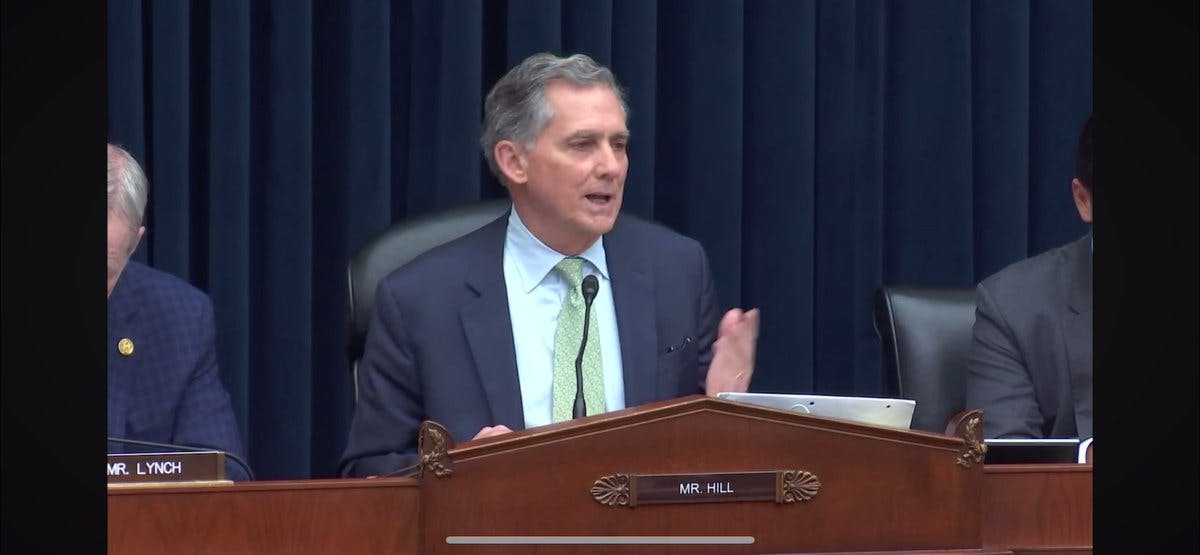

Does French Hill Support Crypto?

Based on previous comments, French Hill has indicated they are very pro-cryptocurrency. Below you can view the tweets, quotes, and other commentary French Hill has made about Bitcoin, Ethereum, and cryptocurrency innovation.

French Hill reposted the post below

Tom Emmer

@GOPMajorityWhip

100% correct, Mr. Chairman. We need to get CLARITY to President Trump’s desk ASAP to give all digital asset market participants a clear roadmap to operate and thrive in the United States.

The House did its job, the Senate must act.

2026-02-11T14:09:05.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

Chairman @RepFrenchHill on @RepMeuser & the Committee's digital asset debanking report:

"This report identifies all the ways former @SECGov Chair Gensler, former bank supervisors like Michael Barr and others, to systematically debank legal businesses in the US engaged in the digital asset innovative space. This was terrible for American competitiveness and it led me during the course of the Biden Admin to offer my market structure bill which gives clear rules of the road for digital assets so people know how to innovate and count on the federal government to not debank them, but encourage the use of blockchain technology inside financial services."

2025-12-03T14:25:00.000Z

Analysis on Stance

Add your own analysis on this stanceRepresentative French Hill delivers a powerful and precise condemnation of one of the most significant threats to the digital asset industry: systematic debanking. This statement is a masterclass in pro-crypto advocacy and fully earns its perfect support score.

He correctly identifies that the lack of clear rules has enabled regulators, including former SEC Chair Gensler and bank supervisors, to pressure financial institutions into denying services to legal crypto businesses. This "debanking" is not a free market outcome; it's a coordinated effort to stifle a legitimate industry through regulatory ambiguity, which Hill rightly calls "terrible for American competitiveness."

Crucially, he doesn't just diagnose the problem; he provides the solution. He directly links this hostile environment to the necessity of his market structure bill, the CLARITY Act. As a reminder, this legislation is designed to create the "clear rules of the road" that the industry has been demanding. It would provide a pathway for innovators to operate without fear of being arbitrarily cut off from the financial system.

By framing his goal as encouraging the use of blockchain technology and ensuring the government supports, rather than attacks, this innovation, Chairman Hill confirms his position as a true champion for the space. He understands the core issues and is leading the charge to solve them with sound policy.

French Hill

@ElectFrench

Arkansans deserve clear, safe rules for digital assets. I’m working to promote innovation, jobs, and your savings, without Washington red tape.

2025-10-22T11:29:35.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill joins @CoinDesk to discuss the importance of passing digital asset market structure legislation into law and the significance of this pivotal moment to solidify America as the crypto capital of the world.

2025-09-10T18:45:38.000Z

Analysis on Stance

Add your own analysis on this stanceRepresentative French Hill continues his consistent and vocal advocacy for establishing the United States as a global leader in digital assets. This appearance on a major crypto-native media outlet to discuss legislation is another clear indicator of his deeply pro-crypto stance.

The "digital asset market structure legislation" he refers to is the CLARITY Act, a bill he authored. As a reminder, this legislation is designed to end the "regulation by enforcement" approach by creating clear definitions for digital commodities and giving primary jurisdiction to the CFTC. It is one of the most significant pieces of pro-crypto legislation proposed.

By framing the goal as making America the "crypto capital of the world," Chairman Hill is positioning crypto not as a threat to be managed, but as a generational opportunity for American innovation and leadership. This perspective is crucial and stands in stark contrast to regulators who focus narrowly on enforcement without providing a path forward for legitimate projects.

This action is entirely in line with his perfect support score. He is not just voting correctly; he is actively leading the charge, engaging with the industry directly, and consistently working to pass foundational, common-sense laws. This is the definition of a champion for the space.

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill on digital asset market structure legislation:

"The CLARITY Act in the House, which I wrote, got 78 Democrat votes here in the House. ... We got such overwhelming support by Democrats and Republicans. ... I would hope that the Senate would consider taking up the CLARITY Act in their process and simply make improvements to it.”

2025-09-03T14:26:09.000Z

Analysis on Stance

Add your own analysis on this stanceRepresentative French Hill once again demonstrates his unwavering commitment to establishing a clear and sensible regulatory framework for digital assets in the United States. In this statement, he highlights the crucial bipartisan support for the CLARITY Act, a bill he authored.

For context, the Digital Asset Market Clarity Act (CLARITY Act) is landmark legislation designed to provide the crypto industry with the certainty it has long sought. It would grant the Commodity Futures Trading Commission (CFTC) jurisdiction over digital commodities and establish a clear process for distinguishing them from securities, effectively pushing back against the current approach of regulation by enforcement.

By emphasizing that the bill received "78 Democrat votes" and "overwhelming support by Democrats and Republicans," Hill is sending a powerful message: supporting crypto innovation is not a partisan issue. This broad-based support is essential for building the momentum needed to pass legislation in the Senate. His call for the Senate to take up the bill shows his focus is on getting this across the finish line. This is a perfect example of effective, pro-crypto leadership and is entirely consistent with his perfect score.

French Hill

@ElectFrench

Congressman Hill witnesses President Trump signing the GENIUS Act creating federally chartered and regulated U.S. Dollar backed payment stablecoin.

Senator Bernie Moreno; Cong. Tom Emmer; Cong. GT Thompson; Senator Bill Hagarty; Speaker Mike Johnson; Commerce Sec. Howard Lutnick back right.

2025-07-19T01:30:49.000Z

French Hill

@RepFrenchHill

What a historic moment for American innovation. Proud to stand with @POTUS and my colleagues as the GENIUS Act was signed into law.

#GENIUSAct #Stablecoin #Cryptoweek #AR02

2025-07-18T21:04:02.000Z

Took stances on a bill between 2025-05-29T00:00:00.000Z and 2025-07-17T00:00:00.000Z

Bill Name

CLARITY Act

Details

The "Digital Asset Market Clarity Act of 2025," or "CLARITY Act of 2025," establishes a regulatory framework for digital commodities, granting the CFTC exclusive jurisdiction over spot market transactions and related entities like exchanges, brokers, and dealers. It aims to differentiate digital commodities from securities, introduce a "mature blockchain system" concept for regulatory exemptions, and protect individual self-custody rights.

Timeline

2025-05-29

Very Pro-Crypto

Sponsored

2025-07-17

Very Pro-Crypto

Voted for - Final Passage Out Of House

Voted for a bill on 2025-07-17

Bill Name

GENIUS Act

Details

The GENIUS Act of 2025 proposes a regulatory framework for payment stablecoins. It defines permitted issuers (insured depository institutions, their subsidiaries, and approved nonbank entities) and mandates 1:1 reserve backing with specific high-quality assets. The bill outlines federal and state regulatory oversight options, sets requirements for customer asset segregation, and grants stablecoin holders priority in insolvency proceedings. It also clarifies that regulated payment stablecoins are not considered securities or commodities under various acts. The bill designates issuers as financial institutions under the Bank Secrecy Act, requiring compliance with AML, KYC, and sanctions regulations to prevent illicit finance and safeguard national security. It also reinforces U.S. leadership in digital finance by supporting innovation and ensuring the dollar remains competitive in a rapidly evolving global financial landscape.

Vote Type

Final Passage Out Of House

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

WATCH: Chairman @RepFrenchHill in support of the Anti-CBDC Surveillance State Act:

"At stake is a fundamental choice about the future of money in America. A choice between freedom or government control. Central Bank Digital Currencies, or CBDC's, put the government at the center of every financial transaction, monitoring, controlling, and possibly restricting how Americans could use their own hard-earned money."

2025-07-17T15:52:59.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

WATCH: Chairman @RepFrenchHill in support of the GENIUS Act:

"Today we have an opportunity to send stablecoin legislation to President Trump's desk. This is a multi-congress priority item and it ensures American competitiveness, strong guardrails for our consumers, and we should not squander that opportunity."

2025-07-17T14:44:30.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chair @RepFrenchHill's statement after House Leadership announced a path forward on digital asset legislation.

"Congratulations to @POTUS, @SpeakerJohnson, Majority Leader @SteveScalise, and @GOPMajorityWhip for your engagement and hard work over the last few days to craft a strategy whereby President Trump’s digital asset agenda moves through the House and opens the door to a golden age of digital assets."

Read more  https://t.co/4QLHOqEvOY

https://t.co/4QLHOqEvOY

https://t.co/4QLHOqEvOY

https://t.co/4QLHOqEvOY2025-07-17T03:37:56.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

WATCH: Chairman @RepFrenchHill speaks at @RulesReps on the three bills as part of "Crypto Week:"

WATCH: Chairman @RepFrenchHill speaks at @RulesReps on the three bills as part of "Crypto Week:"

CLARITY Act

CLARITY Act

GENIUS Act

GENIUS Act

Anti-CBDC Surveillance State Act https://t.co/VoHiAoaUt1

Anti-CBDC Surveillance State Act https://t.co/VoHiAoaUt1

2025-07-14T21:30:14.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill and @HouseAgGOP Chairman @CongressmanGT drop new op-ed as "Crypto Week" gets underway.

Read the Chairmen's piece

NEW: Chairman @RepFrenchHill and @HouseAgGOP Chairman @CongressmanGT drop new op-ed as "Crypto Week" gets underway.

Read the Chairmen's piece

https://t.co/86iAFAqANQ

https://t.co/86iAFAqANQ2025-07-14T17:48:32.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill on @FaceTheNation on "Crypto Week" in the House:

"I believe the bills we will have on the floor this week will protect investors, consumers, and make America as @POTUS wants, a leader in financial technology and crypto and digital assets innovation."

2025-07-13T16:07:14.000Z

French Hill reposted the post below

Face The Nation

@FaceTheNation

SUNDAY: Financial Services Chairman French Hill joins us to discuss his push for cryptocurrency legislation. How would it impact the growing industry and Americans’ finances? Tune in, 10:30amET.

2025-07-11T21:30:00.000Z

French Hill reposted the post below

Tony Edward (Thinking Crypto Podcast)

@ThinkingCrypto1

Crypto Week will be Historic for Stablecoin & Crypto Legislation!

WATCH  hyoutu.be/-Grq_b1wtAA

Congressman French Hill, Chairman of the House Financial Services Committee, joined me to discuss the upcoming Crypto Week, during which the House will vote on the Stablecoin and Crypto Market Structure bills, as well as the anti-CBDC legislation.

Topics:

- What is Crypto Week

- Genius Act Stablecoin Bill

- Clarity Act Market Structure Bill

- AntiCBDC Bill

- Implications of Stablecoin legislation passing

- Crypto tax policy

#interview #podcast #congress #crypto #stablecoins @RepFrenchHill @SenLummis @SenatorHagerty

hyoutu.be/-Grq_b1wtAA

Congressman French Hill, Chairman of the House Financial Services Committee, joined me to discuss the upcoming Crypto Week, during which the House will vote on the Stablecoin and Crypto Market Structure bills, as well as the anti-CBDC legislation.

Topics:

- What is Crypto Week

- Genius Act Stablecoin Bill

- Clarity Act Market Structure Bill

- AntiCBDC Bill

- Implications of Stablecoin legislation passing

- Crypto tax policy

#interview #podcast #congress #crypto #stablecoins @RepFrenchHill @SenLummis @SenatorHagerty

hyoutu.be/-Grq_b1wtAA

Congressman French Hill, Chairman of the House Financial Services Committee, joined me to discuss the upcoming Crypto Week, during which the House will vote on the Stablecoin and Crypto Market Structure bills, as well as the anti-CBDC legislation.

Topics:

- What is Crypto Week

- Genius Act Stablecoin Bill

- Clarity Act Market Structure Bill

- AntiCBDC Bill

- Implications of Stablecoin legislation passing

- Crypto tax policy

#interview #podcast #congress #crypto #stablecoins @RepFrenchHill @SenLummis @SenatorHagerty

hyoutu.be/-Grq_b1wtAA

Congressman French Hill, Chairman of the House Financial Services Committee, joined me to discuss the upcoming Crypto Week, during which the House will vote on the Stablecoin and Crypto Market Structure bills, as well as the anti-CBDC legislation.

Topics:

- What is Crypto Week

- Genius Act Stablecoin Bill

- Clarity Act Market Structure Bill

- AntiCBDC Bill

- Implications of Stablecoin legislation passing

- Crypto tax policy

#interview #podcast #congress #crypto #stablecoins @RepFrenchHill @SenLummis @SenatorHagerty

2025-07-11T12:49:18.000Z

French Hill

@RepFrenchHill

In two weeks, we'll bring the CLARITY Act and GENIUS Act to the House Floor, which give rules of the road for digital assets and dollar-backed payment stablecoins.

Watch more @FoxNews  https://t.co/evfJUNiamg

https://t.co/evfJUNiamg

https://t.co/evfJUNiamg

https://t.co/evfJUNiamg

2025-07-05T16:39:38.000Z

Analysis on Stance

Add your own analysis on this stanceFrench Hill continues to push for crucial legislation for digital assets! His announcement that the CLARITY Act and the GENIUS Act will be brought to the House floor soon is a major development. As a reminder, the CLARITY Act aims to establish a clear regulatory framework for digital commodities, providing much-needed certainty for the crypto industry. The GENIUS Act focuses on stablecoins, promoting innovation while ensuring consumer protection. Together, these bills represent a significant step towards fostering a thriving and well-regulated digital asset ecosystem in the US. This is excellent news for the crypto community, as it demonstrates continued progress towards sensible regulation.

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill, Chairman @CongressmanGT, and @GOPMajorityWhip chart course for America's digital asset leadership in their new @CoinDesk op-ed.

Read more

NEW: Chairman @RepFrenchHill, Chairman @CongressmanGT, and @GOPMajorityWhip chart course for America's digital asset leadership in their new @CoinDesk op-ed.

Read more

https://t.co/76kqVTl03u

https://t.co/76kqVTl03u2025-06-11T16:39:53.000Z

French Hill

@RepFrenchHill

Today, @FinancialCmte and @HouseAgGOP are marking up our CLARITY Act, which gives us the market framework that will make America the leader in crypto development and distributed ledger financial services.

More

@MorningsMaria https://t.co/yMQ3u3khvR

@MorningsMaria https://t.co/yMQ3u3khvR

@MorningsMaria https://t.co/yMQ3u3khvR

@MorningsMaria https://t.co/yMQ3u3khvR

2025-06-10T11:57:56.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

WATCH: Chairman @RepFrenchHill delivers opening remarks at today's hearing on the CLARITY Act:

"Digital assets and blockchain technology are driving the next evolution of the internet. This technology empowers individuals, spurs innovation, and creates new economic opportunities."

2025-06-04T14:09:35.000Z

French Hill

@RepFrenchHill

I hope before the end of the summer, the American people will have clear rules of the road for digital assets to protect consumers and entrepreneurs who want to be in this new, dynamic fintech business.

More on the status of our digital asset legislation @FoxNews https://t.co/1U9LXgLYK6

@FoxNews https://t.co/1U9LXgLYK6

@FoxNews https://t.co/1U9LXgLYK6

@FoxNews https://t.co/1U9LXgLYK6

2025-06-02T13:11:07.000Z

French Hill

@RepFrenchHill

The CLARITY Act is a bipartisan bill that builds on our success in the last Congress where 71 Democrats supported digital asset market structure reforms on the House Floor. We're going to repeat that and hope to get this bill to the President soon.

Watch @MorningsMaria  https://t.co/M1xN5KZP1e

https://t.co/M1xN5KZP1e

https://t.co/M1xN5KZP1e

https://t.co/M1xN5KZP1e

2025-05-30T15:45:54.000Z

French Hill reposted the post below

Solana Policy Institute

@SolanaInstitute

Thank you @RepFrenchHill, @SenatorHagerty, and @SenRickScott for your thoughtful takes on how sensible stablecoin legislation will advance American innovation.

2025-05-23T14:33:22.000Z

French Hill

@RepFrenchHill

My goal is to have legislation for a dollar-backed stablecoin and market structure for digital assets passed that President Trump can sign into law.

Watch more  @SquawkCNBC https://t.co/eZqDXEygkV

@SquawkCNBC https://t.co/eZqDXEygkV

@SquawkCNBC https://t.co/eZqDXEygkV

@SquawkCNBC https://t.co/eZqDXEygkV

2025-05-23T13:53:01.000Z

French Hill

@RepFrenchHill

We believe the bill we've written to create a regulatory framework for digital assets will bring clarity to the US market and make us a leader in global fintech.

More on our market structure bill @LizClaman https://t.co/YwDc5S1LEk

@LizClaman https://t.co/YwDc5S1LEk

@LizClaman https://t.co/YwDc5S1LEk

@LizClaman https://t.co/YwDc5S1LEk

2025-05-12T19:51:31.000Z

Analysis on Stance

Add your own analysis on this stanceFrench Hill continues to champion a clear regulatory framework for digital assets in the US! His assertion that their bill will establish the US as a global fintech leader is a powerful statement about the potential of this legislation. This bill aims to provide regulatory clarity, which is crucial for fostering innovation and investment in the crypto space. By creating a predictable and transparent regulatory environment, the US can attract businesses and entrepreneurs, driving growth and establishing itself as a hub for digital asset innovation. This is a significant step towards securing America's future as a global leader in fintech.

French Hill reposted the post below

Crypto In America

@CryptoAmerica_

NEW: Stablecoin and Market Structure: One Big Bill or Two?

@FinancialCmte Chairman @RepFrenchHill addresses a key question from industry stakeholders in the latest episode of @CryptoAmerica_. Plus, catch up on the week’s biggest headlines.

NEW: Stablecoin and Market Structure: One Big Bill or Two?

@FinancialCmte Chairman @RepFrenchHill addresses a key question from industry stakeholders in the latest episode of @CryptoAmerica_. Plus, catch up on the week’s biggest headlines.  https://t.co/UtVx6fhtYd

https://t.co/UtVx6fhtYd2025-04-30T11:32:06.000Z

French Hill

@RepFrenchHill

We need the permanence of a legislative solution for a digital asset framework, and that's what we're going to deliver in the House and Senate this summer.

Watch more on @MorningsMaria https://t.co/E27ZKGTgqe

https://t.co/E27ZKGTgqe

https://t.co/E27ZKGTgqe

https://t.co/E27ZKGTgqe

2025-04-30T13:40:13.000Z

French Hill

@RepFrenchHill

A historic moment for crypto. Thanks to President Trump for his leadership in ensuring America leads in the digital asset space.

.@FinancialCmte looks forward to continuing our legislative work to fulfill the President’s vision of a Golden Age for digital assets.

Rapid Response 47

@RapidResponse47

President Donald J. Trump has officially signed the bill to repeal the “DeFi Crypto Broker Rule.”

It is the first cryptocurrency bill ever signed into law by a president.

2025-04-11T00:46:29.000Z

2025-04-11T01:48:08.000Z

French Hill

@RepFrenchHill

An important component for the future of finance is a dollar-backed stablecoin here in the US, under US law. We think it'll then set the standard for stablecoins and facilitating payments on a blockchain.

Watch more on @SquawkCNBC  https://t.co/JebW2FbdGH

https://t.co/JebW2FbdGH

https://t.co/JebW2FbdGH

https://t.co/JebW2FbdGH

2025-04-01T13:49:05.000Z

French Hill reposted the post below

Tim Scott

@SenatorTimScott

.@RepFrenchHill and I understand that our regulatory framework for digital assets must encourage innovation in the United States, not overseas. Working together, we can unlock pathways for success and empower communities to thrive. Thank you, @DigitalChamber, for having us!

2025-03-26T21:01:04.000Z

French Hill reposted the post below

U.S. Senate Banking Committee GOP

@BankingGOP

#ICYMI Chairman @SenatorTimScott joined @FinancialCmte Chairman @RepFrenchHill for a conversation on digital assets legislation and their efforts to make America the crypto capital of the world at the @DigitalChamber’s DC Blockchain Summit

2025-03-27T12:28:02.000Z

French Hill

@RepFrenchHill

We've outlined a legislative path forward for a dollar-backed #stablecoin both in the House where we've posted legislation and held a hearing, and in the Senate where @BankingGOP advanced their bill forward last week.

Watch more @MorningsMaria https://t.co/1woN9OmiCu

@MorningsMaria https://t.co/1woN9OmiCu

@MorningsMaria https://t.co/1woN9OmiCu

@MorningsMaria https://t.co/1woN9OmiCu

2025-03-17T13:52:25.000Z

Voted for a bill on 2025-03-11

Bill Name

H.J. Res 25

Details

A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Internal Revenue Service relating to "Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales".

Vote Type

Final Passage Out Of House

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

Next week, the Committee's holding a hearing examining a federal framework for payment stablecoins and the consequences of a U.S. CBDC.

The Committee will also examine the updated bill text for the STABLE Act.

View the new bill text here:

docs.house.gov/meetings/BA/BA…

2025-03-07T19:29:22.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill statement on Executive Order establishing a Strategic Bitcoin Reserve and Digital Asset Stockpile

NEW: Chairman @RepFrenchHill statement on Executive Order establishing a Strategic Bitcoin Reserve and Digital Asset Stockpile https://t.co/WH50KFq5SD

https://t.co/WH50KFq5SD

2025-03-07T16:19:28.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

Chairman @RepFrenchHill: “As more voices come to the table to discuss a robust legislative solution for stablecoins, I will continue to listen to ensure we get this right. Building on our prior work, we have a new opportunity with the Trump Admin and Republican control of the House and Senate to pass legislation that would establish a framework for a dollar-backed stablecoin in the US. @RepBryanSteil and I released our discussion draft based on conversations with our members, and we welcome feedback from our House and Senate colleagues, the Trump Admin, and industry leaders. The strong bipartisan support we saw for digital asset legislation in the last Congress demonstrates that digital assets are not a partisan issue, and I look forward to working together to pass meaningful legislation.”

Chairman @RepFrenchHill: “As more voices come to the table to discuss a robust legislative solution for stablecoins, I will continue to listen to ensure we get this right. Building on our prior work, we have a new opportunity with the Trump Admin and Republican control of the House and Senate to pass legislation that would establish a framework for a dollar-backed stablecoin in the US. @RepBryanSteil and I released our discussion draft based on conversations with our members, and we welcome feedback from our House and Senate colleagues, the Trump Admin, and industry leaders. The strong bipartisan support we saw for digital asset legislation in the last Congress demonstrates that digital assets are not a partisan issue, and I look forward to working together to pass meaningful legislation.”2025-02-10T20:15:34.000Z

Analysis on Stance

Add your own analysis on this stanceFrench Hill, Chairman of the House Financial Services Committee, once again demonstrates his unwavering commitment to establishing a clear and robust regulatory framework for stablecoins in the US. His recent statement highlights the importance of collaboration and open dialogue in crafting legislation that addresses the unique challenges and opportunities presented by dollar-backed stablecoins.

The emphasis on "getting this right" underscores Hill's dedication to thoughtful and effective regulation, rather than a rushed or ill-conceived approach. His acknowledgment of "prior work" and the "new opportunity" with the Trump administration and Republican control of Congress suggests a strategic approach to building consensus and achieving legislative success.

The fact that Hill and Rep. Bryan Steil released a discussion draft for stablecoin legislation demonstrates their proactive approach to shaping the future of digital finance. Their willingness to solicit feedback from various stakeholders, including House and Senate colleagues, the Trump administration, and industry leaders, further reinforces their commitment to creating a regulatory framework that fosters innovation while mitigating risks.

Hill's observation about the bipartisan support for digital asset legislation in the previous Congress is a crucial point. It signifies that the potential benefits of digital assets, including stablecoins, are recognized across the political spectrum. This bipartisan recognition is essential for the long-term success and adoption of stablecoins and other digital assets in the United States. Hill's commitment to working together to pass meaningful legislation is a positive sign for the crypto community and suggests a bright future for responsible innovation in the digital asset space.

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill and @RepBryanSteil today released their discussion draft for #stablecoins.

Read more

NEW: Chairman @RepFrenchHill and @RepBryanSteil today released their discussion draft for #stablecoins.

Read more financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…2025-02-06T21:59:22.000Z

Analysis on Stance

Add your own analysis on this stanceFrench Hill continues to be a champion for sound money and common sense crypto regulation! Releasing a discussion draft for stablecoin legislation is a critical step towards providing regulatory clarity, which is essential for the growth and adoption of stablecoins. This proactive approach will help ensure the U.S. remains a leader in the digital asset space. A well-regulated stablecoin market can foster innovation while protecting consumers. This is a big win for the crypto community! I encourage everyone to read the draft and engage in the discussion. The future of finance depends on it!

French Hill

@RepFrenchHill

I was so pleased to come together with @SenatorTimScott, @davidsacks47, @JohnBoozman, and @CongressmanGT yesterday to talk about our priorities to move regulatory clarity for digital assets in the US so that we can have #fintech and #digitalassets be a premiere area of innovation and technological advance right here in America.

2025-02-05T17:42:05.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

Chairman @RepFrenchHill: "In the 119th Congress, we have a bicameral project for both a stablecoins bill and a regulatory framework that will bring clarity to digital assets in the United States."

Watch more

Chairman @RepFrenchHill: "In the 119th Congress, we have a bicameral project for both a stablecoins bill and a regulatory framework that will bring clarity to digital assets in the United States."

Watch more

2025-02-04T22:09:42.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

NEW: Chairman @RepFrenchHill and @RepBryanSteil: “As leaders of this Committee on digital assets, we look forward to working with the Trump Administration as we coordinate on crafting legislation to provide much needed clarity and protections for consumers and investors while securing the US as the trailblazer in digital financial innovation."

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…2025-01-24T14:00:00.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

Chairman @RepFrenchHill: “I am pleased to see @SECgov form a crypto task force. This is the first step in undoing the immense harm caused by former Chair Gary Gensler and his regulation by enforcement approach. This action sends a clear message to the world that when it comes to crypto, ‘America is back.’ I look forward to working with my colleagues in Congress and the Trump Administration to provide long overdue regulatory clarity that will allow the digital asset ecosystem to thrive in the United States.”

2025-01-21T21:45:35.000Z

French Hill

@RepFrenchHill

The Biden-Harris Treasury chose to defy both Democrats and Republicans in Congress by finalizing its controversial broker tax reporting rule today. This rule is an overreach by the Treasury, a blatant and poorly crafted attempt to target DeFi, and should never have been finalized i Biden-Harris Admin.

Financial Services GOP

@FinancialCmte

Congress has consistently fought to protect the digital asset ecosystem from misguided regulation on a bipartisan basis.

Read lawmakers’ recent bipartisan letter on this issue  https://t.co/vy9RiCT7FB

https://t.co/vy9RiCT7FB

https://t.co/vy9RiCT7FB

https://t.co/vy9RiCT7FB2024-12-27T18:35:20.000Z

2024-12-27T19:46:38.000Z

Analysis on Stance

Add your own analysis on this stanceI see Congressman French Hill is once again standing up for the crypto community by criticizing the Treasury's new broker reporting rule. As many of you know, this rule vastly expands the definition of "broker" in the context of digital assets, potentially capturing entities like miners, validators, and even software developers. This is a significant concern for the decentralized nature of crypto, as it could impose burdensome reporting requirements on individuals and entities who don't even have access to the information the Treasury seeks. It's a clear overreach and, as Rep. Hill points out, a poorly crafted attempt to bring DeFi under traditional financial regulations. This is a crucial fight for the future of crypto, and I applaud Rep. Hill for his continued strong support. His consistent pro-crypto stance is a beacon of hope in these uncertain regulatory times.

analysis submitted by Joe Pesci

French Hill

@RepFrenchHill

Fantastic to join my friend @PatrickMcHenry at the @BlockchainAssn’s 2024 #BAPolicySummit. The future is bright in the US for #DigitalAssets and #crypto!  I

I

I

I

2024-12-17T17:05:45.000Z

French Hill

@RepFrenchHill

With AI and crypto rapidly advancing in our society, I couldn’t think of a better time than now to appoint @DavidSacks to lead the charge with @realDonaldTrump. As a proven leader on #DigitalAssets in Congress, I look forward to working with David and President Trump on driving our mutual priorities of bolstering innovation and ensuring America is the leader of these groundbreaking technologies. A new era in American innovation starts now.

David Sacks

@DavidSacks

2024-12-06T05:21:23.000Z

2024-12-06T16:01:36.000Z

French Hill

@RepFrenchHill

Legal business like @Anchorage should not be politically targeted and debanked simply because they are “in the business of crypto.”

Eleanor Terrett

@EleanorTerrett

NEW: The CEO of @Anchorage @nathanmccauley just told @RepFrenchHill that in June 2023, the company’s bank told them explicitly they were dropping them as a client because they are “in the business of crypto.” Anchorage is itself a federally chartered and @USOCC-examined bank that got debanked for being involved in #crypto.

NEW: The CEO of @Anchorage @nathanmccauley just told @RepFrenchHill that in June 2023, the company’s bank told them explicitly they were dropping them as a client because they are “in the business of crypto.” Anchorage is itself a federally chartered and @USOCC-examined bank that got debanked for being involved in #crypto.

2024-12-04T17:18:27.000Z

2024-12-04T18:00:54.000Z

French Hill

@RepFrenchHill

Under Operation Choke Point 2.0, @FDICgov politically targeted American business and pressured banks to sever ties with entire industries like crypto.

Next Congress @FinancialCmte stands ready to work with @realDonaldTrump to halt and reverse these practices, and finally conduct a full investigation.

2024-11-20T16:19:10.000Z

French Hill reposted the post below

MySaline.com

@mysalineshelli

Cong. Hill indicates a focus on inflation, affordable housing & digital assets mysaline.com/us-hill-110824/

2024-11-08T20:21:47.000Z

French Hill

@RepFrenchHill

During his tenure at @SECGov, Director Grewal pursued a needless and arbitrary “regulation by enforcement” strategy that has only created uncertainty and challenges for digital asset companies.

Hopefully, @SECGov will now turn the page and adopt an approach that fosters a fair and transparent regulatory environment for all market participants.

U.S. Securities and Exchange Commission

@SECGov

Today we announced that Gurbir S. Grewal, Director of the Division of Enforcement, will depart the agency, effective Oct. 11, 2024. sec.gov/newsroom/press…

2024-10-02T18:38:48.000Z

2024-10-02T21:48:10.000Z

French Hill

@RepFrenchHill

While Congress has been hard at work to establish a regulatory framework for digital assets though #FIT21, time and time again, @SECgov has chosen to bring numerous enforcement actions in an attempt to front-run Congress.

Watch more  https://t.co/6BtXQveJhj

https://t.co/6BtXQveJhj

https://t.co/6BtXQveJhj

https://t.co/6BtXQveJhj

2024-09-24T15:45:24.000Z

French Hill

@RepFrenchHill

Instead of following the bipartisan progress we’ve made on digital assets, Gensler’s SEC has chosen to front-end the work of Congress and make spurious arguments that have been rejected by the House, the courts, and market participants.

The SEC’s approach to digital assets is a lsors, and everyone in between.

Watch more

2024-09-18T15:04:15.000Z

French Hill

@RepFrenchHill

Former President @realDonaldTrump is a strong voice for #Crypto. There is a future for crypto in America, which is why it’s crucial that #FIT21 becomes law to ensure #DigitalAssets have a regulatory framework that protects consumers and investors while keeping innovation in our country.

Unlike Kamala Harris, Trump has shown unwavering support for the crypto community, and his announcement tonight furthers that support.

2024-09-17T01:33:50.000Z

French Hill

@RepFrenchHill

#Defi technology can preserve an individual’s freedom to transact.

Today’s @FinancialCmte hearing is about how Congress can help Americans access and leverage this technology to preserve their individual freedom and improve our financial system.

Watch more  https://t.co/BOC8wfCVLA

https://t.co/BOC8wfCVLA

https://t.co/BOC8wfCVLA

https://t.co/BOC8wfCVLA

2024-09-10T15:38:44.000Z

French Hill

@RepFrenchHill

Well said, @PatrickMcHenry. We passed #FIT21 with strong bipartisan support three months ago. It's time for the Senate to step up and take action on digital asset legislation.

Patrick McHenry

@PatrickMcHenry

I welcome @SenSchumer’s interest in digital asset legislation to protect consumers and foster innovation.

The House has done its work by passing the bipartisan #FIT21 with 2/3rds voting in support back in May.

Senate action on digital asset market structure is long overdue.

2024-08-15T14:07:44.000Z

2024-08-15T14:38:28.000Z

French Hill

@RepFrenchHill

Americans deserve clarity and a regulatory framework for payment stablecoins, and @realDonaldTrump understands this. We have a good #stablecoin bill to deliver that clarity. @PatrickMcHenry @FinancialCmte

2024-07-27T21:17:18.000Z

French Hill

@RepFrenchHill

Former President Trump said America needs to lead the way in #crypto and #digitalasset innovation and I fully agree.

My #FIT21 bill is crucial in creating a regulatory framework for digital assets that protects consumers and investors while keeping innovation in the US.

2024-07-27T20:27:59.000Z

French Hill

@RepFrenchHill

Excited to hear @realDonaldTrump’s vision for American innovation with support for #digitalassets and a regulatory framework. Great to see my friend @VivekGRamaswamy!

@TheBitcoinConf #Bitcoin2024Conference #FIT21 #stablecoins #Bitcoin2024Nashville

2024-07-27T19:34:11.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

The @SECGov's final approval of spot #ETH ETFs is another step towards making digital assets more accessible to American investors.

However, a comprehensive regulatory framework remains essential and the SEC must engage with Congress in a meaningful way.

coindesk.com/business/2024/…

2024-07-22T23:24:29.000Z

French Hill reposted the post below

Bankless

@BanklessHQ

PREMIERE -- Making America Pro-Crypto

w/ Congressman @RepFrenchHill

What would pro-crypto America look like & what laws need to be passed to get there?

As the @FinancialCmte Vice-Chairman, Congressman Hill is at the center of these convos in D.C.

These are his answers

w/ Congressman @RepFrenchHill

What would pro-crypto America look like & what laws need to be passed to get there?

As the @FinancialCmte Vice-Chairman, Congressman Hill is at the center of these convos in D.C.

These are his answers

w/ Congressman @RepFrenchHill

What would pro-crypto America look like & what laws need to be passed to get there?

As the @FinancialCmte Vice-Chairman, Congressman Hill is at the center of these convos in D.C.

These are his answers

w/ Congressman @RepFrenchHill

What would pro-crypto America look like & what laws need to be passed to get there?

As the @FinancialCmte Vice-Chairman, Congressman Hill is at the center of these convos in D.C.

These are his answers

2024-07-18T13:22:37.000Z

Analysis on Stance

Add your own analysis on this stance

analysis submitted by iCloud unlock

French Hill

@RepFrenchHill

.@SecYellen admitted that she’s not quarterbacking between the @SECGov and @CFTC on crypto regulation, yet it’s her job to lead the team as head of FSOC.

#FIT21 passed the House with strong bipartisan support - it’s time to get it across the finish line.

2024-07-09T16:01:54.000Z

French Hill

@RepFrenchHill

#FIT21 that passed the House with 71 Democratic votes is exactly the kind of regulatory framework for digital assets that former President Trump would support if he were re-elected.

Watch more on @SquawkCNBC

2024-07-03T14:13:52.000Z

French Hill

@RepFrenchHill

71 Democrats voted with us on #FIT21 in the House. This strong bipartisan vote sends a positive message to the Senate - work with us to create a digital assets framework that allows America to innovate and lead the world in this technology.

Watch more @MorningsMaria:

2024-06-06T16:46:27.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#WATCH: Chairman @RepFrenchHill at this morning's Digital Assets Subcommittee hearing:

"Tokenization can leverage the efficiency and transparency of blockchains to help modernize U.S. markets."

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his remarks

Watch his remarks

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his remarks

Watch his remarks

2024-06-05T13:55:05.000Z

French Hill reposted the post below

Squawk Box

@SquawkCNBC

The first ever digital asset legislation is passed in the House of Representative but the future of the bill is unclear in the Senate. @RepFrenchHill gives us the latest on the future of #crypto legislation:

2024-05-28T16:16:24.000Z

Took stances on a bill between 2023-09-12T00:00:00.000Z and 2024-05-23T00:00:00.000Z

Bill Name

CBDC Anti-Surveillance State Act

Details

To amend the Federal Reserve Act to prohibit the Federal Reserve banks from offering certain products or services directly to an individual, to prohibit the use of central bank digital currency for monetary policy, and for other purposes.

Timeline

2023-09-12

Somewhat Pro-Crypto

Cosponsored

2024-05-23

Somewhat Pro-Crypto

Voted for - Final Passage Out Of House

French Hill

@RepFrenchHill

The CBDC Anti-Surveillance State Act is necessary now more than ever because we live in a world where someone like Canadian PM Trudeau can freeze your bank account if you protest the government.

A vote for this bill is a vote to safeguard our economic freedom, protect our pecial system.

2024-05-23T16:23:55.000Z

Took stances on a bill between 2023-07-20T00:00:00.000Z and 2024-05-22T00:00:00.000Z

Bill Name

FIT21

Details

Financial Innovation and Technology for the 21st Century Act

Timeline

2023-07-20

Very Pro-Crypto

Cosponsored

2024-05-22

Very Pro-Crypto

Voted for - Final Passage Out Of House

French Hill

@RepFrenchHill

I would argue that #FIT21 is responsive to both President Biden's own Executive Order and the FSOC report calling on Congress to enact a framework for digital assets - and that's what we've done.

We must pass #FIT21 today.

2024-05-22T19:23:53.000Z

French Hill reposted the post below

House Rules Committee

@RulesReps

@RepFrenchHill:

Congress must act to provide regulatory clarity to the digital asset ecosystem.

Without it, the SEC will continue to pursue a "regulation by enforcement" agenda that leaves markets and individuals worse off.

H.R. 4763 delivers a critical solution.

@RepFrenchHill:

Congress must act to provide regulatory clarity to the digital asset ecosystem.

Without it, the SEC will continue to pursue a "regulation by enforcement" agenda that leaves markets and individuals worse off.

H.R. 4763 delivers a critical solution.

2024-05-21T21:59:20.000Z

French Hill reposted the post below

Rep. Dusty Johnson

@RepDustyJohnson

Ready to testify in @RulesReps on behalf of our FIT21 bill to create a necessary framework for digital assets with @RepFrenchHill.

2024-05-21T20:34:06.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

To date, the U.S. digital asset ecosystem has been mired by uncertainty and regulation by enforcement.

Congress has the chance to provide the robust consumer protections and regulatory clarity needed to foster innovation here in America by advancing #FIT21.

To date, the U.S. digital asset ecosystem has been mired by uncertainty and regulation by enforcement.

Congress has the chance to provide the robust consumer protections and regulatory clarity needed to foster innovation here in America by advancing #FIT21.

2024-05-21T14:30:06.000Z

French Hill

@RepFrenchHill

#FIT21 may be the most substantial piece of digital asset legislation in Congress’s history.

It heads to the House Floor this week, where it must pass to ensure America continues fostering innovation and remains a global tech and finance hub.

@RepDustyJohnson

washingtontimes.com/news/2024/may/…

2024-05-21T13:36:46.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

This week, @HouseGOP will take action to protect consumers and foster innovation with two landmark digital asset bills, including:

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

@GOPMajorityWhip's CBDC Anti-Surveillance State Act

@GOPMajorityWhip's CBDC Anti-Surveillance State Act

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

@GOPMajorityWhip's CBDC Anti-Surveillance State Act

@GOPMajorityWhip's CBDC Anti-Surveillance State Act2024-05-20T15:13:43.000Z

French Hill reposted the post below

Rep. Mike Flood

@USRepMikeFlood

This is a landmark result for digital asset regulation. Both the House and Senate – including Majority Leader Schumer in the Senate – have delivered a clear, bipartisan message to the @SECGov that SAB 121 needs to go.

2024-05-16T16:50:23.000Z

French Hill

@RepFrenchHill

Thanks to @FINRA for having me join their Annual Conference today, where we discussed a range of topics including #crypto, digital assets, and #AI.

2024-05-16T16:29:27.000Z

French Hill

@RepFrenchHill

After tirelessly working across the aisle and across the nation over the past year to craft a clear, pragmatic regulatory framework for digital assets, I am proud that this landmark legislation, #FIT21, is coming to the House Floor.

More below https://t.co/WM8wPYRMZR

https://t.co/WM8wPYRMZR

https://t.co/WM8wPYRMZR

https://t.co/WM8wPYRMZR

Financial Services GOP

@FinancialCmte

BREAKING: House to consider the Financial Innovation and Technology for the 21st Century Act.

#FIT21 will deliver robust consumer protections and regulatory clarity for digital asset markets.

BREAKING: House to consider the Financial Innovation and Technology for the 21st Century Act.

#FIT21 will deliver robust consumer protections and regulatory clarity for digital asset markets.

Read more

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents… 2024-05-10T19:20:17.000Z

2024-05-10T19:22:51.000Z

Took stances on a bill between 2024-03-05T00:00:00.000Z and 2024-05-08T00:00:00.000Z

Bill Name

SAB 121 House Joint Resolution

Details

For congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to "Staff Accounting Bulletin No. 121".

This staff accounting bulletin expresses the views of the staff regarding the accounting for obligations to safeguard crypto-assets an entity holds for platform users.

Timeline

2024-03-05

Very Pro-Crypto

Cosponsored

2024-05-08

Very Pro-Crypto

Voted for - Final Passage Out Of House

French Hill

@RepFrenchHill

I am pleased to see several of our @FinancialCmte

Digital Assets Subcommittee members join me in leading strong FinTech bills that passed out of our committee today.

My full statement, below:

hill.house.gov/news/documents…

2024-04-17T23:42:48.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#HappeningNow: Chairman @RepFrenchHill convenes the Digital Assets Subcommittee for a hearing entitled "Bureaucratic Overreach or Consumer Protection? Examining the CFPB’s Latest Action to Restrict Competition in Payments."

Read more  financialservices.house.gov/calendar/event…

financialservices.house.gov/calendar/event…

financialservices.house.gov/calendar/event…

financialservices.house.gov/calendar/event…

2024-03-13T13:03:33.000Z

French Hill reposted the post below

IIB

@IIBnews

.@RepFrenchHill talks crypto, SVB and other hot topics in a fireside chat with IIB CEO Beth Zorc at #IIBAWC24.

2024-03-11T19:39:40.000Z

French Hill reposted the post below

Rep. Mike Flood

@USRepMikeFlood

.@SECGov has virtually locked out the most regulated institutions from serving as custodians for digital assets. It’s time to roll back SAB 121 and to stop @GaryGensler’s overreach.

2024-02-29T16:23:08.000Z

French Hill

@RepFrenchHill

#Crypto is not the enemy. Terrorists will use any means necessary - cash or crypto- to accomplish their means.

Bitcoin Magazine

@BitcoinMagazine

JUST IN:  U.S. Congressman French Hill says "bad actors still prefer to use traditional finance rather than digital assets."

U.S. Congressman French Hill says "bad actors still prefer to use traditional finance rather than digital assets."

U.S. Congressman French Hill says "bad actors still prefer to use traditional finance rather than digital assets."

U.S. Congressman French Hill says "bad actors still prefer to use traditional finance rather than digital assets."2024-02-15T19:54:11.000Z

2024-02-15T20:49:32.000Z

French Hill

@RepFrenchHill

Pleased to join today's @FDD panel with @jahimes to discuss digital asset regulation and more. Thanks for including us in this important conversation.

2024-01-29T21:08:36.000Z

French Hill

@RepFrenchHill

Today's spot #Bitcoin ETF approvals marks a historic milestone for the future of the digital asset ecosystem. The @FinancialCmte will continue to enhance consumer protection in the crypto market through market structure and payment stablecoin legislation.

Financial Services GOP

@FinancialCmte

#NEW: Chairman @PatrickMcHenry and Digital Assets, Financial Technology and Inclusion Subcommittee Chairman @RepFrenchHill release a statement regarding the @SECGov's spot Bitcoin ETF approvals.

Read more

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Read more

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents… 2024-01-10T21:50:05.000Z

2024-01-10T22:03:36.000Z

French Hill

@RepFrenchHill

Digital assets are the future of development on the internet, and the United States must be a leader in this technology. We need a regulatory framework that facilitates innovation and investment for #crypto in a safe way.

2023-12-22T21:16:01.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

This is why we must pass the bipartisan #FIT21:

@CFTCbehnam says many digital assets are commodities.

@CFTCbehnam says many digital assets are commodities.

@GaryGensler says almost all are securities.

#FIT21 provides much needed clarity with marching orders for both regulators & robust protections for consumers. https://t.co/eJjmsgJc6Y

@GaryGensler says almost all are securities.

#FIT21 provides much needed clarity with marching orders for both regulators & robust protections for consumers. https://t.co/eJjmsgJc6Y

@CFTCbehnam says many digital assets are commodities.

@CFTCbehnam says many digital assets are commodities.

@GaryGensler says almost all are securities.

#FIT21 provides much needed clarity with marching orders for both regulators & robust protections for consumers. https://t.co/eJjmsgJc6Y

@GaryGensler says almost all are securities.

#FIT21 provides much needed clarity with marching orders for both regulators & robust protections for consumers. https://t.co/eJjmsgJc6Y2023-12-12T19:24:56.000Z

French Hill

@RepFrenchHill

Discussed all things #crypto with @jahimes at @BlockchainAssn's Policy Summit today. Thank you @julie_stitzel for facilitating a great conversation.

2023-11-30T20:32:13.000Z

French Hill

@RepFrenchHill

Terrorist financing is unacceptable no matter what form or fashion it may take, whether that is #crypto or cash.

2023-11-15T19:47:06.000Z

French Hill

@RepFrenchHill

Bad actors are the problem, not #crypto. @SenLummis and I sent a letter to the DOJ urging a full investigation into Binance and Tether’s roles as intermediaries in Hamas’ illicit financial activities that may have been used to facilitate terrorism and other nefarious actions. Read our letter:

Senator Cynthia Lummis

@SenLummis

When it comes to illicit finance, crypto is not the enemy - bad actors are.

I sent a letter asking DOJ to finish its investigation and consider criminal charges against Binance and Tether after reports they served as intermediaries for Hamas and engaged in illicit activities.

2023-10-26T16:54:32.000Z

2023-10-26T17:52:26.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#WATCH: Digital Assets, Financial Technology and Inclusion Subcommittee Chairman @RepFrenchHill at today's hearing:

"Innovation and technology have always been at the heart of financial services."

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his opening remarks

Watch his opening remarks

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his opening remarks

Watch his opening remarks

2023-10-25T15:10:39.000Z

Cosponsored a bill on 2023-09-27

Bill Name

Uniform Treatment of Custodial Assets Act

Details

To prohibit certain Federal agencies from requiring certain institutions to include assets held in custody as a liability, and for other purposes.

French Hill

@RepFrenchHill

There is absolutely no support for a #CBDC in Congress, except from those who think somehow a CBDC might be an amazing solution to many unstated global problems.

@FinancialCmte

2023-09-14T19:21:04.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

The FIT for the 21st Century Act is the bipartisan solution to unlock the promise of digital assets in the U.S.

Thanks to unprecedented collaboration with @HouseAgGOP, we're delivering much-needed regulatory clarity and robust consumer protections.

2023-09-12T16:58:26.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

"Chairman Gary Gensler’s SEC whiffs again."

From an assault on digital assets to the climate disclosure rule to a private funds overhaul, Chair Gensler's agenda exceeds his statutory authority.

Now, the courts are waking up to his unlawful actions.

wsj.com/articles/grays…

2023-08-31T19:59:33.000Z

French Hill

@RepFrenchHill

Americans have a right to financial privacy. We do not need a #CBDC that can track your purchases like China does with their Digital Yuan. The authority rests with Congress, not unelected bureaucrats, to create and implement a CBDC. And that’s non-partisan.

2023-08-30T18:20:55.000Z

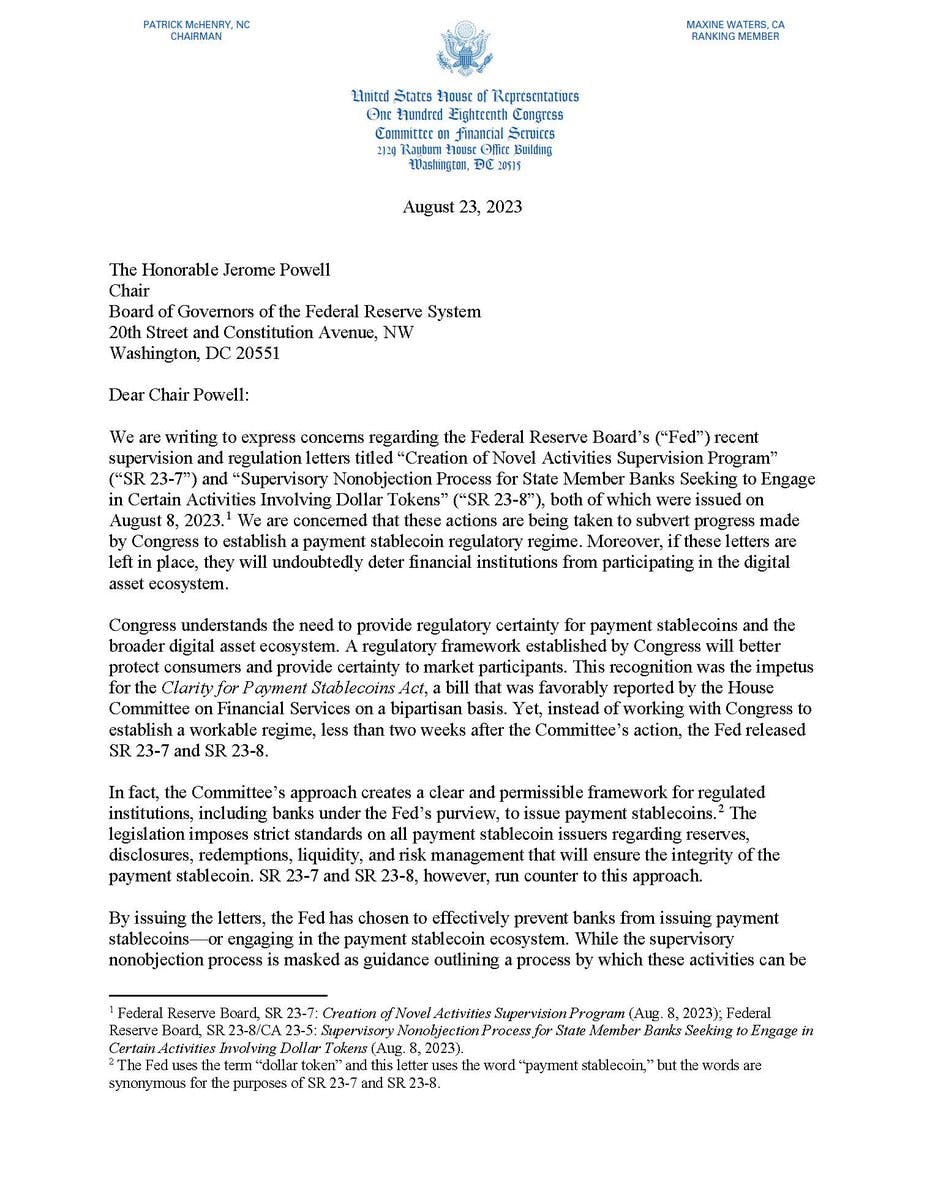

French Hill

@RepFrenchHill

I sent a letter alongside @PatrickMcHenry and @RepHuizenga to the @FederalReserve objecting to their efforts to undermine @FinancialCmte's progress on stablecoin legislation. The Fed has chosen to effectively prevent banks from issuing payment stablecoins.

#crypto #digitalassets

2023-08-28T15:14:54.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#NEW: Chairman @PatrickMcHenry slams @USTreasury & @IRSnews' Notice of Proposed Rulemaking on digital asset reporting requirements under the Infrastructure Investment and Jobs Act.

Read his full statement

Read his full statement  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Read his full statement

Read his full statement  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

2023-08-25T15:14:13.000Z

French Hill

@RepFrenchHill

Everyone agrees the #crypto ecosystem needs regulatory clarity. The @SECGov and @CFTC need defined statutory authorities over digital assets to adequately protect investors and consumers. My bill, #FIT21, provides this clarity.

2023-08-25T19:07:11.000Z

French Hill

@RepFrenchHill

I sat down with @Steven_Ehrlich from @ForbesCrypto to discuss all things #crypto.

Read more https://t.co/kdiTuIABnf

https://t.co/kdiTuIABnf

https://t.co/kdiTuIABnf

https://t.co/kdiTuIABnf2023-08-23T18:31:59.000Z

French Hill

@RepFrenchHill

@FinancialCmte is countering @GaryGensler and @SECGov on their unreasonable mandates that negatively affect businesses and the #crypto ecosystem. America should be the leader in web 3 development and digital asset innovation.

WATCH | @MorningsMaria https://t.co/zQju62oFcf

| @MorningsMaria https://t.co/zQju62oFcf

| @MorningsMaria https://t.co/zQju62oFcf

| @MorningsMaria https://t.co/zQju62oFcf

2023-08-11T15:06:26.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

For digital assets to thrive in the U.S., Congress must provide legislative clarity to protect consumers and foster innovation.

@RepFrenchHill & @CongressmanGT’s bipartisan FIT for the 21st Century Act fills existing regulatory gaps so America can lead blockchain innovation.

2023-08-10T19:18:09.000Z

French Hill

@RepFrenchHill

The FIT for the 21st Century Act, coauthored by myself and members on @HouseAgGOP, will provide clarity on the @SECGov and @CFTC's jurisdiction over digital assets, fill the gaps in the existing system and provide robust consumer protections.

More  #FIT21 @FinancialCmte https://t.co/dDYH3efJTX

#FIT21 @FinancialCmte https://t.co/dDYH3efJTX

#FIT21 @FinancialCmte https://t.co/dDYH3efJTX

#FIT21 @FinancialCmte https://t.co/dDYH3efJTX

2023-07-26T15:15:37.000Z

French Hill reposted the post below

Squawk Box

@SquawkCNBC

Today, the House will begin the markup of two digital asset bills to establish a regulatory framework for #crypto. @FinancialCmte Vice-Chairman @RepFrenchHill joins with more:

2023-07-26T11:41:49.000Z

French Hill

@RepFrenchHill

I was pleased to join @ThinkingCrypto1 to discuss all things #Crypto. Watch my full interview, below:

Tony Edward (Thinking Crypto Podcast)

@ThinkingCrypto1

Congressman French Hill and I had a great conversation about US #Crypto Regulations. @RepFrenchHill

WATCH  hyoutu.be/Kae_FrxNpi8

Topics:

- How the US can get Crypto Right

- Crypto Bills that have been introduced

- Can #Congress pass Crypto #Regulations this year

- #BackRock & TradFi Entering the Crypto market

- SEC Gary Gensler & #Ripple #XRP Lawsuit Victory

- #DigitalDollar #CBDC

- #Blockchain Voting

- Updating the Accredited Investor Laws

#interview #bitcoin #web3 #tech #jobs

hyoutu.be/Kae_FrxNpi8

Topics:

- How the US can get Crypto Right

- Crypto Bills that have been introduced

- Can #Congress pass Crypto #Regulations this year

- #BackRock & TradFi Entering the Crypto market

- SEC Gary Gensler & #Ripple #XRP Lawsuit Victory

- #DigitalDollar #CBDC

- #Blockchain Voting

- Updating the Accredited Investor Laws

#interview #bitcoin #web3 #tech #jobs

hyoutu.be/Kae_FrxNpi8

Topics:

- How the US can get Crypto Right

- Crypto Bills that have been introduced

- Can #Congress pass Crypto #Regulations this year

- #BackRock & TradFi Entering the Crypto market

- SEC Gary Gensler & #Ripple #XRP Lawsuit Victory

- #DigitalDollar #CBDC

- #Blockchain Voting

- Updating the Accredited Investor Laws

#interview #bitcoin #web3 #tech #jobs

hyoutu.be/Kae_FrxNpi8

Topics:

- How the US can get Crypto Right

- Crypto Bills that have been introduced

- Can #Congress pass Crypto #Regulations this year

- #BackRock & TradFi Entering the Crypto market

- SEC Gary Gensler & #Ripple #XRP Lawsuit Victory

- #DigitalDollar #CBDC

- #Blockchain Voting

- Updating the Accredited Investor Laws

#interview #bitcoin #web3 #tech #jobs2023-07-17T13:10:42.000Z

2023-07-17T14:09:52.000Z

French Hill reposted the post below

Atlantic Council GeoEconomics Center

@ACGeoEcon

LIVE NOW | Join us for a bipartisan conversation on the future of stablecoin legislation with @RepFrenchHill and @JaHimes

2023-07-17T13:09:43.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#WATCH: Digital Assets, Financial Technology & Inclusion Subcommittee Chairman @RepFrenchHill questions witnesses regarding strengthening consumer protection in digital asset markets.

2023-06-13T21:58:41.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#NEW: Chairman @PatrickMcHenry & @RepFrenchHill release a digital asset market structure proposal with @HouseAgGOP Chairman @CongressmanGT & @RepDustyJohnson in an unprecedented joint effort to provide clarity to the digital asset ecosystem.

Read more:

financialservices.house.gov/news/documents…

2023-06-02T19:30:38.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#WATCH: Chairman @RepFrenchHill at today's stablecoin hearing:

"Without action from Congress ... stablecoin issuers will not feel confident to build their projects in the U.S."

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his full remarks

Watch his full remarks

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his full remarks

Watch his full remarks

2023-05-18T14:30:56.000Z

French Hill

@RepFrenchHill

Along with my colleagues @PatrickMcHenry and @RepHuizenga, we called on bank regulators to explain potential coordinated efforts by the agencies to deny banking services to digital asset firms and the ecosystem.

Financial Services GOP

@FinancialCmte

#NEW: Chairmen @PatrickMcHenry, @RepFrenchHill, and @RepHuizenga are demanding information on prudential banking regulators' efforts to de-bank the digital asset ecosystem.

Read more on their letters

Read more on their letters  hfinancialservices.house.gov/news/documents…https://t.co/GInBcOCm90

hfinancialservices.house.gov/news/documents…https://t.co/GInBcOCm90

Read more on their letters

Read more on their letters  hfinancialservices.house.gov/news/documents…https://t.co/GInBcOCm90

hfinancialservices.house.gov/news/documents…https://t.co/GInBcOCm902023-04-26T20:35:25.000Z

2023-04-26T21:19:05.000Z

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#WATCH: Subcommittee Chairman @RepFrenchHill at today's hearing on stablecoins:

"It’s time for Congress to act and pass legislation to establish a regulatory framework for payment stablecoins."

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his opening remarks

Watch his opening remarks

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his opening remarks

Watch his opening remarks

2023-04-19T15:05:30.000Z

French Hill

@RepFrenchHill

Today, I led the inaugural @FinancialCmte hearing of the new Subcommittee on Digital Assets, Financial Technology and Inclusion.

My full opening remarks, below:

hill.house.gov/news/documents…

2023-03-09T21:35:30.000Z

French Hill

@RepFrenchHill

I was delighted to host former @CFTC Commissioner Dawn Stump and former @SECGov Chairman Jay Clayton at the Digital Asset Subcommittee Meet and Greet I organized this week.

2023-03-03T15:10:33.000Z

French Hill

@RepFrenchHill

Consistency, regulatory framework, and transparency, so that investors, innovators, and consumers all know the rules of the road, will really help FinTech and blockchain develop here in the U.S.

I joined @crypto yesterday to discuss FinTech.

bloomberg.com/news/videos/20…

2023-02-01T13:42:32.000Z

French Hill

@RepFrenchHill

We want to make sure that America is the place for innovation in FinTech and blockchain and distributed ledger technology is part of that FinTech future.

This morning, I joined @SquawkCNBC to discuss crypto and Financial Technology.

My interview, below:

cnbc.com/video/2023/01/…

2023-01-26T15:27:21.000Z

French Hill reposted the post below

Meet the Press

@MeetThePress

WATCH: Rep. French Hill (R-Ark.) will chair a new cryptocurrency House subcommittee.

@RepFrenchHill: “We want innovation for fintech and the use of blockchain to be available in the United States.”

2023-01-13T22:06:50.000Z

French Hill

@RepFrenchHill

I am delighted that in the 118th Congress, I will serve in the pioneering role of Chairman of the Subcommittee on Digital Assets, Financial Technology and Inclusion of the @FinancialCmte, and as Vice-Chairman of FSC.

My full statement, below:

hill.house.gov/news/documents…

2023-01-12T22:01:29.000Z

French Hill

@RepFrenchHill

The collapse of FTX tells me that investors don't really know what they're doing in this space. We need to find a bipartisan solution to defining digital assets, how they should be valued, and how their users should be protected.

My full interview, below:

video.foxbusiness.com/v/6315747389112

2022-11-17T22:08:49.000Z

French Hill

@RepFrenchHill

I am committed to protecting consumer privacy and am working to stop any and all efforts by Democrats to develop a federal CBDC to spy on the American people. I introduced a bill that would ensure that the government studies what guardrails would be necessary to protect consumers

2022-10-28T16:00:34.000Z

French Hill

@RepFrenchHill

I understand why Americans are concerned about CBDCs and the potential for a Big-Brother-like surveillance state. I share these concerns. It is a priority of mine to make sure the federal government cannot and does not proceed with issuing a CBDC without Congressional approval.

2022-10-28T16:00:33.000Z

French Hill reposted the post below

Tom Emmer

@GOPMajorityWhip

We’ll be very clear: There is no alternative to authorizing a CBDC other than through legislation. And Congress won’t approve a CBDC unless it’s open, permissionless, & private. I commend @RepFrenchHill & @PatrickMcHenry for leading this letter and am proud to support.

2022-10-05T20:14:30.000Z

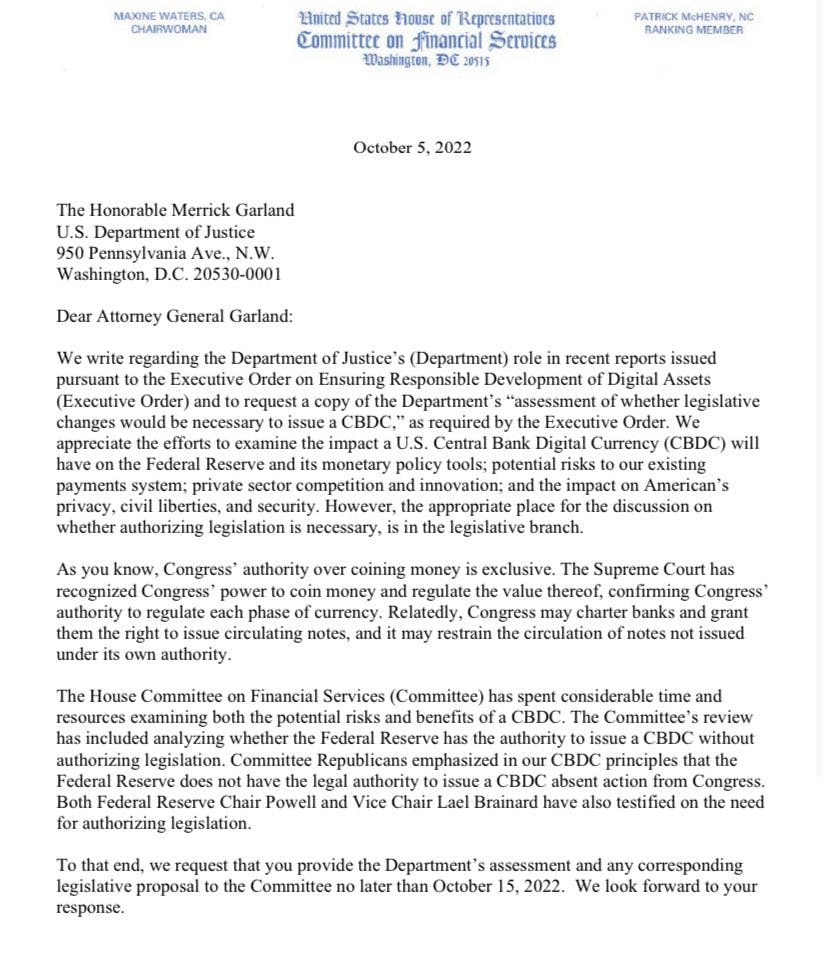

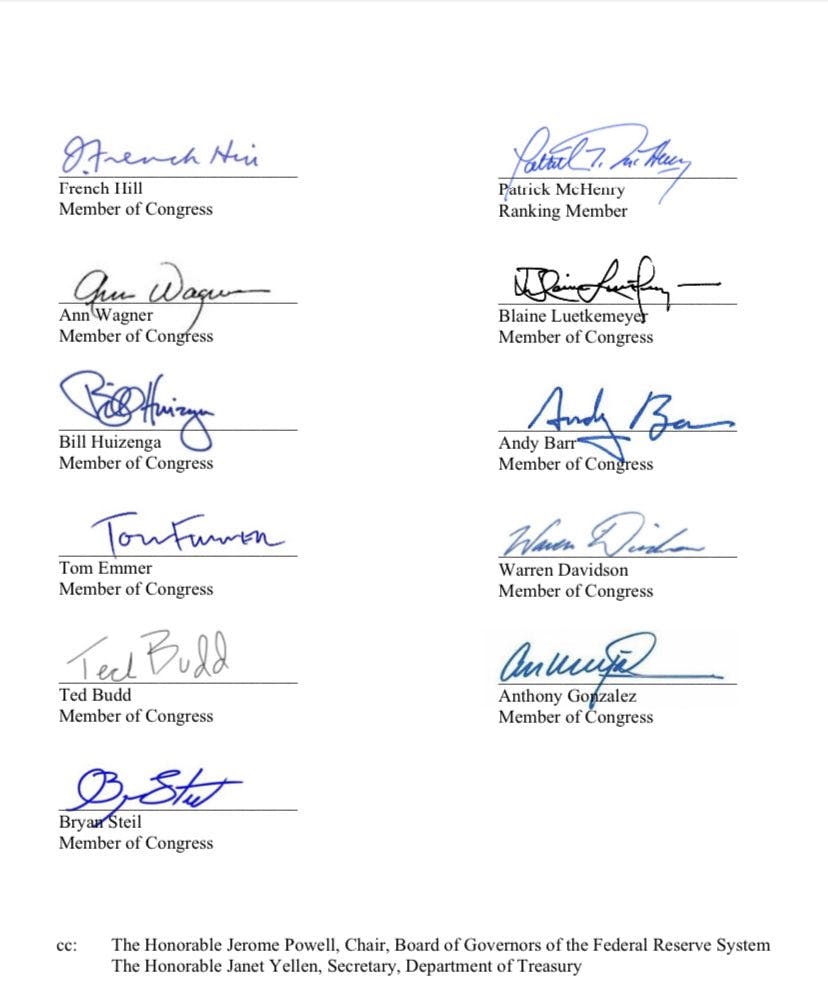

French Hill reposted the post below

Financial Services GOP

@FinancialCmte

#NEW: @PatrickMcHenry, @RepFrenchHill, and members of Committee Republicans' Digital Asset Working Group are demanding Attorney General Garland provide his assessment on the @federalreserve's authority to issue a #CBDC.

Read the letter

Read the letter  …publicans-financialservices.house.gov/news/documents…

…publicans-financialservices.house.gov/news/documents…

Read the letter

Read the letter  …publicans-financialservices.house.gov/news/documents…

…publicans-financialservices.house.gov/news/documents…

2022-10-05T16:10:49.000Z

French Hill

@RepFrenchHill

I sent a letter with @FinancialCmte GOP Leader @PatrickMcHenry and Committee Republicans’ Digital Asset Working Group requesting Attorney General Garland provide his assessment on @federalreserve’s authority to issue a #CBDC.

2022-10-05T16:14:40.000Z

French Hill replied to a post from @Sackmaster13

French Hill

@RepFrenchHill

@Sackmaster13 I'm not. I introduced a bill in March 2021 simply directing the Federal Reserve to issue a report on central bank digital currencies (CBDC) to examine the effect a CBDC would have on consumers, businesses, and the economy. congress.gov/117/bills/hr22…

2022-08-23T13:24:28.000Z

French Hill

@RepFrenchHill

I’ve been urging consideration of a CBDC for nearly 3 years now and last year introduced HR 3506, the 21st Century Dollar Act, to make sure US government has a strategy to maintain the dollar as the primary global reserve currency, with or without a CBDC.

2022-05-26T18:40:28.000Z

French Hill

@RepFrenchHill

There’s a fair amount of agreement between @FinancialCmte Rs and @FSCDems when it comes to stablecoins, starting with their potential to improve the efficiency, cost, and speed of payments; expanding financial access; and facilitating the use and adoption of digital assets.

2022-02-08T17:21:06.000Z

French Hill reposted the post below

Yahoo Finance

@YahooFinance

“Republicans in the House Financial Services committee want innovation in blockchain and cryptocurrencies and the development,” Arkansas @RepFrenchHill says. “We want that development in the U.S., benefiting the U.S. GDP, innovators, and workers.”

2022-02-01T22:37:02.000Z

French Hill

@RepFrenchHill

Glad to join my colleagues on this bipartisan letter to @SecYellen. It's important that we encourage innovation and allow digital asset technologies to flourish by not having an overly broad definition of a crypto "broker" for the purpose of digital asset reporting requirements.

Financial Services GOP

@FinancialCmte

RM @PatrickMcHenry, @RepTimRyan, and colleagues sent a letter to @SecYellen ahead of the expected guidance on new digital asset reporting requirements.

They urge her to provide additional clarity to America’s innovators and entrepreneurs.

Read more

Read more  …publicans-financialservices.house.gov/news/documents…

…publicans-financialservices.house.gov/news/documents…

Read more

Read more  …publicans-financialservices.house.gov/news/documents…

…publicans-financialservices.house.gov/news/documents… 2022-01-27T14:30:34.000Z

2022-01-27T20:21:50.000Z

French Hill

@RepFrenchHill

For years, @RepBillFoster and I have advocated for the careful, thoughtful approach in designing a CBDC. While I am pleased to read Federal Reserve’s new report, I am disappointed it was released months behind schedule. It is important to not delay the work on CBDCs any further.

2022-01-20T22:27:41.000Z