Congressman John Rose

@RepJohnRose

This report confirms the worst: Joe Biden worked to debank the digital assets of conservatives, Christians, and firearm businesses because of their politics. Just as they did when the last administration weaponized banks against its political opponents, this pattern of abuse must end.

I look forward to working with Chairman @RepFrenchHill, Subcommittee Chairman @RepMeuser, and my @FinancialCmte colleagues to ensure this never happens again.

Financial Services GOP

@FinancialCmte

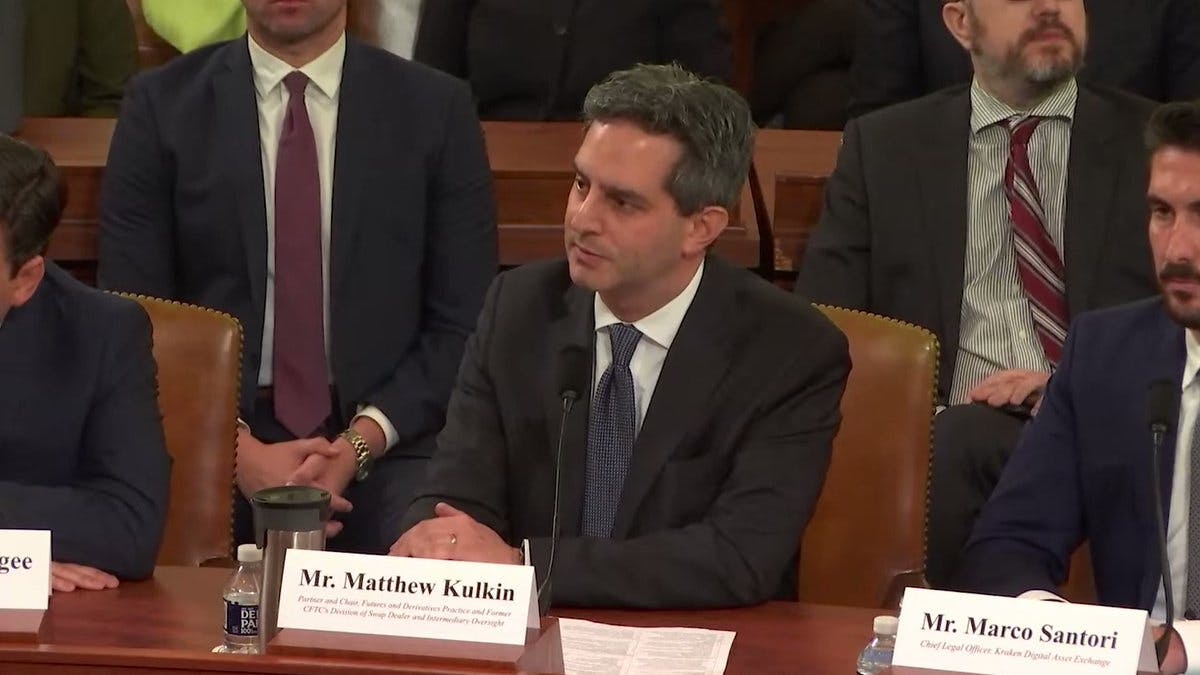

NEW: Chairman @RepFrenchHill and Oversight Subcommittee Chair @RepMeuser issued a final staff report on the Biden Administration’s efforts to debank digital asset businesses and individuals.

Read more

https://t.co/wDGo0nE6uK

https://t.co/wDGo0nE6uK

https://t.co/wDGo0nE6uK

https://t.co/wDGo0nE6uK2025-12-01T15:31:52.000Z

2025-12-01T21:27:16.000Z

Promises made. Promises kept.

Promises made. Promises kept.

SCOOP:

SCOOP:

Require digital asset developers to provide accurate and critical disclosures to consumers

Require digital asset developers to provide accurate and critical disclosures to consumers

:

:

Read more

Read more

Holds China accountable by targeting the CCP's military-industrial complex

Holds China accountable by targeting the CCP's military-industrial complex

Read more

Read more