Requiring all stablecoins to be backed 1-to-1

Requiring all stablecoins to be backed 1-to-1

Giving consumers strong rights in bankruptcy

Giving consumers strong rights in bankruptcy

Establishing strict marketing standards

Establishing strict marketing standards

Brought accountability and transparency to Operation Chokepoint 2.0

Brought accountability and transparency to Operation Chokepoint 2.0

Appointed a crypto czar

Appointed a crypto czar

Hosted the first ever White House crypto summit

Hosted the first ever White House crypto summit

Established a strategic bitcoin reserve

Established a strategic bitcoin reserve

Declared America will be the crypto capital of the world

Declared America will be the crypto capital of the world

https://t.co/J5TQjiEDSJ

https://t.co/J5TQjiEDSJ

@senlummis, Capitol Hill’s ‘Bitcoin Senator,’ joins the latest episode of CoinDesk Spotlight with @jennsanasie.

Watch now

@senlummis, Capitol Hill’s ‘Bitcoin Senator,’ joins the latest episode of CoinDesk Spotlight with @jennsanasie.

Watch now

More

More bitcoinmagazine.com/politics/from-…

bitcoinmagazine.com/politics/from-…

U.S. Senator Cynthia Lummis is leading the Bitcoin Revolution in Washington.

Her bold plans for America through Bitcoin & digital asset policy promise to reshape the financial system—reduce U.S. debt, protect Bitcoin self-custody, and reinforce dollar domookmark for later and support our show by liking, sharing, and subscribing!

Timecodes:

00:00 Bitcoin Trump administration shift 2:54 BITCOIN Act of 2024 (S.4912) 8:57 Revaluing gold 12:20 Gold vs. Bitcoin 14:45 Clarifying digital security vs utility token vs stablecoin 16:39 What is a memecoin? 19:23 Stablecoins and GENIUS Act of 2025 (S.394) 21:44 Creating regulation around stablecoins, Tether 23:52 Status of U.S. Dollar as global reserve currency 26:07 Save Bitcoin, spend dollars 27:21 White House embracing Bitcoin 29:22 When will the US buy Bitcoin?

U.S. Senator Cynthia Lummis is leading the Bitcoin Revolution in Washington.

Her bold plans for America through Bitcoin & digital asset policy promise to reshape the financial system—reduce U.S. debt, protect Bitcoin self-custody, and reinforce dollar domookmark for later and support our show by liking, sharing, and subscribing!

Timecodes:

00:00 Bitcoin Trump administration shift 2:54 BITCOIN Act of 2024 (S.4912) 8:57 Revaluing gold 12:20 Gold vs. Bitcoin 14:45 Clarifying digital security vs utility token vs stablecoin 16:39 What is a memecoin? 19:23 Stablecoins and GENIUS Act of 2025 (S.394) 21:44 Creating regulation around stablecoins, Tether 23:52 Status of U.S. Dollar as global reserve currency 26:07 Save Bitcoin, spend dollars 27:21 White House embracing Bitcoin 29:22 When will the US buy Bitcoin?

Defines a payment stablecoin

Defines a payment stablecoin

Establishes clear procedures for institutions seeking charters to issue stablecoins

Establishes clear procedures for institutions seeking charters to issue stablecoins

Promotes responsible innovation and protects consumers

Promotes responsible innovation and protects consumers

Bitcoin for America by @btcpolicyorg

Bitcoin for America by @btcpolicyorg

Streaming LIVE Tuesday, March 11 @ 8:45am ET

Set your reminder

Streaming LIVE Tuesday, March 11 @ 8:45am ET

Set your reminder

Rumble:rumble.com/v6qfzha-live-b…C

Rumble:rumble.com/v6qfzha-live-b…C

YouTube:youtube.com/live/Dtb-k2Bxu…pv

YouTube:youtube.com/live/Dtb-k2Bxu…pv

BREAKING: Kraken has announced that the SEC has agreed to drop its lawsuit against the cryptocurrency exchange.

BREAKING: Kraken has announced that the SEC has agreed to drop its lawsuit against the cryptocurrency exchange.

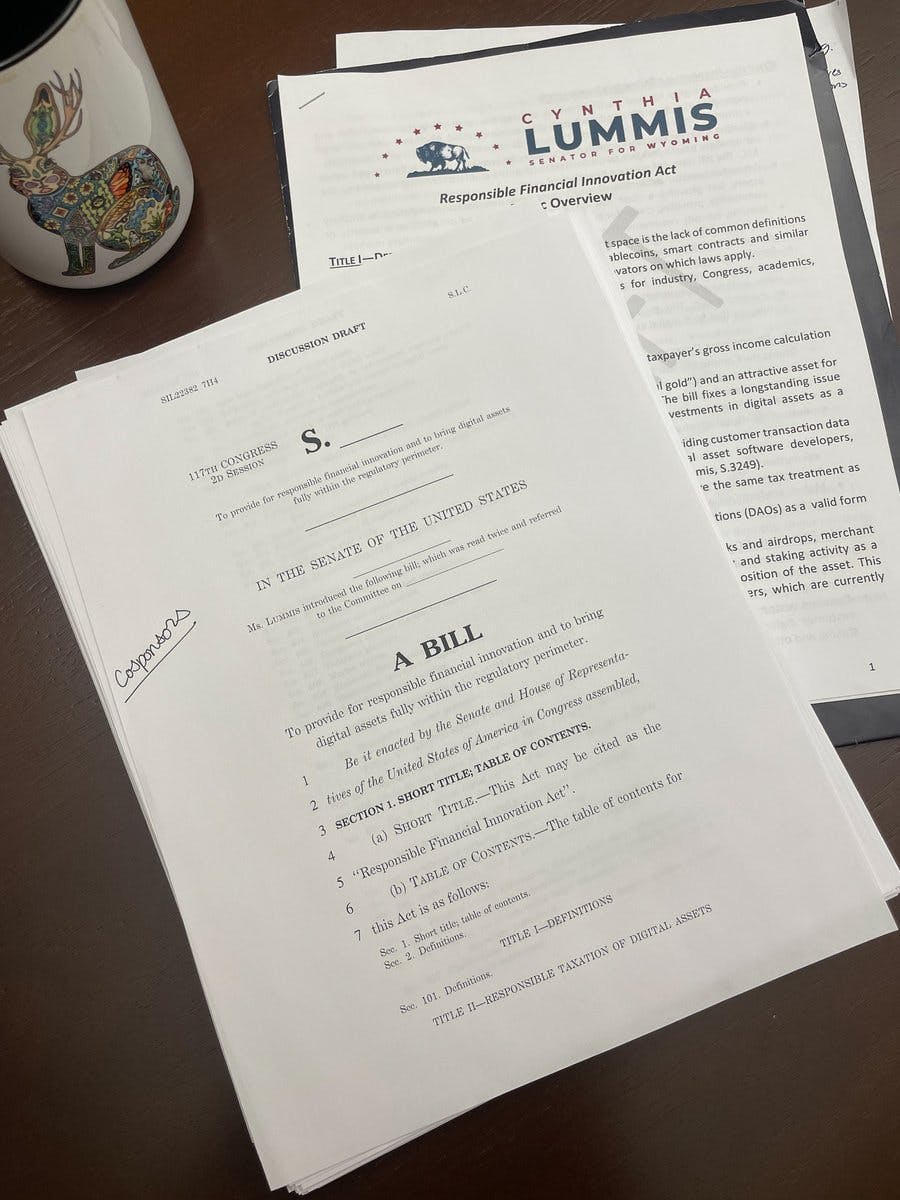

Most digital assets are not legally securities under the Howey test

Most digital assets are not legally securities under the Howey test

The United States is behind other countries in creating laws for digital assets

The United States is behind other countries in creating laws for digital assets

Stablecoins will bring our payment system into the 21st century

Stablecoins will bring our payment system into the 21st century

https://t.co/eXXOjeStvN

https://t.co/eXXOjeStvN

banking.senate.gov/hearings/explo…

banking.senate.gov/hearings/explo…

Don’t miss it

Don’t miss it https://t.co/isE5UN15XQ

https://t.co/isE5UN15XQ

This is the 1st step towards bipartisan legislation

This is the 1st step towards bipartisan legislation

We'll hear from experts who will shape policy on market structure & stablecoins

We'll hear from experts who will shape policy on market structure & stablecoins

Stay tuned for livestream details

Stay tuned for livestream details

Yes this is a big deal

Yes this is a big deal

x

x

On March 11th, alongside honorary co-host @SenLummis, top executives, public officials, and policy experts will convene in DC to shape America’s Bitcoin strategy.

To request an invitation, visit the link below.S

On March 11th, alongside honorary co-host @SenLummis, top executives, public officials, and policy experts will convene in DC to shape America’s Bitcoin strategy.

To request an invitation, visit the link below.S

https://t.co/Fk8RjaB8LC

https://t.co/Fk8RjaB8LC

https://t.co/pjCtOxheET

https://t.co/pjCtOxheET

@SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

@SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

Pass legislation promoting responsible innovation and consumer protection

Pass legislation promoting responsible innovation and consumer protection

Eradicate Operation Chokepoint 2.0

Eradicate Operation Chokepoint 2.0

Make America the bitcoin and digital asset capital of the world

Make America the bitcoin and digital asset capital of the world

BREAKING: The SEC has launched a new crypto task force, led by Commissioner Peirce, aimed at establishing a clear regulatory framework for the cryptocurrency industry.d

BREAKING: The SEC has launched a new crypto task force, led by Commissioner Peirce, aimed at establishing a clear regulatory framework for the cryptocurrency industry.d

https://t.co/yUWN3Dx6Vm

https://t.co/yUWN3Dx6Vm

More

More

https://t.co/CHcr7gKESQ

https://t.co/CHcr7gKESQ

https://t.co/Pz2Rc0egze

https://t.co/Pz2Rc0egze

I look forward to working closely with @DavidSacks to pass comprehensive digital asset legislation & my strategic bitcoin reserve.3

I look forward to working closely with @DavidSacks to pass comprehensive digital asset legislation & my strategic bitcoin reserve.3

v

v

d

d

cut our national debt in half by 2045

cut our national debt in half by 2045

secure the U.S. as a world leader in financial innovation

secure the U.S. as a world leader in financial innovation

create a brighter future for generations of Americans.

Let’s get serious about our national debt and pass the BITCOIN Act!

create a brighter future for generations of Americans.

Let’s get serious about our national debt and pass the BITCOIN Act!

NEW VIDEO

NEW VIDEO The BITCOIN Act of 2024 with Senator Cynthia Lummis

Joe and Nik sit down with @SenLummis for a detailed discussion of the US' unsustainable debt problem, and how #Bitcoin can help address it with a strategic reserve.

The BITCOIN Act of 2024 with Senator Cynthia Lummis

Joe and Nik sit down with @SenLummis for a detailed discussion of the US' unsustainable debt problem, and how #Bitcoin can help address it with a strategic reserve.

https://t.co/mSYJVwn1wI

https://t.co/mSYJVwn1wI

https://t.co/1cWAssvZIW

https://t.co/1cWAssvZIW

https://t.co/5OCYiXttu6

https://t.co/5OCYiXttu6

https://t.co/5OCYiXttu6

https://t.co/5OCYiXttu6

This is HUGE

This is HUGE  CL: “Should banks be able to provide services to digital asset companies like payment services?”

CGR: “Yeah, I don’t think it’s the FDIC’s role to tell banks what industries or companies they should be providing services to.”

Watch the full clip below

CL: “Should banks be able to provide services to digital asset companies like payment services?”

CGR: “Yeah, I don’t think it’s the FDIC’s role to tell banks what industries or companies they should be providing services to.”

Watch the full clip below

https://t.co/NicfAz1VCr

https://t.co/NicfAz1VCr

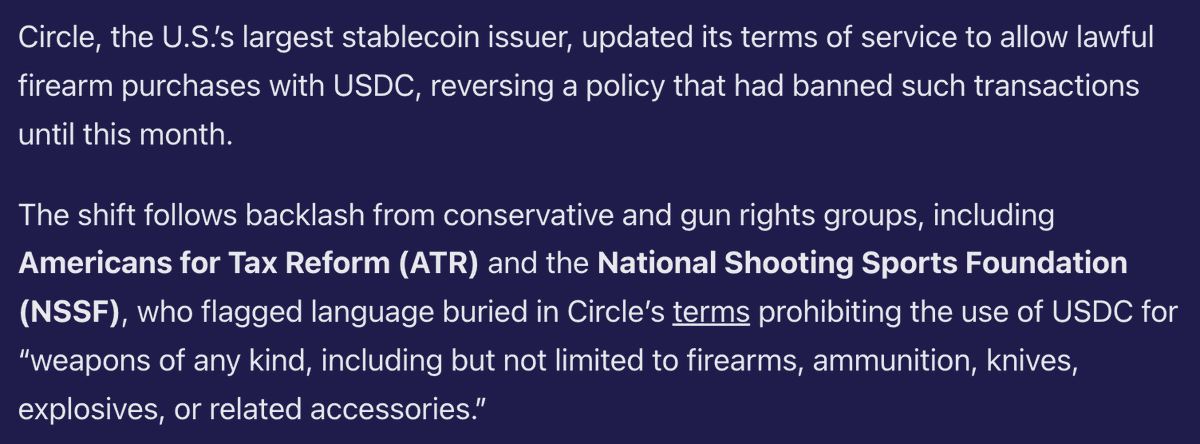

No retail Central Bank Digital Currencies

No retail Central Bank Digital Currencies

Clear protections for self-custody Bitcoin wallets

Clear protections for self-custody Bitcoin wallets

Restore Dollar Dominance for the 21st Century https://t.co/yEy9tcxU5b

Restore Dollar Dominance for the 21st Century https://t.co/yEy9tcxU5b

https://t.co/pXjGXPi6fN

https://t.co/pXjGXPi6fN

Spot ETH ETF approvals

Spot ETH ETF approvals

Her criticism of Gary Gensler’s SEC

Her criticism of Gary Gensler’s SEC

Why she believes Congress is realizing crypto is not going away

And more!

Don’t miss it!

Timestamps:

00:00 Introduction

02:53 Why the SAB 121 approval was bipartisan

04:52 Whether President Biden will veto the resolution

08:40 How it's a "mystery" to Sen. Lummis why the SEC had a change of heart about Ether ETFs

13:23 Whether there is a bipartisan majority in favor of crypto in Congress

20:19 Sen. Lummis' thoughts on how to regulate the stablecoin industry and avoid a Terra Luna situation

23:55 The differences between the Lummis-Gillibrand bill and FIT21

28:59 How Sen. Lummis feels about the denial of a master account for Custodia Bank

30:20 Whether there's a move against Bitcoin mining companies in the US, given the recent ban of an operation in Wyoming

33:44 What Sen. Lummis would advise for the industry to accomplish its goals

Why she believes Congress is realizing crypto is not going away

And more!

Don’t miss it!

Timestamps:

00:00 Introduction

02:53 Why the SAB 121 approval was bipartisan

04:52 Whether President Biden will veto the resolution

08:40 How it's a "mystery" to Sen. Lummis why the SEC had a change of heart about Ether ETFs

13:23 Whether there is a bipartisan majority in favor of crypto in Congress

20:19 Sen. Lummis' thoughts on how to regulate the stablecoin industry and avoid a Terra Luna situation

23:55 The differences between the Lummis-Gillibrand bill and FIT21

28:59 How Sen. Lummis feels about the denial of a master account for Custodia Bank

30:20 Whether there's a move against Bitcoin mining companies in the US, given the recent ban of an operation in Wyoming

33:44 What Sen. Lummis would advise for the industry to accomplish its goals

https://t.co/iazbBhMcOv

https://t.co/iazbBhMcOv

https://t.co/M3CHcNTi3x

https://t.co/M3CHcNTi3x

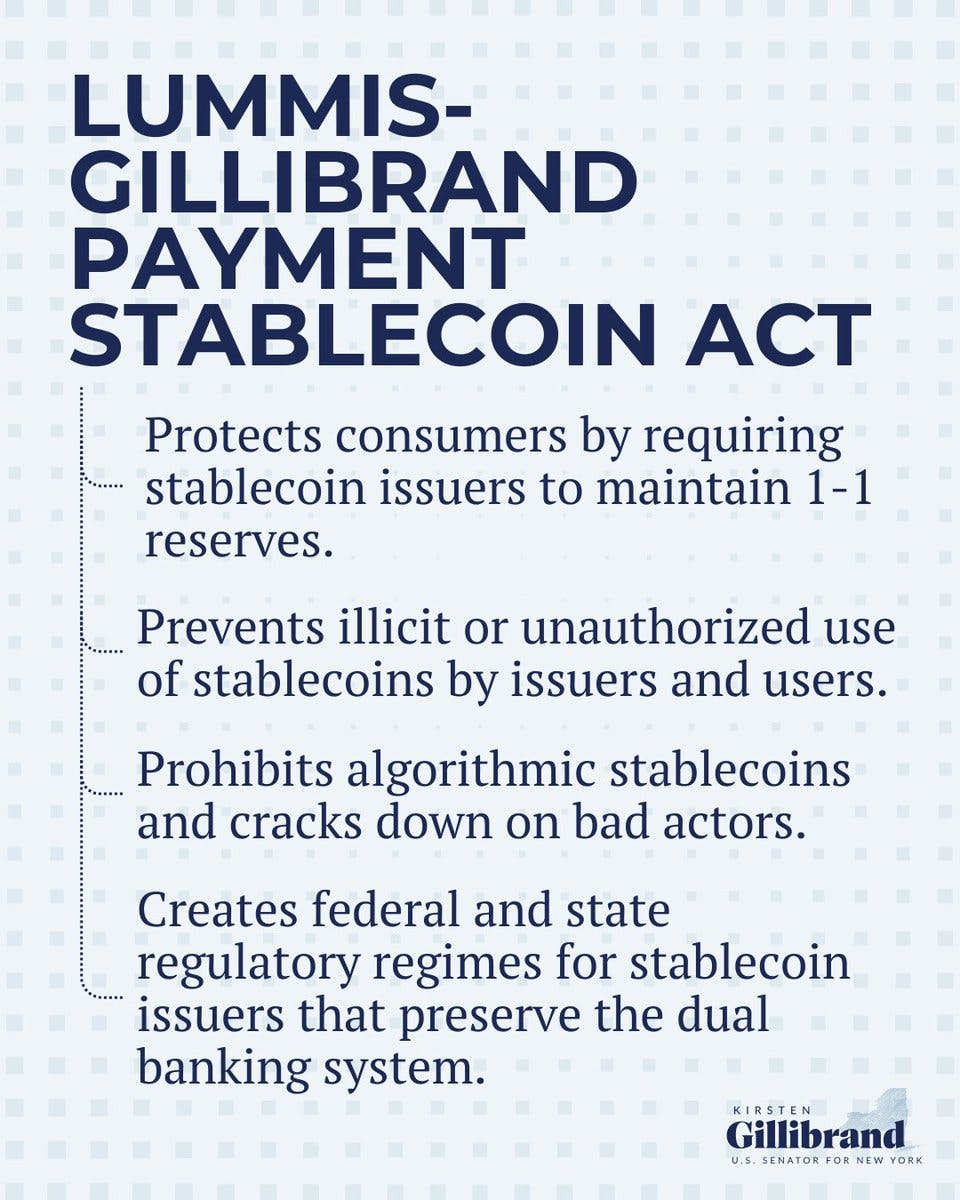

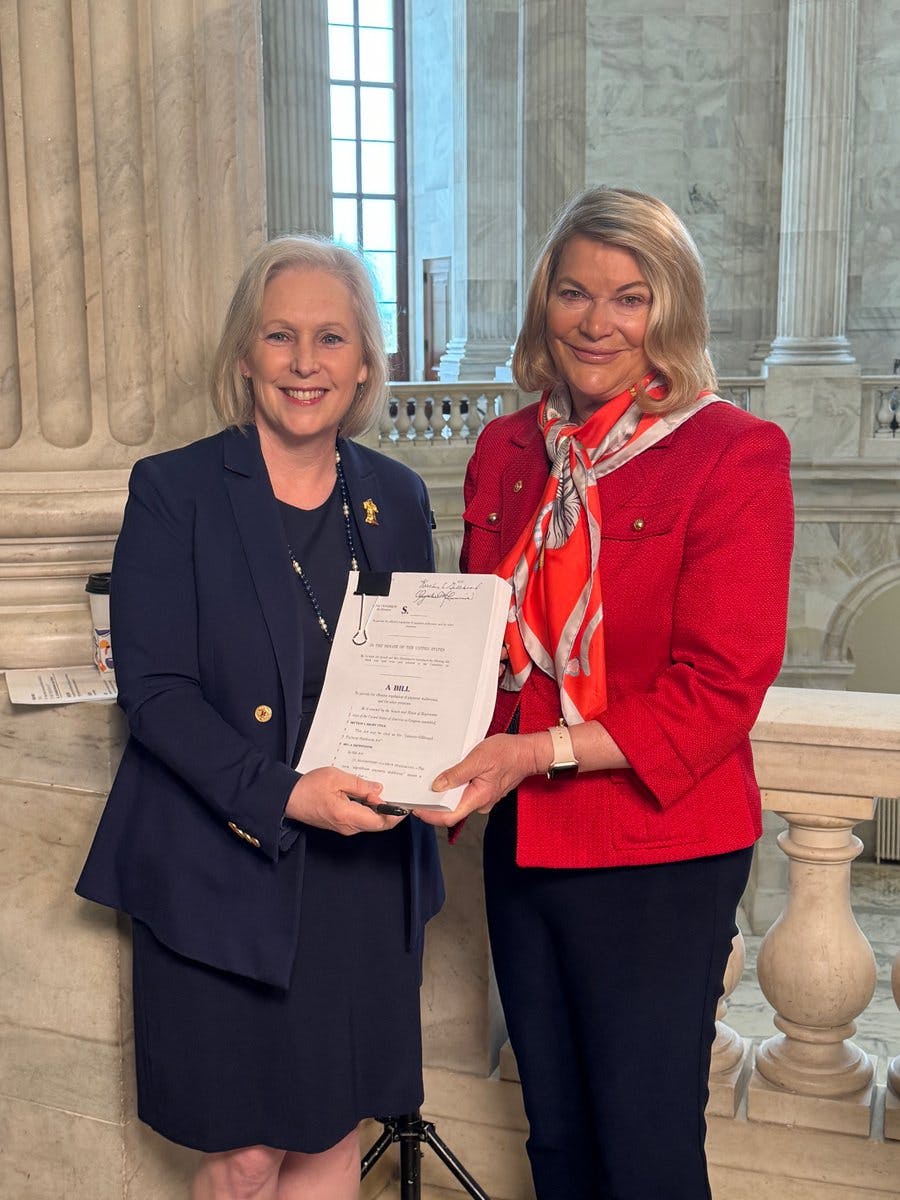

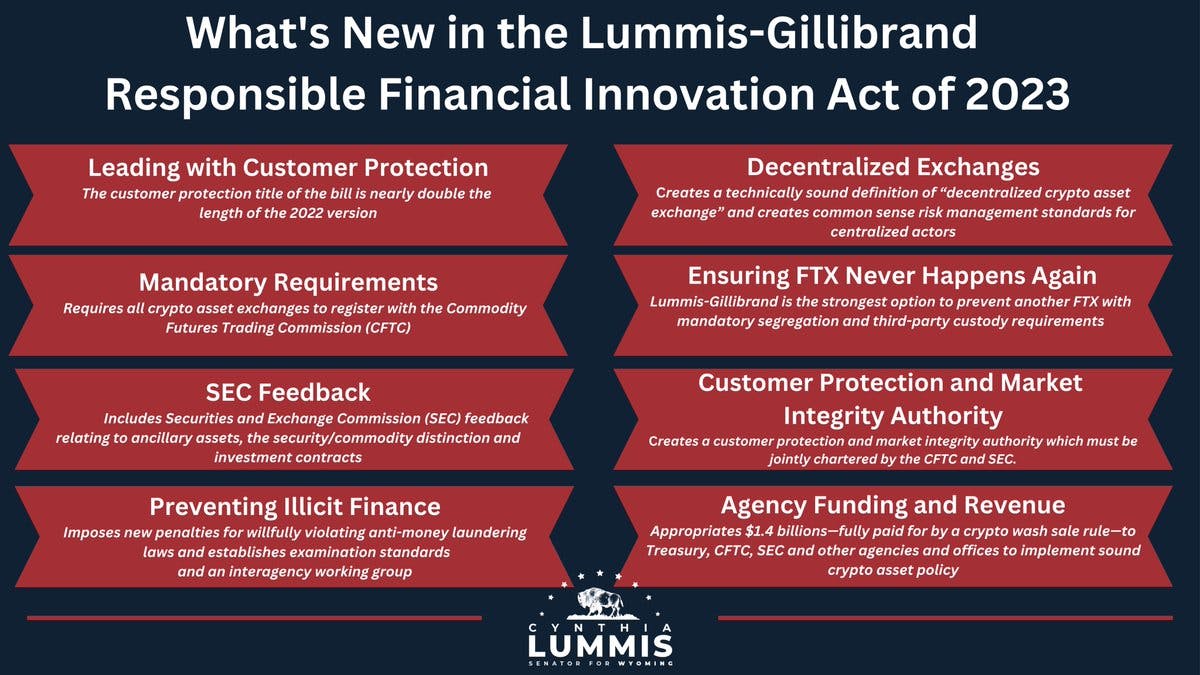

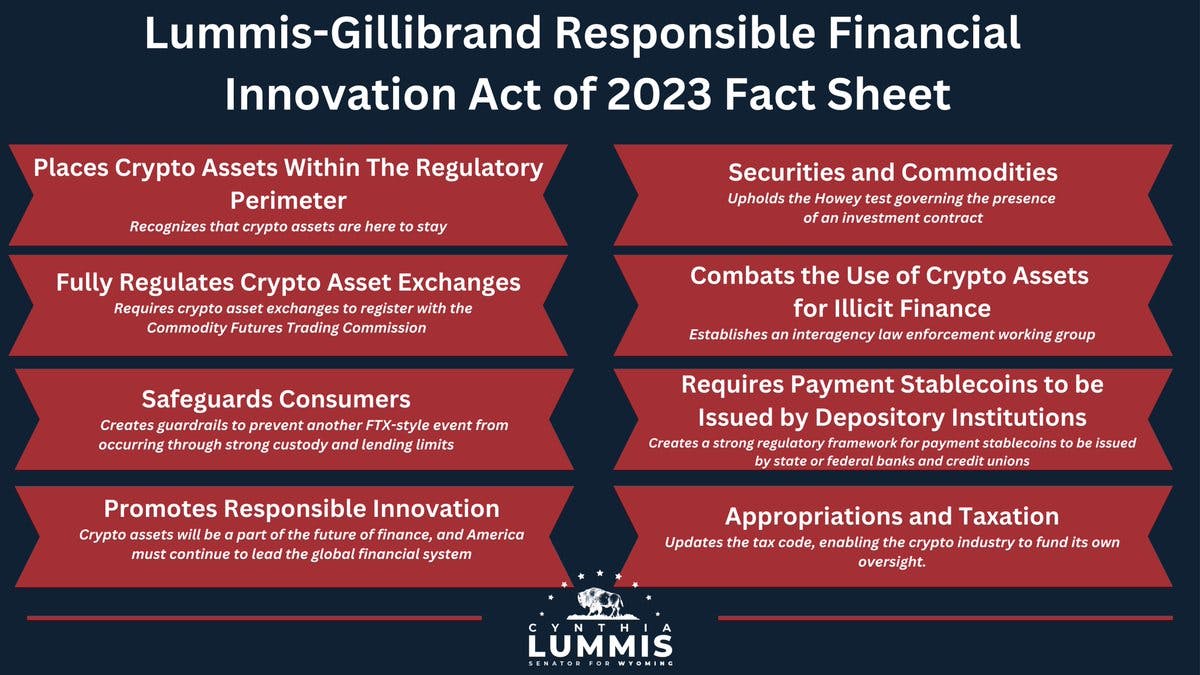

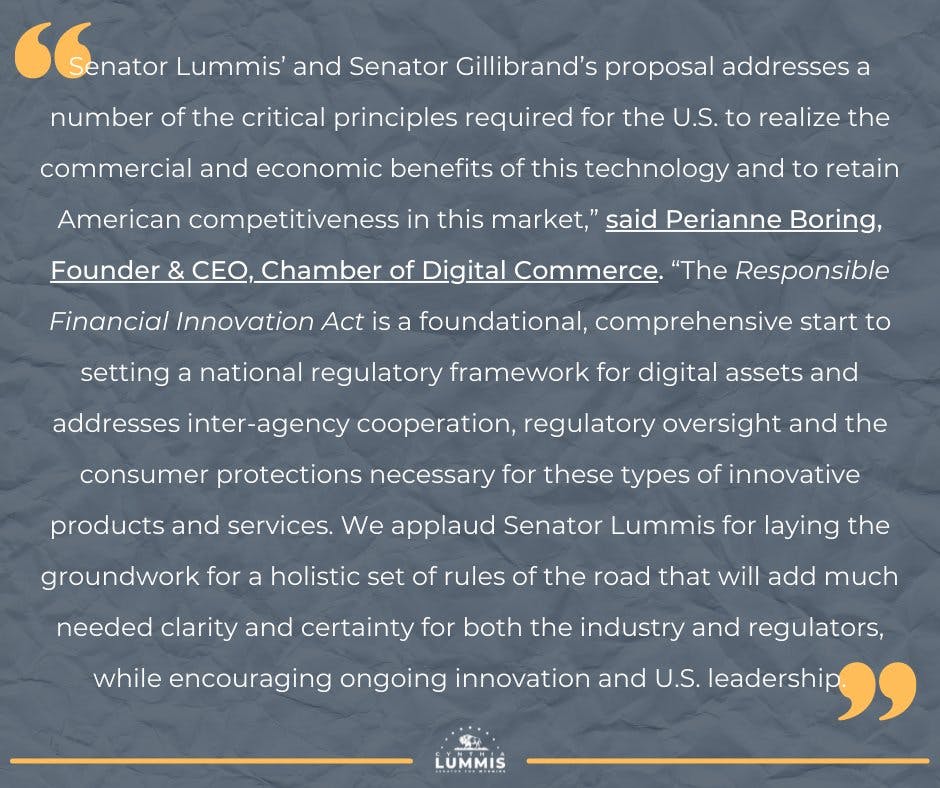

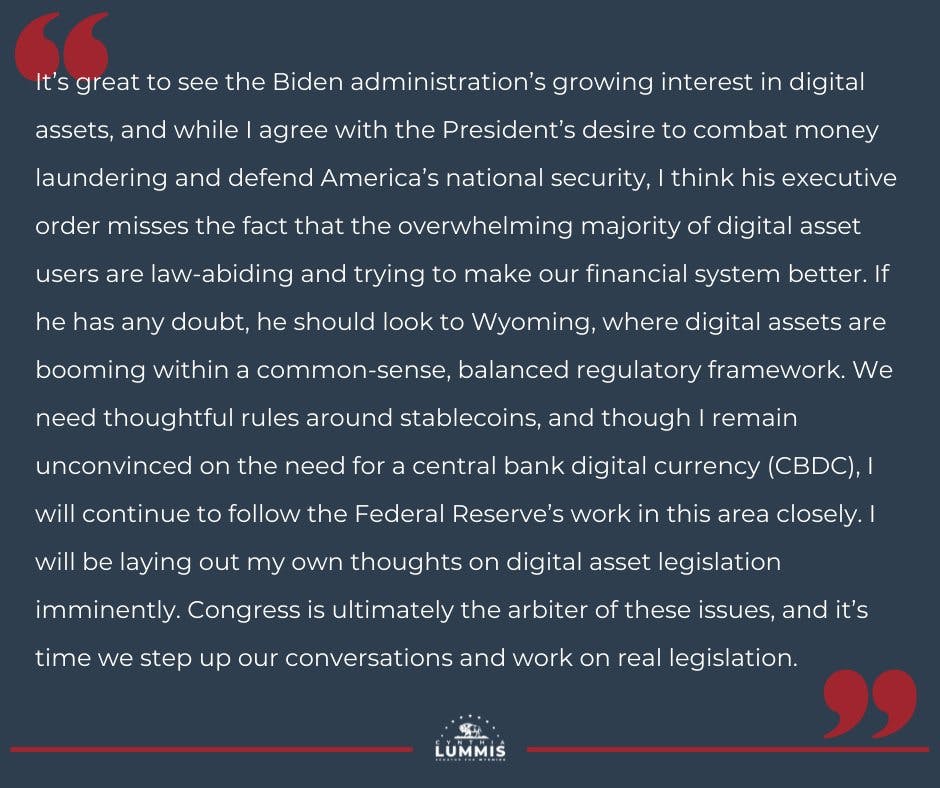

@gillibrandny and I are introducing the most comprehensive stablecoin bill to date.

Crypto assets are revolutionizing the world and as the undisputed leader in financial innovation, the U.S. must embrace crypto assets, but it cannot be done without clear rules for stablecoins.

@gillibrandny and I are introducing the most comprehensive stablecoin bill to date.

Crypto assets are revolutionizing the world and as the undisputed leader in financial innovation, the U.S. must embrace crypto assets, but it cannot be done without clear rules for stablecoins.

But a proposed 30% punitive tax on digital asset mining would destroy any foothold the industry has in America.

But a proposed 30% punitive tax on digital asset mining would destroy any foothold the industry has in America.

https://t.co/VkSbtVE2Do

https://t.co/VkSbtVE2Do

NEW VIDEO

NEW VIDEO Senator Lummis: #Bitcoin Is A COMMODITY

- US Senator @CynthiaMLummis joins the show to discuss Bitcoin and digital asset regulation

- Why @SenLummis believes Bitcoin is a commodity

- Why there is so much momentum within the government to understand Bitcoin

Senator Lummis: #Bitcoin Is A COMMODITY

- US Senator @CynthiaMLummis joins the show to discuss Bitcoin and digital asset regulation

- Why @SenLummis believes Bitcoin is a commodity

- Why there is so much momentum within the government to understand Bitcoin

https://t.co/6x5VeNnaJz

https://t.co/6x5VeNnaJz

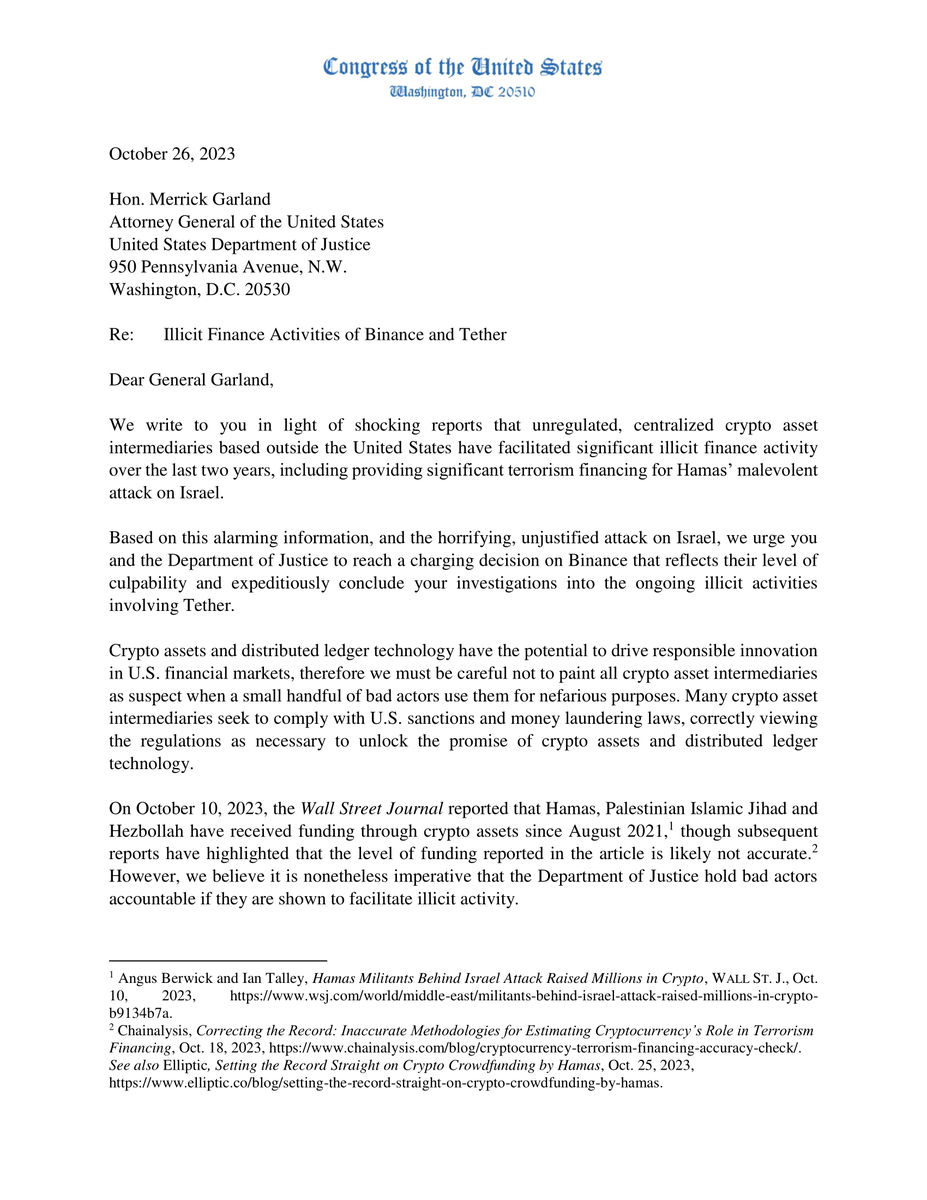

My letter with @PatrickMcHenry here:

https://t.co/kEQKJMg4tC

My letter with @PatrickMcHenry here:

https://t.co/kEQKJMg4tC

-Strong protection & separation of customer assets on an exchange

-Strong protection & separation of customer assets on an exchange  -Tight limits on digital asset leverage & lending

-Tight limits on digital asset leverage & lending

https://t.co/hCrENlfovx

https://t.co/hCrENlfovx

youtube.com/watch?v=LPZF9i…

youtube.com/watch?v=LPZF9i…

https://t.co/YA02t6SxDe

https://t.co/YA02t6SxDe

https://t.co/p1mp1JuSFu

https://t.co/p1mp1JuSFu

https://t.co/J8Dhmw7ew4

https://t.co/J8Dhmw7ew4

hdcblockchainsummit.com/agendahttps://t.co/DGV4FrcNdd

hdcblockchainsummit.com/agendahttps://t.co/DGV4FrcNdd

Live at #Bitcoin2022

Live at #Bitcoin2022 Kraken’s Chief Legal Officer @msantoriESQ hosts a fireside chat on the Nakamoto Stage with U.S Senator, Wyoming @SenLummis on Friday, April 8 at 3 pm ET.

Get more details

Kraken’s Chief Legal Officer @msantoriESQ hosts a fireside chat on the Nakamoto Stage with U.S Senator, Wyoming @SenLummis on Friday, April 8 at 3 pm ET.

Get more details b.tc/conference/age… @TheBitcoinConf

b.tc/conference/age… @TheBitcoinConf

hyoutu.be/fOSU7J1_f0Q

Topics:

- #Bitcoin's Growth & Adoption

- BTC Mining in the US

- US #Crypto Regulations

- Her Upcoming New Crypto Bill

- Wyoming Crypto Vision

- #SEC & #Altcoin Regulations

- #CBDCs & #Metaverse https://t.co/LL3nwmQvxg

hyoutu.be/fOSU7J1_f0Q

Topics:

- #Bitcoin's Growth & Adoption

- BTC Mining in the US

- US #Crypto Regulations

- Her Upcoming New Crypto Bill

- Wyoming Crypto Vision

- #SEC & #Altcoin Regulations

- #CBDCs & #Metaverse https://t.co/LL3nwmQvxg

https://t.co/zSxM7w8Diq

https://t.co/zSxM7w8Diq