hyoutu.be/_DGG04tT44Y

Congressman Tom Emmer joined me to discuss the latest developments on the crypto market structure bill (CLARITY Act) in the Senate.

Topics:

- Timeline for the passing of the CLARITY Act

- Will Democrats try to block the CLARITY Act because of Trump

- Senate Democrats introduce a version of the market structure bill

- US Strategic Bitcoin Reserve updates

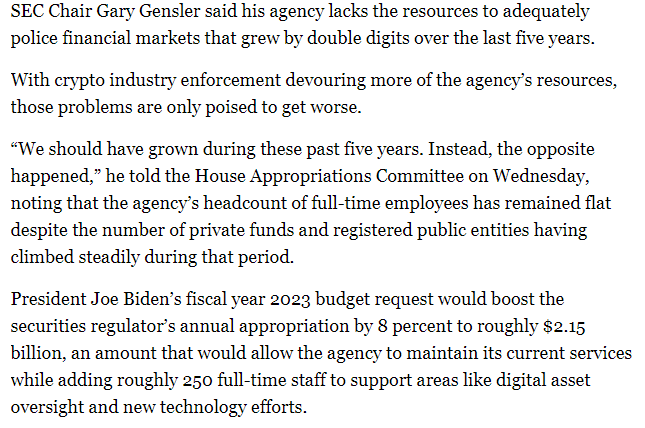

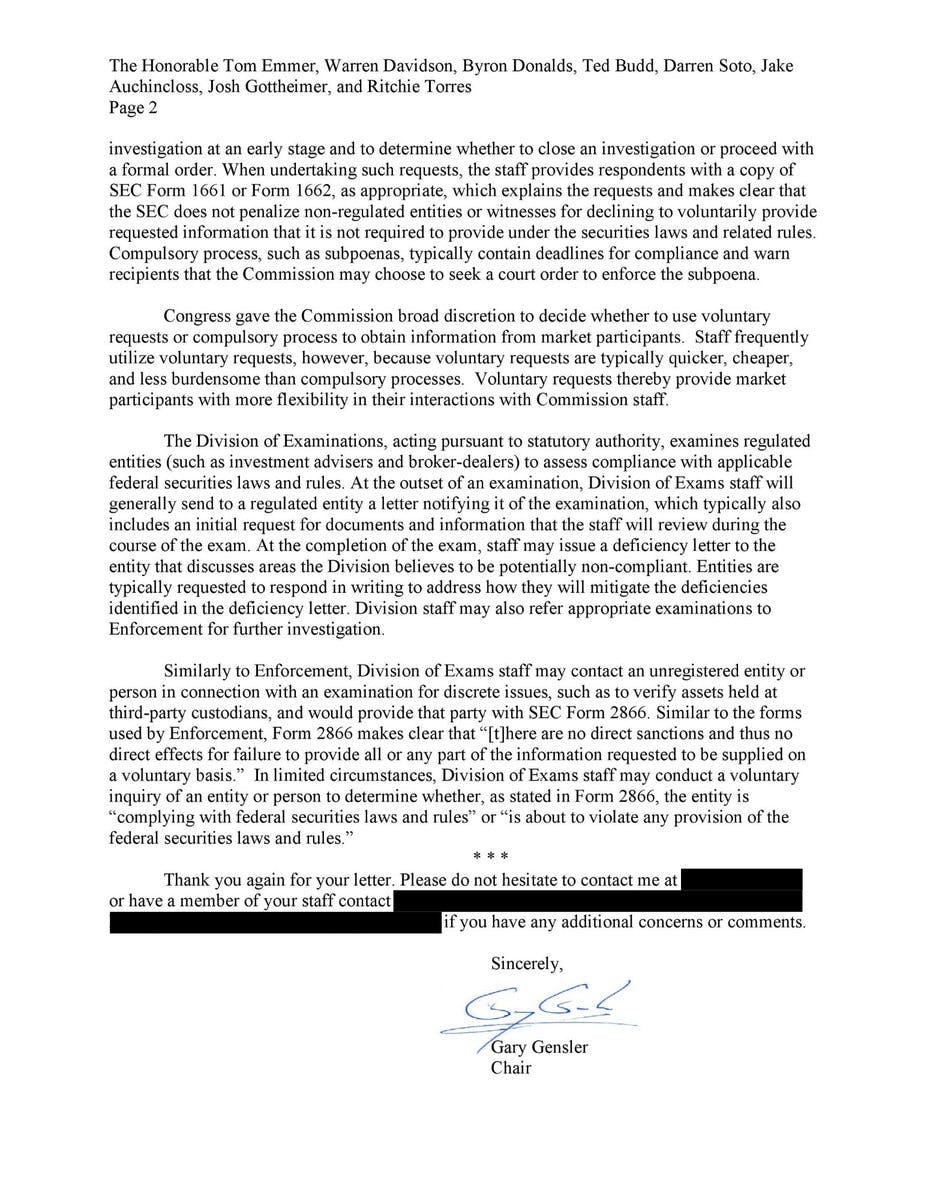

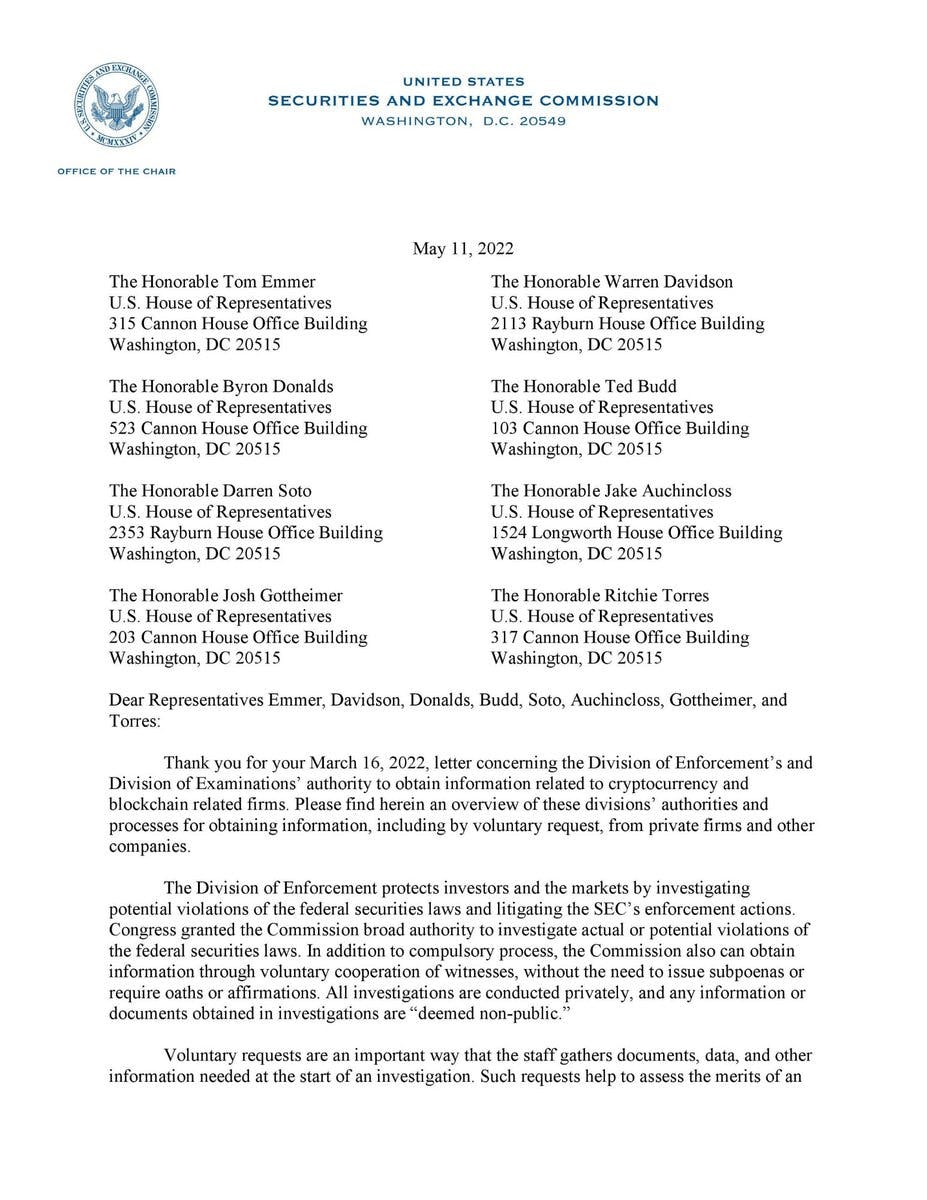

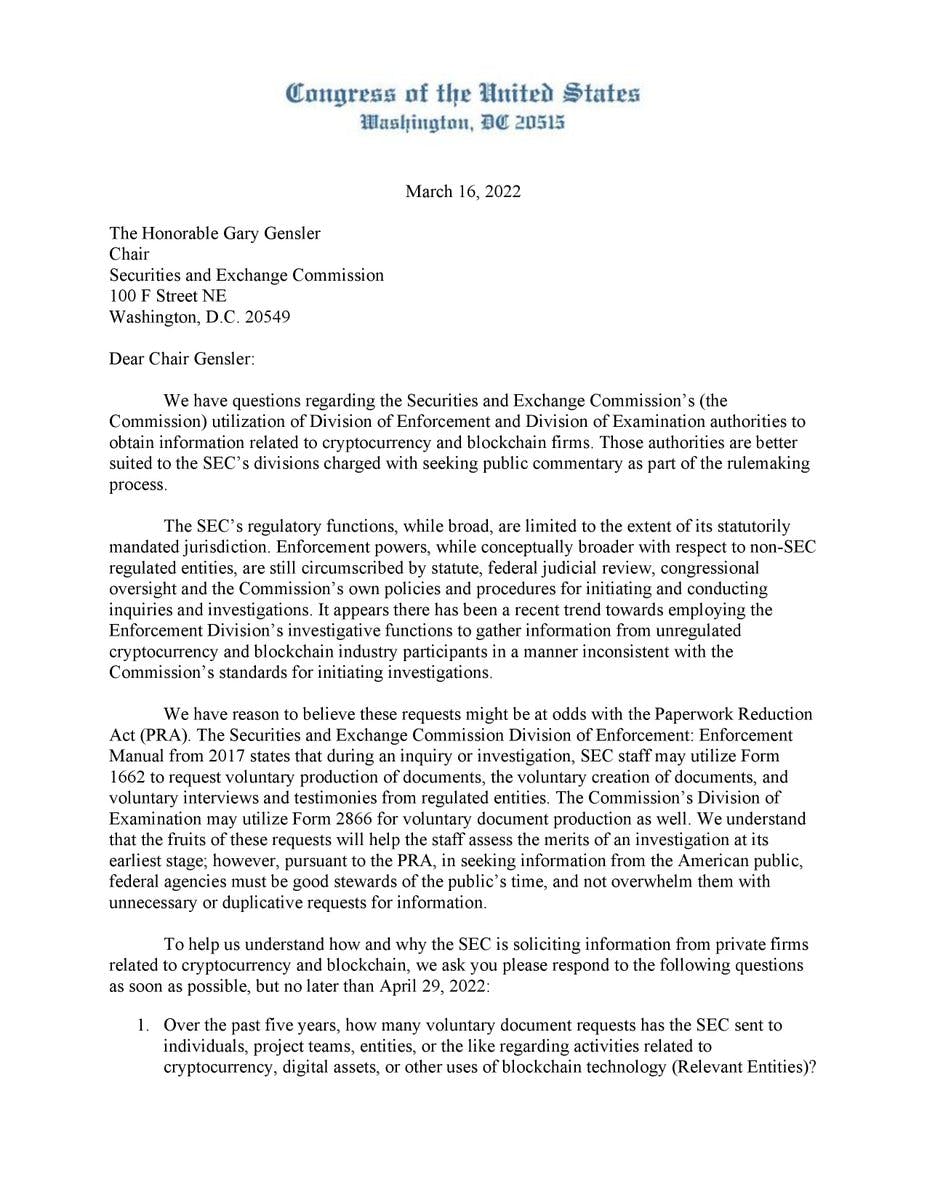

- SEC Gary Gensler deleted text messages

- Anti CBDC Legislation included in National Defense Authorization Act

#crypto #senate #congress #interview #podcast @GOPMajorityWhip

hyoutu.be/_DGG04tT44Y

Congressman Tom Emmer joined me to discuss the latest developments on the crypto market structure bill (CLARITY Act) in the Senate.

Topics:

- Timeline for the passing of the CLARITY Act

- Will Democrats try to block the CLARITY Act because of Trump

- Senate Democrats introduce a version of the market structure bill

- US Strategic Bitcoin Reserve updates

- SEC Gary Gensler deleted text messages

- Anti CBDC Legislation included in National Defense Authorization Act

#crypto #senate #congress #interview #podcast @GOPMajorityWhip

https://t.co/4QLHOqEvOY

https://t.co/4QLHOqEvOY

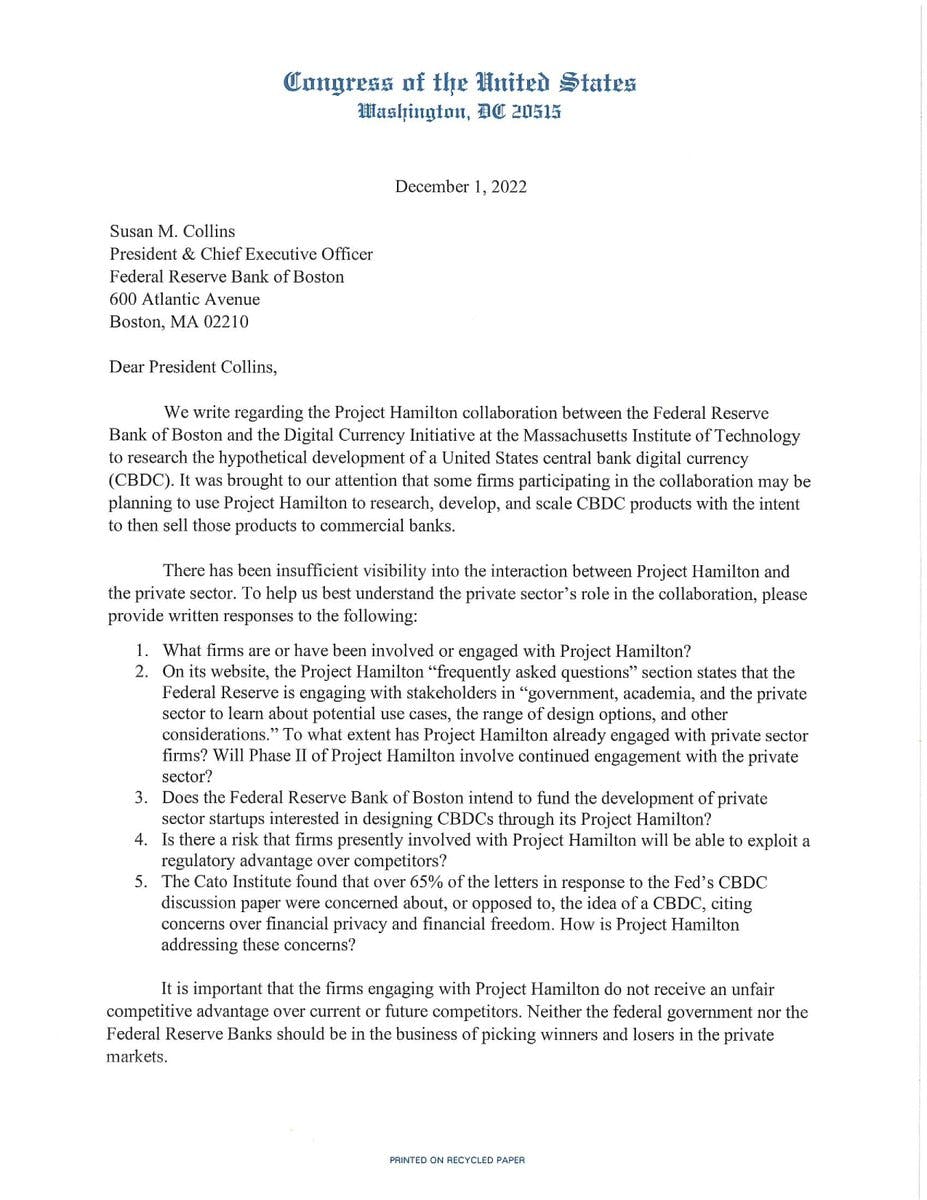

@Heritage_Action KEY VOTES YES @GOPMajorityWhip’s CBDC Anti-Surveillance State Act.

“Heritage Action has consistently opposed CBDCs as these assets threaten the privacy and civil liberties of American citizens” – VP of Government Relations Steve Chartan

Read the exclusive with @BreitbartNews

@Heritage_Action KEY VOTES YES @GOPMajorityWhip’s CBDC Anti-Surveillance State Act.

“Heritage Action has consistently opposed CBDCs as these assets threaten the privacy and civil liberties of American citizens” – VP of Government Relations Steve Chartan

Read the exclusive with @BreitbartNews  https://t.co/4RWOVmHFmE

https://t.co/4RWOVmHFmE

KEY VOTE ALERT

KEY VOTE ALERT  Heritage Action SUPPORTS the CBDC Anti-Surveillance State Act (HR 1919)

@GOPMajorityWhip’s bill works to prevent unelected bureaucrats from tracking, tracing, and taxing Americans' hard-earned money.

Read the full Key Vote

Heritage Action SUPPORTS the CBDC Anti-Surveillance State Act (HR 1919)

@GOPMajorityWhip’s bill works to prevent unelected bureaucrats from tracking, tracing, and taxing Americans' hard-earned money.

Read the full Key Vote  heritageaction.com/key-vote/key-v…

heritageaction.com/key-vote/key-v…

NEW: Chairman @RepFrenchHill and @HouseAgGOP Chairman @CongressmanGT drop new op-ed as "Crypto Week" gets underway.

Read the Chairmen's piece

NEW: Chairman @RepFrenchHill and @HouseAgGOP Chairman @CongressmanGT drop new op-ed as "Crypto Week" gets underway.

Read the Chairmen's piece

https://t.co/86iAFAqANQ

https://t.co/86iAFAqANQ

T

T

NEW: Chairman @RepFrenchHill, Chairman @CongressmanGT, and @GOPMajorityWhip chart course for America's digital asset leadership in their new @CoinDesk op-ed.

Read more

NEW: Chairman @RepFrenchHill, Chairman @CongressmanGT, and @GOPMajorityWhip chart course for America's digital asset leadership in their new @CoinDesk op-ed.

Read more

https://t.co/76kqVTl03u

https://t.co/76kqVTl03u

NEW: In a notable display of unity, eight of the biggest crypto policy organizations in Washington D.C. have issued a joint statement calling on Congress to include the Blockchain Regulatory Certainty Act (BRCA) in market structure legislation.

The groups — @fund_defi, @coincenter @SolanaInstitute, @DigitalChamber, @BlockchainAssn, @crypto_council, @btcpolicyorg and @paradigm — say the amendment is essential to protecting software developers and infrastructure providers who do not custody customer funds.

The amendment, originally introduced by @GOPMajorityWhip and now with bipartisan support from @RepRitchie, is being viewed by many in the industry as a foundational policy safeguard for DeFi developers.

“It’s critically important that we don’t treat open-source developers like traditional financial institutions,” one policy lead told me. “The BRCA draws that line clearly and protects innovation.”

The joint statement urges lawmakers to include the BRCA in the CLARITY Act, the House’s digital asset market structure bill, which is expected to be marked up next week.

Full statement here

NEW: In a notable display of unity, eight of the biggest crypto policy organizations in Washington D.C. have issued a joint statement calling on Congress to include the Blockchain Regulatory Certainty Act (BRCA) in market structure legislation.

The groups — @fund_defi, @coincenter @SolanaInstitute, @DigitalChamber, @BlockchainAssn, @crypto_council, @btcpolicyorg and @paradigm — say the amendment is essential to protecting software developers and infrastructure providers who do not custody customer funds.

The amendment, originally introduced by @GOPMajorityWhip and now with bipartisan support from @RepRitchie, is being viewed by many in the industry as a foundational policy safeguard for DeFi developers.

“It’s critically important that we don’t treat open-source developers like traditional financial institutions,” one policy lead told me. “The BRCA draws that line clearly and protects innovation.”

The joint statement urges lawmakers to include the BRCA in the CLARITY Act, the House’s digital asset market structure bill, which is expected to be marked up next week.

Full statement here

hyoutu.be/6D_oM_jOtt8

Congressman Tom Emmer joined me to discuss the latest with US crypto regulations.

Topics:

- President Trump’s first crypto bill signed into law - repeal of the IRS DeFi Rule

- Crypto Market Structure and Stablecoin Bills

- Timeline for getting bills to President Trump

- New SEC Chair Paul Atkins - expectations and will the SEC assist in providing rules for the Crypto market structure bill

- Bitcoin Reserve & Digital Stockpile

- Banks getting involved in crypto - SAB121 repeal - FDIC, OCC, and Fed removing restrictions.

- Will Gary Gensler work in government again?

#interview #podcast #crypto #stablecoins #usa #congress #senate #trump @GOPMajorityWhip

hyoutu.be/6D_oM_jOtt8

Congressman Tom Emmer joined me to discuss the latest with US crypto regulations.

Topics:

- President Trump’s first crypto bill signed into law - repeal of the IRS DeFi Rule

- Crypto Market Structure and Stablecoin Bills

- Timeline for getting bills to President Trump

- New SEC Chair Paul Atkins - expectations and will the SEC assist in providing rules for the Crypto market structure bill

- Bitcoin Reserve & Digital Stockpile

- Banks getting involved in crypto - SAB121 repeal - FDIC, OCC, and Fed removing restrictions.

- Will Gary Gensler work in government again?

#interview #podcast #crypto #stablecoins #usa #congress #senate #trump @GOPMajorityWhip

GOP MAJORITY WHIP TOM EMMER TO SPEAK IN LAS VEGAS AT CODE+COUNTRY

GOP MAJORITY WHIP TOM EMMER TO SPEAK IN LAS VEGAS AT CODE+COUNTRY

https://t.co/JEsVfMAOCg

https://t.co/JEsVfMAOCg

l

l

NEW per my @FoxBusiness colleague @EdwardLawrence: The #crypto executive order has officially been signed.

Here are the details:

NEW per my @FoxBusiness colleague @EdwardLawrence: The #crypto executive order has officially been signed.

Here are the details:

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance.

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance.

The Working Group will be tasked with developing a Federal regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.

The Working Group will be tasked with developing a Federal regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.

The Working Group will be chaired by the White House AI & Crypto Czar @DavidSacks and include the Secretary of the Treasury, the Chairman of the Securities and Exchange Commission, and the heads of other relevant departments and agencies.

The Working Group will be chaired by the White House AI & Crypto Czar @DavidSacks and include the Secretary of the Treasury, the Chairman of the Securities and Exchange Commission, and the heads of other relevant departments and agencies.

The White House AI & Crypto Czar will engage leading experts in digital assets and digital markets to ensure that the actions of the Working Group are informed by expertise beyond the Federal Government.

The White House AI & Crypto Czar will engage leading experts in digital assets and digital markets to ensure that the actions of the Working Group are informed by expertise beyond the Federal Government.

The Executive Order directs departments and agencies with identifying and making recommendations to the Working Group on any regulations and other agency actions affecting the digital assets sector that should be rescinded or modified.

The Executive Order directs departments and agencies with identifying and making recommendations to the Working Group on any regulations and other agency actions affecting the digital assets sector that should be rescinded or modified.

The Executive Order prohibits agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs).

The Executive Order prohibits agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs).

The Executive Order revokes the previous Administration’s Digital Assets Executive Order and the Treasury Department’s Framework for International Engagement on Digital Assets which suppressed innovation and undermined U.S. economic liberty and global leadership in digital finance.

The Executive Order revokes the previous Administration’s Digital Assets Executive Order and the Treasury Department’s Framework for International Engagement on Digital Assets which suppressed innovation and undermined U.S. economic liberty and global leadership in digital finance.

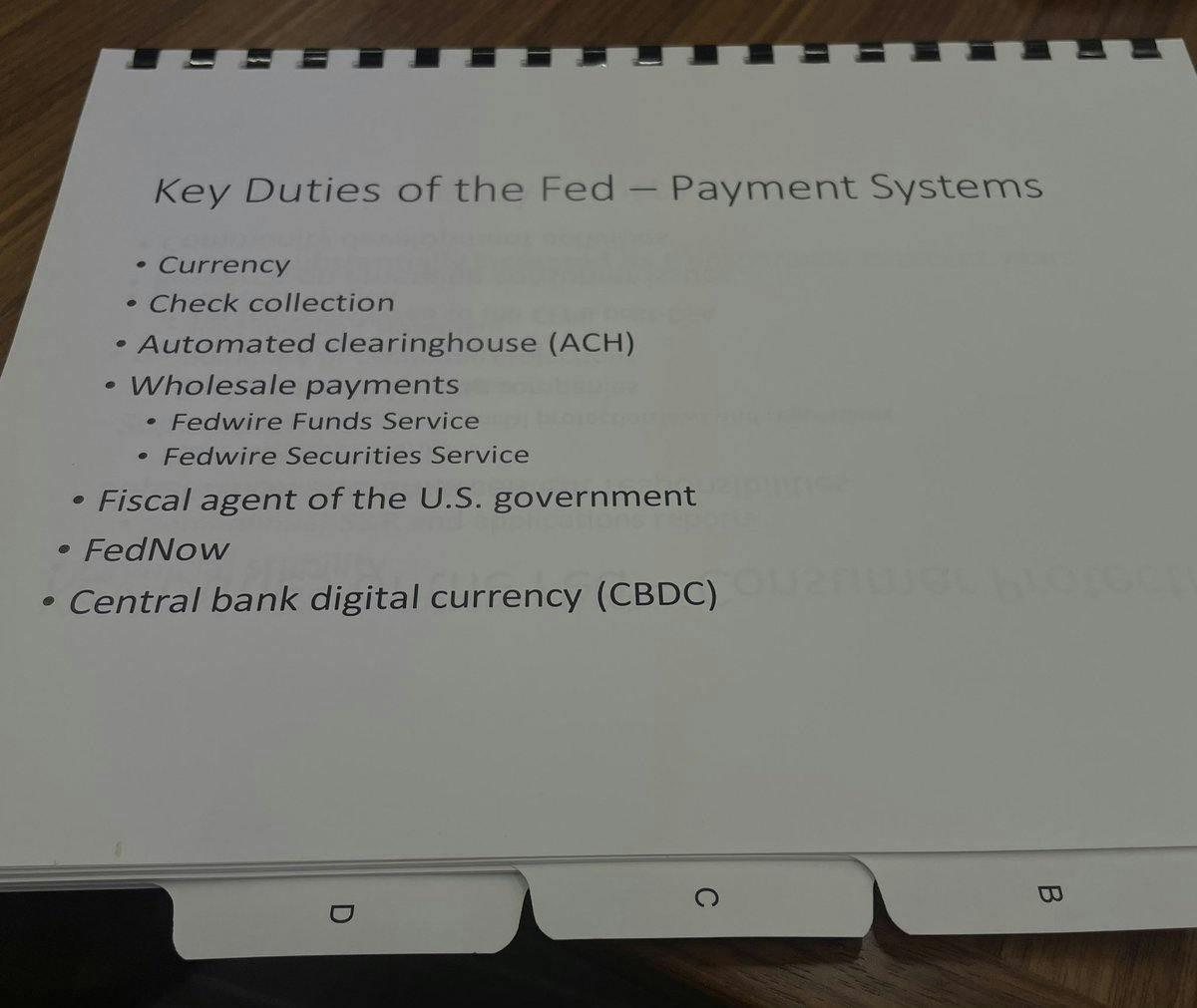

#FSCRewind

#FSCRewind  The threat that a central bank digital currency poses to Americans' financial privacy cannot be overstated.

The House passed @GOPMajorityWhip’s CBDC Anti-Surveillance State Act to block the creation of a government-issued, government-controlled CBDC.

The threat that a central bank digital currency poses to Americans' financial privacy cannot be overstated.

The House passed @GOPMajorityWhip’s CBDC Anti-Surveillance State Act to block the creation of a government-issued, government-controlled CBDC.

https://t.co/pG0yfxNzbn

https://t.co/pG0yfxNzbn

Donald Trump uses #Bitcoin to pay at a bar in New York.g

Donald Trump uses #Bitcoin to pay at a bar in New York.g

@GOPconvention master thread

Just caught up with #MN06’s @GOPMajorityWhip, who published a great oped @DC_Reporter on cryptocurrency and the presidential election

Now, he’s talking about crypto and the VP pick, @JDVance1!

washingtonreporter.news/op-ed/op-ed-wh…

(1/xx)

@GOPconvention master thread

Just caught up with #MN06’s @GOPMajorityWhip, who published a great oped @DC_Reporter on cryptocurrency and the presidential election

Now, he’s talking about crypto and the VP pick, @JDVance1!

washingtonreporter.news/op-ed/op-ed-wh…

(1/xx)

Key Vote Alert! We're urging all Representatives to vote yes on the #CBDC Anti-Surveillance State Act. The creation of a U.S. CBDC would threaten the financial health of the country and the constitutional rights of law-abiding Americans. Learn more - clubforgrowth.org/yes-on-the-the…

Key Vote Alert! We're urging all Representatives to vote yes on the #CBDC Anti-Surveillance State Act. The creation of a U.S. CBDC would threaten the financial health of the country and the constitutional rights of law-abiding Americans. Learn more - clubforgrowth.org/yes-on-the-the…

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

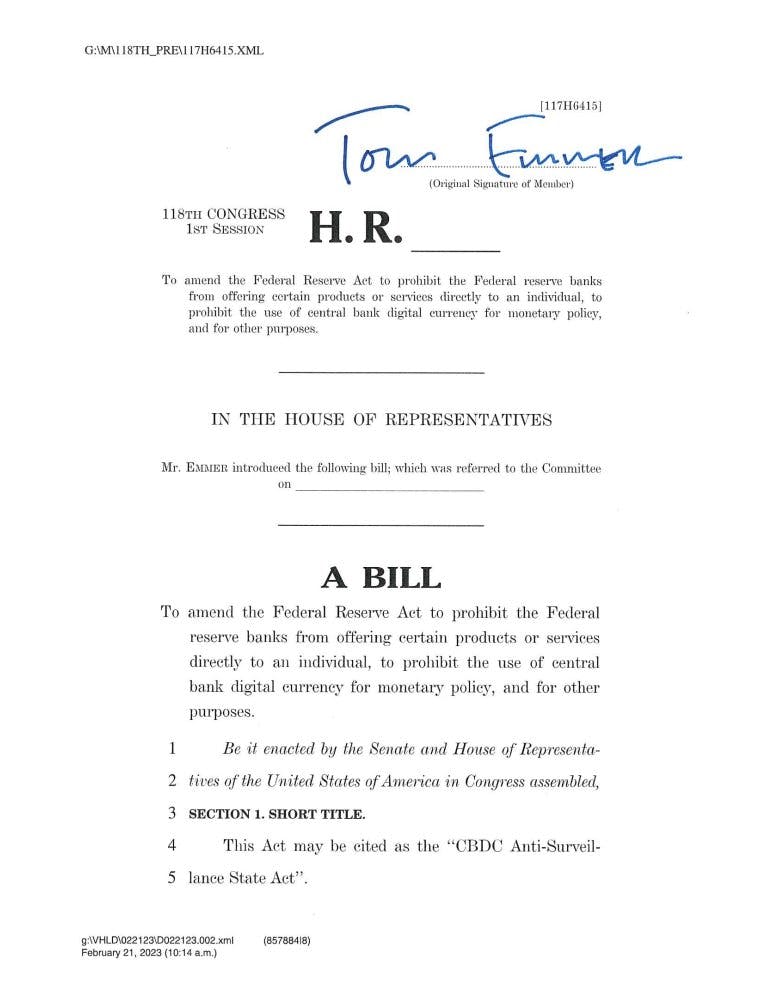

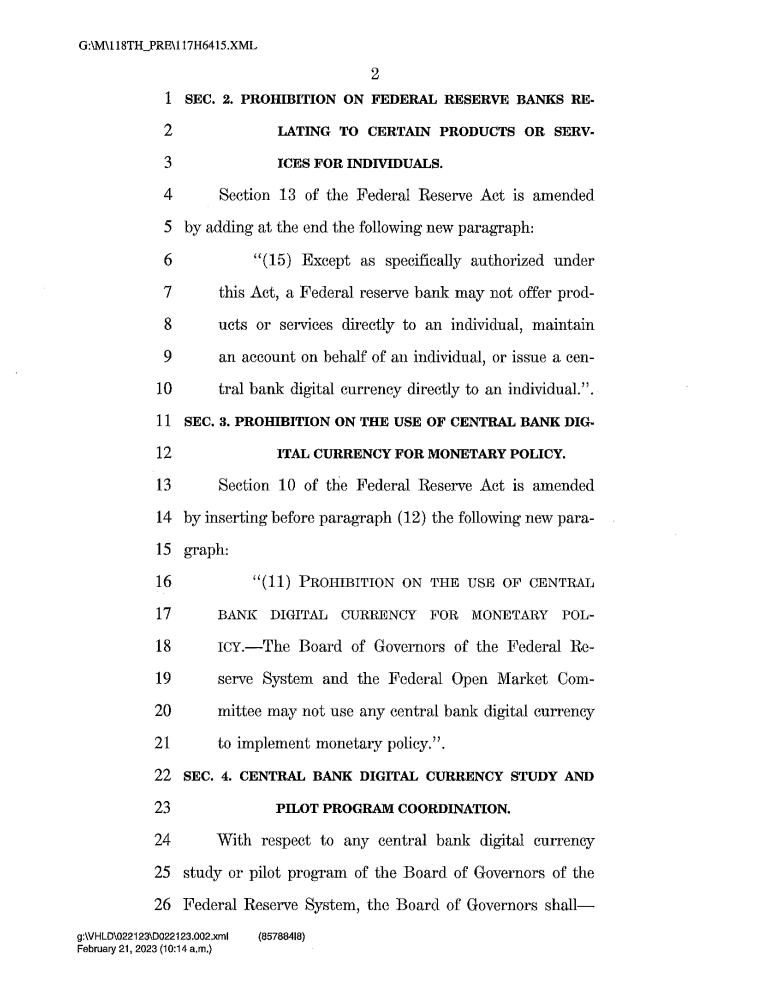

@GOPMajorityWhip's CBDC Anti-Surveillance State Act

@GOPMajorityWhip's CBDC Anti-Surveillance State Act

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

NEW: The @EIAgov has decided to DROP its emergency survey of $BTC miners following the lawsuit filed by @RiotPlatforms, @TXblockchain_ and @DigitalChamber.

The EIA has agreed to undergo the proper notice and comment procedure before attempting any future reissuance.

NEW: The @EIAgov has decided to DROP its emergency survey of $BTC miners following the lawsuit filed by @RiotPlatforms, @TXblockchain_ and @DigitalChamber.

The EIA has agreed to undergo the proper notice and comment procedure before attempting any future reissuance.

hyoutu.be/hkq7sHVUDhQ

Topics:

- DOJ #Binance settlement

- #SEC enforcement action against Kraken exchange

- Amendment to prevent tax payers funds being used in SEC Crypto enforcement actions

- Stopping Gary Gensler & Elizabeth Warren's anti Crypto agenda

- #Crypto Bills in the House

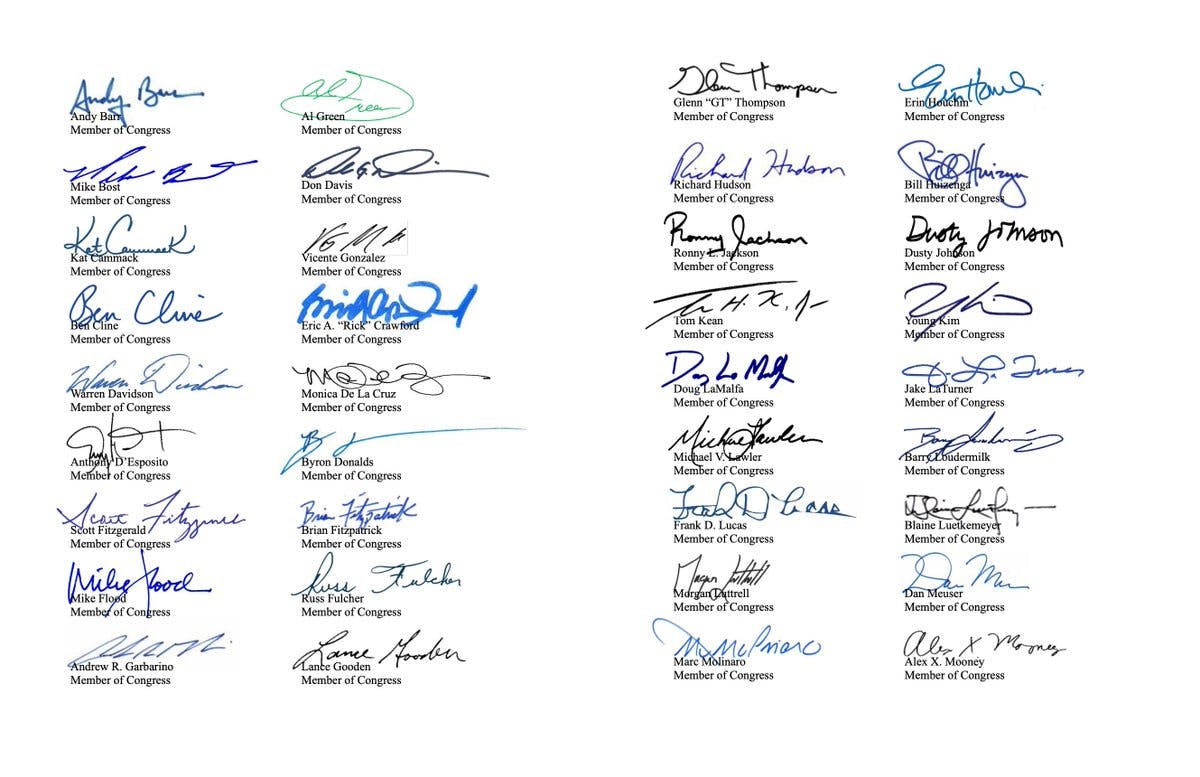

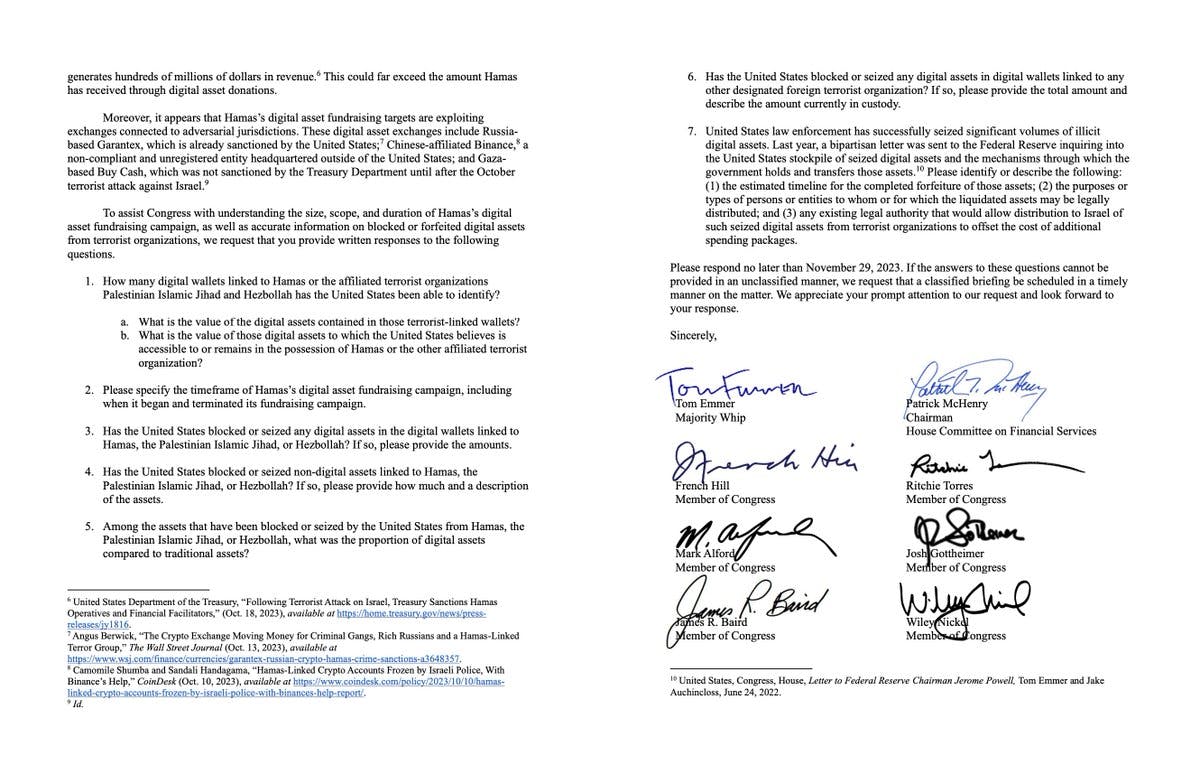

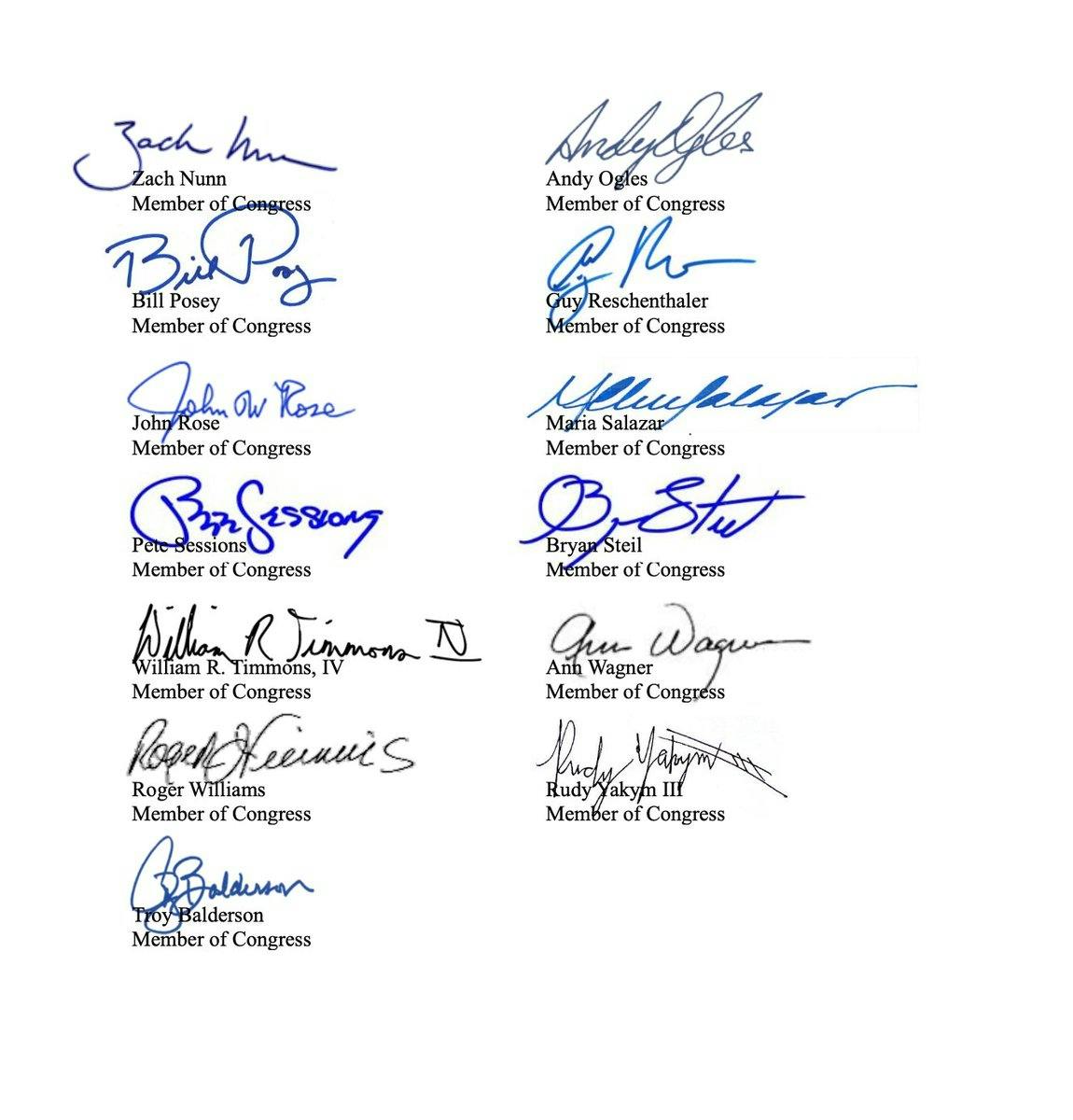

- Bi-partisan letter to Biden Administration regarding Hamas’s digital asset fundraising campaign.

- #Stablecoin Regulation and #CBDCs

#congress #interview #podcast #thinkingcrypto #bitcoin #xrp #ripple #grayscale #garygensler #firegarygensler

hyoutu.be/hkq7sHVUDhQ

Topics:

- DOJ #Binance settlement

- #SEC enforcement action against Kraken exchange

- Amendment to prevent tax payers funds being used in SEC Crypto enforcement actions

- Stopping Gary Gensler & Elizabeth Warren's anti Crypto agenda

- #Crypto Bills in the House

- Bi-partisan letter to Biden Administration regarding Hamas’s digital asset fundraising campaign.

- #Stablecoin Regulation and #CBDCs

#congress #interview #podcast #thinkingcrypto #bitcoin #xrp #ripple #grayscale #garygensler #firegarygensler

#ICYMI: @FinancialCmte advanced legislation to prohibit the @federalreserve from issuing a #CBDC without Congressional approval.

Read more on our bill, led by @GOPMajorityWhip, to protect our financial system and the privacy of the American people.

#ICYMI: @FinancialCmte advanced legislation to prohibit the @federalreserve from issuing a #CBDC without Congressional approval.

Read more on our bill, led by @GOPMajorityWhip, to protect our financial system and the privacy of the American people.  https://t.co/Aj7Fc14jbS

https://t.co/Aj7Fc14jbS

NEW: @GOPMajorityWhip’s anti-CBDC bill has just passed out of the House Financial Services Committee.

NEW: @GOPMajorityWhip’s anti-CBDC bill has just passed out of the House Financial Services Committee.

Today, with 49 of my Republican colleagues, I reintroduced the CBDC Anti-Surveillance State Act

Today, with 49 of my Republican colleagues, I reintroduced the CBDC Anti-Surveillance State Act foxbusiness.com/markets/gop-ta…

foxbusiness.com/markets/gop-ta…

majoritywhip.gov/news/documents…

majoritywhip.gov/news/documents…

Miners/validators

Miners/validators  Front ends

Front ends

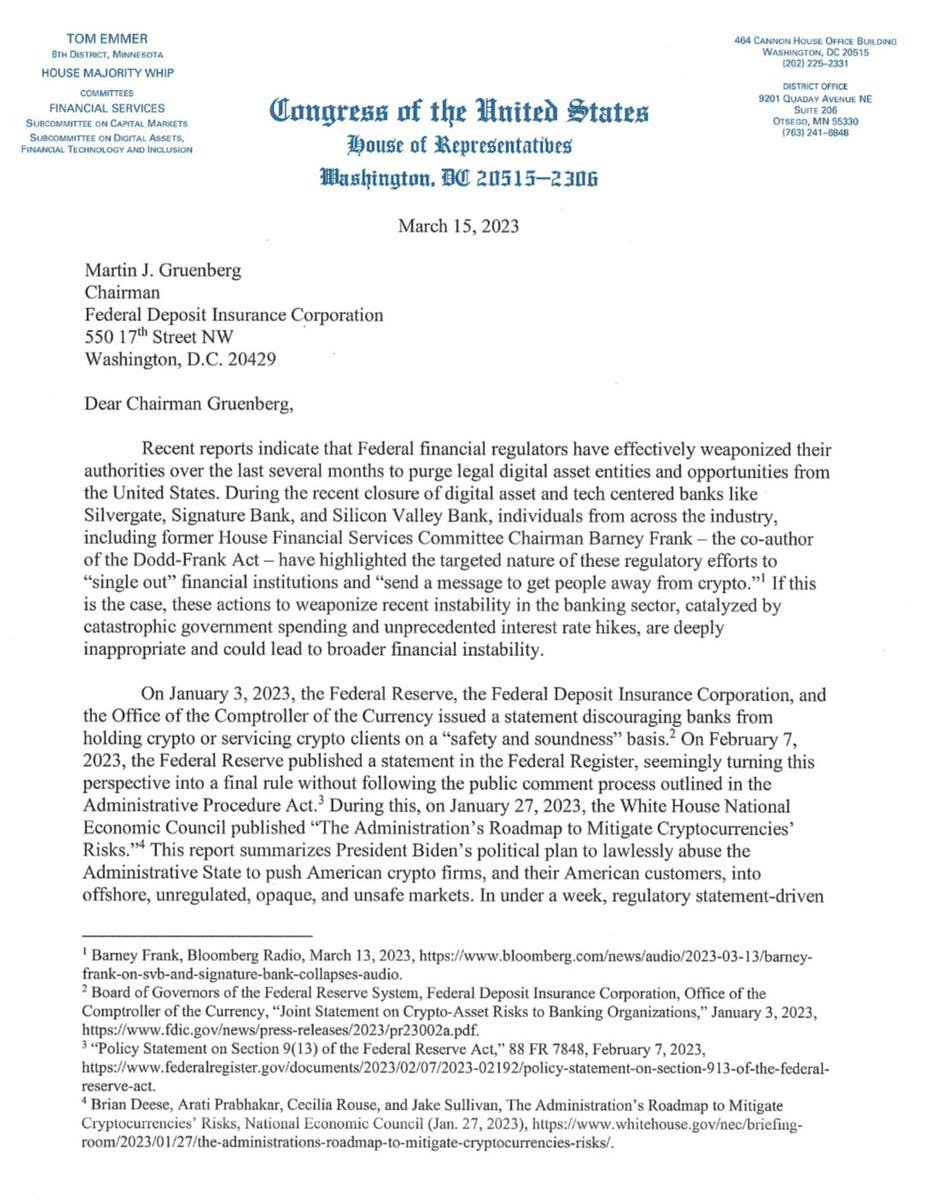

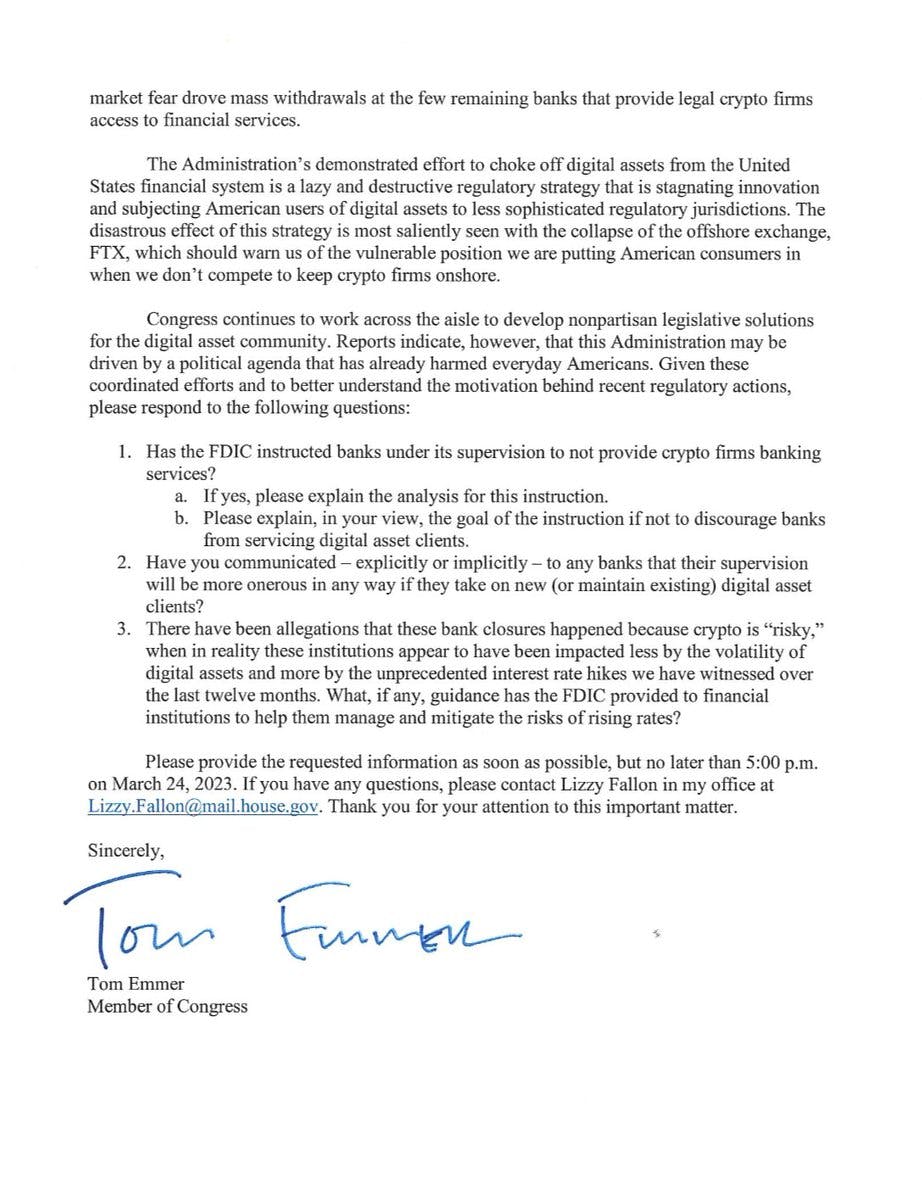

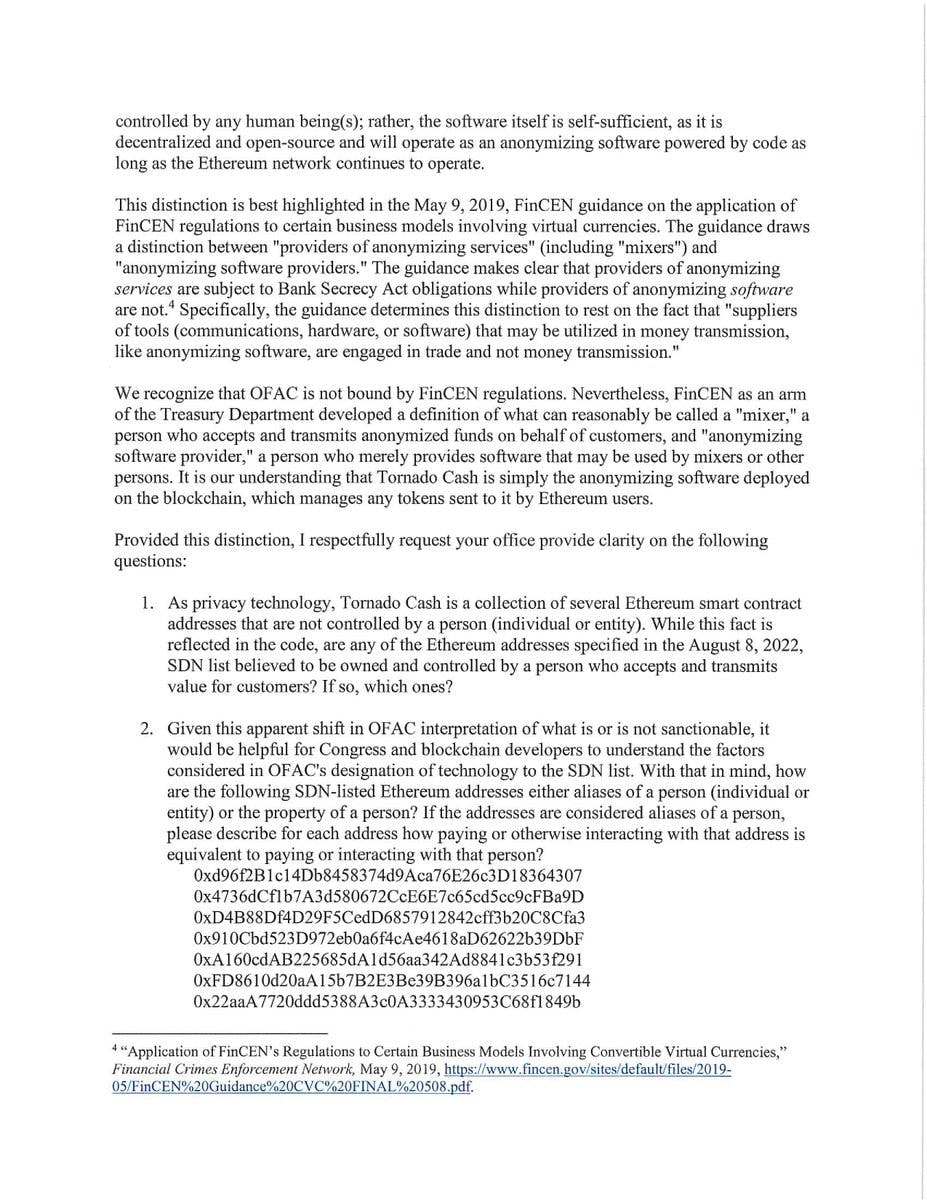

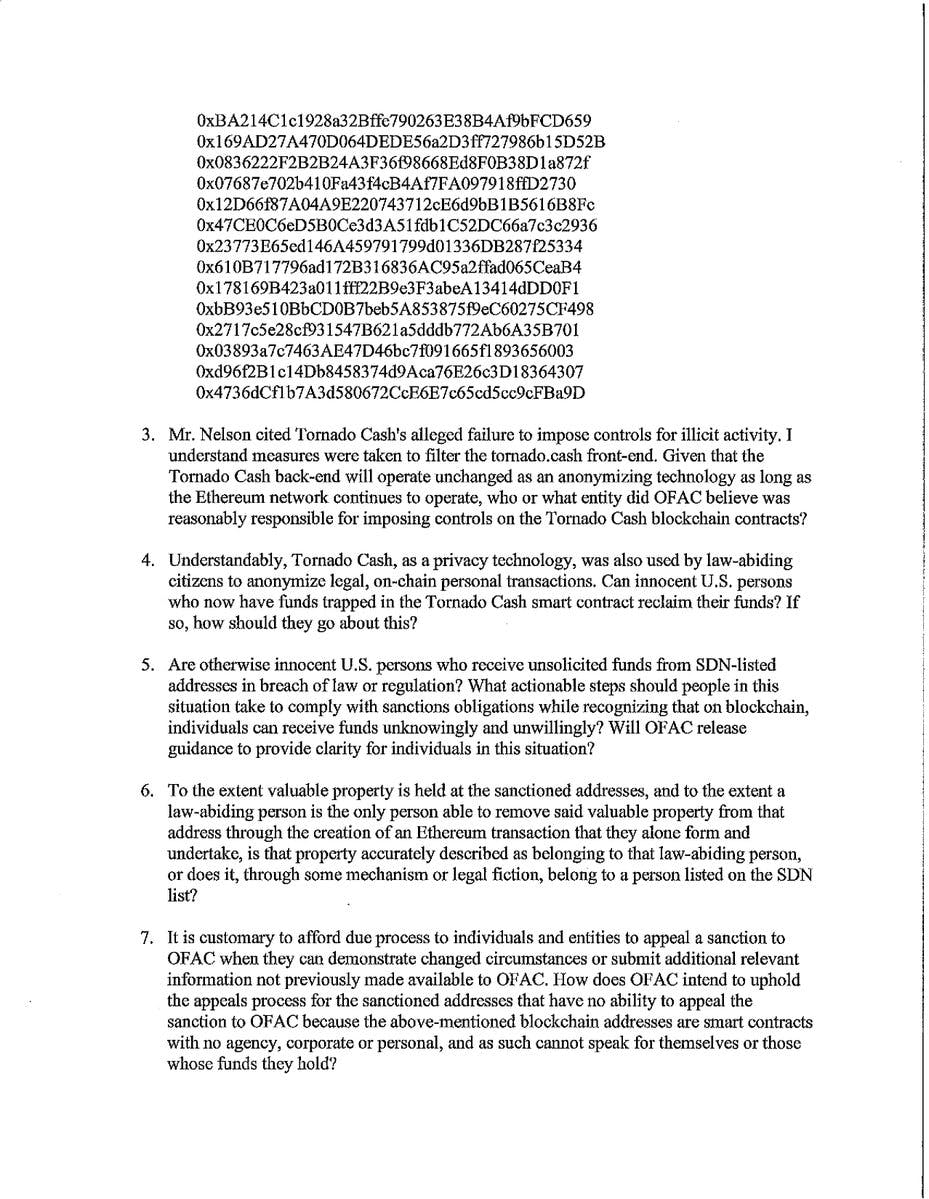

emmer.house.gov/2023/2/emmer-l…C

emmer.house.gov/2023/2/emmer-l…C

reuters.com/business/finan…

reuters.com/business/finan…

home.treasury.gov/news/press-rel…

home.treasury.gov/news/press-rel…

https://t.co/0aN4a4A6tb

https://t.co/0aN4a4A6tb

americanbanker.com/opinion/the-u-…

americanbanker.com/opinion/the-u-…

wsj.com/articles/fasb-…

wsj.com/articles/fasb-…

https://t.co/TOi1cIVXE5

https://t.co/TOi1cIVXE5

https://t.co/0aN4a4A6tb

https://t.co/0aN4a4A6tb

https://t.co/0aN4a4A6tb

https://t.co/0aN4a4A6tb

https://t.co/ymjXCou8xD

https://t.co/ymjXCou8xD

https://t.co/TOi1cIVXE5

https://t.co/TOi1cIVXE5

Crypto donations to Ukraine have totaled almost $100 million.

Crypto donations to Ukraine have totaled almost $100 million.

40% of the vendors supporting Ukraine have accepted crypto as payment.

40% of the vendors supporting Ukraine have accepted crypto as payment.

Banks in Ukraine are not operating. Crypto exchanges are operating 24/7.

Crypto is essential.

https://t.co/mXmwG7JPqf

Banks in Ukraine are not operating. Crypto exchanges are operating 24/7.

Crypto is essential.

https://t.co/mXmwG7JPqf

https://t.co/iJVlhrtmsU

https://t.co/iJVlhrtmsU

Doesn't provide a definition for stablecoin

Doesn't provide a definition for stablecoin

Asserts that both bank-like products & investment-like products could be stablecoins

Asserts that both bank-like products & investment-like products could be stablecoins

Abuses this ambiguity to ask Congress to lump these assets together & hand them solely to the banks

I'm not on board with that.

Abuses this ambiguity to ask Congress to lump these assets together & hand them solely to the banks

I'm not on board with that.

https://t.co/fNK9KVNjth

https://t.co/fNK9KVNjth

hyoutube.com/watch?v=G-y-6Z…https://t.co/qeOQ9wh0GG

hyoutube.com/watch?v=G-y-6Z…https://t.co/qeOQ9wh0GG

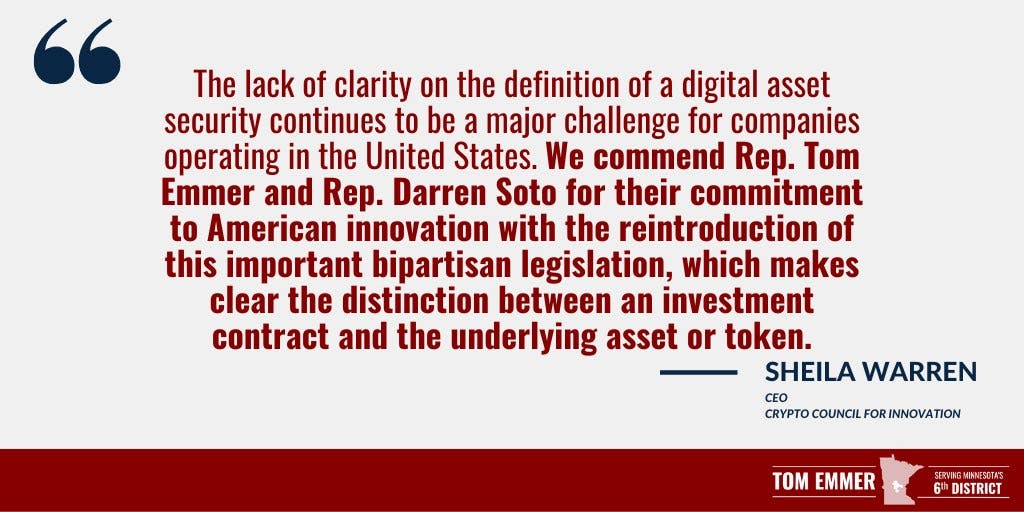

hyoutu.be/G-y-6Zn_71s

We discuss:

- US #Crypto Regulations

- Infrastructure Bill

- Securities Clarity Act

- #SEC #Ripple #XRP

- #Bitcoin adoption and mining

- #Blockchain Voting & much more

@tomemmer https://t.co/jyWGpYpaAC

hyoutu.be/G-y-6Zn_71s

We discuss:

- US #Crypto Regulations

- Infrastructure Bill

- Securities Clarity Act

- #SEC #Ripple #XRP

- #Bitcoin adoption and mining

- #Blockchain Voting & much more

@tomemmer https://t.co/jyWGpYpaAC

https://t.co/kLggaoYwrC

https://t.co/kLggaoYwrC

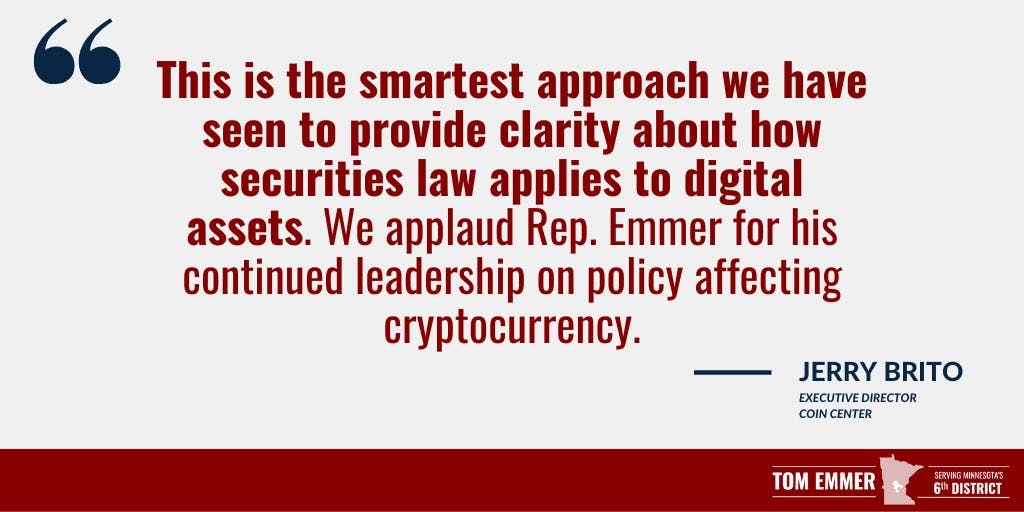

The Securities Clarity Act

The Securities Clarity Act

The Digital Commodities Exchange Act

The Digital Commodities Exchange Act

Watch

Watch  https://t.co/0TKSN8OMW2

https://t.co/0TKSN8OMW2

Watch his opening remarks

Watch his opening remarks