Does Bill Hagerty Support Crypto?

Based on previous comments, Bill Hagerty has indicated they are very pro-cryptocurrency. Below you can view the tweets, quotes, and other commentary Bill Hagerty has made about Bitcoin, Ethereum, and cryptocurrency innovation.

Senator Bill Hagerty

@SenatorHagerty

The GENIUS Act, which I proudly sponsored, is now law. This framework makes the U.S. the crypto capital of the world, strengthens US dollar dominance, protects consumers, and fuels innovation.

2026-01-20T14:43:33.000Z

Analyzing a January 2026 statement from Senator Bill Hagerty of Tennessee.

This statement is a declaration of a monumental victory for the digital asset industry in the United States and perfectly encapsulates why Senator Hagerty maintains a 100/100 pro-crypto score. He is not just expressing support; he is announcing the successful passage into law of the GENIUS Act, a landmark piece of legislation that he sponsored.

His framing of this achievement is flawless from a pro-innovation perspective. He lists four key outcomes:

1. **Making the U.S. the crypto capital:** This shows an ambition for American leadership in the space, viewing it as a strategic opportunity rather than a threat.

2. **Strengthening US dollar dominance:** This is a crucial and sophisticated point. Hagerty understands that regulated, dollar-backed stablecoins operating on global blockchain rails increase the utility and demand for the U.S. dollar, directly countering the narrative that crypto seeks to undermine it.

3. **Protecting consumers:** He correctly positions a clear regulatory framework as the best form of consumer protection—a stark contrast to the anti-crypto approach of regulation-by-enforcement that creates uncertainty and drives business offshore.

4. **Fueling innovation:** This underscores his belief in the technology's potential for economic growth and progress.

The GENIUS Act itself provides the "rules of the road" specifically for payment stablecoins, one of the most important and fastest-growing sectors of the digital asset economy. By creating this clarity, the law provides a robust, private-sector alternative to a potential Central Bank Digital Currency (CBDC), thereby protecting financial privacy.

This action represents the pinnacle of pro-crypto advocacy: moving beyond rhetoric to successfully author and pass foundational legislation that secures the industry's future in America.

Senator Bill Hagerty

@SenatorHagerty

I applaud Chairman @SenatorTimScott for his leadership, as well as @SenLummis and the White House, for working day and night with all the members of the Banking Committee on the crypto market structure legislation. I am confident we will get to a consensus product in short order.

It took hard work and dedication to get the GENIUS Act across the finish line last year, and this is no different. Because of GENIUS, America will become the crypto capital of the world, and what we produce on market structure will significantly improve the United States’ posture.

I am fully committed to continuing this important work with my colleagues on market structure and look forward to passing legislation that ensures this innovative technology flourishes in the United States for decades to come.

Tim Scott

@SenatorTimScott

I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith.

As we take a brief pause before moving to a markup, this market structure bill reflects months of serious bipartisan negotiations and real input from innovators, investors, and law enforcement.

The goal is to deliver clear rules of the road that protect consumers, strengthen our national security, and ensure the future of finance is built in the United States.

2026-01-15T02:42:15.000Z

2026-01-15T15:17:54.000Z

Analysis on Stance

Add your own analysis on this stanceAnalyzing a statement from Senator Bill Hagerty of Tennessee.

Senator Hagerty continues to demonstrate his unwavering commitment to establishing the United States as a global leader in digital assets. This statement reinforces his position as one of the most effective and dedicated advocates for the crypto industry in Congress.

His applause for the bipartisan work on "crypto market structure legislation" is highly significant. Following his own success in passing the GENIUS Act for stablecoins, Hagerty is now throwing his weight behind the next logical step: creating clear, comprehensive rules for the entire digital asset ecosystem. This is precisely the kind of regulatory clarity the industry needs to move beyond the ambiguous and often hostile environment created by regulators like Gary Gensler.

Hagerty correctly frames this effort as a continuation of his work on the GENIUS Act. By referencing that landmark achievement, he’s not just talking about future hopes; he's pointing to a proven track record of getting pro-crypto legislation signed into law. He sees a direct line from creating a safe harbor for stablecoins to building a full framework that allows all forms of digital asset innovation to "flourish."

His language is unequivocally positive, focusing on making "America the crypto capital of the world" and improving our nation's "posture" on the global stage. This is a far cry from the anti-crypto narrative that frames digital assets primarily as a threat. Hagerty understands that this technology is a massive opportunity for American innovation and economic strength. His commitment to passing this market structure legislation is a clear signal that he intends to see this through, solidifying his perfect 100/100 pro-crypto stance.

Bill Hagerty reposted the post below

Blockchain Association

@BlockchainAssn

@SKMersinger before we begin our next panel we’re pleased to award @SenatorHagerty the annual Crypto Champion Award!

2025-12-09T15:41:21.000Z

Bill Hagerty

@BillHagertyTN

2025-12-09T15:32:27.000Z

Bill Hagerty

@BillHagertyTN

America is home to innovators and leaders who refuse to let our nation fall behind- especially when it comes to securing American leadership in crypto. While Elizabeth Warren and the Democrats were content to let other countries take the lead, I was proud to author the GENIUS he United States as the Crypto Capital of the World.

2025-12-09T15:32:26.000Z

Senator Bill Hagerty

@SenatorHagerty

Since @POTUS signed my bill into law, the GENIUS Act has rapidly accelerated the modernization of our payment system.

Combining the dollar’s advantages with the blockchain’s speed & efficiency will unlock tremendous benefits for U.S. innovation and economic leadership.

Bloomberg

@business

Consumers and businesses are using stablecoins at an accelerating pace since the July passage of the first US legislation to regulate that niche of the cryptocurrency sector bloomberg.com/news/articles/…

2025-10-25T12:48:45.000Z

2025-10-28T00:09:57.000Z

Analysis on Stance

Add your own analysis on this stanceAnalyzing the stance of Senator Bill Hagerty of Tennessee.

Senator Hagerty celebrates the success of the GENIUS Act, a landmark bill he authored that was signed into law. This is an unequivocally pro-crypto action, representing one of the most significant legislative victories for the digital asset industry in the United States.

The GENIUS Act is not just talk; it's the first major piece of US legislation to create a clear regulatory framework specifically for payment stablecoins. By doing so, it provides the "rules of the road" that builders and institutions need to operate with confidence. This clarity is essential for fostering innovation and ensuring the industry can grow safely and responsibly within the US.

Hagerty's framing is crucial. He highlights how blockchain technology enhances the U.S. dollar, promoting "speed & efficiency" to modernize payments. He correctly identifies this as a path to strengthening American innovation and economic leadership. This is the opposite of the anti-crypto narrative, which focuses exclusively on risk and illicit use.

Furthermore, by championing a framework for private-sector stablecoins, Hagerty provides a powerful alternative to a Central Bank Digital Currency (CBDC), which would threaten financial privacy and freedom. This legislation legitimizes stablecoins as a key part of our financial future, backed by secure assets like U.S. treasuries, which in turn strengthens the position of the dollar. This is exactly the kind of thoughtful, forward-looking policy the crypto space needs.

Senator Bill Hagerty

@SenatorHagerty

Chairman Atkins’ clear-eyed leadership on crypto strikes the right balance: giving our innovators room to grow while protecting consumers. Let’s ensure the future of finance is built here at home.

Paul Atkins

@SECPaulSAtkins

We will make sure the next chapter of financial innovation is written right here in America.

Watch highlights from my speech launching Project Crypto at @A1Policy.

youtube.com/watch?v=_gc5oO…

2025-08-01T20:33:57.000Z

2025-08-04T19:38:37.000Z

Senator Bill Hagerty

@SenatorHagerty

With @POTUS's signing of my GENIUS Act into law, we’ve built crucial momentum toward achieving regulatory certainty for digital asset market structure.

This discussion draft demonstrates a strong commitment to unlocking the full potential of the digital asset economy by delivering responsible legislation that reflects input from stakeholders, fosters innovation, and ensures the United States remains a global leader in digital assets. hagerty.senate.gov/press-releases…

2025-07-22T17:23:08.000Z

Senator Bill Hagerty

@SenatorHagerty

Watch how we made history with the first crypto legislation signed into law.

The GENIUS Act faced roadblocks, but we got it done.

@POTUS @realDonaldTrump

2025-07-19T15:00:41.000Z

Senator Bill Hagerty

@SenatorHagerty

.@POTUS just signed my bill—the GENIUS Act—into law.

Proud to be there for this historic moment. This is the first crypto legislation ever signed into law in the United States.

A major win for American innovation, leadership, and the future.  g

g

g

g

2025-07-18T19:52:14.000Z

Bill Hagerty reposted the post below

Charlie Kirk

@charliekirk11

Another legislative win for President Trump as the House has just overwhelming passed the pro-crypto, GENIUS Act. Backed by President Trump and Treasury Secretary Scott Bessent, the bill now goes to Trump's desk to be signed into law.

2025-07-17T19:45:15.000Z

Senator Bill Hagerty

@SenatorHagerty

This afternoon, the House passed the GENIUS Act — soon to be the first-ever crypto law in our nation’s history.

It will be great for the freedom and prosperity of American citizens, our businesses, and the Greatest Nation in the history of the world.

I look forward to being with @POTUS when he signs it into law very soon!

2025-07-17T20:39:05.000Z

Bill Hagerty reposted the post below

Tim Scott

@SenatorTimScott

The GENIUS Act takes a bold step forward to promote innovation and consumer protection for payment stablecoins.

Thank you to @SenatorHagerty for your work in leading this bill, and I look forward to @POTUS signing it into law!

2025-07-17T20:06:54.000Z

Senator Bill Hagerty

@SenatorHagerty

The House just passed my bill – The GENIUS Act!

This historic legislation will bring our payment system into the 21st century. It will ensure the dominance of the U.S. dollar. It will increase demand for U.S. Treasuries.

I look forward to @POTUS signing GENIUS into law – the first step in making America the crypto capital of the world.

The House just passed my bill – The GENIUS Act!

This historic legislation will bring our payment system into the 21st century. It will ensure the dominance of the U.S. dollar. It will increase demand for U.S. Treasuries.

I look forward to @POTUS signing GENIUS into law – the first step in making America the crypto capital of the world.

2025-07-17T19:49:06.000Z

Senator Bill Hagerty

@SenatorHagerty

I oppose Central Bank Digital Currencies. They are a threat to Americans' freedom and privacy.

We need private-sector innovation and competition to drive stablecoin innovation in America.

That's why the GENIUS Act ensures that U.S. innovators, not central planners, shape digital asset policy in the United States.

2025-07-17T18:25:51.000Z

Senator Bill Hagerty

@SenatorHagerty

This afternoon, the House will vote on the GENIUS Act.

I am proud to have authored this legislation that will update America’s payment system and make the United States the hub for innovation in digital assets.

GENIUS will:

Bring America’s payment system into the 21st century

Bring America’s payment system into the 21st century

Cement U.S. dollar dominance

Cement U.S. dollar dominance

Increase demand for U.S. treasuries

Increase demand for U.S. treasuries

Bring America’s payment system into the 21st century

Bring America’s payment system into the 21st century

Cement U.S. dollar dominance

Cement U.S. dollar dominance

Increase demand for U.S. treasuries

Increase demand for U.S. treasuries2025-07-17T16:26:45.000Z

Senator Bill Hagerty

@SenatorHagerty

It’s Crypto Week in Congress.

The House is set to pass my GENIUS Act — legislation that’s great for Americans, great for business, and ensures innovation happens right here in the U.S.

Let’s get it to @POTUS’s desk and keep America at the forefront.  r

r

r

r

2025-07-16T15:55:37.000Z

Senator Bill Hagerty

@SenatorHagerty

The GENIUS Act is my landmark bipartisan legislation to regulate stablecoins and bring America’s payment system into the 21st century.

The CLARITY Act fosters innovation and protects consumers by defining market structure, allowing builders to build without regulatory overreach.

The Anti-CBDC Surveillance State Act would ban the Federal Reserve from issuing digital dollars that could surveil our financial transactions. (2/3)

2025-07-15T18:21:58.000Z

Senator Bill Hagerty

@SenatorHagerty

It’s #CryptoWeek in the House.

With votes on the GENIUS Act, CLARITY Act, and the Anti-CBDC Surveillance State Act, we have a historic opportunity to cement America’s leadership in digital assets.

All 3 bills protect our freedoms, provide regulatory clarity, and promote innovation. (1/3)

It’s #CryptoWeek in the House.

With votes on the GENIUS Act, CLARITY Act, and the Anti-CBDC Surveillance State Act, we have a historic opportunity to cement America’s leadership in digital assets.

All 3 bills protect our freedoms, provide regulatory clarity, and promote innovation. (1/3)2025-07-15T18:21:58.000Z

Senator Bill Hagerty

@SenatorHagerty

With the GENIUS Act heading to @POTUS's desk at the end of this week, the Senate is committed to finishing the job and passing a digital asset framework built by and for American values. (3/3)

2025-07-15T18:21:58.000Z

Senator Bill Hagerty

@SenatorHagerty

The House votes on my GENIUS Act this week.

With this bill, we are one step closer to becoming the global leader in crypto.

Let’s get this to @POTUS’s desk ASAP.

The House votes on my GENIUS Act this week.

With this bill, we are one step closer to becoming the global leader in crypto.

Let’s get this to @POTUS’s desk ASAP.2025-07-14T14:03:40.000Z

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

Proud to team up with @SenatorTimScott, @SenThomTillis, and @SenatorHagerty to unveil critical digital asset market structure principles to help guide clear & innovative legislation for the industry.

2025-06-24T14:01:01.000Z

Took stances on a bill between 2025-05-01T00:00:00.000Z and 2025-06-17T00:00:00.000Z

Bill Name

GENIUS Act

Details

The GENIUS Act of 2025 proposes a regulatory framework for payment stablecoins. It defines permitted issuers (insured depository institutions, their subsidiaries, and approved nonbank entities) and mandates 1:1 reserve backing with specific high-quality assets. The bill outlines federal and state regulatory oversight options, sets requirements for customer asset segregation, and grants stablecoin holders priority in insolvency proceedings. It also clarifies that regulated payment stablecoins are not considered securities or commodities under various acts. The bill designates issuers as financial institutions under the Bank Secrecy Act, requiring compliance with AML, KYC, and sanctions regulations to prevent illicit finance and safeguard national security. It also reinforces U.S. leadership in digital finance by supporting innovation and ensuring the dollar remains competitive in a rapidly evolving global financial landscape.

Timeline

2025-05-01

Very Pro-Crypto

Sponsored

2025-05-20

Very Pro-Crypto

Voted for - Because of the way Senate rules work, GENIUS could not have gotten to a final vote without members voting in favor.

2025-06-12

Very Pro-Crypto

Voted for - Because of the way Senate rules work, GENIUS could not have gotten to a final vote without members voting in favor.

2025-06-17

Very Pro-Crypto

Voted for - Final Passage Out Of Senate

Senator Bill Hagerty

@SenatorHagerty

Projections show that with the passage of GENIUS, stablecoin issuers could become the world’s largest holders of U.S. Treasuries by 2030. Such an outcome would shore up our fiscal resilience and cement the U.S. dollar’s status as the global reserve currency. (6/7)

2025-06-17T21:24:14.000Z

Senator Bill Hagerty

@SenatorHagerty

This legislation establishes procedures for issuing stablecoins, designates clear roles for federal and state regulators, implements standards for consumer protection, and includes strong safeguards to deter illicit activity. (5/7)

2025-06-17T21:24:13.000Z

Senator Bill Hagerty

@SenatorHagerty

Once the GENIUS Act is law, corporations, small businesses, and individuals will be able to settle payments nearly instantaneously, rather than wait for days or weeks and accrue the fees that go with it. Put simply, stablecoins are a paradigm-shifting development that can bring our payment system into the twenty-first century. (4/7)

2025-06-17T21:24:12.000Z

Senator Bill Hagerty

@SenatorHagerty

With GENIUS, the value of stablecoins will be pegged to the U.S. dollar and backed 1 to 1 by cash or short-term U.S. treasuries.

By combining the dollar’s advantages with the speed and efficiency of blockchain technology, the GENIUS Act facilitates trad-fi’s adoption of crypto and ushers in a new generation in payment processing.

The prospect of faster and cheaper payments will have far-reaching implications for our financial system. (3/7)

2025-06-17T21:24:12.000Z

Senator Bill Hagerty

@SenatorHagerty

The GENIUS Act establishes the first ever pro-growth regulatory framework for payment stablecoins. This bill will cement US dollar dominance, protect customers, increase demand for US treasuries, and ensure that innovation in the digital asset space is in the hands of the United States of America, not our adversaries. (2/7)

2025-06-17T21:24:11.000Z

Analysis on Stance

Add your own analysis on this stanceSenator Hagerty's tweet thread announcing the Senate passage of the GENIUS Act is a monumental victory for the crypto industry. The 100 stance score assigned to this tweet reflects its immense positive impact. As a champion of this bill, Senator Hagerty's excitement is palpable. The GENIUS Act, as he's consistently articulated, aims to establish a pro-growth regulatory framework for payment stablecoins. This is a critical step towards fostering innovation and ensuring the U.S. maintains its leadership in the digital asset space. The bipartisan support for this bill is particularly encouraging, demonstrating a growing consensus on the importance of clear and balanced regulation for stablecoins.

The key benefits of the GENIUS Act, as highlighted by Senator Hagerty, include cementing U.S. dollar dominance, protecting customers, increasing demand for U.S. Treasuries, and ensuring American leadership in digital asset innovation. These are all compelling arguments in favor of the bill. A well-regulated stablecoin market can strengthen the dollar's global role, provide consumer protections, and boost demand for U.S. government debt. Perhaps most importantly, the GENIUS Act aims to keep digital asset innovation within the United States, preventing other nations from taking the lead. This is a strategic imperative for the U.S., as other countries are making significant strides in developing their own digital currency frameworks. The passage of the GENIUS Act sends a clear signal that the U.S. is committed to fostering innovation and maintaining its competitive edge in the global financial arena.

Senator Bill Hagerty

@SenatorHagerty

The GENIUS Act will cement U.S. dollar dominance, protect customers, drive demand for U.S. Treasuries, & ensure that digital asset innovation happens in the U.S., not overseas.

With this bill, we are one step closer to becoming the global leader in crypto.

Let’s get this done.

2025-06-17T20:37:20.000Z

Senator Bill Hagerty

@SenatorHagerty

I’m excited to see the GENIUS Act pass the Senate later today. It will:

-Establish U.S. dollar dominance

-Revitalize our payment system into the 21st century

-Make  the worldwide leader in stablecoins

Let’s get it done!z

the worldwide leader in stablecoins

Let’s get it done!z

the worldwide leader in stablecoins

Let’s get it done!z

the worldwide leader in stablecoins

Let’s get it done!z

2025-06-17T11:52:56.000Z

Senator Bill Hagerty

@SenatorHagerty

It was an honor to participate in this year’s Bitcoin Conference in Las Vegas!

I enjoyed seeing @BoHines and @DavidFBailey, along with participating in @CodyCarboneDC’s panel with @samkazemian, @GOPMajorityWhip, @davidmarcus, and @RepBryanSteil.

Digital asset technology is the future. I look forward to working hand-in-hand with @POTUS implementing his pro-crypto agenda.

2025-05-30T14:09:43.000Z

Bill Hagerty reposted the post below

Treasury Secretary Scott Bessent

@SecScottBessent

The Trump Administration is going big on digital assets.

Why? Because the previous administration nearly destroyed the industry with its anti-innovation agenda and regulation-by-enforcement approach.

No more.

Digital asset companies deserve regulatory clarity—and that’s king toward.

Passing the stablecoin bill is just the start.

2025-05-23T17:30:28.000Z

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

Stablecoins aren’t the future, they’re the present.

Digital assets can facilitate payments 365 days of the year, without the extra costs.

The GENIUS Act is a game-changer for everyone, from small businesses in Cheyenne, to major companies in New York City.

2025-05-22T16:31:17.000Z

Senator Bill Hagerty

@SenatorHagerty

My goal is simple: make certain that the stablecoin legislation passes.

2025-05-22T00:02:00.000Z

Senator Bill Hagerty

@SenatorHagerty

The GENIUS Act will revitalize our payment systems here in America. Stablecoin holders will be the largest short-term treasuries owners in the world, which asserts U.S. dollar dominance.

2025-05-20T17:52:00.000Z

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

Digital assets are the future and now we’re one step closer to ensuring America leads the way.

Thank you @LeaderJohnThune, @SenatorTimScott, @SenatorHagerty, and @SenGillibrand.

2025-05-20T02:05:22.000Z

Senator Bill Hagerty

@SenatorHagerty

Tonight, the Senate moved forward on the GENIUS Act. This groundbreaking, bipartisan legislation will bring America’s payment system into the 21st century.

The GENIUS Act skyrockets the United States with a digital payment framework with the fastest rails possible. It will ensure U.S. dollar dominance. Customers will be protected, the demand for U.S. treasuries will balloon to the tune of more than $1 trillion, and innovation in the digital asset space will thrive in the United States going forward.

I look forward to making history with my colleagues this week.

2025-05-20T01:49:28.000Z

Senator Bill Hagerty

@SenatorHagerty

Tonight’s vote is a historic opportunity to move toward passing the first major piece of digital asset legislation into law. It is an essential first step that will protect consumers, keep America at the forefront of technological innovation, and further solidify the dominance of the U.S. dollar.

Leader John Thune

@LeaderJohnThune

Stablecoin regulation is a bipartisan issue, and the GENIUS Act reflects bipartisan consensus. Thanks to @SenatorHagerty, @SenLummis, and @SenatorTimScott, in particular, for keeping the ball rolling on this issue.

I hope that in the future we will be able to take up bipartisan legislation without Democrats creating these unnecessary delays.

2025-05-19T19:31:41.000Z

2025-05-19T21:39:24.000Z

Senator Bill Hagerty

@SenatorHagerty

Stablecoin issuers will be the largest holders of U.S. treasuries in the world.

2025-05-19T16:34:00.000Z

Senator Bill Hagerty

@SenatorHagerty

The last thing I want to see is innovation leaving America. The GENIUS Act keeps stablecoin innovation here.

2025-05-19T16:16:00.000Z

Senator Bill Hagerty

@SenatorHagerty

The GENIUS Act is a historic first step in establishing a regulatory framework for stablecoins and asserting dollar dominance. I joined @SquawkCNBC on @CNBC to discuss.

2025-05-19T13:10:53.000Z

Senator Bill Hagerty

@SenatorHagerty

Next week, the Senate will make history when we pass the GENIUS Act that establishes the first ever pro-growth regulatory framework for payment stablecoins. This bill will cement US dollar dominance, protect customers, increase demand for US treasuries, and ensure that innovation in the digital asset space is in the hands of the United States of America, not our adversaries.

2025-05-16T18:03:13.000Z

Analysis on Stance

Add your own analysis on this stanceSenator Hagerty's tweet expresses strong optimism about the upcoming Senate vote on the GENIUS Act, a bill he has championed tirelessly. His confidence that the bill will pass and make history by establishing the first pro-growth regulatory framework for payment stablecoins is a significant positive indicator for the crypto industry. A 100 stance score accurately reflects the potential impact of this legislation.

The GENIUS Act represents a landmark effort to create a clear and balanced regulatory environment for stablecoins in the United States. This is crucial for fostering innovation and ensuring the U.S. remains a leader in the digital asset space. By providing regulatory certainty, the bill aims to attract investment and talent to the U.S., strengthening the country's position in the global crypto landscape.

Senator Hagerty highlights several key benefits of the GENIUS Act: cementing US dollar dominance, protecting customers, increasing demand for US treasuries, and ensuring American leadership in digital asset innovation. These are all compelling arguments in favor of the bill's passage. A well-regulated stablecoin market can indeed strengthen the US dollar's role in the global financial system, while also providing consumer protections and boosting demand for U.S. government debt.

Perhaps most importantly, the GENIUS Act aims to keep digital asset innovation within the United States, preventing other nations from taking the lead in this rapidly evolving space. This is a strategic imperative for the U.S., as other countries, including China and several nations in Europe, are already making significant strides in developing their own digital currency frameworks. The passage of the GENIUS Act would send a clear signal that the U.S. is committed to fostering innovation and maintaining its competitive edge in the global financial arena. We will continue to monitor the progress of the GENIUS Act and keep the community updated on any further developments.

Senator Bill Hagerty

@SenatorHagerty

Great to see Chairman Atkins’ work underway at the SEC to develop clear rules for digital assets. Under his watch, the Commission’s approach will no longer rely on ad hoc enforcement actions, but provide long-needed clarity to the digital asset ecosystem and the American public. sec.gov/newsroom/speec…

2025-05-12T22:39:28.000Z

Analysis on Stance

Add your own analysis on this stanceSenator Hagerty's tweet expressing support for SEC Chairman Atkins' work on developing clear rules for digital assets is a significant development. A 100 stance score reflects the potential positive impact of this shift in regulatory approach. For far too long, the SEC under Gary Gensler has relied on regulation by enforcement, creating uncertainty and stifling innovation in the crypto space. This has been a major impediment to the growth of the digital asset ecosystem in the U.S.

Hagerty's praise for Chairman Atkins signals a potential move away from this harmful approach. The development of clear rules, rather than ad hoc enforcement actions, would provide much-needed clarity for the industry. This predictability allows businesses to operate with confidence, fostering innovation and investment. It also benefits the American public by providing a more stable and transparent regulatory environment for digital assets. This shift towards a more rules-based approach is precisely what the crypto industry has been advocating for. It's a crucial step towards fostering responsible innovation and ensuring the U.S. remains a leader in the digital asset space. We'll be closely monitoring Chairman Atkins' progress and keeping the community updated on any further developments.

Bill Hagerty reposted the post below

U.S. Senate Banking Committee GOP

@BankingGOP

Today should’ve been a historic day for digital assets.

Unfortunately, Senate Democrats put politics in the way of commonsense, bipartisan stablecoin legislation.

2025-05-08T20:26:13.000Z

Bill Hagerty reposted the post below

Senator Pete Ricketts

@SenatorRicketts

Today, Democrats torpedoed a bill that would make America the global leader on stablecoin.

This was a bipartisan bill. It received five Democrat votes in committee. This is Democrat hypocrisy putting politics over the country.

2025-05-08T18:35:33.000Z

Bill Hagerty reposted the post below

Treasury Secretary Scott Bessent

@SecScottBessent

For stablecoins and other digital assets to thrive globally, the world needs American leadership.

The Senate missed an opportunity to provide that leadership today by failing to advance the GENIUS Act.

This bill represents a once-in-a-generation opportunity to expand dollar dominance and U.S. influence in financial innovation. Without it, stablecoins will be subject to a patchwork of state regulations instead of a streamlined federal framework that is more conducive to growth and competitiveness.

The world is watching while American lawmakers twiddle their thumbs. Senators who voted to stonewall U.S. ingenuity today face a simple choice: Either step up and lead or watch digital asset innovation move offshore.

2025-05-08T18:48:16.000Z

Senator Bill Hagerty

@SenatorHagerty

Voting “no” today means you are not willing to even debate, nor amend, the GENIUS Act.

It means that all of the recent comments made in the press about needing changes or tweaks were simply lip service. It means a sudden change of heart from a “yes” in committee to a swift “no” in the last week is purely about politics, not policy. A “no” vote today is a vote against crypto and against innovation. (4/5)

2025-05-08T14:29:14.000Z

Analysis on Stance

Add your own analysis on this stanceSenator Hagerty's tweets regarding the GENIUS Act highlight a critical juncture in the legislative process and expose the political maneuvering surrounding this crucial piece of legislation. His assertion that a "no" vote is a vote against crypto and innovation is a strong statement, but one that's grounded in the reality of how legislative processes work. Let's break down his argument.

The GENIUS Act, a bill designed to establish a regulatory framework for stablecoins, has been a focal point of Senator Hagerty's efforts. He's consistently advocated for its passage, emphasizing its importance for fostering innovation and securing America's leadership in the digital asset space. His recent tweets reveal his frustration with the opposition to the bill, particularly from those who initially signaled support but later reversed their stance.

Hagerty's argument centers on the procedural aspect of the legislative process. A "no" vote at this stage effectively blocks any further debate or amendments to the bill. This means that even those who claim to support the bill's overall goals but have concerns about specific provisions are essentially preventing any opportunity to improve the legislation. By refusing to even debate the bill, these senators are effectively killing it, regardless of their stated intentions.

Hagerty's accusation of "lip service" is directed at those who publicly expressed a desire for changes to the bill but then voted against its advancement. This suggests a lack of genuine commitment to finding common ground and improving the legislation. It raises the question of whether their concerns were truly about the bill's content or driven by political considerations.

The timing of the shift in stance, from "yes" in committee to "no" on the floor, further fuels Hagerty's suspicion of political motivations. This sudden change of heart, coinciding with increased media scrutiny of certain political figures' involvement in crypto, suggests that external factors may be influencing the legislative process.

Hagerty's tweets underscore the importance of transparency and good faith in legislative processes. While it's essential for lawmakers to scrutinize legislation and raise concerns, obstructing any opportunity for debate and amendment undermines the democratic process and hinders progress on critical issues like crypto regulation. His call for a "yes" vote to allow for debate and amendments is a plea for a more constructive and collaborative approach to shaping the future of crypto in America. A "yes" vote doesn't necessarily mean full endorsement of the bill in its current form, but it does signal a willingness to engage in productive dialogue and work towards a solution that benefits both the industry and the American people.

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

The GENIUS Act protects consumers by:

Requiring all stablecoins to be backed 1-to-1

Requiring all stablecoins to be backed 1-to-1

Giving consumers strong rights in bankruptcy

Giving consumers strong rights in bankruptcy

Establishing strict marketing standards

Establishing strict marketing standards

Requiring all stablecoins to be backed 1-to-1

Requiring all stablecoins to be backed 1-to-1

Giving consumers strong rights in bankruptcy

Giving consumers strong rights in bankruptcy

Establishing strict marketing standards

Establishing strict marketing standards2025-05-07T00:14:00.000Z

Senator Bill Hagerty

@SenatorHagerty

My historic legislation establishes the first ever regulatory framework for stablecoins to modernize America’s payment system and affirm the dominance of the US dollar. See the many statements of support from industry stakeholders @BankingGOP.

My historic legislation establishes the first ever regulatory framework for stablecoins to modernize America’s payment system and affirm the dominance of the US dollar. See the many statements of support from industry stakeholders @BankingGOP.

U.S. Senate Banking Committee GOP

@BankingGOP

#NEW: Ahead of the Senate’s historic vote on legislation to establish the first ever regulatory framework for payment stablecoins, key stakeholders are voicing support for the GENIUS Act. banking.senate.gov/newsroom/major…

2025-05-06T20:06:55.000Z

2025-05-06T20:48:41.000Z

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

.@SenatorHagerty's GENIUS Act gets us one step closer to maintaining American leadership in digital assets.

2025-05-06T17:05:30.000Z

Bill Hagerty reposted the post below

Senator Thom Tillis

@SenThomTillis

The world is rapidly establishing digital asset regulatory frameworks. Europe’s MiCA and Singapore’s PSA are clear warning signs that the U.S. risks falling behind in the race to innovate for the 21st Century. Senate Republicans stand ready to pass @SenatorHagerty's GENIUS Act, which establishes meaningful stablecoin regulation to ensure the United States remains on the cutting edge of financial innovation.

2025-05-05T18:28:43.000Z

Bill Hagerty reposted the post below

Blockchain Association

@BlockchainAssn

Today, the CEOs of the three leading digital asset trade associations jointly urged the Senate to bring the GENIUS Act to the floor for debate this week. Read below.

@BlockchainAssn @crypto_council @DigitalChamber

2025-05-05T16:33:10.000Z

Senator Bill Hagerty

@SenatorHagerty

We must advance legislation that enshrines American leadership in the digital asset space and protects the US dollar for centuries to come. That time is now.

We have a choice here. Move forward and make any remaining changes needed in a bipartisan way, or show that digital ation remains a solely Republican issue.

Eleanor Terrett

@EleanorTerrett

NEW: Senator @RubenGallego and nine other senators just issued a joint statement regarding the updated text of the GENIUS Act that was released last week, saying they cannot support the bill in its current form. The group notes several concerns, including insufficient provisions on anti-money laundering, national security, and financial system safety.

Notably, four Dems on the list supported the bill in its original form during the @BankingGOP markup in March: Gallego, Warner, Kim and Blunt Rochester. Democrat Angela Alsobrooks, a co-sponsor of the bill, did not sign the letter.

“This is all about the political dynamics of President Trump,” one Republican Senate aide tells me.

The letter comes following major media scrutiny of Trump’s various crypto ventures, including a New York Times story that stated Trump's family members could profit heavily from $2 billion worth of @worldlibertyfi USD1 stablecoins being used for an investment by a foreign fund.

It also comes just two days after @LeaderJohnThune initiated a process that would expedite a full floor vote on the GENIUS Act.

NEW: Senator @RubenGallego and nine other senators just issued a joint statement regarding the updated text of the GENIUS Act that was released last week, saying they cannot support the bill in its current form. The group notes several concerns, including insufficient provisions on anti-money laundering, national security, and financial system safety.

Notably, four Dems on the list supported the bill in its original form during the @BankingGOP markup in March: Gallego, Warner, Kim and Blunt Rochester. Democrat Angela Alsobrooks, a co-sponsor of the bill, did not sign the letter.

“This is all about the political dynamics of President Trump,” one Republican Senate aide tells me.

The letter comes following major media scrutiny of Trump’s various crypto ventures, including a New York Times story that stated Trump's family members could profit heavily from $2 billion worth of @worldlibertyfi USD1 stablecoins being used for an investment by a foreign fund.

It also comes just two days after @LeaderJohnThune initiated a process that would expedite a full floor vote on the GENIUS Act.2025-05-03T23:38:09.000Z

2025-05-04T00:36:59.000Z

Analysis on Stance

Add your own analysis on this stanceSenator Hagerty's recent tweet underscores the urgent need for bipartisan cooperation on crypto legislation. He's absolutely right: the time to act is now. His message comes in response to a concerning development where several senators withdrew their support for the GENIUS Act, citing concerns about AML, national security, and financial system safety. Let's unpack this situation.

The GENIUS Act, championed by Senator Hagerty, aims to establish a clear regulatory framework for stablecoins and other digital assets. It's a crucial piece of legislation that could cement America's leadership in the crypto space. However, the recent withdrawal of support by some senators throws a wrench into the process. While these senators previously supported the bill, they now claim the updated version doesn't adequately address their concerns.

It's worth noting that this shift in stance coincides with increased media scrutiny of former President Trump's crypto ventures. This raises questions about whether the senators' concerns are genuinely about the bill's content or if they're influenced by political dynamics. Regardless of the motivation, this development highlights the challenges of achieving bipartisan consensus on crypto regulation.

Senator Hagerty's call for bipartisan cooperation is more critical now than ever. A solely Republican-backed crypto bill faces an uphill battle in a divided Congress. Bipartisan support is essential for ensuring the bill's passage and long-term success. It's also crucial for creating a regulatory framework that fosters innovation while addressing legitimate concerns about consumer protection and financial stability.

The future of crypto in America hinges on the ability of lawmakers to work together. Senator Hagerty's tweet serves as a timely reminder of this crucial fact. We need a regulatory framework that supports responsible innovation and protects the US dollar's long-term standing. Let's hope that lawmakers heed Senator Hagerty's call and prioritize bipartisan collaboration on this critical issue.

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

Our landmark legislation is a huge victory for the digital assets industry and a critical step in securing our nation’s financial future. I want to thank @SenatorHagerty @SenatorTimScott for their leadership & @LeaderJohnThune for bringing this important legislation to the floor

2025-05-01T22:46:59.000Z

Senator Bill Hagerty

@SenatorHagerty

America no longer stifles and regulates the crypto industry. President Trump has allowed digital assets to flourish in our markets. (17/35) foxbusiness.com/politics/presi…

2025-04-29T15:50:16.000Z

Senator Bill Hagerty

@SenatorHagerty

This was a broad effort to get this bill to its current form. I want to thank Chairman Scott, Senators Alsobrooks, Lummis, Gillibrand, Kim, Warner, Blunt Rochester, Gallego, and all of my Republican colleagues for working with me on this. More improvements to come but today was a hoin legislation.

Brad Garlinghouse

@bgarlinghouse

Stablecoin policy is on its way – big thanks to

@SenatorHagerty

@SenLummis

@SenGillibrand and

@SenatorTimScott

for their commitment with the GENIUS Act.

2025-03-13T20:01:40.000Z

2025-03-13T21:06:24.000Z

Senator Bill Hagerty

@SenatorHagerty

I’m pleased to see my GENIUS Act successfully pass out of the Senate Banking Committee with bipartisan support. This legislation is a critical first step in establishing a safe and pro-growth regulatory framework that will unleash innovation and advance the President’s mission to ma forward to seeing this bill pass the Senate in the near future and ultimately signed into law by President Trump.

Senator Bill Hagerty

@SenatorHagerty

Whether it’s improving transaction efficiency, freeing up working capital, or driving U.S. treasury demand, the benefits of a clear regulatory framework for stablecoin are immense.

The Genius Act has gained bipartisan support because it presents common sense rules that protect ctation. It’s time we provide the clarity and stability that our country and its innovators so desperately need.

2025-03-13T16:10:55.000Z

2025-03-13T16:54:02.000Z

Senator Bill Hagerty

@SenatorHagerty

Whether it’s improving transaction efficiency, freeing up working capital, or driving U.S. treasury demand, the benefits of a clear regulatory framework for stablecoin are immense.

The Genius Act has gained bipartisan support because it presents common sense rules that protect ctation. It’s time we provide the clarity and stability that our country and its innovators so desperately need.

2025-03-13T16:10:55.000Z

Senator Bill Hagerty

@SenatorHagerty

The Senate Banking Committee’s debate and vote on my GENIUS Act re: crypto stablecoins starts now.

WATCH LIVE HERE: banking.senate.gov/hearings/03/10…

2025-03-13T14:00:34.000Z

Senator Bill Hagerty

@SenatorHagerty

My GENIUS Act with @SenatorTimScott, @SenGillibrand, @SenLummis, and @Sen_Alsobrooks establishes a safe and pro-growth regulatory framework that will unleash innovation and advance @POTUS’s mission to make America the world capital of crypto. I look forward to getting this bill voted out of the Senate Banking Committee this week and ultimately signed into law. hagerty.senate.gov/press-releases…

2025-03-11T02:04:24.000Z

Analysis on Stance

Add your own analysis on this stanceSenator Hagerty's championing of the GENIUS Act marks a significant stride toward establishing a robust and growth-oriented regulatory framework for crypto in the United States. His recent tweet expressing optimism about the bill's progress is a welcome development for the entire crypto community. Let's break down why this legislation is so vital.

The GENIUS Act, co-sponsored by a bipartisan group of senators, aims to create a clear and balanced regulatory environment for digital assets. This is crucial for fostering innovation and attracting investment in the crypto space. A well-defined regulatory framework provides much-needed certainty for businesses operating in this evolving landscape, encouraging responsible growth while mitigating potential risks. This bill directly addresses the concerns raised by many in the industry regarding the current regulatory ambiguity that has hindered the growth and adoption of cryptocurrencies.

Senator Hagerty's commitment to making America the "world capital of crypto" aligns perfectly with the goals of the GENIUS Act. By providing a safe and transparent regulatory framework, the bill aims to attract crypto businesses and talent to the U.S., fostering a thriving ecosystem for innovation and investment. This stands in stark contrast to the current regulatory uncertainty that has driven some crypto companies offshore.

The fact that the GENIUS Act is being championed by a bipartisan group of senators is particularly encouraging. It signifies a growing consensus across the political spectrum on the importance of fostering responsible innovation in the crypto space. This bipartisan support increases the likelihood of the bill's successful passage and implementation. It's a testament to the growing recognition of the transformative potential of digital assets.

Senator Hagerty's confidence in the bill's passage through the Senate Banking Committee and its eventual signing into law is a positive sign. It suggests that the bill has gained significant momentum and is on track to becoming a reality. The successful passage of the GENIUS Act would be a landmark achievement for the crypto industry, providing the regulatory clarity and stability needed to unlock its full potential. We will continue to monitor the bill's progress and keep the community informed of any further developments.

Took stances on a bill between 2025-01-21T00:00:00.000Z and 2025-03-04T00:00:00.000Z

Bill Name

S.J. Res 3

Details

A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Internal Revenue Service relating to "Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales".

Timeline

2025-01-21

Very Pro-Crypto

Cosponsored

2025-03-04

Very Pro-Crypto

Voted for - Final Passage Out Of Senate

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

We need a bipartisan regulatory framework for stablecoins. Let’s get @SenatorHagerty's GENIUS Act across the finish line and to @POTUS' desk. The race is on, and America is falling behind.

2025-02-26T13:30:05.000Z

Senator Bill Hagerty

@SenatorHagerty

The tide has turned in favor of digital assets here in America. I’m pleased to lead my colleagues in the GENIUS Act, which will help make our nation a positive environment for stablecoins and digital assets.

2025-02-04T23:52:36.000Z

Senator Bill Hagerty

@SenatorHagerty

Today, I’m introducing the GENIUS Act w/ @SenatorTimScott, @SenGillibrand, & @SenLummis, a bill that establishes a clear regulatory framework for stablecoins.

I look forward to working with @RepFrenchHill and @FinancialCmte to get it to the President’s desk and signed into law.

Bloomberg

@business

Senator Bill Hagerty will introduce legislation to create a framework for stablecoins, the latest push to create crypto-friendly guidelines for an industry that’s a priority for Donald Trump trib.al/5YIkabN

2025-02-04T14:44:38.000Z

2025-02-04T15:06:34.000Z

Senator Bill Hagerty

@SenatorHagerty

.@POTUS has unleashed digital assets innovation and unburdened the industry from predatory regulations. (4/10)

2025-01-28T20:03:13.000Z

Bill Hagerty reposted the post below

Senator Cynthia Lummis

@SenLummis

The digital asset dream team. Let’s get to work @SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

@SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

@SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

@SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

2025-01-27T19:04:00.000Z

Senator Bill Hagerty

@SenatorHagerty

It’s the dawn of a new era for digital assets. This is a groundbreaking moment for crypto innovation in America  K

K

K

K

Eleanor Terrett

@EleanorTerrett

NEW per my @FoxBusiness colleague @EdwardLawrence: The #crypto executive order has officially been signed.

Here are the details:

NEW per my @FoxBusiness colleague @EdwardLawrence: The #crypto executive order has officially been signed.

Here are the details:

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance.

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance.

The Working Group will be tasked with developing a Federal regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.

The Working Group will be tasked with developing a Federal regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.

The Working Group will be chaired by the White House AI & Crypto Czar @DavidSacks and include the Secretary of the Treasury, the Chairman of the Securities and Exchange Commission, and the heads of other relevant departments and agencies.

The Working Group will be chaired by the White House AI & Crypto Czar @DavidSacks and include the Secretary of the Treasury, the Chairman of the Securities and Exchange Commission, and the heads of other relevant departments and agencies.

The White House AI & Crypto Czar will engage leading experts in digital assets and digital markets to ensure that the actions of the Working Group are informed by expertise beyond the Federal Government.

The White House AI & Crypto Czar will engage leading experts in digital assets and digital markets to ensure that the actions of the Working Group are informed by expertise beyond the Federal Government.

The Executive Order directs departments and agencies with identifying and making recommendations to the Working Group on any regulations and other agency actions affecting the digital assets sector that should be rescinded or modified.

The Executive Order directs departments and agencies with identifying and making recommendations to the Working Group on any regulations and other agency actions affecting the digital assets sector that should be rescinded or modified.

The Executive Order prohibits agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs).

The Executive Order prohibits agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs).

The Executive Order revokes the previous Administration’s Digital Assets Executive Order and the Treasury Department’s Framework for International Engagement on Digital Assets which suppressed innovation and undermined U.S. economic liberty and global leadership in digital finance.

The Executive Order revokes the previous Administration’s Digital Assets Executive Order and the Treasury Department’s Framework for International Engagement on Digital Assets which suppressed innovation and undermined U.S. economic liberty and global leadership in digital finance.2025-01-23T20:25:42.000Z

2025-01-23T20:35:16.000Z

Senator Bill Hagerty

@SenatorHagerty

Yesterday, I had the pleasure of joining the Blockchain Association Summit in Washington.

With President Trump in the White House and Republicans in control of Congress, the future is bright for the digital asset community.

2024-12-18T15:35:30.000Z

Senator Bill Hagerty

@SenatorHagerty

Today, my Republican colleagues and I blocked Banking Democrats’ 11th-hour attempt to install an anti-crypto, climate activist at the SEC.

Thank you to incoming Chairman @SenatorTimScott @BankingGOP for his efforts to block radical nominees from getting confirmed.

2024-12-17T18:11:12.000Z

Senator Bill Hagerty

@SenatorHagerty

The American people spoke, yet Democrats aren’t listening.

Today we blocked Biden and Senate Democrats from installing an anti-crypto, climate activist at the SEC for the next 5 years—during their last 5 weeks in office.

This Administration has done enough damage.

Brendan Pedersen

@BrendanPedersen

News: Senate Banking Republicans blocked a request from Chair Sherrod Brown to move a postponed nomination vote from this morning to this afternoon. They needed a waiver to host that vote outside of the noticed time, and Rs denied it, per two aides.

2024-12-11T21:39:43.000Z

2024-12-11T22:47:25.000Z

Senator Bill Hagerty

@SenatorHagerty

Just now, Sherrod Brown tried to install Biden’s anti-crypto, climate-activist SEC nominee with an eleventh-hour backroom deal. A word of warning to my Democrat colleagues: I will have no sympathy for crocodile tears when we move our nominees through at lightning speed next year.

2024-12-11T15:33:56.000Z

Analysis on Stance

Add your own analysis on this stanceSenator Hagerty's staunch pro-crypto stance is to be lauded. His recent tweet highlights a concerning development regarding the SEC nominee and underscores the importance of vigilance in protecting the future of digital assets. Let's delve into the details.

Senator Hagerty is referring to President Biden's attempt to install an SEC nominee who is perceived as being unfavorable to the crypto industry. While the tweet doesn't explicitly name the nominee, it's crucial to understand the context surrounding this appointment. It appears this maneuver was attempted during a period when the Senate was less likely to face scrutiny. Such tactics raise concerns about transparency and potential undue influence on regulatory bodies.

Senator Hagerty's warning to his Democratic colleagues signals his commitment to swift action on nominations next year. This suggests a potential shift in the Senate's approach to confirming presidential appointments, which could have significant implications for various sectors, including the crypto industry. A faster confirmation process could lead to quicker decisions on regulatory frameworks, potentially accelerating the clarity and stability that the crypto market needs.

Senator Hagerty's unwavering support for crypto is evident in his firm opposition to this appointment. He recognizes the potential harm that an anti-crypto SEC Chair could inflict on the burgeoning digital asset ecosystem. His proactive stance serves as a reminder of the importance of having informed and supportive individuals in positions of power to foster responsible innovation and growth within the crypto space. This is a critical moment for the industry, and Senator Hagerty's vigilance is commendable.

Senator Bill Hagerty

@SenatorHagerty

It is unfortunate that it came to this point, but I’m glad to see states—including Tennessee—taking a stand against Gary Gensler’s anti-crypto agenda.

Eleanor Terrett

@EleanorTerrett

SCOOP: 18 U.S. states have filed to sue the @SECGov and its commissioners, accusing them of unconstitutional overreach and unfair persecution of the #crypto industry under the leadership of agency chief @GaryGensler.

The lawsuit, signed by 18 Republican Attorneys General, details how the agency has committed “gross government overreach” with its regulation by enforcement crusade against the $3 trillion industry, resulting in an infringement upon states’ rights to regulate their economies.

Story developing and full write-up coming soon.

SCOOP: 18 U.S. states have filed to sue the @SECGov and its commissioners, accusing them of unconstitutional overreach and unfair persecution of the #crypto industry under the leadership of agency chief @GaryGensler.

The lawsuit, signed by 18 Republican Attorneys General, details how the agency has committed “gross government overreach” with its regulation by enforcement crusade against the $3 trillion industry, resulting in an infringement upon states’ rights to regulate their economies.

Story developing and full write-up coming soon.2024-11-14T19:44:39.000Z

2024-11-14T19:49:29.000Z

Senator Bill Hagerty

@SenatorHagerty

It is long overdue for Congress to pass legislation that gives clarity to stablecoins in the US. That is why I released draft legislation that builds off @PatrickMcHenry's work that establishes the framework necessary to unlock this technology’s potential to benefit Americans.

2024-10-22T19:14:05.000Z

Senator Bill Hagerty

@SenatorHagerty

For too long, the benefits & promise of stablecoins have been hindered by a lack of legal clarity. My new draft legislation builds off @PatrickMcHenry’s work & establishes the framework necessary to unlock this technology’s potential to benefit Americans. hagerty.senate.gov/press-releases…

2024-10-11T02:20:19.000Z

Senator Bill Hagerty

@SenatorHagerty

Gary Gensler's testimony before the Banking Committee has been canceled due to some "scheduling issues."

Gensler has skirted the law to advance his radical agenda and attack crypto—Americans deserve to hear him explain what has been going on under his watch at the @SECGov.

2024-09-25T14:11:14.000Z

Senator Bill Hagerty

@SenatorHagerty

Regulators shouldn't be forcing innovation into unregulated offshore markets. Just like with crypto, the federal government must adopt a more innovation-friendly posture, or risk losing America's competitive edge. coindesk.com/policy/2024/09…

2024-09-09T17:51:35.000Z

Bill Hagerty

@BillHagertyTN

Actions speak louder than words. Every step of the way, Kamala Harris has acted against the crypto community, and no half-hearted effort to “pivot” three months before the election can hide the truth. (6/6)

2024-08-08T17:56:38.000Z

Bill Hagerty

@BillHagertyTN

Any rumored “pivot” or “reset” on crypto is just another untrustworthy attempt by Kamala Harris to distance herself from the radical progressive policies that have defined her career: anti-crypto and anti-innovation. (5/6)

2024-08-08T17:56:37.000Z

Bill Hagerty

@BillHagertyTN

Congressional Democrats have doubled down on this stance by blocking key pro-crypto legislation at every turn, including the legislative effort to repeal SAB 121—an anti-crypto rule issued by Gary Gensler’s SEC. (3/6)

2024-08-08T17:56:36.000Z

Bill Hagerty

@BillHagertyTN

When progressives have attempted to legislate on crypto, they have pushed radical proposals like DAAMLA, which would crack down on the industry and drive innovators overseas. (4/6)

2024-08-08T17:56:36.000Z

Bill Hagerty

@BillHagertyTN

For nearly 4 years, the Biden-Harris Admin has waged an ideological war against U.S. crypto innovation. Taking cues from the Admin, Gary Gensler has denied the industry a basic regulatory framework and assailed firms with groundless enforcement actions. (2/6)

2024-08-08T17:56:35.000Z

Bill Hagerty

@BillHagertyTN

Democrats’ attempt to “pivot” on crypto policy is peak political desperation. They may try to rewrite history as they often do, but the facts speak for themselves:  (1/6)

(1/6)

(1/6)

(1/6) 2024-08-08T17:56:34.000Z

Senator Bill Hagerty

@SenatorHagerty

We need to allow crypto innovation here in America. President Trump will do that.

2024-08-01T19:35:00.000Z

Senator Bill Hagerty

@SenatorHagerty

The Biden Admin has made several moves toward creating a CBDC. This is what's being done in Communist China, & it would allow govt surveillance & control of all of our financial transactions. The Bitcoin community doesn’t want something centrally controlled by the federal govt.

2024-07-30T16:37:00.000Z

Senator Bill Hagerty

@SenatorHagerty

Innovation in crypto, one of the greatest, most impactful technologies that we see for our nation's future, should happen here in America—not be forced offshore the way the current Administration has been doing. President Trump made that clear last weekend at Bitcoin Nashville.

2024-07-30T16:11:18.000Z

Bill Hagerty

@BillHagertyTN

Had a blast talking to @TheBitcoinConf this afternoon. Now more than ever, we must elect candidates that support Bitcoin & digital assets, especially @realDonaldTrump!

2024-07-26T20:30:00.000Z

Bill Hagerty

@BillHagertyTN

Republicans in both chambers have worked together to:

-try to overturn Biden’s most egregious policies

-address concerns about illicit finance

-promote private-sector stablecoin innovation

-prevent the development of a CBDC. (5/6)

2024-07-26T19:16:17.000Z

Bill Hagerty

@BillHagertyTN

The Biden-Harris regulators have also tried to stifle adoption of crypto in the traditional financial system, whether by forcing Signature Bank into receivership or imposing SEC SAB 121, which makes it too expensive to hold customers’ crypto assets. (3/6)

2024-07-26T19:16:15.000Z

Bill Hagerty

@BillHagertyTN

Meanwhile, as the party of free enterprise & innovation, Republicans have taken concrete steps to develop a constructive crypto environment.

The Republican House has passed bills to provide clarity for crypto market structure & for USD-denominated private stablecoins. (4/6)

2024-07-26T19:16:15.000Z

Bill Hagerty

@BillHagertyTN

The Biden-Harris Admin’s combination of refusing to provide a basic legal framework to support crypto + brass-knuckled enforcement of non-existent rules is pushing the industry overseas.

It’s another Operation Chokepoint. (2/6)

2024-07-26T19:16:14.000Z

Bill Hagerty

@BillHagertyTN

Bill Hagerty

@BillHagertyTN

As Americans head to the polls this fall, their decision regarding who will lead our country will also determine the fate of crypto here in the United States, and our security, prosperity, and freedom are at stake. Read my new op-ed in @BitcoinMagazine:

bitcoinmagazine.com/politics/the-f…

2024-07-25T18:20:10.000Z

2024-07-26T19:16:13.000Z

Bill Hagerty reposted the post below

Bitcoin Magazine

@BitcoinMagazine

JUST IN:  US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville  “I love liberty and freedom, I don’t care for centralization.”

“I love liberty and freedom, I don’t care for centralization.”  d

d

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville  “I love liberty and freedom, I don’t care for centralization.”

“I love liberty and freedom, I don’t care for centralization.”  d

d

2024-07-26T18:49:14.000Z

Bill Hagerty reposted the post below

Bitcoin Magazine

@BitcoinMagazine

JUST IN:  US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville  “I love liberty and freedom, I don’t care for centralization.”

“I love liberty and freedom, I don’t care for centralization.”  d

d

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville  “I love liberty and freedom, I don’t care for centralization.”

“I love liberty and freedom, I don’t care for centralization.”  d

d

2024-07-26T18:49:14.000Z

Bill Hagerty

@BillHagertyTN

2024-07-26T18:22:17.000Z

Bill Hagerty reposted the post below

Bitcoin Magazine

@BitcoinMagazine

JUST IN:  US Senator Bill Hagerty says he's fighting to pass pro-#Bitcoin legislation that promotes freedom and opportunity.

7

US Senator Bill Hagerty says he's fighting to pass pro-#Bitcoin legislation that promotes freedom and opportunity.

7

US Senator Bill Hagerty says he's fighting to pass pro-#Bitcoin legislation that promotes freedom and opportunity.

7

US Senator Bill Hagerty says he's fighting to pass pro-#Bitcoin legislation that promotes freedom and opportunity.

7

2024-07-26T16:32:30.000Z

Bill Hagerty

@BillHagertyTN

Great to be on with my friend @michaeljknowles at Bitcoin Nashville 2024!

2024-07-26T16:59:07.000Z

Senator Bill Hagerty

@SenatorHagerty

Grateful to join Comissioner Stuart McWhorter to announce Tennessee’s commitment to: (1) fostering free and open source software development and (2) making our state Sovereign Valley when it comes to freedom tech. #BitcoinNashville2024

2024-07-26T14:57:18.000Z

Bill Hagerty

@BillHagertyTN

As Americans head to the polls this fall, their decision regarding who will lead our country will also determine the fate of crypto here in the United States, and our security, prosperity, and freedom are at stake. Read my new op-ed in @BitcoinMagazine:

bitcoinmagazine.com/politics/the-f…

2024-07-25T18:20:10.000Z

Senator Bill Hagerty

@SenatorHagerty

While I am glad to see this finally happen, these approvals are long overdue, and should never have taken so long. Gary Gensler and the SEC have proven to be nothing short of hostile toward the crypto industry, at the expense of American competitiveness.

CoinDesk

@CoinDesk

JUST IN: #Ethereum ETFs just got approval to trade in the U.S., easing access to $ETH.

trib.al/LhyRse6

2024-07-22T20:56:57.000Z

2024-07-22T23:36:34.000Z

Senator Bill Hagerty

@SenatorHagerty

It’s official: Democrats are hellbent on crushing crypto.

The promise of decentralization threatens their control.

We need to build a future for crypto in America, and we’ll need new political leadership to do it.

Bitcoin Magazine

@BitcoinMagazine

JUST IN:  US House fails to overturn President Biden's veto on bill that would allow highly regulated financial firms to custody #Bitcoin and crypto.

They needed to 2/3's of the votes to overturn the veto.

US House fails to overturn President Biden's veto on bill that would allow highly regulated financial firms to custody #Bitcoin and crypto.

They needed to 2/3's of the votes to overturn the veto.

US House fails to overturn President Biden's veto on bill that would allow highly regulated financial firms to custody #Bitcoin and crypto.

They needed to 2/3's of the votes to overturn the veto.

US House fails to overturn President Biden's veto on bill that would allow highly regulated financial firms to custody #Bitcoin and crypto.

They needed to 2/3's of the votes to overturn the veto.2024-07-11T16:14:51.000Z

2024-07-11T17:57:02.000Z

Bill Hagerty

@BillHagertyTN

Great news that @realDonaldTrump will be at @TheBitcoinConf in Nashville.

Americans’ decision at the polls will determine the fate of Bitcoin in the U.S.

President Trump is the only candidate who will deliver prosperity and freedom.

Pleased to work with @DavidFBailey on this!

The Bitcoin Conference

@TheBitcoinConf

ANNOUNCING: PRESIDENT DONALD J. TRUMP TO SPEAK AT #BITCOIN2024

2024-07-10T23:30:33.000Z

2024-07-11T13:38:40.000Z

Bill Hagerty

@BillHagertyTN

REMINDER: Republicans are the party of crypto & have the record to prove it.

America should be leading on crypto by promoting freedom, opportunity, & limited gov’t.

A vote for @realDonaldTrump & Republicans down the ballot is a vote for crypto!

en.cryptonomist.ch/2024/07/09/cry…

2024-07-10T13:21:02.000Z

Senator Bill Hagerty

@SenatorHagerty

This vote will reveal your elected officials’ true stance on crypto.

The last vote was pre-determined given Biden’s veto threat - this time it is live.

Pro-innovation Republicans have made our stance clear—will Democrats have the courage to join us? theblock.co/post/303779/us…

2024-07-09T17:05:28.000Z

Bill Hagerty reposted the post below

Mario Nawfal

@MarioNawfal

THE FUTURE OF CRYPTO IN THE U.S. - LIVE X SPACE TODAY @ 6PM ET

Join us on X Spaces TODAY at PM ET as we discuss the future of crypto policy in the U.S. with Senator @BillHagertyTN and Senate Candidates @CaptainSamBrown and @DaveMcCormickPA.

Co-Host: Mayor @JessAnderson2

Set your reminder:i

THE FUTURE OF CRYPTO IN THE U.S. - LIVE X SPACE TODAY @ 6PM ET

Join us on X Spaces TODAY at PM ET as we discuss the future of crypto policy in the U.S. with Senator @BillHagertyTN and Senate Candidates @CaptainSamBrown and @DaveMcCormickPA.

Co-Host: Mayor @JessAnderson2

Set your reminder:i

2024-07-08T21:37:10.000Z

Bill Hagerty

@BillHagertyTN

I had a great time on the @ValidatedPod discussing how crypto has become a focal point of the 2024 elections.

Now, more than ever, we must elect pro-crypto & pro-American leaders into the White House, Senate, and House of Representatives.

Watch the full episode here:

Solana

@solana

2024-07-05T13:13:23.000Z

2024-07-05T15:40:03.000Z

Bill Hagerty

@BillHagertyTN

The choice is clear in November:

President Trump & Republicans across the country want to encourage U.S. crypto innovation & leadership

Joe Biden & his cronies have refused clarity and thrown up roadblocks at every turn.

donaldjtrump.com/crypto

2024-06-15T00:35:20.000Z

Senator Bill Hagerty

@SenatorHagerty

.@GaryGensler’s failure to provide clear rules of the road for crypto is pushing the industry overseas. Crypto innovation creates jobs, drives technological progress, and spurs economic growth—it should be happening here in America.

2024-06-13T19:21:01.000Z

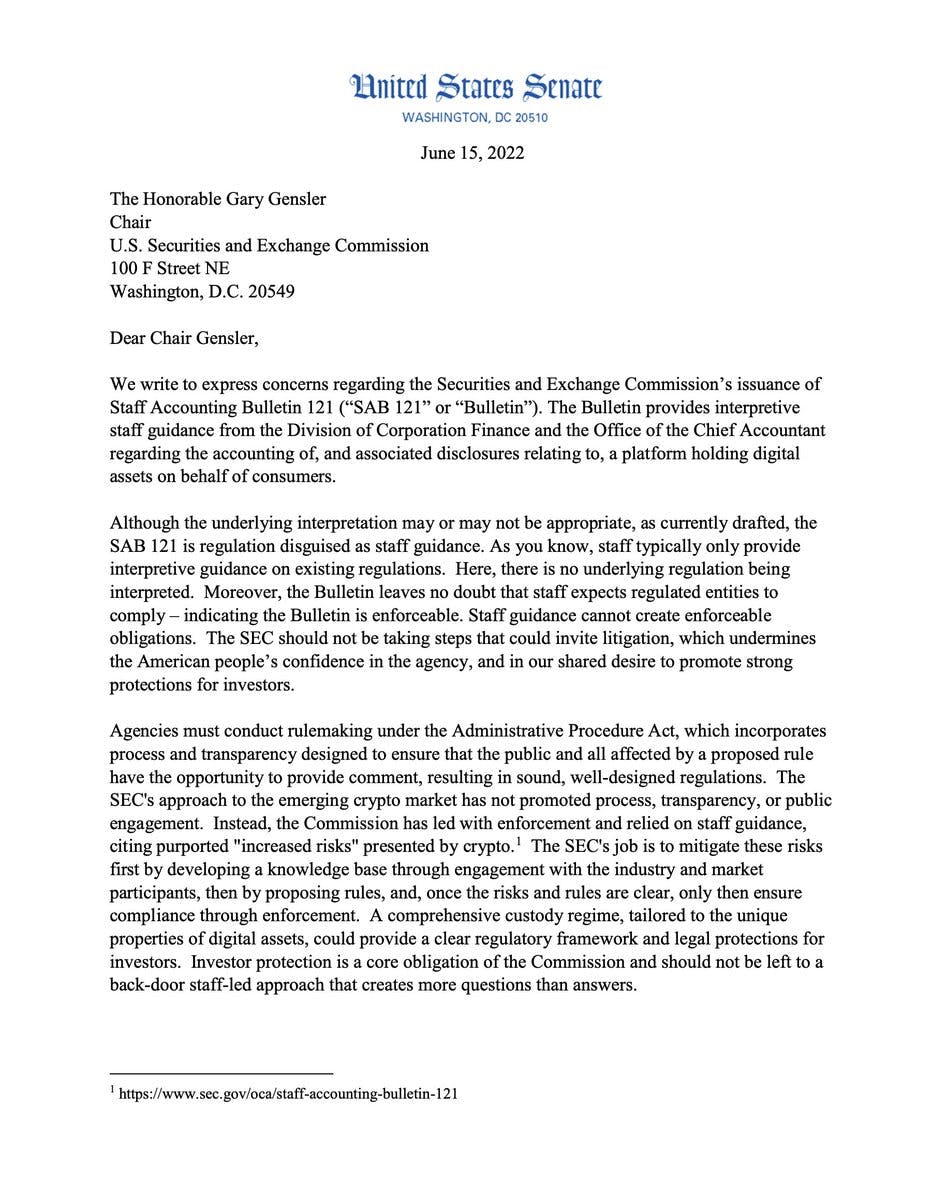

Voted for a bill on 2024-05-16

Bill Name

SAB 121 House Joint Resolution

Details

For congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to "Staff Accounting Bulletin No. 121".

This staff accounting bulletin expresses the views of the staff regarding the accounting for obligations to safeguard crypto-assets an entity holds for platform users.

Vote Type

Final Passage Out Of Senate

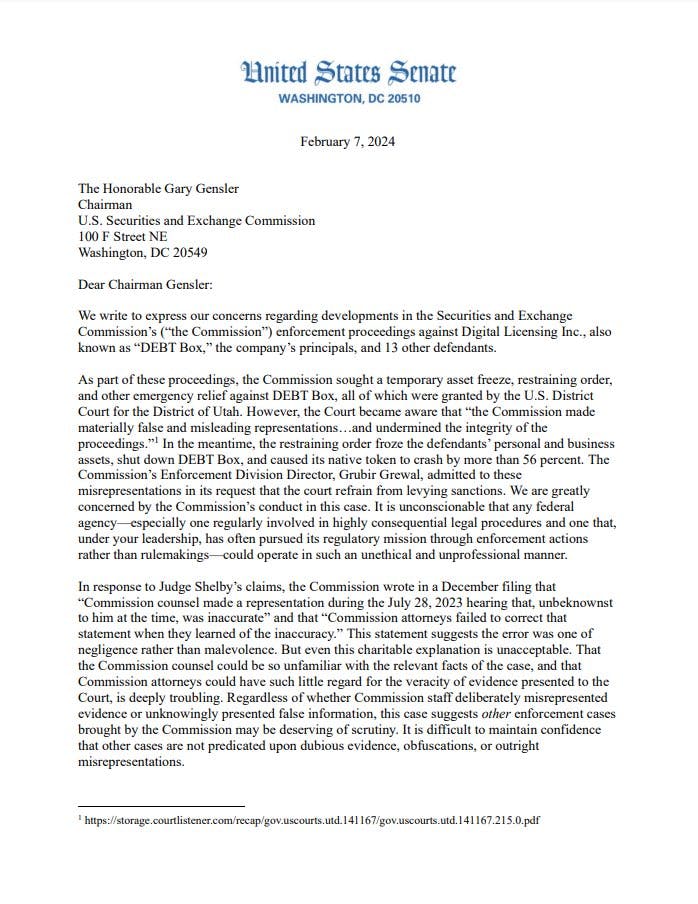

Senator Bill Hagerty

@SenatorHagerty

Earlier this year, I joined @JDVance1 and my colleagues in calling out the SEC’s abuse of power. While this news is an encouraging first step, much more must be done to restore the SEC's accountability and ensure it drops its groundless hostility to crypto innovation.

Bloomberg

@business

Two Securities and Exchange Commission lawyers resigned after a federal judge sanctioned and sharply rebuked the Wall Street regulator for “gross abuse” of power in a crypto case. trib.al/7MfI6qE

2024-04-22T17:42:20.000Z

2024-04-22T20:22:09.000Z

Senator Bill Hagerty

@SenatorHagerty

The @SECGov is not above the law, and today’s decision reinforces this fact. These sanctions ought to remind the agency that there are consequences when it abuses its power to target crypto and blockchain innovation.

Eleanor Terrett

@EleanorTerrett

NEW: A Utah judge has found the @SECGov engaged in bad faith conduct against #crypto firm @TheDebtBox.

The judge has placed sanctions on the SEC for “abuse of judicial process,” ordered them to pay the legal fees of Debt Box and denied its motion to dismiss the charges without prejudice, meaning it will not be able to refile the same charges at a later date.

Full decision here:

storage.courtlistener.com/recap/gov.usco…

NEW: A Utah judge has found the @SECGov engaged in bad faith conduct against #crypto firm @TheDebtBox.

The judge has placed sanctions on the SEC for “abuse of judicial process,” ordered them to pay the legal fees of Debt Box and denied its motion to dismiss the charges without prejudice, meaning it will not be able to refile the same charges at a later date.

Full decision here:

storage.courtlistener.com/recap/gov.usco…2024-03-18T21:35:25.000Z

2024-03-18T22:13:30.000Z

Senator Bill Hagerty

@SenatorHagerty

Government bureaucrats have been far too willing to exploit the financial system to advance political agendas & target Americans. I joined @SenTedCruz in introducing legislation to halt efforts by the Biden Admin to issue a CBDC, which would violate Americans’ privacy & rights.

Senator Ted Cruz

@SenTedCruz

RELEASE: Sen. Cruz Introduces Legislation to Ban Central Bank Digital Currencies

cruz.senate.gov/newsroom/press…

2024-02-26T19:45:01.000Z

2024-02-27T16:09:23.000Z

Senator Bill Hagerty

@SenatorHagerty

The federal govt should partner with private industry to combat bad actors—including in the crypto space. My bill w/ @SenLummis would help law enforcement agencies leverage their existing authorities to better identify violations w/out stifling innovation. hagerty.senate.gov/press-releases…

2024-01-17T21:06:14.000Z

Senator Bill Hagerty

@SenatorHagerty

This milestone ought to be a turning point for @SECGov—it must end its excessive hostility toward cryptocurrency and refocus on its mission of protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation. (2/2)

2024-01-10T21:43:22.000Z

Senator Bill Hagerty

@SenatorHagerty

Today's long overdue approval of spot Bitcoin ETFs strengthens U.S. leadership in financial innovation. This not only takes a step toward greater regulatory clarity for crypto, but also opens the door for more Americans to become involved in this cutting-edge technology. (1/2)

Bloomberg Markets

@markets

BREAKING: Bitcoin-spot ETFs receive SEC approval to launch in the US — the culmination of a years' long campaign by the digital-asset industry trib.al/T2qSKBP

2024-01-10T21:34:25.000Z

2024-01-10T21:43:21.000Z

Senator Bill Hagerty

@SenatorHagerty

I can understand why large banks are opposed to cryptocurrencies – the technology has the potential to disrupt much of the traditional banking model. This is not a fight for DC to pick sides on. We need to regulate with a light touch that doesn’t kill innovation in the US.

2023-12-07T17:32:21.000Z

Senator Bill Hagerty

@SenatorHagerty

When it comes to regulating crypto, we need a scalpel, not a sledgehammer.

youtube.com/watch?v=CgBclr…

2023-10-30T14:57:31.000Z

Senator Bill Hagerty

@SenatorHagerty