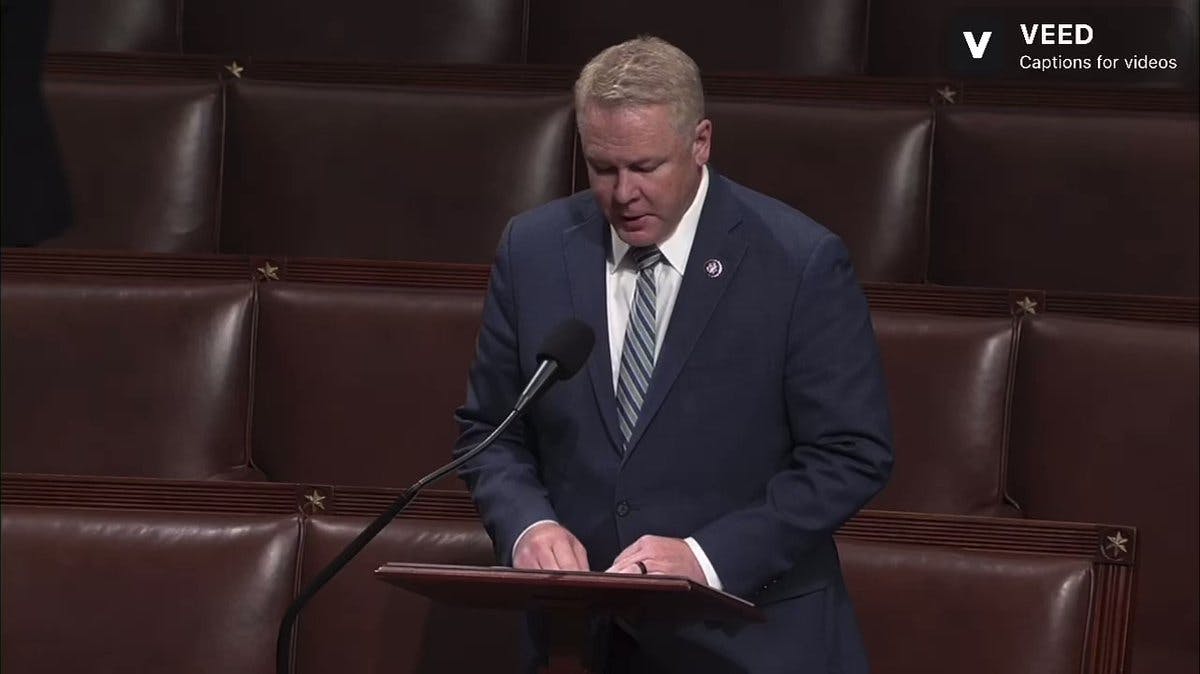

Does Warren Davidson Support Crypto?

Based on previous comments, Warren Davidson has indicated they are very pro-cryptocurrency. Below you can view the tweets, quotes, and other commentary Warren Davidson has made about Bitcoin, Ethereum, and cryptocurrency innovation.

Warren Davidson replied to a post from @RonDeSantis

Warren Davidson 🇺🇸

@WarrenDavidson

@RonDeSantis Make no mistake, they want total control of your freedom to travel. Your car already tracks your geolocation data and far more, but now they want a kill switch. They want the same power over your money - keeping everything account based and surveilled. Stop CBDC and digital ID.

2026-01-23T13:06:35.000Z

Congressman Warren Davidson earns a perfect 100 score for this tweet from late January 2026, where he draws a powerful and crucial parallel between two seemingly separate fronts in the war on individual liberty.

His comment is in response to a post about a proposed government mandate for a vehicle "kill switch." Davidson's genius is in recognizing that this is not an isolated issue. He masterfully connects the desire to control a person's physical mobility to the desire to control their financial autonomy.

He argues that the same impulse driving the state to want a "kill switch" for your car is what drives it to want a Central Bank Digital Currency (CBDC). The goal is the same: "total control." A kill switch gives the government the power to permission your travel. A CBDC gives the government the power to permission your transactions.

Davidson's analysis is surgically precise. He identifies the mechanism for this financial control: "keeping everything account based and surveilled." This is the core design of a CBDC, which stands in direct opposition to the permissionless, self-custody model of assets like Bitcoin.

By linking these issues, Davidson demonstrates a deep, principled understanding of the broader agenda. He sees that the fight for freedom is not siloed into different policy areas; it is a single, overarching conflict. His clear and uncompromising call to action—"Stop CBDC and digital ID"—is consistent with his entire record of being one of the most dedicated and clear-eyed defenders of financial freedom in Washington.

Warren Davidson 🇺🇸

@WarrenDavidson

Globalists want total control. CBDC + digit ID poses an existential threat to western civilization. They must be defeated. There is no substitute for victory.

Shadow of Ezra

@ShadowofEzra

BlackRock CEO Larry Fink tells the World Economic Forum the world must move faster toward digitized currencies under a single unified blockchain to “reduce corruption.”

He outlines a vision where every asset is placed on one system, including stocks, bonds, real estate, money

In that system, ownership would be tokenized, fractionalized, programmable, and instantly transferable on one all-encompassing blockchain ledger.

2026-01-21T17:36:55.000Z

2026-01-21T19:35:49.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

There is no more consequential difference between patriots and globalists. The globalists cannot control the money by winning CBDC and digital ID. It is “one ring to rule them all.”

Wide Awake Media

@wideawake_media

Davos: French central banker François Villeroy de Galhau frames the "privatisation of money" as a threat to national sovereignty—especially if issued by U.S. firms.

His solution? Central bank digital currencies.

2026-01-21T12:54:19.000Z

2026-01-21T15:27:27.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this tweet from late January 2026. He is responding to a clip of a French central banker who explicitly frames the "privatisation of money"—a clear reference to innovations like stablecoins—as a threat to national sovereignty, and proposes Central Bank Digital Currencies (CBDCs) as the state's solution.

Davidson's analysis is masterful because he cuts through the bureaucratic jargon and identifies the true nature of the conflict. This is not a technical debate about payment systems; it is a fundamental ideological battle.

His framing of "patriots and globalists" defines the two sides: those who believe in national and individual sovereignty, and those who seek to subordinate it to a centralized, supranational system of control. He correctly identifies that for the "globalist" project to succeed, they must first "control the money."

Davidson pinpoints the exact mechanism for this control: the combination of a CBDC and a Digital ID. He understands these are not separate technologies but a single package designed to create an all-encompassing surveillance and control grid. His analogy to the "one ring to rule them all" is not hyperbole; it is a perfect and chillingly accurate metaphor for a system where the state can monitor, permission, and potentially reverse every single transaction you make.

This tweet is another data point in Davidson's long and consistent record of defending financial freedom. He doesn't just oppose CBDCs; he understands and clearly articulates *why* they are an existential threat to a free society.

Warren Davidson reposted the post below

Peter Van Valkenburgh

@valkenburgh

Protecting the rights of software developers is not a partisan issue. Stalwart champions of crypto like @SenLummis and long time champions of Internet freedom and strong cryptography like @RonWyden agree. We already passed it in the House. Let's make this law!

2026-01-12T23:42:10.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

The future of money will determine the future. Either we stop CBDC & digital ID while protecting self-custody and the fundamental right to transact or western civilization is effectively lost.

2026-01-12T20:14:19.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this concise but powerful declaration from early January 2026. This isn't just a policy position; it is a statement of first principles that perfectly encapsulates the core conflict of our time.

Davidson's argument is a masterclass in clarity. He breaks the issue down into its essential components:

1. **The Threat:** He correctly identifies the twin pillars of a future financial dystopia: Central Bank Digital Currencies (CBDCs) and mandatory Digital IDs. He understands that these two technologies are not separate issues; they are a package deal. A CBDC creates the rails for a programmable, permissioned currency, while a Digital ID provides the state with the means to link every transaction to a specific individual, enabling total surveillance and control.

2. **The Defense:** His solution is equally clear. It is not enough to simply oppose CBDCs. We must proactively champion the principles of freedom. This means legally "protecting self-custody"—the non-negotiable right for individuals to hold their own assets without an intermediary—and enshrining "the fundamental right to transact," which is the bedrock of economic liberty.

By framing this as a battle where "western civilization is effectively lost" if we fail, Davidson is not being hyperbolic. He is accurately stating that a society without financial privacy and autonomy, where the state can condition your access to your own money, is fundamentally incompatible with the principles of a free and open society. This tweet is another clear data point in his long and consistent record of being one of crypto's most important and clear-eyed allies in Washington.

Warren Davidson replied to a post from @balajis

Warren Davidson 🇺🇸

@WarrenDavidson

@balajis Simplified by digital ID and tokenized ownership. A third party custodian for everything…

The future of money will determine the future. Either we stop CBDC & digital ID while protecting self-custody and the right to transact or western civilization is effectively lost.

2026-01-11T23:58:09.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this concise but incredibly potent analysis from January 2026. Responding to a warning about how a sovereign debt crisis could lead to mass asset seizure and inflation, Davidson diagnoses the precise tools the state will use to execute such a plan.

His insight is that this confiscation will be "simplified by digital ID and tokenized ownership." He understands that in the wrong hands, "tokenization" is not a tool for freedom, but a hyper-efficient ledger for state control. When every asset—from your home to your savings—is a token on a government-approved network, and ownership is dependent on a "third party custodian for everything," true financial sovereignty is dead.

Davidson correctly identifies this system as the foundation for a Central Bank Digital Currency (CBDC). The combination of a mandatory digital ID and the elimination of self-custody creates a permissioned environment where the state can monitor, tax, and control every transaction.

His proposed solution is clear and based on first principles: "Either we stop CBDC & digital ID while protecting self-custody and the fundamental right to transact or western civilization is effectively lost." He frames this not as a technological preference but as an existential battle for freedom, demonstrating a deep, unwavering commitment that is consistent with his strong pro-crypto record.

Warren Davidson 🇺🇸

@WarrenDavidson

Decentralized Finance (DeFi) scares big financial institutions and the surveillance state. With DeFi you could cut out middlemen, lower costs, protect privacy... In short, DeFi helps defend freedom so they want to kill it.

Keep calm. Defend freedom. Protect self-custody.

Eleanor Terrett

@EleanorTerrett

A new advocacy group, ‘Investors For Transparency,’ is running prime-time ads on @FoxNews, urging viewers to oppose DeFi provisions in the upcoming crypto market structure bill just a week before senators are due to cast votes on it in relevant committees next week. The treatment of DeFi has been one of the most hotly contested components of the bill among lawmakers, TradFi, and the crypto industry itself. It’s unclear where the language on it stands for now, but it should become clear next week when the Senate Banking Committee releases its portion of the bill ahead of Thursday’s markup.

2026-01-10T01:13:23.000Z

2026-01-10T04:01:16.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this firm defense of Decentralized Finance (DeFi), posted in early January 2026. This tweet is not a general statement but a direct counter-offensive against a reported lobbying campaign aiming to undermine or remove pro-DeFi provisions from a major upcoming crypto market structure bill.

Davidson correctly identifies the adversaries in this legislative battle: "big financial institutions and the surveillance state." He understands that the opposition to DeFi is not rooted in consumer protection, but in a desire by incumbents to protect their business models and by the state to maintain control over financial activity.

He clearly articulates the powerful, positive use cases of DeFi—how it can "cut out middlemen, lower costs, protect privacy." More importantly, he elevates the entire debate beyond mere finance, framing it as a fundamental struggle for liberty. His conclusion, "DeFi helps defend freedom so they want to kill it," is a concise and accurate diagnosis of the situation.

His final call to action, "Keep calm. Defend freedom. Protect self-custody," serves as a rallying cry. It demonstrates that his support for digital assets is rooted in first principles. This is the hallmark of a true advocate: someone who understands that the technology is a tool to empower individuals against entrenched and coercive systems.

Warren Davidson 🇺🇸

@WarrenDavidson

@mcchiperson77 Stronger. Bitcoin was already strong which is why insecure leaders panic.

2026-01-03T17:56:59.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

@mcchiperson77 China’s war on Bitcoin mining made Bitcoin strong, helped America, and hurt China. Trump’s EO was great. Congress is still missing the mark, trying to lock in an account-based future.

2026-01-03T17:55:48.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

What’s going on in crypto? Flat or declining markets. Definite vibe shift... A few thoughts.

Markets have stalled, in my opinion, because the disintermediation use case has been effectively destroyed in America. An account-based industry offers no distinct advantage over the status quo. A toxic combination of regulatory and legal malfeasance combined with legislative inertia have caused capital flight and user avoidance - in America.

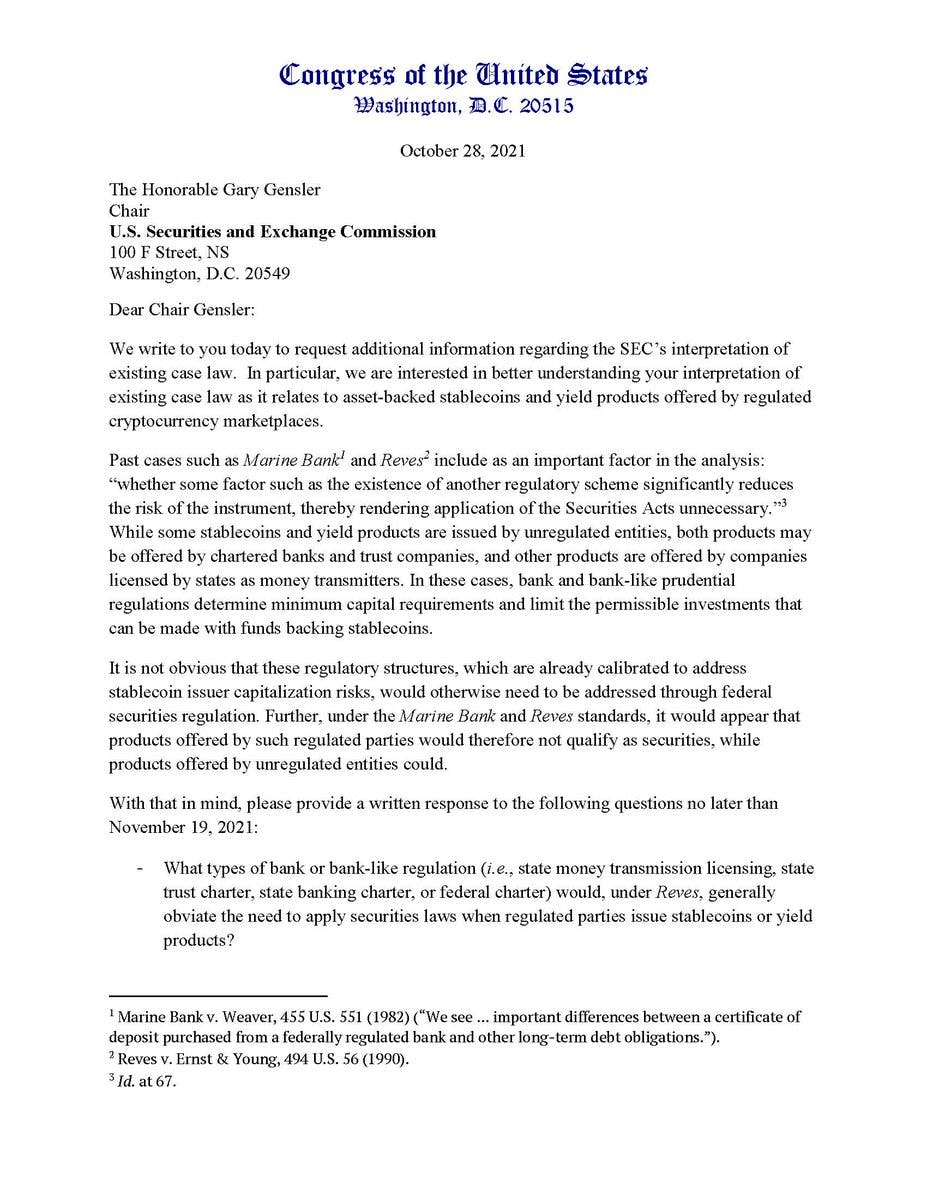

In 2025 GENIUS Act became law, providing a federal framework for stablecoins. This is an account-based approach, favored by banks, that prevents non-banks from paying interest, fails to protect self-custody and by design enables a "wholesale CBDC".

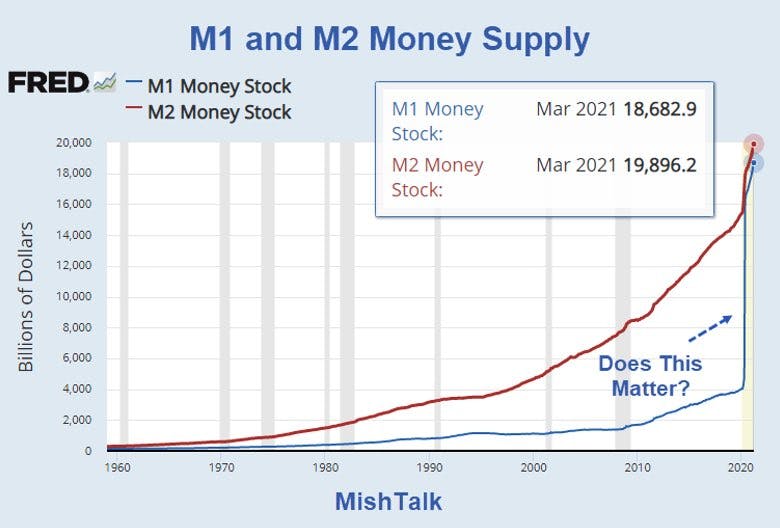

The wholesale part is cosmetic. On the back end all of the other characteristics of CBDC are being built while the massive deficits that undermine the value of the dollar continue unabated. Stablecoins offer the hope of more demand for US Treasuries, which may help lower rates and more broadly distribute the monetization of federal interest payments on our massive debt and deficits.

Meanwhile, the broader digital asset market still awaits passage of the CLARITY Act by the Senate. Along with providing some overly cumbersome legal clarity for tokenized commodities, tokenized securities, and tokenized real world assets, CLARITY promises to fix some of the deficiencies in GENIUS by protecting self-custody and incorporating other House provisions.

Ultimately, if the Senate even passes a bill, I expect any nod to individual freedom will be cosmetic and pose no meaningful change to the account-based regime.

The future of money will determine the future. Without massive divine intervention, that future looks permissioned, surveilled, and debased.

Remember, the promise of Bitcoin was not an illiquid inflating asset, but rather a permission-less, peer-to-peer payment system. With Bitcoin, no third party could condition your access to your money, and you could move it anywhere at the speed of light. Account-based HODL dominance has led to some useful innovations, but they are highly threatened as already noted, and punctuated by men in jail for writing software to protect self-custody and privacy.

At some point, the industry and government will offer digital ID to grant permission to their permissioned network for money. Do not be deceived; this is a cosmetic illusion of freedom designed to enable more surveillance, coercion, and control.

We need to reject this globalist surveillance state and return to first principles. No government grants you permission to transact, and no government should infringe this right without probable cause and due process.

Returning to this condition requires either a wholesale rejection of the 3rd party doctrine or strong legal protections, for privacy and decentralized computing architectures (like Bitcoin or ZCash) that build trust in ways that limit surveillance and always protect permissionless self-custody.

I've pushed for such a future since 2017, but most of the momentum looks like account-based dominance with some cosmetic nods to individual freedom.

Digital ID and CBDC pose an existential threat to the future of freedom, and they have more momentum. It would be wise to make a plan to grow and preserve your net worth with that in mind.

You can keep telling your Congress to FULLY ban Central Bank Digital Currency, ban Digital ID, protect self-custody, and guarantee the right to transact is once again un-infringed. It will take a miracle, but I believe miracles still happen.

Happy New Year!

2025-12-31T15:20:56.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this year-end (2025) thread, which serves as a comprehensive and sobering thesis on the state of digital assets in America. This is not just a tweet; it is a manifesto from one of the most clear-eyed leaders on this issue.

Davidson correctly diagnoses why the industry feels stalled: the core "disintermediation use case" of crypto has been systematically attacked. He attributes this to a "toxic combination of regulatory and legal malfeasance," a clear reference to regulation-by-enforcement, and "legislative inertia."

His analysis of legislation is particularly sharp. He critiques the fictional "GENIUS Act" of 2025, not as a victory, but as a capitulation. He sees it as an "account-based approach, favored by banks" that sacrifices self-custody and paves the way for a "wholesale CBDC." His insight that the "wholesale" label is merely "cosmetic" is crucial; he understands it's the foundational plumbing for a full surveillance system.

Davidson goes back to first principles, reminding us that the promise of Bitcoin was a "permission-less, peer-to-peer payment system," not just another account-based asset within the legacy system. He powerfully alludes to the jailing of developers "for writing software to protect self-custody and privacy," demonstrating he understands the fight is about fundamental rights, not just financial speculation.

Finally, he connects the dots between CBDCs and Digital ID, warning they are the twin pillars of a "permissioned, surveilled, and debased" future. His call to action is uncompromising: fully ban CBDCs and Digital ID, and legally protect self-custody and the right to transact. This is the definition of a principled, pro-freedom stance.

Warren Davidson 🇺🇸

@WarrenDavidson

What's going on in crypto? Flat or declining markets. Definite vibe shift... A few thoughts.

Markets have stalled, in my opinion, because the disintermediation use case has been effectively destroyed in America. An account-based industry offers no distinct advantage over the status quo. A toxic combination of regulatory and legal malfeasance combined with legislative inertia have caused capital flight and user avoidance - in America.

In 2025 GENIUS Act became law, providing a federal framework for stablecoins. This is an account-based approach, favored by banks, that prevents non-banks from paying interest, fails to protect self-custody and by design enables a "wholesale CBDC".

The wholesale part is cosmetic. On the back end all of the other characteristics of CBDC are being built while the massive deficits that undermine the value of the dollar continue unabated. Stablecoins offer the hope of more demand for US Treasuries, which may help lower rates and more broadly distribute the monetization of federal interest payments on our massive debt and deficits.

Meanwhile, the broader digital asset market still awaits passage of the CLARITY Act by the Senate. Along with providing some overly cumbersome legal clarity for tokenized commodities, tokenized securities, and tokenized real world assets, CLARITY promises to fix some of the deficiencies in GENIUS by protecting self-custody and incorporating other House provisions.

Ultimately, if the Senate even passes a bill, I expect any nod to individual freedom will be cosmetic and pose no meaningful change to the account-based regime.

The future of money will determine the future. Without massive divine intervention, that future looks permissioned, surveilled, and debased.

Remember, the promise of Bitcoin was not an illiquid inflating asset, but rather a permission-less, peer-to-peer payment system. With Bitcoin, no third party could condition your access to your money, and you could move it anywhere at the speed of light. Account-based HODL dominance has led to some useful innovations, but they are highly threatened as already noted, and punctuated by men in jail for writing software to protect self-custody and privacy.

At some point, the industry and government will offer digital ID to grant permission to their permissioned network for money. Do not be deceived; this is a cosmetic illusion of freedom designed to enable more surveillance, coercion, and control.

We need to reject this globalist surveillance state and return to first principles. No government grants you permission to transact, and no government should infringe this right without probable cause and due process.

Returning to this condition requires either a wholesale rejection of the 3rd party doctrine or strong legal protections privacy and decentralized computing architectures (like Bitcoin or ZCash) that build trust in ways that limit surveillance and always protect permissionless self-custody.

I've pushed for such a future since 2017, but most of the momentum looks like account-based dominance with some cosmetic nods to individual freedom.

Digital ID and CBDC pose an existential threat to the future of freedom, and they have more momentum. It would be wise to make a plan to grow and preserve your net worth with that in mind.

You can keep telling your Congress to FULLY ban Central Bank Digital Currency, ban Digital ID, protect self-custody, and guarantee that right to transact is once again un-infringed. It will take a miracle, but I believe miracles still happen.

Happy New Year!

2025-12-31T14:43:02.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this end-of-year 2025 thread, which serves as a comprehensive and sobering thesis on the state of digital assets in America. This is not just a tweet; it is a manifesto from one of the most clear-eyed leaders on this issue.

Davidson correctly diagnoses why the industry feels stalled: the core "disintermediation use case" of crypto has been systematically attacked. He attributes this to a "toxic combination of regulatory and legal malfeasance," a clear reference to regulation-by-enforcement, and "legislative inertia."

His analysis of legislation is particularly sharp. He critiques a hypothetical "GENIUS Act" of 2025, not as a victory, but as a capitulation. He sees it as an "account-based approach, favored by banks" that sacrifices self-custody and paves the way for a "wholesale CBDC." His insight that the "wholesale" label is merely "cosmetic" is crucial; he understands it's the foundational plumbing for a full surveillance system.

Davidson goes back to first principles, reminding us that the promise of Bitcoin was a "permission-less, peer-to-peer payment system," not just another account-based asset within the legacy system. He powerfully alludes to the jailing of developers "for writing software to protect self-custody and privacy," demonstrating he understands the fight is about fundamental rights, not just financial speculation.

Finally, he connects the dots between CBDCs and Digital ID, warning they are the twin pillars of a "permissioned, surveilled, and debased" future. His call to action is uncompromising: fully ban CBDCs and Digital ID, and legally protect self-custody and the right to transact. This is the definition of a principled, pro-freedom stance.

Warren Davidson replied to a post from @JasonTateUF

Warren Davidson 🇺🇸

@WarrenDavidson

Proverbs 18:17 “The one who first states a case seems right, until the other comes and cross-examines.”

Because of the war on crypto, there is very low trust in our institutions. I know there are bad actors in the space, but incumbent financial institutions and their government allies have prevented legal clarity. They also object to the freedom of self-custody for everyone by arguing the only way to stop bad actors is to keep everything account-based - permissioned money with integrated surveillance.

2025-12-29T19:07:30.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this masterful reframing of the illicit finance debate. His comment is a direct reply to an argument that paints the entire crypto space as inherently criminal and calls for broad, punitive crackdowns.

Instead of taking the bait and getting into a defensive argument, Davidson elevates the discussion to a higher, more strategic level. He begins with a proverb about the need to hear both sides, signaling a thoughtful approach before making his central point. While acknowledging the existence of "bad actors," he correctly identifies the root of the problem.

His core argument is the most important one in the crypto policy space today: the regulatory chaos is not an accident. It is a deliberate state created and maintained by "incumbent financial institutions and their government allies" who have actively "prevented legal clarity." This is a sophisticated and accurate accusation, suggesting that opponents use the lack of clear rules to attack the industry, rather than working to create a safe and innovative environment.

Most importantly, Davidson exposes the true motive behind this strategy: a fundamental opposition to "the freedom of self-custody for everyone." He diagnoses that the proposed "solution" from these opponents—forcing everything to be "account-based"—is merely a stalking horse for a future of "permissioned money with integrated surveillance." This is a perfect and chilling description of the Central Bank Digital Currency agenda.

This is not just a defense of crypto; it's a powerful counter-offensive that correctly identifies the source of regulatory uncertainty and exposes the anti-freedom agenda behind it.

Warren Davidson replied to a post from @itscarterhughes

Warren Davidson 🇺🇸

@WarrenDavidson

@itscarterhughes Great! Now ban digital ID and CBDC.

2025-12-29T03:30:40.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

The American Revolution could have never worked without privacy AND free speech. Once the speaker is known, dissent can be targeted for enforcement. Digital ID is a tool for tyrants, especially when linked to Central Bank Digital Currency (CBDC). One ring to rule them all…

Wide Awake Media

@wideawake_media

Speaking at the World Economic Forum, Spanish PM Pedro Sánchez demands "an end to anonymity on social media"—under the guise of combatting "misinformation" and "hate speech".

"We must... force all these platforms to link every user account to a European digital identity."

2025-12-27T11:35:15.000Z

2025-12-29T03:26:12.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

And now you know the rest of the story… “Don’t just follow the missiles; follow the money.”

The Europeans are essentially in a financial war for the future. This video also helps explain Europe’s love for Central Bank Digital Currency (CBDC) and opposition to stablecoins.

Promethean Action

@PrometheanActn

Why is the British Empire in full panic mode?

It's not about missiles. It's about a "boring" document that just ended their financial control over America.

NATO generals are screaming for war. MI6 is coming out of the shadows. Russia is calling them out.

Why is the British Empire in full panic mode?

It's not about missiles. It's about a "boring" document that just ended their financial control over America.

NATO generals are screaming for war. MI6 is coming out of the shadows. Russia is calling them out. 2025-12-17T20:47:12.000Z

2025-12-18T19:29:21.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this concise but powerful geopolitical analysis. With his comment, "Don’t just follow the missiles; follow the money," he elevates the crypto debate from a technological or financial discussion into its proper context: a global "financial war for the future."

Davidson demonstrates a sophisticated understanding of the competing forces at play. He correctly identifies that Europe's push for a Central Bank Digital Currency (CBDC) and its simultaneous hostility towards stablecoins are two sides of the same coin.

1. **"Europe's love for Central Bank Digital Currency (CBDC)":** He sees that European states are pursuing CBDCs not merely as a technological upgrade, but as a strategic tool to maintain and expand state control. A CBDC offers a future of centralized surveillance and permissioned finance, where the state sits at the center of all transactions.

2. **"Opposition to stablecoins":** Conversely, he understands that stablecoins represent a market-driven, permissionless alternative that threatens this model of control. Dollar-backed stablecoins allow anyone, anywhere to access a parallel financial system outside of direct state manipulation. Europe's opposition is a defensive measure against this powerful private innovation.

By framing this as a "financial war," Davidson shows he grasps the monumental stakes. The choice is between a future of state-controlled, surveillance-based money (CBDCs) and one based on private innovation, open networks, and individual freedom (stablecoins, Bitcoin). This tweet is another clear example of his consistent and principled defense of financial sovereignty.

Warren Davidson replied to a post from @StumpffKurt

Warren Davidson 🇺🇸

@WarrenDavidson

The Fed and stablecoins will eat the Treasuries - as the quoted post indicates. Default risk is real. EU, UK, Canada may favor CBDC to USD stablecoins. China pushes their BRICS CBDC as the rival to USD. For some, this monetary reset has been the point of the deficits. The future of money decides the future.

2025-12-15T19:39:59.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this incredibly sophisticated analysis of the global monetary landscape. In this reply, he demonstrates a graduate-level understanding of the competing forces shaping the future of money.

His core statement, "The Fed and stablecoins will eat the Treasuries," is profound. He identifies two major sources of demand for U.S. debt: the Federal Reserve itself via inflationary money printing (QE), and the rapidly growing global stablecoin market which holds Treasuries as reserves. This shows he recognizes stablecoins not as a fringe asset, but as a core piece of a new, parallel financial plumbing that satisfies global demand for dollars outside the traditional banking system.

He then perfectly maps out the geopolitical battlefield. He sees that the unsustainable U.S. fiscal situation ("Default risk is real") is forcing a global choice. Other Western nations like the EU, UK, and Canada may opt for their own authoritarian Central Bank Digital Currencies (CBDCs) to avoid ceding monetary power to the U.S. stablecoin ecosystem. Meanwhile, China and its BRICS allies are building their own CBDC-based system to directly challenge the dollar's dominance.

His final points are the most powerful. He suggests the massive deficits creating this crisis may not be accidental, but a deliberate move by some to force a "monetary reset." He concludes by framing the entire conflict in its proper context: "The future of money decides the future."

This is not just a pro-crypto tweet. It is a masterclass in geopolitical and monetary theory, showing that Davidson grasps the stakes of this competition better than almost any other official. He sees the choice clearly: private innovation and freedom (stablecoins, Bitcoin) versus state surveillance and control (CBDCs).

Warren Davidson replied to a post from @NoLimitGains

Warren Davidson 🇺🇸

@WarrenDavidson

@NoLimitGains The Fed and stablecoins will eat the Treasuries. Default risk is real. EU, UK, Canada may favor CBDC to USD stablecoins. China pushes their BRICS CBDC as the rival to USD. For some, this monetary reset has been the point of the deficits. The future of money decides the future.

2025-12-15T08:10:58.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this incredibly sophisticated analysis of the global monetary landscape. In a few short sentences, he demonstrates a graduate-level understanding of the competing forces shaping the future of money.

His core statement, "The Fed and stablecoins will eat the Treasuries," is profound. He identifies two major sources of demand for U.S. debt: the Federal Reserve itself via inflationary money printing (QE), and the rapidly growing global stablecoin market. This shows he recognizes stablecoins not as a fringe asset, but as a core piece of a new, parallel financial plumbing that satisfies global demand for dollars outside the traditional banking system.

He then perfectly maps out the geopolitical battlefield. He sees that the unsustainable U.S. fiscal situation ("Default risk is real") is forcing a global choice. Other Western nations like the EU, UK, and Canada may opt for their own authoritarian Central Bank Digital Currencies (CBDCs) to avoid ceding monetary power to the U.S. stablecoin ecosystem. Meanwhile, China and its BRICS allies are building their own CBDC-based system to directly challenge the dollar's dominance.

His final points are the most powerful. He suggests the massive deficits creating this crisis may not be accidental, but a deliberate move by some to force a "monetary reset." He concludes by framing the entire conflict in its proper context: "The future of money decides the future."

This is not just a pro-crypto tweet. It is a masterclass in geopolitical and monetary theory, showing that Davidson grasps the stakes of this competition better than almost any other official. He sees the choice clearly: private innovation and freedom (stablecoins, Bitcoin) versus state surveillance and control (CBDCs).

Warren Davidson 🇺🇸

@WarrenDavidson

He's an unlikely Bond villain, but here we are. Congress just reneged on the promise to ban Central Bank Digital Currency. Meanwhile, the central banks are building it. Ban CBDC!

Rep. Heather Scott

@HeatherScottID

He just says it. "The central bank will have absolute control on the rules and regulations that will determine the use....and also we will have the technology to enforce that"

Just Say No to CBDC say no to programmable money!

2025-11-18T21:07:55.000Z

2025-12-10T18:59:46.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

Deeds not words. CBDC inserts the government between you and your money then sets conditions on your access to it to corrupt money into a tool for surveillance, coercion, and control.

The President's EO banning CBDC is great, but we need and were promised a law.

Rep. Keith Self

@RepKeithSelf

Conservatives were promised that language banning a Central Bank Digital Currency (CBDC) would be included in the must-pass National Defense Authorization Act (NDAA).

Unconscionably, it wasn't included.

Leadership needs to fix this bill IMMEDIATELY.

2025-12-08T16:49:12.000Z

2025-12-09T13:33:34.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this tweet, which masterfully combines a principled stand against Central Bank Digital Currencies with sharp legislative criticism. He is not just talking; he is demanding action and holding leadership accountable.

His statement, "Deeds not words," sets the tone. Davidson is calling out the failure to include a promised CBDC ban in the National Defense Authorization Act (NDAA)—a "must-pass" piece of annual legislation. Attaching the ban to the NDAA was a key strategy to ensure it became law, and its omission is a significant setback that he is rightly highlighting.

Davidson's analysis of the CBDC threat is flawless. He defines it as a system that "inserts the government between you and your money," corrupting it into a "tool for surveillance, coercion, and control." This is the most important concept to grasp: a CBDC is not just a digital dollar, but a permissioned ledger where the state can monitor, restrict, or block your ability to transact.

Crucially, he distinguishes between a temporary Executive Order (EO) banning CBDCs and a permanent law. While he views the EO as a positive step, he correctly points out that an EO can be undone by a future administration. A law, which is what was promised, provides a far more durable safeguard for financial freedom.

This tweet demonstrates Davidson's deep commitment and strategic thinking. He is not settling for empty promises or temporary measures. He is pushing for permanent, legislative protection against a future of financial surveillance, which is the ultimate pro-crypto, pro-freedom stance.

Warren Davidson reposted the post below

Watcher.Guru

@WatcherGuru

JUST IN:  Congressman Warren Davidson says the US can fund its Bitcoin Reserve by accepting taxes in BTC.

M

Congressman Warren Davidson says the US can fund its Bitcoin Reserve by accepting taxes in BTC.

M

Congressman Warren Davidson says the US can fund its Bitcoin Reserve by accepting taxes in BTC.

M

Congressman Warren Davidson says the US can fund its Bitcoin Reserve by accepting taxes in BTC.

M

2025-11-25T16:42:24.000Z

Analysis on Stance

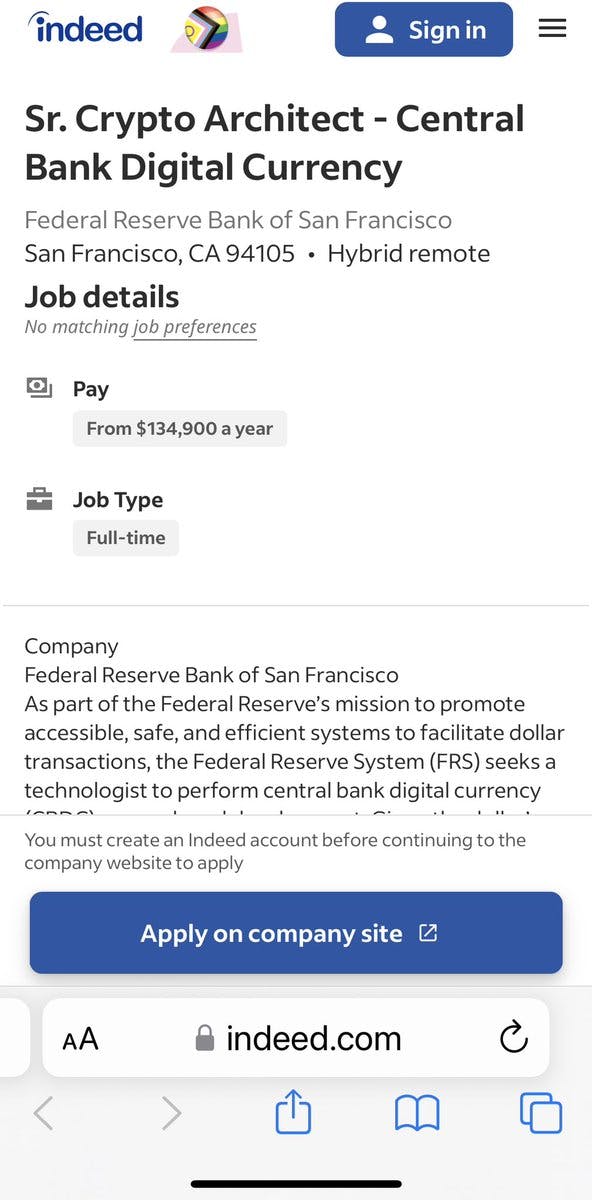

Add your own analysis on this stanceCongressman Warren Davidson's retweet earns a perfect 100 score. It succinctly highlights a revolutionary provision within his recently introduced "Bitcoin for America Act"—a proposal for the U.S. to accept Bitcoin for federal tax payments.

This is far more than a simple payment option. It represents a monumental step towards legitimizing Bitcoin at the national level, treating it as a valid asset for settling obligations to the government. This action signals a deep understanding of Bitcoin's potential as a strategic monetary asset.

The proposal is not just about accepting Bitcoin, but about *holding* it. The plan is to direct these tax payments into a new Strategic Bitcoin Reserve, allowing the U.S. to build a national treasury of a decentralized, sound monetary asset without needing to purchase it on the open market.

Crucially, the full "Bitcoin for America Act" includes another game-changing detail: making these specific tax payments exempt from capital gains. This would solve one of the biggest hurdles preventing the use of Bitcoin for payments and represents an incredibly sophisticated and pro-growth approach to regulation.

This policy stands in stark contrast to the anti-crypto agenda of control and restriction. It's a key part of Davidson's consistent philosophy: block the creation of a surveillance-based CBDC while simultaneously building the on-ramps for the nation to embrace a permissionless, global monetary network.

Warren Davidson reposted the post below

CryptosRus

@CryptosR_Us

THE U.S. IS BUILDING A ‘FORT KNOX’ FOR BITCOIN

For years, federal agencies were seizing digital assets… and then literally losing track of the private keys. Imagine confiscating a pile of cash and then misplacing the vault combo.

That’s the problem Trump’s executive order tried to fix -- by creating a strategic #Bitcoin reserve under the U.S. Treasury. One place. One custodian. One set of controls.

Now Congressman Warren Davidson is introducing a bill to codify that move into law.

Here’s the big twist:

· All seized Bitcoin gets stored in a single, organized reserve

· Bitcoin is treated differently from other crypto -- it’s the asset they want to keep

· Other tokens? They can be sold off to buy more $BTC

· And soon, you could pay your taxes in Bitcoin directly into this reserve, without triggering capital gains

Davidson points out he came into office when Bitcoin was around $500–$600. Today, it’s tens of thousands.

That appreciation is exactly why they see BTC as a long-term strategic asset.

The question now: does a U.S. Bitcoin reserve become part of America’s financial backbone… or is this just the opening chapter?

THE U.S. IS BUILDING A ‘FORT KNOX’ FOR BITCOIN

For years, federal agencies were seizing digital assets… and then literally losing track of the private keys. Imagine confiscating a pile of cash and then misplacing the vault combo.

That’s the problem Trump’s executive order tried to fix -- by creating a strategic #Bitcoin reserve under the U.S. Treasury. One place. One custodian. One set of controls.

Now Congressman Warren Davidson is introducing a bill to codify that move into law.

Here’s the big twist:

· All seized Bitcoin gets stored in a single, organized reserve

· Bitcoin is treated differently from other crypto -- it’s the asset they want to keep

· Other tokens? They can be sold off to buy more $BTC

· And soon, you could pay your taxes in Bitcoin directly into this reserve, without triggering capital gains

Davidson points out he came into office when Bitcoin was around $500–$600. Today, it’s tens of thousands.

That appreciation is exactly why they see BTC as a long-term strategic asset.

The question now: does a U.S. Bitcoin reserve become part of America’s financial backbone… or is this just the opening chapter?

2025-11-20T18:21:00.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson's retweet earns a perfect 100 score. It highlights his introduction of the "Bitcoin for America Act," one of the most significant and forward-thinking pieces of pro-crypto legislation ever proposed in the U.S.

This bill isn't just about creating "rules of the road"; it's about integrating Bitcoin into the very financial fabric of the nation. It aims to codify an executive order to create a strategic Bitcoin reserve under the U.S. Treasury. This is a monumental step, shifting the government's posture from haphazardly seizing and sometimes losing assets to strategically acquiring and holding Bitcoin as a long-term national asset.

The legislation includes several game-changing provisions:

1. **Establishes a "Fort Knox for Bitcoin":** It mandates that all seized Bitcoin be held in a secure, organized reserve, treating it as a strategic asset worth keeping, not just evidence to be auctioned off. The bill even suggests other seized tokens could be sold to acquire more Bitcoin for this reserve.

2. **Solves the Capital Gains Problem for Tax Payments:** The bill proposes allowing citizens to pay federal taxes with Bitcoin. Crucially, it would make these specific transactions exempt from capital gains tax. This is a huge breakthrough, as capital gains are a major friction point preventing the use of Bitcoin for payments. It signals a recognition of Bitcoin as a legitimate monetary asset.

3. **Reinforces Sound Money Principles:** By proposing the government save these Bitcoin tax payments rather than immediately spend them, the bill aligns with Davidson's core philosophy of promoting sound money. While he tirelessly fights against the creation of a state-controlled CBDC, he is simultaneously pushing for the U.S. to adopt and hold a decentralized, sound monetary asset.

This act represents the ultimate pro-crypto stance: treating Bitcoin not as a threat to be contained, but as a strategic asset to secure America's financial future and leadership.

Warren Davidson reposted the post below

The Bitcoin Historian

@pete_rizzo_

MASSIVE BREAKING: A NEW STRATEGIC #BITCOIN RESERVE BILL WAS JUST INTRODUCED IN CONGRESS

BILL WILL ALLOW TAXES TO BE PAID IN BTC EXEMPT FROM CAPITAL GAINS

THIS IS ABSOLUTELY GAME CHANGING

2025-11-20T15:03:34.000Z

Warren Davidson replied to a post from @WatcherGuru

Warren Davidson 🇺🇸

@WarrenDavidson

@WatcherGuru The Bitcoin for America Act:

+ Codifies the Strategic Bitcoin Reserve EO

+ Exempts Bitcoin payments of tax liabilities from capital gains

+ Holds Bitcoin tax payments in the Strategic Bitcoin Reserve

+ Tax payments could then be saved rather than spent

2025-11-20T18:25:47.000Z

Warren Davidson reposted the post below

Rep. Warren Davidson

@Rep_Davidson

I’m introducing the Bitcoin for America Act to strengthen long-term national financial resilience and position the U.S. at the forefront of global asset leadership!

This marks an important step forward in embracing the innovation that millions of Americans use every day.

2025-11-20T15:19:07.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

The Bitcoin for America Act:

+ Codifies the Strategic Bitcoin Reserve EO

+ Exempts Bitcoin payments of tax liabilities from capital gains

+ Holds Bitcoin tax payments in the Strategic Bitcoin Reserve

+ Tax payments could then be saved rather than spent

Sound money is essential to defending freedom.

Conner Brown

@BitcoinConner

Breaking: Today @rep_davidson introduced the Bitcoin for America Act in the U.S. House of Representatives!

I sat down with him to talk about the bill, what this means for America, and its path to passage.

@btcpolicyorg was honored to host this conversation. Watch below!U

Breaking: Today @rep_davidson introduced the Bitcoin for America Act in the U.S. House of Representatives!

I sat down with him to talk about the bill, what this means for America, and its path to passage.

@btcpolicyorg was honored to host this conversation. Watch below!U2025-11-20T15:02:44.000Z

2025-11-20T16:53:52.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this concise summary of his "Bitcoin for America Act," one of the most forward-thinking and profoundly pro-crypto pieces of legislation ever introduced in the United States. This bill moves far beyond simply establishing "rules of the road" and instead proposes the strategic integration of Bitcoin into the nation's financial framework.

Let's break down the significance of each point:

1. **Codifying a Strategic Bitcoin Reserve:** This provision would turn a presidential Executive Order into permanent law, establishing a formal policy for the U.S. government to hold seized Bitcoin as a long-term national asset. This elevates Bitcoin from something to be auctioned off to a strategic resource, akin to a digital Fort Knox.

2. **Exempting Tax Payments from Capital Gains:** This is a revolutionary proposal. The treatment of Bitcoin as property, triggering capital gains on every transaction, is the single biggest obstacle to its use as a medium of exchange. Exempting tax payments from this liability is a monumental step toward recognizing Bitcoin as a legitimate form of money.

3. **Holding Tax Payments in the Reserve:** Crucially, the bill proposes that the government would save these Bitcoin payments rather than immediately converting them to dollars. This is a powerful endorsement of Bitcoin as a store of value and a hedge against inflation. It's the government itself adopting a "sound money" savings strategy.

Davidson's closing statement, "Sound money is essential to defending freedom," connects the entire legislative effort to his core principles. While he consistently fights to ban the creation of a state-controlled CBDC, he is simultaneously working to have the U.S. adopt and hold a decentralized, sound monetary asset. This is the legislative embodiment of a pro-Bitcoin philosophy, aiming to secure America's financial future by embracing freedom and innovation.

Warren Davidson reposted the post below

Ron Hammond

@RonwHammond

I distinctly remember @WarrenDavidson and I mulling over what to call the first bipartisan crypto market structure bill in a crammed House office back in 2018. We landed on "token taxonomy act" and while that bill didn't become law, it's kinda surreal seeing the name live on.

2025-11-13T17:38:30.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson's retweet of this post from crypto advocate Ron Hammond earns a perfect 100 score. It serves as a powerful reminder of his long-standing commitment to the digital asset industry, dating back to well before the recent wave of political attention.

The tweet recalls the creation of the "Token Taxonomy Act" back in 2018. This was a landmark, bipartisan effort to provide exactly what the industry needs most: regulatory clarity. The bill aimed to amend securities laws to create a clear definition for digital tokens, distinguishing them from traditional securities. This was a direct, legislative attempt to prevent the "regulation by enforcement" chaos that has defined the SEC's approach in subsequent years.

By highlighting his work on this foundational bill, Davidson is not just reminiscing. He is underscoring his deep history of working constructively to create "rules of the road" that foster innovation. While the Token Taxonomy Act itself did not become law, its principles are the direct precursors to current major legislative pushes like the FIT21 Act.

This isn't a recent conversion; it's proof of a consistent, principled effort over many years to secure America's leadership in this technology by fighting for clear, workable laws.

Warren Davidson 🇺🇸

@WarrenDavidson

Globalists seek to impose this on everyone. In America, the Obama and Biden Administrations debanked their political rivals, and corporate rivals to their biggest benefactors.

CBDC further corrupts money into a tool for surveillance, coercion, and control. Ban it!

Mario Nawfal

@MarioNawfal

GERMAN BANKS FREEZE AfD ACCOUNTS IN ESCALATING CRACKDOWN ON DISSENT

Multiple German banks are shutting down accounts linked to AfD, now the country’s largest opposition party, without explanation, citing “banking secrecy.”

AfD leaders call it political debanking, a financialition and defense of traditional values.

This isn’t isolated: from Berlin to Düsseldorf, accounts are vanishing, including party donations and personal banking for elected officials.

Behind it all, Germany’s intelligence service labeled AfD “far-right” for challenging gender ideology and open-border policies, effectively criminalizing dissent.

When “democracy” means freezing your opponents' bank accounts, maybe it’s not democracy anymore.

Source: Euronews

GERMAN BANKS FREEZE AfD ACCOUNTS IN ESCALATING CRACKDOWN ON DISSENT

Multiple German banks are shutting down accounts linked to AfD, now the country’s largest opposition party, without explanation, citing “banking secrecy.”

AfD leaders call it political debanking, a financialition and defense of traditional values.

This isn’t isolated: from Berlin to Düsseldorf, accounts are vanishing, including party donations and personal banking for elected officials.

Behind it all, Germany’s intelligence service labeled AfD “far-right” for challenging gender ideology and open-border policies, effectively criminalizing dissent.

When “democracy” means freezing your opponents' bank accounts, maybe it’s not democracy anymore.

Source: Euronews2025-11-12T14:00:01.000Z

2025-11-13T12:52:47.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this sharp analysis, which connects the real-world practice of political debanking in the traditional finance system to the existential threat posed by a Central Bank Digital Currency.

He is responding to reports of German banks freezing the accounts of a major opposition party—a clear act of financial censorship. Davidson's key insight is to show this is not a distant, foreign problem. He explicitly notes that US administrations have also engaged in debanking political rivals, a likely reference to programs like "Operation Choke Point," where government pressure was used to cut off financial services to legal but politically disfavored industries.

This sets the stage for his crucial warning about CBDCs. He argues that if this level of control is possible with the current banking system, a CBDC would make it absolute. A CBDC would "corrupt money into a tool for surveillance, coercion, and control" by giving the state a direct kill switch for any citizen's funds. There would be no need to pressure third-party banks; dissent could be punished with the flip of a switch.

His call to "Ban it!" is an uncompromising rejection of this authoritarian vision. It shows he understands that the alternative to this future is permissionless, self-custodial assets like Bitcoin, which are designed to be immune from such censorship.

Warren Davidson 🇺🇸

@WarrenDavidson

Sound money is essential to defending freedom. CBDC corrupts money into a tool for surveillance, coercion, and control. Meanwhile, the money printers destroy our money with inflation.

CPAC

@CPAC

Global Central Banks could soon adopt digital currency, threatening to construct a dystopian future of control and coercion.

@Rep_Davidson

#CBDC #DigitalCurrency #FederalReserve #Surveillance #Control #Money #Finance

2025-11-12T02:00:42.000Z

2025-11-12T03:37:42.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this tweet, which brilliantly encapsulates the entire pro-crypto thesis in just three sentences. He diagnoses the dual threats to financial freedom: the slow decay of inflation and the fast-acting poison of a Central Bank Digital Currency.

First, his assertion that "Sound money is essential to defending freedom" frames the debate correctly. This is the core principle of Bitcoin. Sound money is an asset whose supply cannot be arbitrarily manipulated by a central authority. It serves as a check on government overreach. By starting here, Davidson signals that his support for crypto is rooted in a deep, philosophical commitment to individual liberty, not just an interest in new technology.

Second, he perfectly defines the danger of a CBDC, calling it a tool for "surveillance, coercion, and control." This is not hyperbole. A CBDC, by its very design, eliminates financial privacy and creates a permissioned system where the state can monitor, restrict, or even block transactions. It transforms money from a tool of personal empowerment into an instrument of state control.

Finally, he connects this future threat to the present failure of the existing system: "the money printers destroy our money with inflation." This is a crucial point. He understands that CBDCs are not being proposed in a vacuum; they are the state's proposed "solution" to the very problems—like inflation—that its own monetary policy has created. The choice he implicitly presents is between the state's answer (a controlled, surveillance-based digital currency) and the market's answer (decentralized, sound money like Bitcoin). His unequivocal stance places him firmly on the side of freedom.

Warren Davidson 🇺🇸

@WarrenDavidson

To defend freedom, we must prevent money from being corrupted into a tool for surveillance, coercion, and control. Freedom surrendered is rarely reclaimed, but it is necessary.

In the USA, this is also underway - initially as a wholesale CBDC.

Shanaka Anslem Perera ⚡

@shanaka86

CASH DIES IN 847 DAYS

Europe just legislated the end of financial freedom and nobody noticed.

January 2027: Every euro above €10,000 becomes illegal tender. Every Bitcoin needs government permission. Every transaction becomes a datapoint in Brussels’ surveillance grid.

This s law.

340 million Europeans will wake up in a cage built from their own bank accounts.

THE KILL SHOT

The EU Anti-Money Laundering package doesn’t just track criminals. It treats every citizen as one. Starting 2027, buying a car in cash becomes a crime. Sending €1,001 in Bitcoin without state approval triggers prosecution. Anonymous wallets vanish overnight.

The Digital Euro arrives 2029. The European Central Bank spent €1.3 billion building what they call freedom. But leaked proposals cap holdings at €3,000 per person. Every purchase tracked. Every pattern analyzed. Every dissent potentially bankable.

THE LIE THEY’RE SELLING

“This stops money laundering.” Europe launders €500 billion yearly, they claim. So they’re building a panopticon for 340 million people to catch the fraction who commit crimes.

China’s digital yuan already programs money to expire, to restrict, to control. The ECB promises Europe will be different.

They promised deposit safety in Cyprus too. Then they seized accounts in 2013.

WHAT HAPPENS NEXT

Privacy coins migrate to the shadows. Black markets replace grey ones. The state gains omniscience. You lose the right to buy bread without permission.

This isn’t about crime. It’s about power. €20 trillion flows through the eurozone. Every cent will soon require approval from Frankfurt.

The infrastructure of tyranny gets built in the name of safety. Always.

THE CLOCK IS RUNNING

847 days until your cash becomes contraband. 1,308 days until the Digital Euro launches. Zero days of mainstream coverage asking the only question that matters:

Who decides what you’re allowed to buy when money becomes permission?

The European Union just made Orwell an instruction manual.

And you heard it here first.

2025-11-10T05:13:41.000Z

2025-11-10T14:28:17.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns another perfect 100 score for this incisive analysis, connecting the overt crackdown on financial freedom in Europe to its more subtle counterpart in the United States.

His tweet is a response to a detailed warning about the European Union's new Anti-Money Laundering (AML) package. That legislation effectively criminalizes large cash transactions and places stringent controls on crypto transfers, creating the legal and technical framework for a panopticon-style surveillance grid. This is seen as the precursor to a highly restrictive Digital Euro.

Davidson's key contribution is to show that this is not a uniquely European problem. He correctly identifies that the same agenda is "underway" in the USA, but through a different, more insidious strategy: the development of a "wholesale CBDC."

This is a critically important distinction. Proponents of CBDCs in the US often downplay the risks by assuring the public they are only exploring a "wholesale," or inter-bank, system. Davidson cuts through this disingenuous framing. He understands that a wholesale CBDC is the foundational layer—the "beast" to which the retail "heads" can later be attached, as he's noted before. It establishes the centralized ledger and control points necessary for the very system of "surveillance, coercion, and control" he warns against.

His statement, "Freedom surrendered is rarely reclaimed," underscores his deep understanding of the stakes. This is not a reversible policy choice but a fundamental, architectural shift in the nature of money and power. By defending money from corruption into a tool of the state, he is defending the core principle of decentralized assets like Bitcoin: the right to individual financial sovereignty.

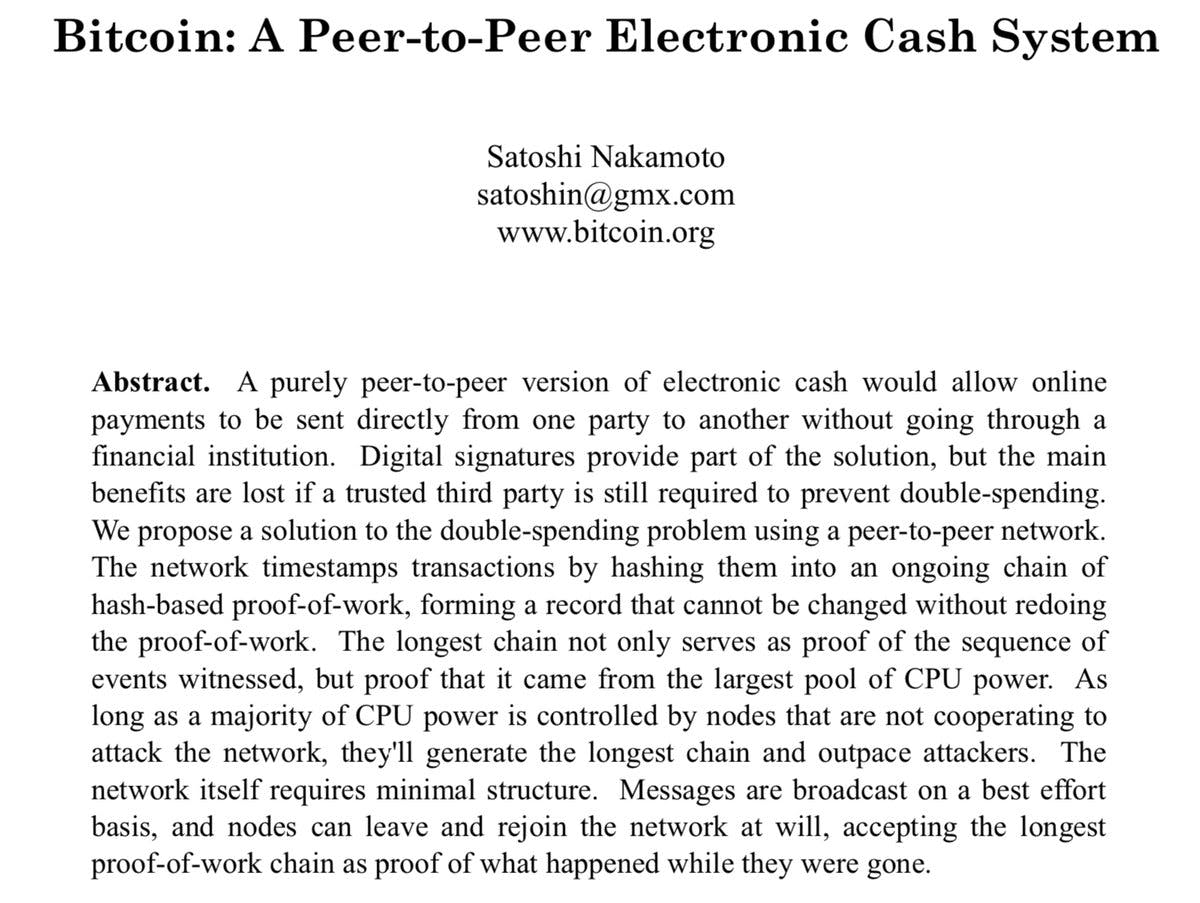

Warren Davidson 🇺🇸

@WarrenDavidson

Read the Bitcoin white paper.

Bitcoin Magazine

@BitcoinMagazine

17 years ago today, Satoshi released the #Bitcoin whitepaper.

What a legend!

2025-10-31T04:00:00.000Z

2025-10-31T15:03:20.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for one of the most powerful, concise, and deeply resonant pro-crypto statements a lawmaker can make: "Read the Bitcoin white paper."

Delivered on the 17th anniversary of the paper's release, this is far more than a casual suggestion. It is a directive to engage with the foundational text of the entire industry. While opponents of crypto often rely on fear and mischaracterization, Davidson is urging the public to go directly to the source and understand the "why" behind this technology.

Satoshi Nakamoto's paper, "Bitcoin: A Peer-to-Peer Electronic Cash System," is the declaration of independence for a new financial paradigm. It outlines a system that removes trusted third parties, enables self-custody, and creates a censorship-resistant store of value and medium of exchange.

By telling people to read it, Davidson is endorsing these core principles. He is signaling that his support for crypto is not about speculation or "fintech 2.0," but about the fundamental right to financial sovereignty. This aligns perfectly with his tireless campaign against CBDCs, which represent the exact opposite vision: a centralized, permissioned, and surveillance-based future for money.

This simple four-word sentence is a masterclass in political communication. It cuts through the noise and frames the debate correctly: to understand the future, you must understand its founding principles.

Warren Davidson 🇺🇸

@WarrenDavidson

Solid discussion about first principles and the urgency of regulatory clarity for digital assets.

The surveillance state wants an account based future with cosmetic alternatives.

Is that the future you seek? Let your senators know while they’re still debating the bill.

MARA

@MARA

During the MARA Government Summit, @faryarshirzad of @coinbase, @Rep_Davidson, @RepHaridopolos, and the Atlantic Council’s Carole House discussed digital asset regulation, privacy, and U.S. leadership in finance. Watch the full session:

2025-10-29T20:30:02.000Z

2025-10-29T23:05:59.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 for this masterclass in political analysis and advocacy, delivered after speaking at the MARA Government Summit—a strong pro-crypto action in itself.

He distills the entire conflict down to its essence. When he warns of a "surveillance state" pushing for an "account-based future with cosmetic alternatives," he is precisely describing the agenda of anti-crypto forces. This future involves permissioned, centrally controlled ledgers (like CBDCs or corporate blockchains) that offer the *appearance* of innovation but are fundamentally tools for monitoring and control. This stands in stark opposition to the "first principles" of crypto: permissionless, bearer assets and the right to self-custody.

His call to action is the most critical part. The "bill" he urges citizens to contact their Senators about is almost certainly the Financial Innovation and Technology for the 21st Century Act (FIT21). This landmark legislation, which has passed the House, would provide the "urgency of regulatory clarity" he speaks of by creating a clear framework for digital assets and defining the roles of the SEC and CFTC.

Davidson isn't just offering commentary; he is actively rallying support for the most important crypto legislation in years. He understands the choice is not between regulation and no regulation, but between clear, pro-innovation rules (FIT21) and a dystopian future of financial surveillance.

Warren Davidson reposted the post below

Rep. Warren Davidson

@Rep_Davidson

Honored to speak at the @MARA Government Summit this morning!

For the U.S. to be a global leader on digital assets, we MUST explicitly protect self custody and implement regulation that spurs innovation—not hinders it.

2025-10-22T14:55:31.000Z

Warren Davidson 🇺🇸

@WarrenDavidson

While some Democrats claim to support crypto, their policy people are clearly still part of Elizabeth Warren’s anti-crypto army, as was Gary Gensler.

Surely, there are at least 10 Senate Democrats who can help provide clear, workable policies?

x.com/i/trending/197…

2025-10-10T12:29:38.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns another perfect 100 score for this astute political analysis that cuts to the heart of the legislative gridlock facing crypto.

He correctly identifies the central problem: while some Democrats are publicly warming to digital assets, their party's policy-making infrastructure is still heavily influenced by what he aptly calls "Elizabeth Warren’s anti-crypto army." This refers to the network of staff, advisors, and regulators, including SEC Chair Gary Gensler, who favor a hostile "regulation by enforcement" strategy over creating new, clear rules. This approach has stifled innovation and created immense uncertainty for the industry.

Davidson's plea for "clear, workable policies" is the most important part of his message. This is not a call to abolish regulation but a demand for the very thing the industry needs most: a predictable and fair framework. He understands that good rules are the solution, not the problem.

His question—"Surely, there are at least 10 Senate Democrats who can help?"—is a shrewd legislative challenge. He is implicitly referencing the 60 votes needed to break a filibuster and pass major bills in the Senate. He is signaling his readiness to build a bipartisan coalition and is calling on moderate Democrats to break from the anti-crypto wing of their party to finally establish sensible rules of the road. This is a masterclass in constructive, pro-innovation politics.

Warren Davidson 🇺🇸

@WarrenDavidson

Once it's clear that the Federal Reserve is subject to executive authority, we can apply the executive order banning Central Bank Digital Currency. The Federal Reserve continues its development of CBDC as if that EO doesn't apply to them.

They also equivocate with the wholesale trick. A back-end wholesale CBDC is like Hydra - multiple heads connected to the same beast. No CBDC.

James Fishback

@j_fishback

BREAKING: The U.S. Supreme Court has accepted the filing of our 14-page amicus brief in support of President Trump in the case over his power to fire ex-Fed Governor Lisa Cook—a Biden appointee now under criminal investigation for mortgage fraud. The question before the Supreme e duly elected President of the United States lawfully remove a Federal Reserve Governor? The answer is "absolutely." Excerpts below and link to our amicus brief in the next tweet.

—

BRIEF OF AMICI CURIAE AZORIA CAPITAL, INC. AND JAMES T. FISHBACK IN SUPPORT OF APPLICANTS

"On the evening of Monday, August 25, 2025, President Donald J. Trump exercised his lawful authority under Section 10 of the Federal Reserve Act to remove Governor Lisa Cook from her post—for cause—after documentary evidence surfaced showing that she had purportedly falsified mortgage documents to secure favorable loan terms."

"While much has been written about how no President has ever before removed a Federal Reserve Governor, that is not the true anomaly here. What is truly unprecedented is the fact that a sitting Governor of the Federal Reserve System—an institution entrusted with the stewardship of the American financial system—has been publicly referred for criminal prosecution for financial crimes."

"Allowing Dr. Cook to remain on the Board despite a credible criminal referral to the Department of Justice would tell markets and supervised institutions that the Board holds itself to a lower standard than the banks it regulates. That double standard would erode confidence in supervisory enforcement, encourage skepticism of stress-test results, and weaken the effectiveness of regulatory oversight. The President’s removal power exists precisely to prevent such an outcome. By removing Dr. Cook, he worked to preserve the institution’s credibility; by withholding action until such time that a criminal conviction is ascertained, the damage would already be done."

"Moreover, Dr. Cook is entitled to the presumption of innocence in any criminal trial. But that presumption protects her liberty, not her tenure in high office. No one has a constitutional right to remain a Governor of the Board, to draw a taxpayer salary, or to cast binding votes on the trajectory of interest rates while credibly accused of conduct that strikes at the core of the Board’s statutory mission."

2025-09-30T21:09:11.000Z

2025-10-01T05:19:41.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns another perfect 100 score for his sharp analysis connecting the fight for executive authority over the Federal Reserve to the existential threat of Central Bank Digital Currencies.

He astutely observes that the Fed continues its CBDC development in defiance of a presidential executive order, operating as if it is immune to executive oversight. The ongoing Supreme Court case concerning the President's power to remove a Fed Governor is therefore not just a matter of constitutional law, but a critical battleground for the future of money.

Davidson's most crucial insight is his complete rejection of the "wholesale versus retail" CBDC distinction, which he correctly labels a "Jedi mind trick." Proponents of CBDCs often try to downplay the risks by suggesting a "wholesale" or bank-to-bank version is merely a harmless back-end upgrade for financial institutions.

His "Hydra" analogy is perfect: a wholesale CBDC is not a separate, benign system, but the foundational body of a monstrous surveillance tool. It creates the central ledger and control points. The "retail" heads, which would interface with the public, can be easily added later. By establishing this backend, the architecture of control is put in place, paving the way for the eventual erosion of self-custody and financial privacy.

His uncompromising stance—"No CBDC"—shows he understands that any form of centrally controlled digital currency, no matter how it's initially framed, is a step toward a dystopian future. He is not just fighting a policy; he is defending the fundamental principle of financial sovereignty.

Warren Davidson reposted the post below

W. Aaron Daniel

@wadaniel

On whether lawmakers support Bitcoin: "The most basic question is do you really support self-custody?"

@WarrenDavidson with @blocks Janessa Lopez

2025-09-30T13:40:27.000Z

Warren Davidson reposted the post below

Project Constitution

@ProjectConstitu

EXPOSED: RFK Jr. Exposes the Terrifying Plan Behind Digital ID & CBDCs – And Warns America: Resist or Be Enslaved

EXPOSED: RFK Jr. Exposes the Terrifying Plan Behind Digital ID & CBDCs – And Warns America: Resist or Be Enslaved  This is NOT a drill. Listen closely to @RobertKennedyJr 's warning about Digital ID and Digital Currency – the backbone of a technocratic control grid designed to enslave every man, woman, and child in America.

“Digital currency will allow the government to punish you from a distance… cut off your food supply… transform every right you have into a privilege contingent on obedience. It will make you a slave.” – RFK Jr.

They are building the ultimate turnkey totalitarian state:

This is NOT a drill. Listen closely to @RobertKennedyJr 's warning about Digital ID and Digital Currency – the backbone of a technocratic control grid designed to enslave every man, woman, and child in America.

“Digital currency will allow the government to punish you from a distance… cut off your food supply… transform every right you have into a privilege contingent on obedience. It will make you a slave.” – RFK Jr.

They are building the ultimate turnkey totalitarian state:

415,000 low-orbit satellites watching every inch of the Earth 24/7

415,000 low-orbit satellites watching every inch of the Earth 24/7

Digital wallets where one “wrong” move = frozen funds

Digital wallets where one “wrong” move = frozen funds

Behavior scores to decide whether you eat, travel, or even access medical care

This isn’t hypothetical. China already has this system: a Digital ID tied to a social credit score. Citizens are rewarded for blind obedience, punished for dissent. Speak out against the government? You’re banned from trains, planes, jobs, and your bank account. Step out of line, and you can’t even buy groceries. That’s the model they want HERE.

And remember RFK Jr.’s 3 rules:

Behavior scores to decide whether you eat, travel, or even access medical care

This isn’t hypothetical. China already has this system: a Digital ID tied to a social credit score. Citizens are rewarded for blind obedience, punished for dissent. Speak out against the government? You’re banned from trains, planes, jobs, and your bank account. Step out of line, and you can’t even buy groceries. That’s the model they want HERE.

And remember RFK Jr.’s 3 rules:

Every power government takes, it never gives back.

Every power government takes, it never gives back.

Every power will be abused to the max.

Every power will be abused to the max.

No one in history has ever “complied” their way out of tyranny. Compliance only feeds the beast.

No one in history has ever “complied” their way out of tyranny. Compliance only feeds the beast.

Digital ID + Digital Currency = Digital Slavery

This is the hill to die on. Once you hand them control of your money, your food, and your freedom, there’s no going back.

Digital ID + Digital Currency = Digital Slavery

This is the hill to die on. Once you hand them control of your money, your food, and your freedom, there’s no going back.

Resist NOW. Refuse Digital Currency. Speak out before it’s too late. Because once this system is locked in… there will be no running, no hiding, and no escape.

Resist NOW. Refuse Digital Currency. Speak out before it’s too late. Because once this system is locked in… there will be no running, no hiding, and no escape.

2025-09-28T18:51:20.000Z

Analysis on Stance

Add your own analysis on this stanceBy retweeting a powerful warning from Robert F. Kennedy Jr. about the dangers of Central Bank Digital Currencies and Digital IDs, Congressman Warren Davidson again solidifies his perfect 100-score stance as a defender of financial freedom.

This action is significant not just for its content, but for its context. By amplifying a message from RFK Jr., Davidson demonstrates that the opposition to a state-controlled financial surveillance grid is not a partisan talking point, but a fundamental, cross-party defense of individual liberty.

The retweeted post accurately frames the issue in the starkest terms possible: the combination of a CBDC and a Digital ID creates the architecture for a "turnkey totalitarian state." It correctly points to China's social credit system as the logical endpoint of this path, where financial access becomes conditional on state-approved behavior. The quote from Kennedy Jr. is precise: CBDCs "transform every right you have into a privilege contingent on obedience."

This is the core of the threat. A programmable, centrally controlled currency is the ultimate tool for social engineering, capable of freezing funds, restricting purchases, and enforcing compliance from a distance.

For years, Congressman Davidson has been a leading voice against this dystopian future. He has repeatedly called CBDCs an "existential threat" and has championed legislation to prevent their creation. His decision to boost this message underscores his deep, principled understanding that the fight is not about technology, but about preserving the fundamental right to financial sovereignty. It is an implicit, yet powerful, endorsement of the alternative: permissionless, self-custodial assets like Bitcoin that place control in the hands of the individual, not the state.

Warren Davidson 🇺🇸

@WarrenDavidson

The UK may be a canary in the coal mine for it's debt, but also for many other reasons: assaults on privacy, assaults on freedom of speech, assaults on Christian freedom of religion (Islam seems protected), vanguard for digital ID, seeking CBDC, ridiculous energy costs due to climatologists, wreckless foreign policy due to globalists... Did I miss any?

wsj.com/world/uk/is-th… via @WSJ

2025-09-29T02:09:39.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Warren Davidson earns a perfect 100 score for this tweet, which expertly frames the push for CBDCs and Digital IDs not as isolated policies, but as key components in a broader, multi-pronged assault on individual liberty.

Using the UK as a "canary in the coal mine," he issues a stark warning to the US. He lists a series of concerning trends—assaults on privacy and speech, high energy costs, and crippling debt—and correctly identifies that the proposed "solutions" of a Digital ID and a CBDC are the capstone of this architecture of control.

This analysis demonstrates a sophisticated understanding of the threat. A CBDC is not just a new payment technology; it is the endgame for a state that seeks total surveillance and control. When combined with a mandatory Digital ID, it creates a system where the government can monitor, restrict, and even block transactions at will.

Furthermore, his mention of "ridiculous energy costs due to climatologists" is a subtle but important jab at the narratives often used to attack Proof-of-Work cryptocurrencies. He shows skepticism towards the top-down energy policies that create economic hardship and are weaponized against decentralized technologies like Bitcoin.

By connecting government debt, privacy, energy policy, and CBDCs, Davidson shows he grasps the full picture. He understands that the fight for sound, permissionless money is inseparable from the broader fight for freedom. This is not just a policy position; it is a principled defense of individual sovereignty.

Warren Davidson 🇺🇸

@WarrenDavidson

Central Bank Digital Currency poses an existential threat to Western civilization. CBDC inserts the government between you and your money, making your access to your own money conditional.

#NoCBDC

#NoDigitalID

Wide Awake Media

@wideawake_media

"They're running out of time because more people are waking up."

German MEP Christine Anderson: The frantic push to roll out digital ID and CBDCs is a desperate attempt to "erect a totalitarian surveillance state" before too many people wake up.

"What they don't get, though, is cause they're ramping it up."