What Members of the U.S. House of Representatives from the 117th Session of Congress Support Crypto?

Below is a list of all U.S. house members from the 117th session of congress and whether they are supportive of bitcoin and other cryptocurrencies. You can also view crypto stances broken down by house committees.

Pro-Crypto Representatives

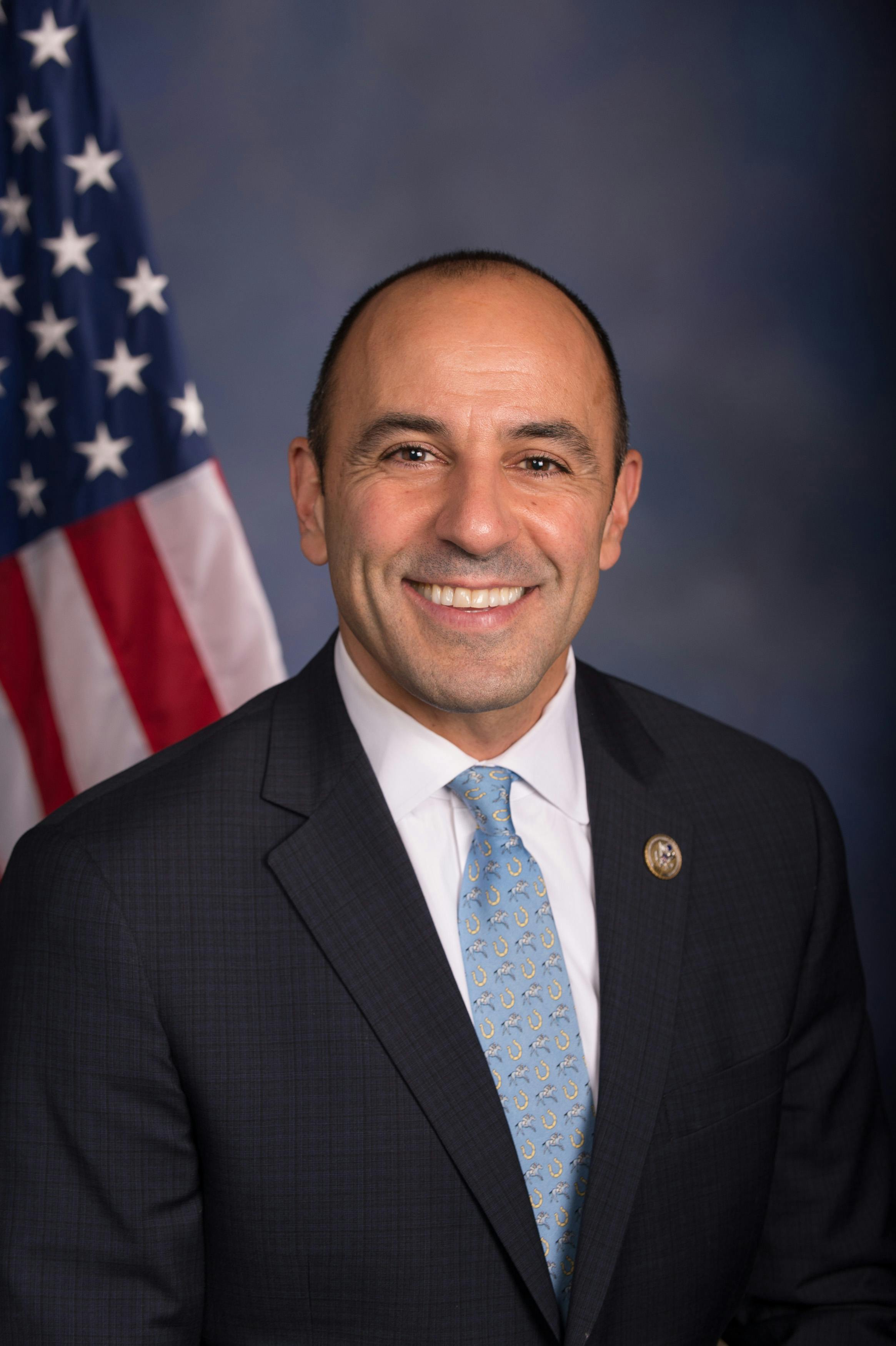

Tom Emmer Jr.

Rep from Minnesota (R)

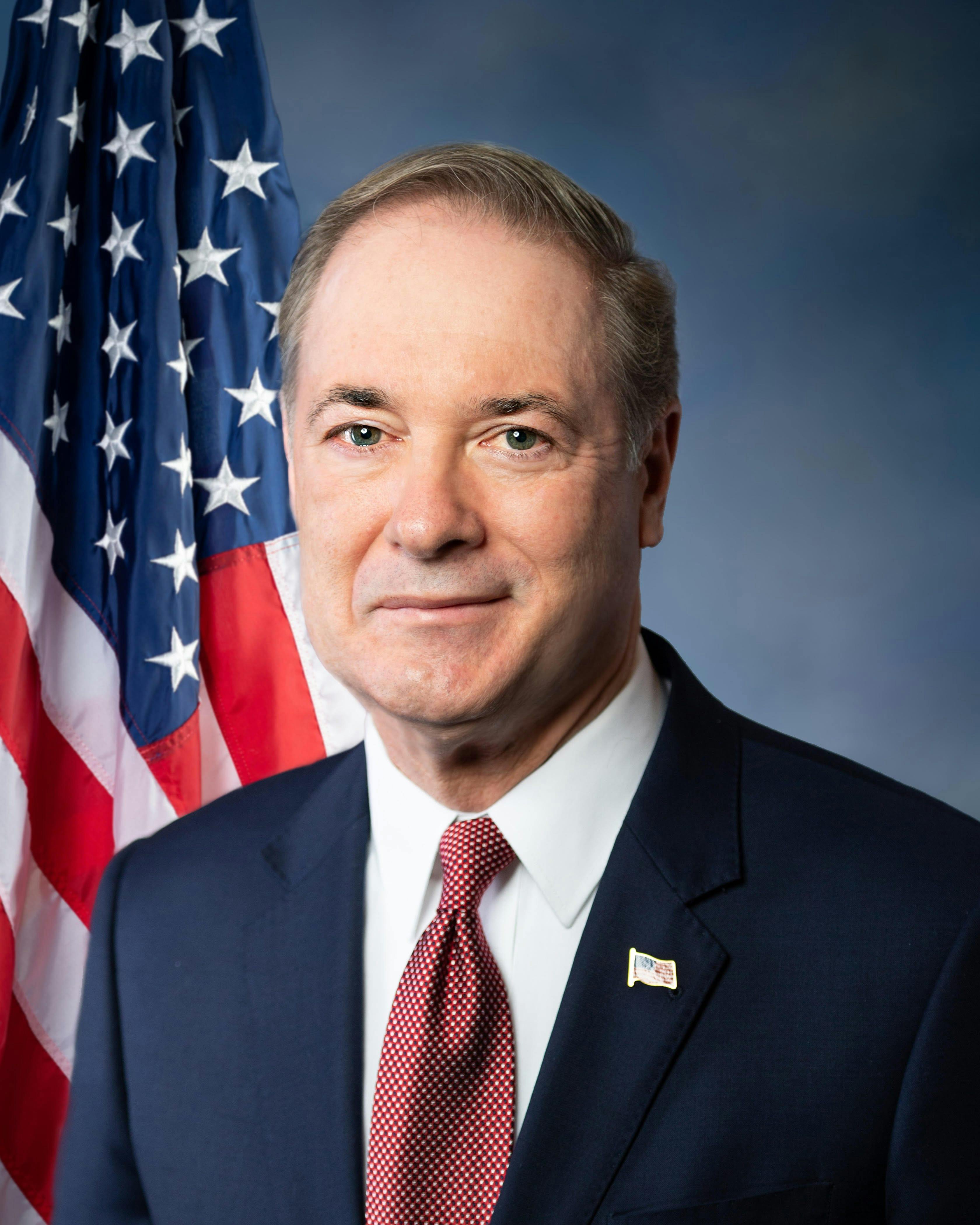

Warren Davidson

Rep from Ohio (R)

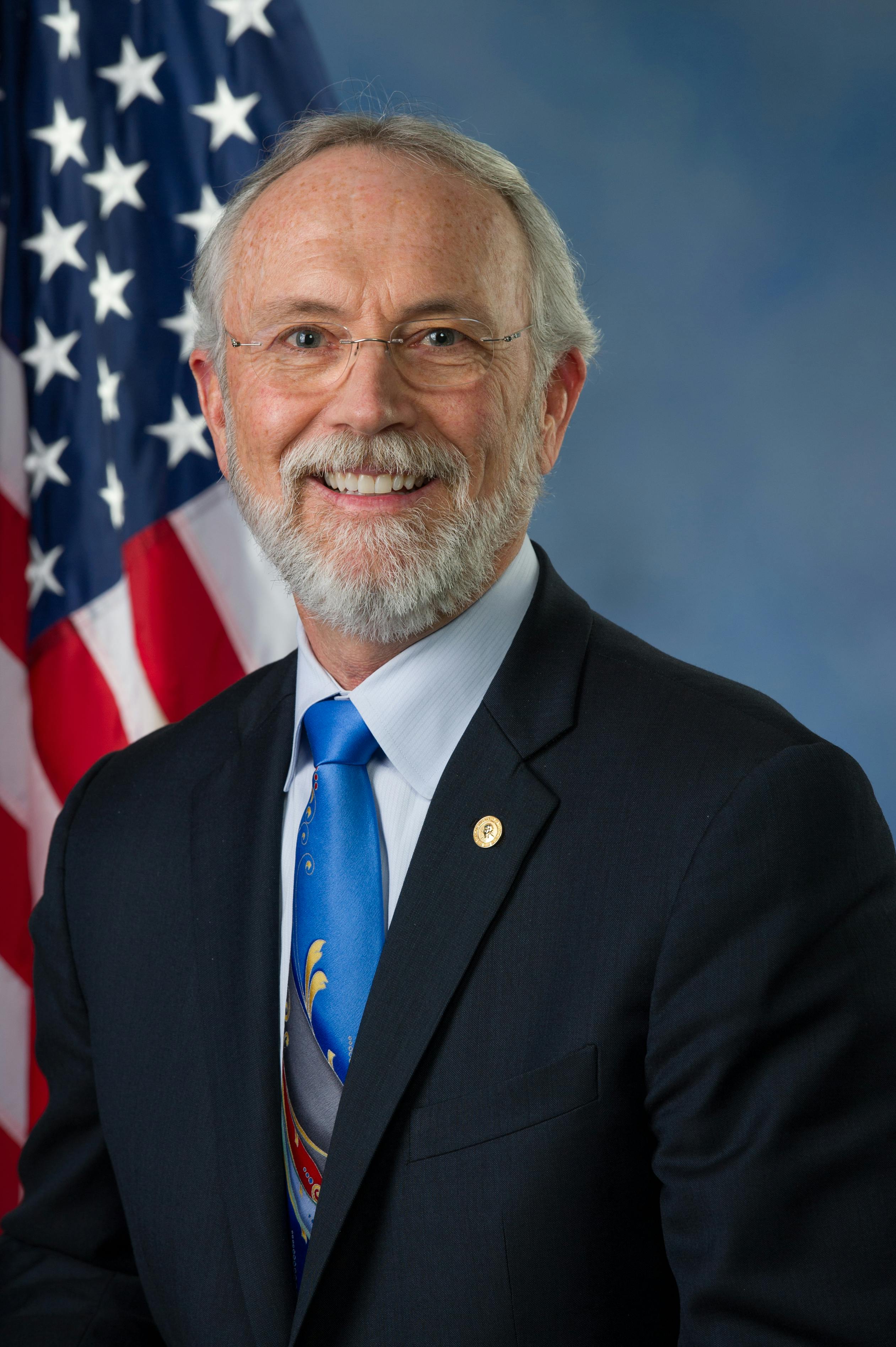

Bryan Steil

Rep from Wisconsin (R)

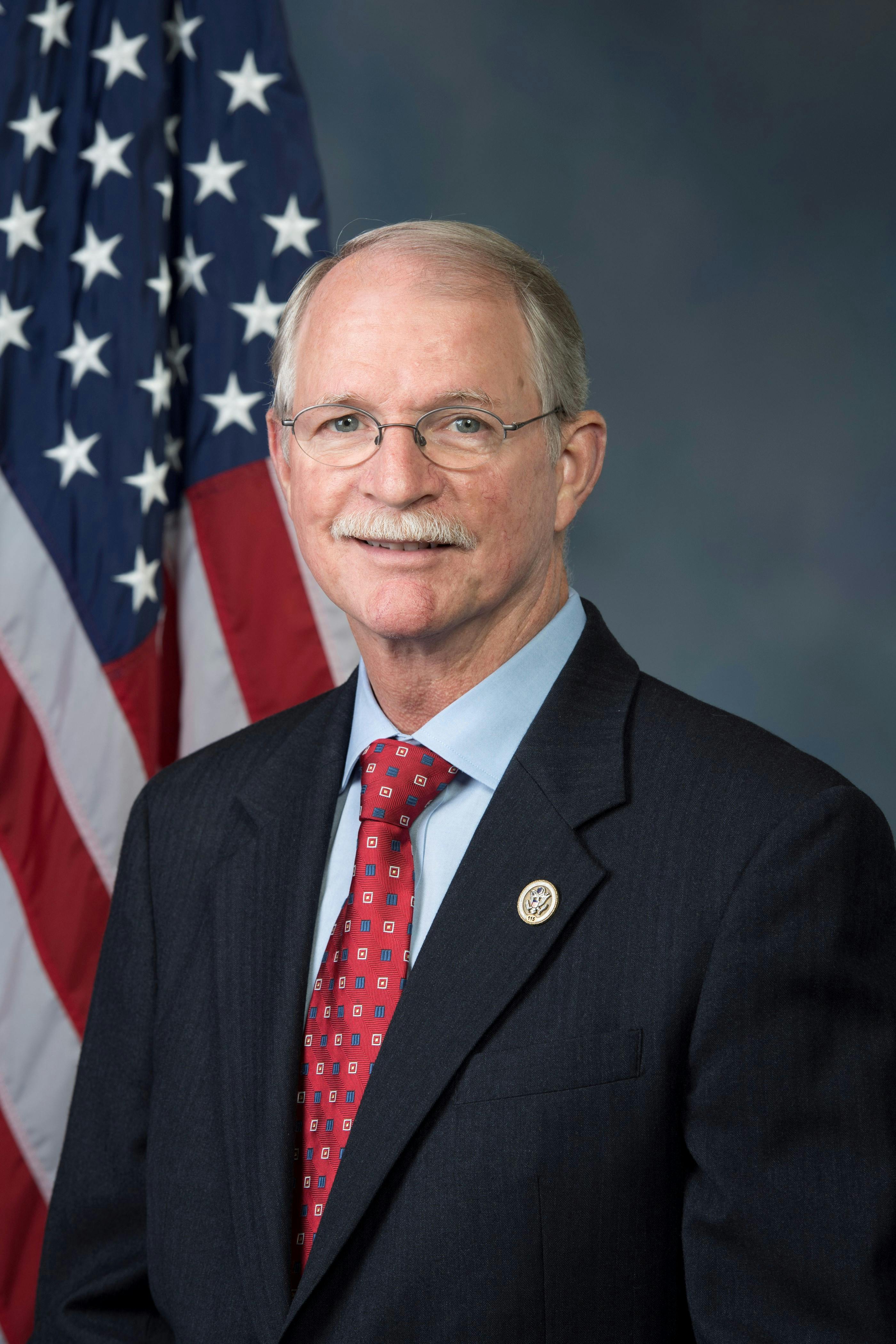

French Hill

Rep from Arkansas (R)

Mike Flood

Rep from Nebraska (R)

Bill Huizenga

Rep from Michigan (R)

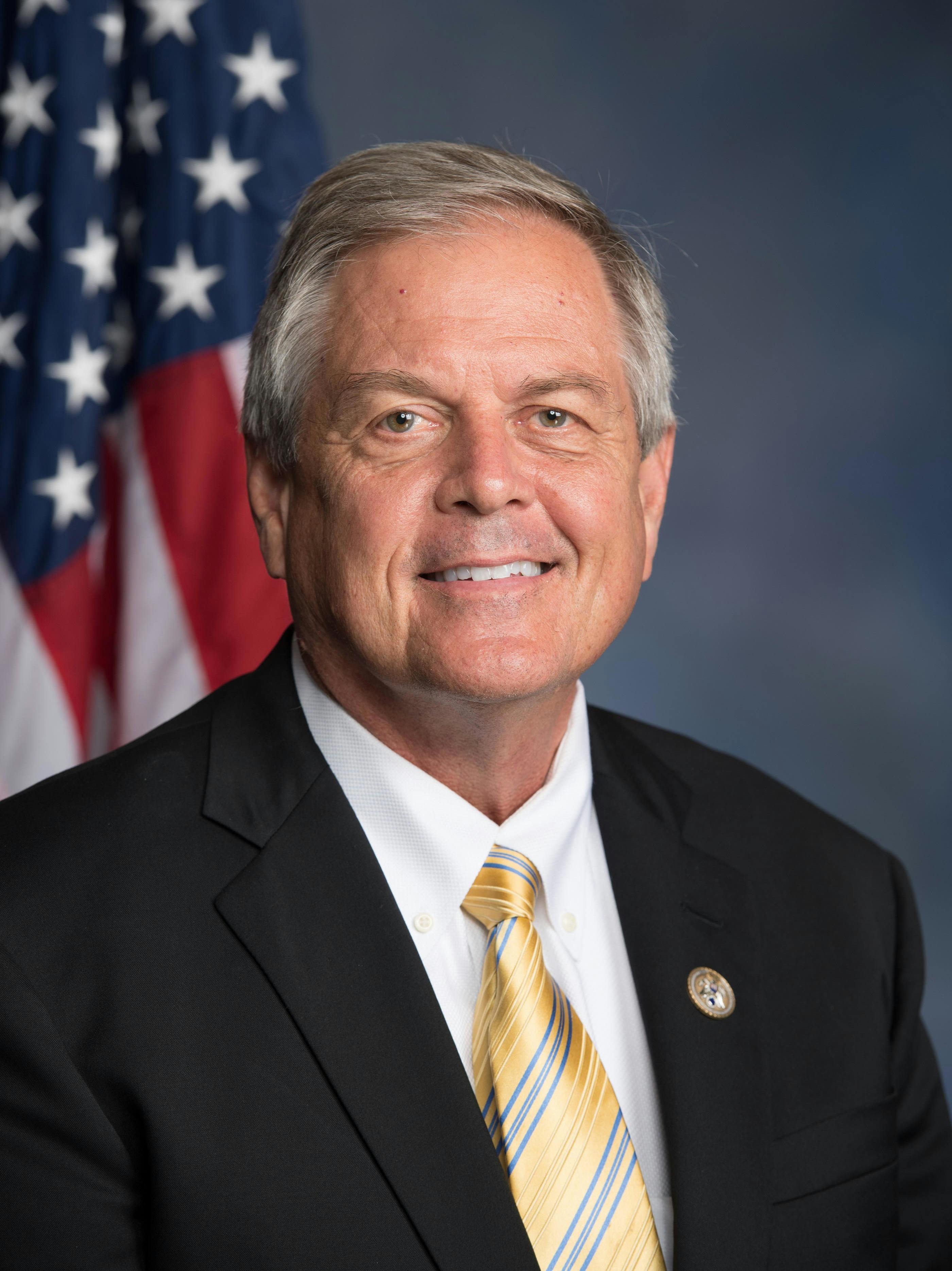

Patrick McHenry

Rep from North Carolina (R)

Pete Sessions

Rep from Texas (R)

Josh Gottheimer

Rep from New Jersey (D)

William Timmons IV

Rep from South Carolina (R)

Ritchie Torres

Rep from New York (D)

Byron Donalds

Rep from Florida (R)

Dan Meuser

Rep from Pennsylvania (R)

John Rose

Rep from Tennessee (R)

Dusty Johnson

Rep from South Dakota (R)

Ted Budd

Senator from North Carolina (R)

Mike Carey

Rep from Ohio (R)

Young Kim

Rep from California (R)

Darren Soto

Rep from Florida (D)

Andy Barr

Rep from Kentucky (R)

Matt Gaetz

Rep from Florida (R)

Elissa Slotkin

Senator from Michigan (D)

Frank Lucas

Rep from Oklahoma (R)

John Curtis

Senator from Utah (R)

Ro Khanna

Rep from California (D)

Buddy Carter

Rep from Georgia (R)

Mark Green

Rep from Tennessee (R)

Ralph Norman Jr.

Rep from South Carolina (R)

Scott Fitzgerald

Rep from Wisconsin (R)

Beth Van Duyne

Rep from Texas (R)

Thomas Massie

Rep from Kentucky (R)

Randy Feenstra

Rep from Iowa (R)

Glenn Thompson

Rep from Pennsylvania (R)

Alex Mooney

Rep from West Virginia (R)

Tim Burchett

Rep from Tennessee (R)

Nancy Mace

Rep from South Carolina (R)

Steven Horsford

Rep from Nevada (D)

Raja Krishnamoorthi

Rep from Illinois (D)

Lance Gooden

Rep from Texas (R)

Chuck Fleischmann

Rep from Tennessee (R)

Rudy Yakym III

Rep from Indiana (R)

Dan Crenshaw

Rep from Texas (R)

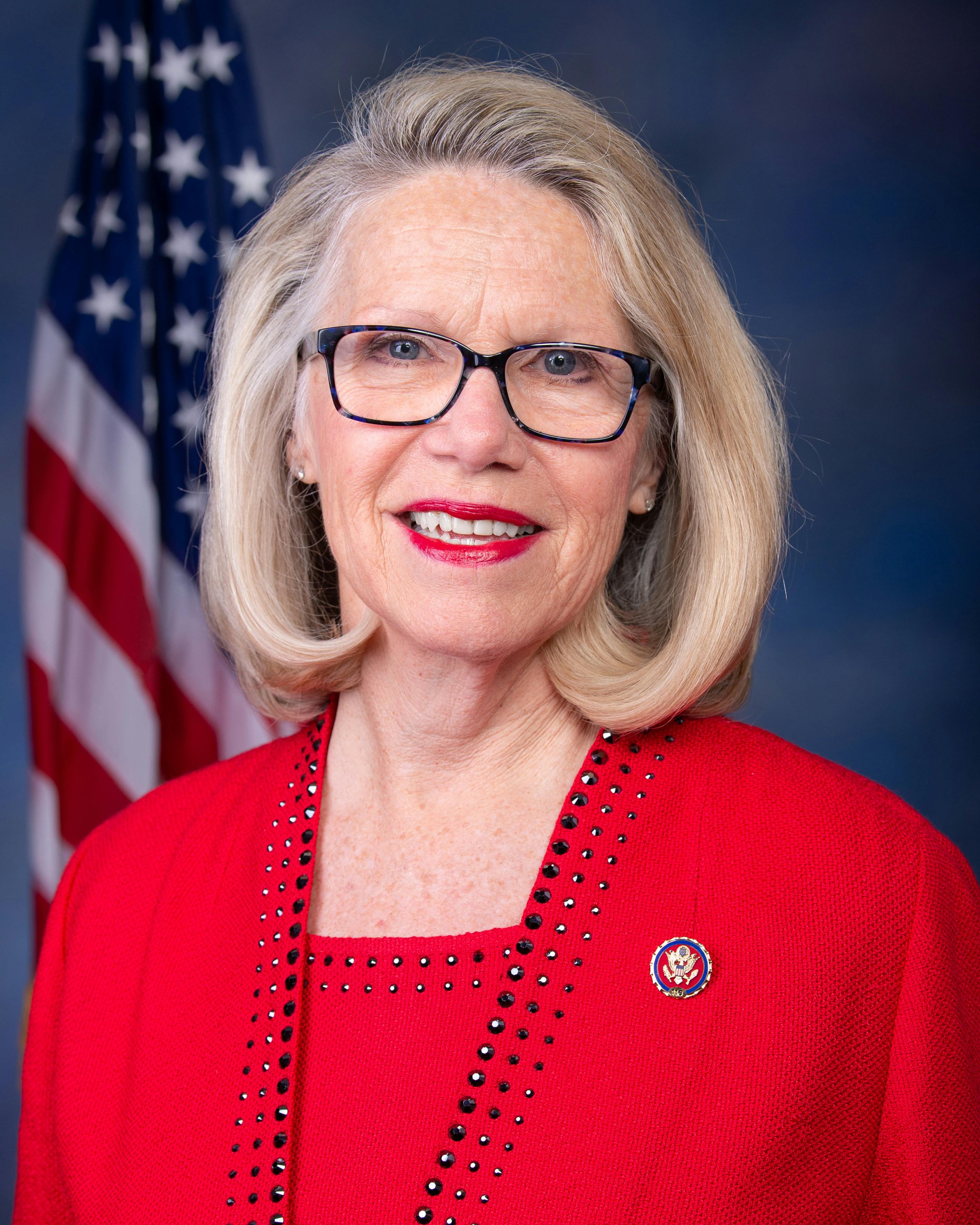

Michelle Fischbach

Rep from Minnesota (R)

Ann Wagner

Rep from Missouri (R)

Haley Stevens

Rep from Michigan (D)

Kat Cammack

Rep from Florida (R)

Burgess Owens

Rep from Utah (R)

Mike Johnson

Rep from Louisiana (R)

Elise Stefanik

Rep from New York (R)

Gus Bilirakis

Rep from Florida (R)

Barry Moore

Rep from Alabama (R)

Ben Cline

Rep from Virginia (R)

Jim Banks

Senator from Indiana (R)

Mariannette Miller-Meeks

Rep from Iowa (R)

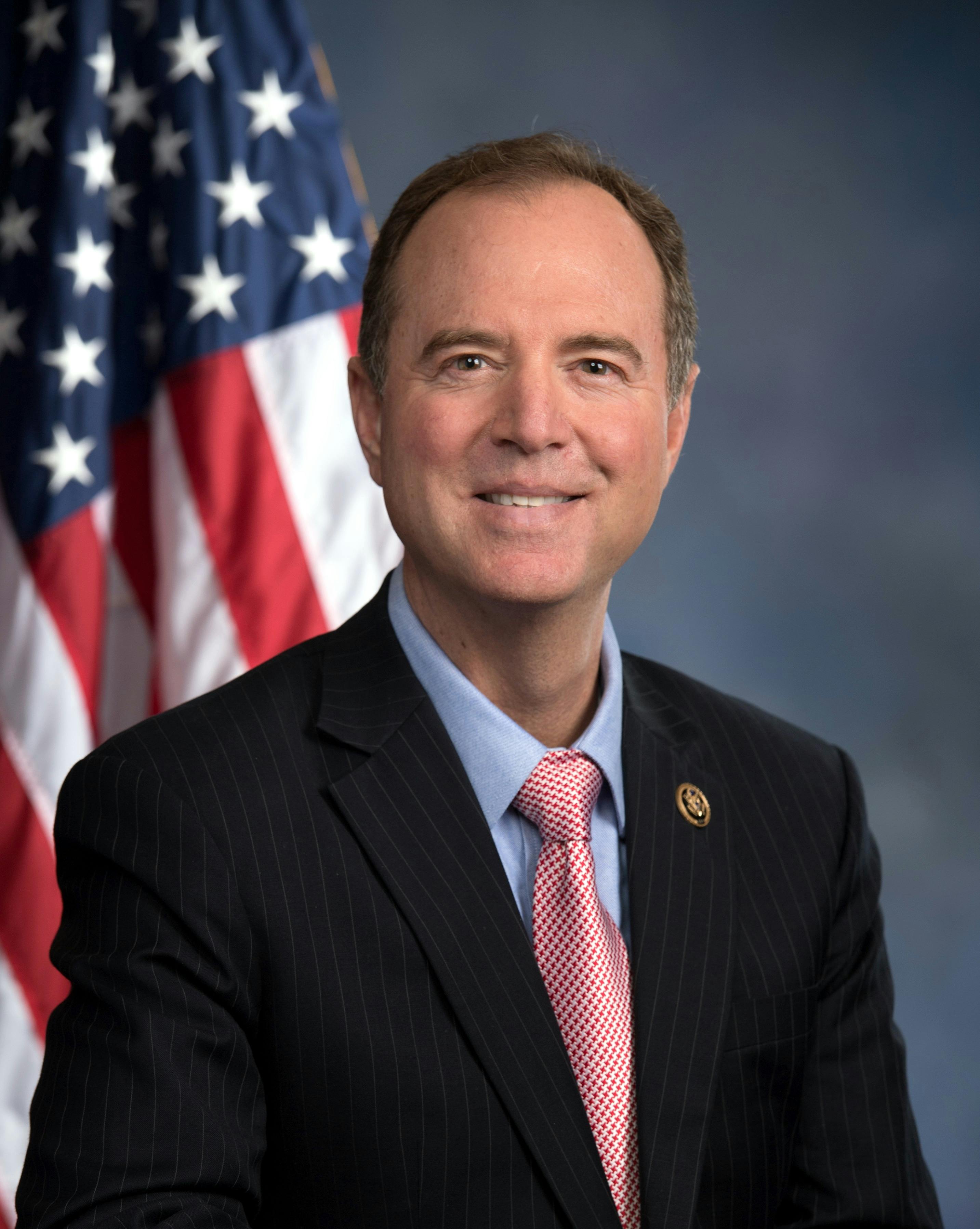

Adam Schiff

Senator from California (D)

Richard Hudson Jr.

Rep from North Carolina (R)

Steve Womack

Rep from Arkansas (R)

Don Bacon

Rep from Nebraska (R)

Tony Gonzales II

Rep from Texas (R)

Henry Cuellar

Rep from Texas (D)

Andrew Garbarino

Rep from New York (R)

David Schweikert

Rep from Arizona (R)

Carlos Giménez

Rep from Florida (R)

Roger Williams

Rep from Texas (R)

Angie Craig

Rep from Minnesota (D)

Ruben Gallego

Senator from Arizona (D)

David Kustoff

Rep from Tennessee (R)

Claudia Tenney

Rep from New York (R)

Rob Wittman

Rep from Virginia (R)

Mary Miller

Rep from Illinois (R)

Ronny Jackson

Rep from Texas (R)

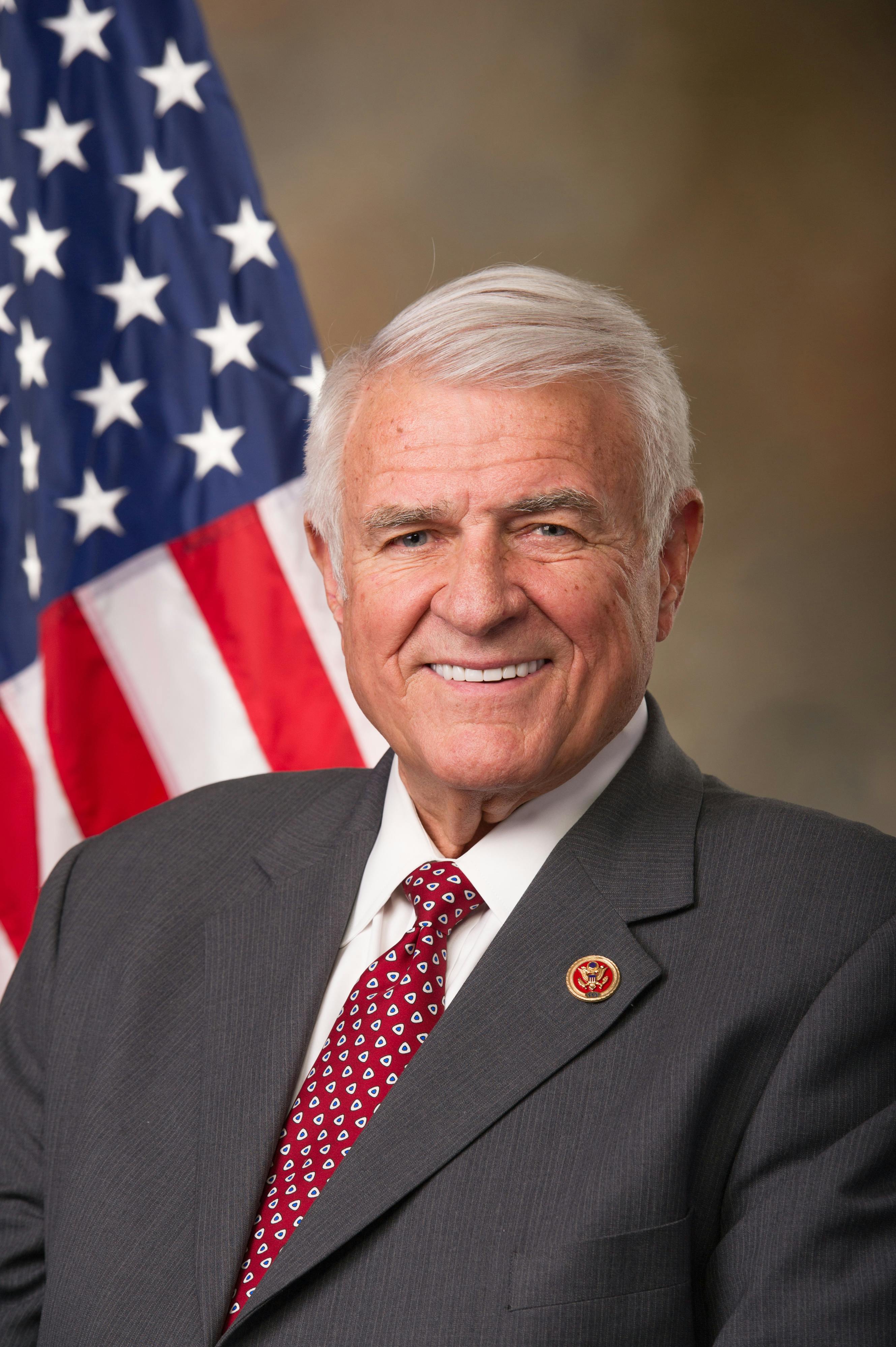

Vern Buchanan

Rep from Florida (R)

Stephanie Bice

Rep from Oklahoma (R)

Paul Gosar

Rep from Arizona (R)

Brian Mast

Rep from Florida (R)

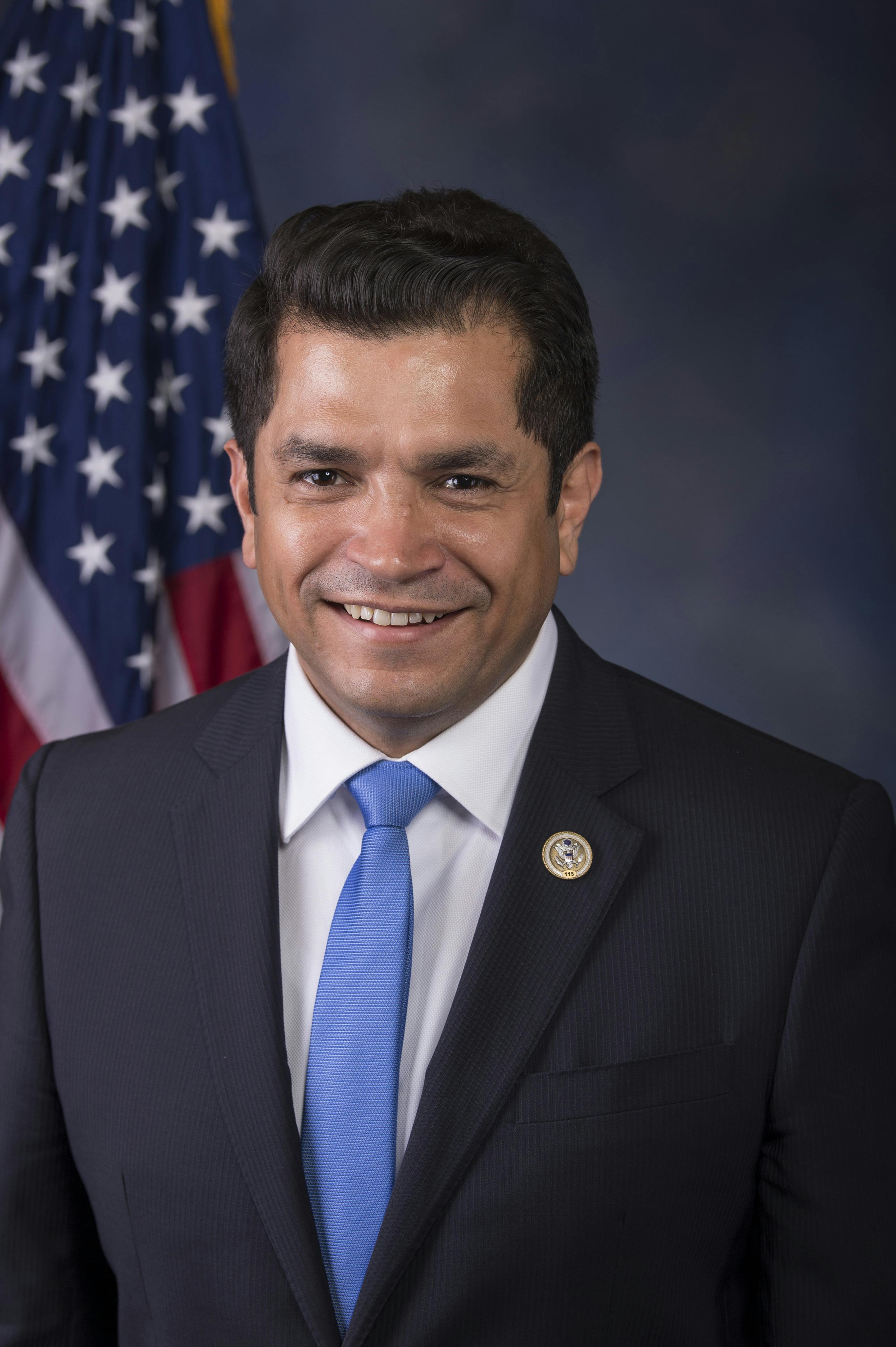

Vicente Gonzalez

Rep from Texas (D)

David Valadao

Rep from California (R)

Brad Finstad

Rep from Minnesota (R)

Troy Nehls

Rep from Texas (R)

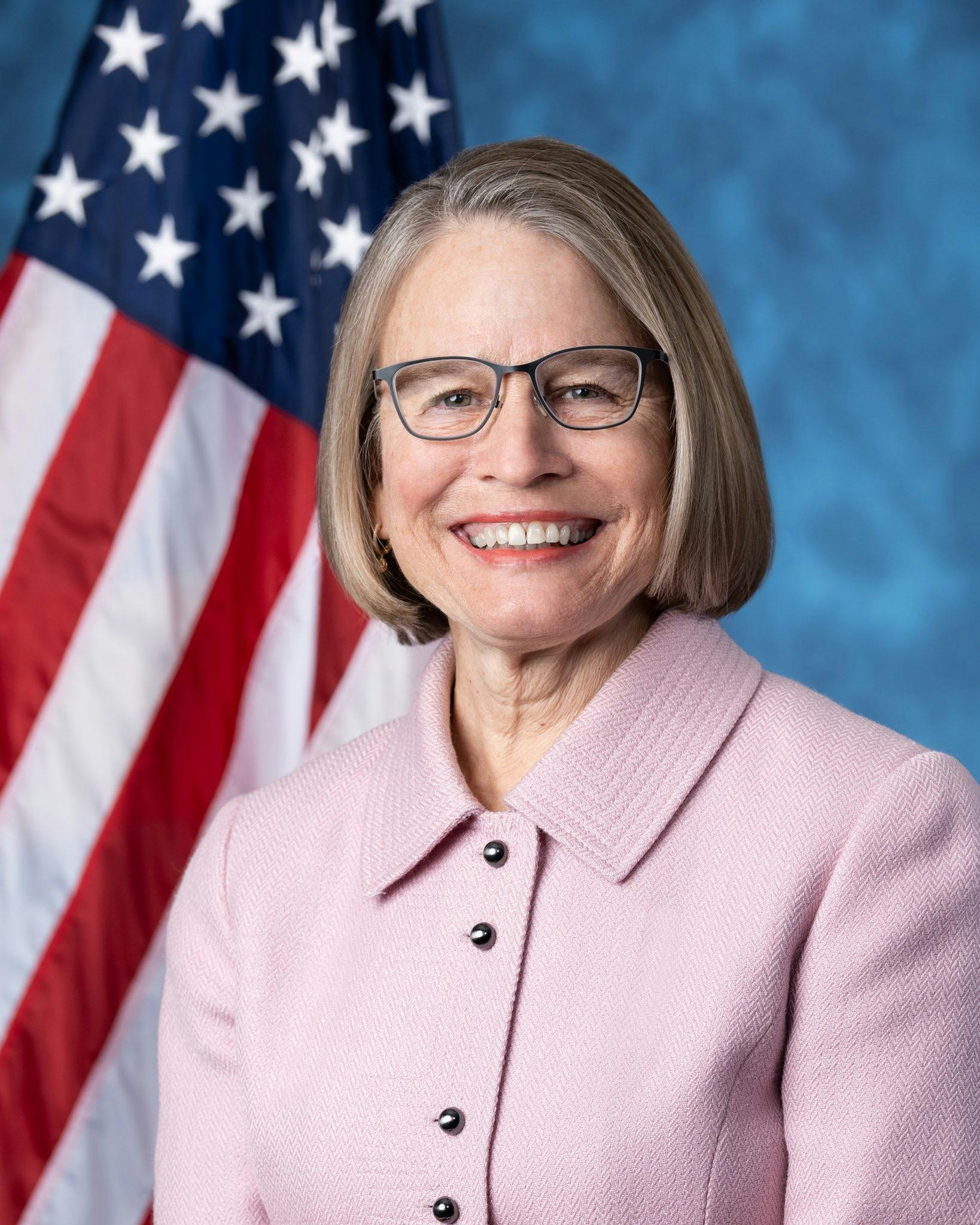

Kim Schrier

Rep from Washington (D)

Barry Loudermilk

Rep from Georgia (R)

Guy Reschenthaler

Rep from Pennsylvania (R)

Terri Sewell

Rep from Alabama (D)

Markwayne Mullin

Senator from Oklahoma (R)

Brett Guthrie

Rep from Kentucky (R)

Jake Ellzey Sr.

Rep from Texas (R)

Andrew Clyde

Rep from Georgia (R)

Glenn Grothman

Rep from Wisconsin (R)

Mike Levin

Rep from California (D)

Lisa McClain

Rep from Michigan (R)

Scott Franklin

Rep from Florida (R)

Ashley Hinson

Rep from Iowa (R)

Steve Scalise

Rep from Louisiana (R)

Randy Weber

Rep from Texas (R)

Lloyd Smucker

Rep from Pennsylvania (R)

Tom McClintock

Rep from California (R)

Mike Bost

Rep from Illinois (R)

Tracey Mann

Rep from Kansas (R)

Kevin Hern

Rep from Oklahoma (R)

Josh Harder

Rep from California (D)

Seth Moulton

Rep from Massachusetts (D)

Julia Letlow

Rep from Louisiana (R)

Chris Smith

Rep from New Jersey (R)

David Rouzer

Rep from North Carolina (R)

Scott DesJarlais

Rep from Tennessee (R)

Jason Smith

Rep from Missouri (R)

Troy Balderson

Rep from Ohio (R)

Pat Fallon

Rep from Texas (R)

Brian Babin

Rep from Texas (R)

Jack Bergman

Rep from Michigan (R)

Victoria Spartz

Rep from Indiana (R)

John Moolenaar

Rep from Michigan (R)

Trent Kelly

Rep from Mississippi (R)

Jeff Van Drew

Rep from New Jersey (R)

Clay Higgins

Rep from Louisiana (R)

Bruce Westerman

Rep from Arkansas (R)

Mike Kelly Jr

Rep from Pennsylvania (R)

Robert Aderholt

Rep from Alabama (R)

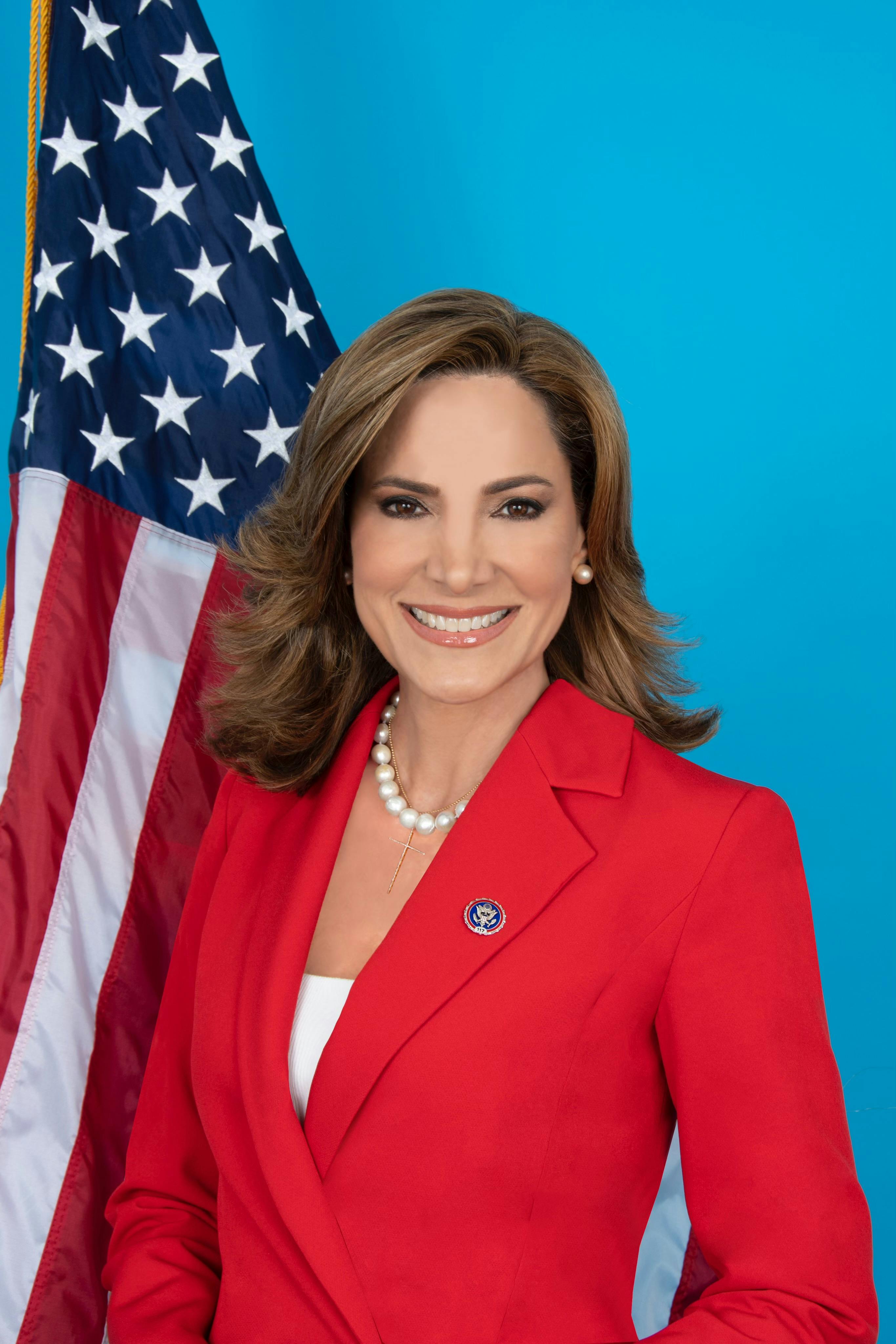

Maria Salazar

Rep from Florida (R)

Blaine Luetkemeyer

Rep from Missouri (R)

Tom Cole

Rep from Oklahoma (R)

Darrell Issa

Rep from California (R)

Greg Steube

Rep from Florida (R)

Blake Moore

Rep from Utah (R)

Colin Allred

Rep from Texas (D)

Rick Crawford

Rep from Arkansas (R)

Neal Dunn

Rep from Florida (R)

Diana Harshbarger

Rep from Tennessee (R)

Bob Good

Rep from Virginia (R)

Tom Tiffany

Rep from Wisconsin (R)

Bob Latta

Rep from Ohio (R)

Rick Allen

Rep from Georgia (R)

Jodey Arrington

Rep from Texas (R)

Michael McCaul

Rep from Texas (R)

Michael Guest

Rep from Mississippi (R)

Darin LaHood

Rep from Illinois (R)

Chrissy Houlahan

Rep from Pennsylvania (D)

Ken Calvert

Rep from California (R)

Nicole Malliotakis

Rep from New York (R)

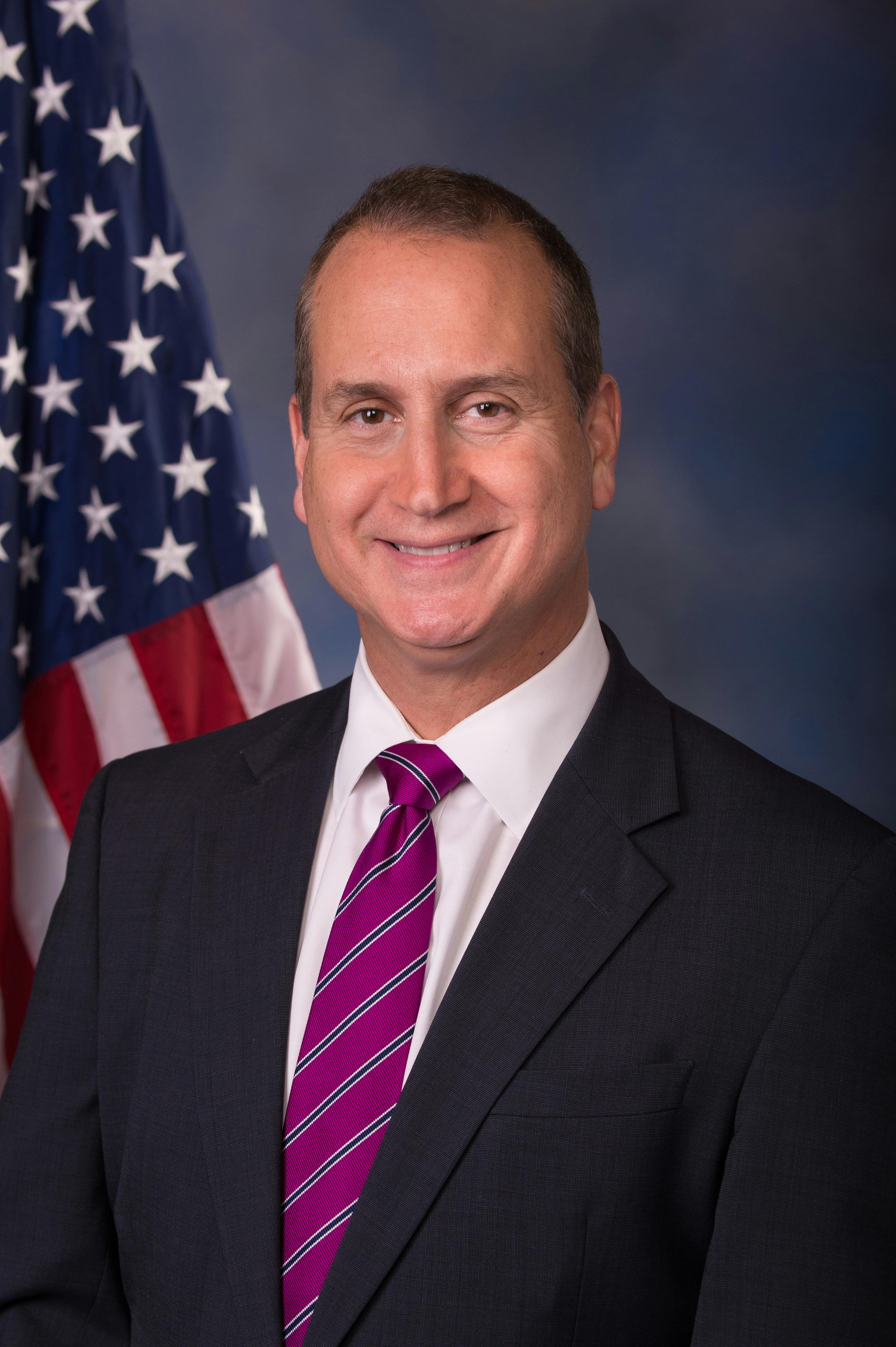

Mario Díaz-Balart

Rep from Florida (R)

Dan Bishop

Rep from North Carolina (R)

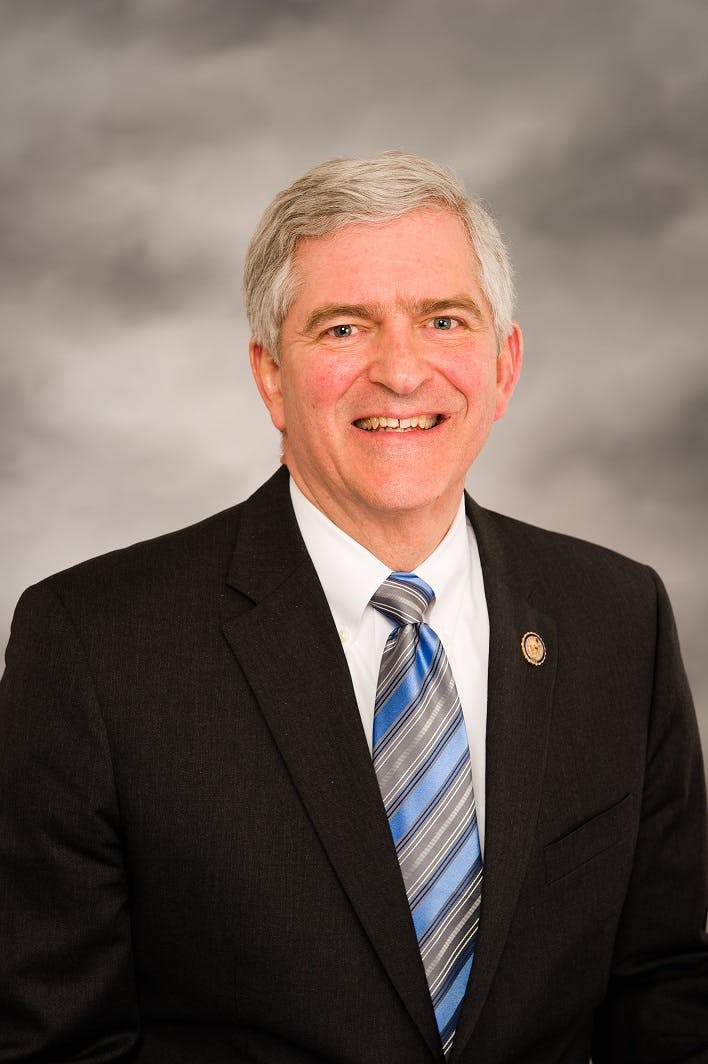

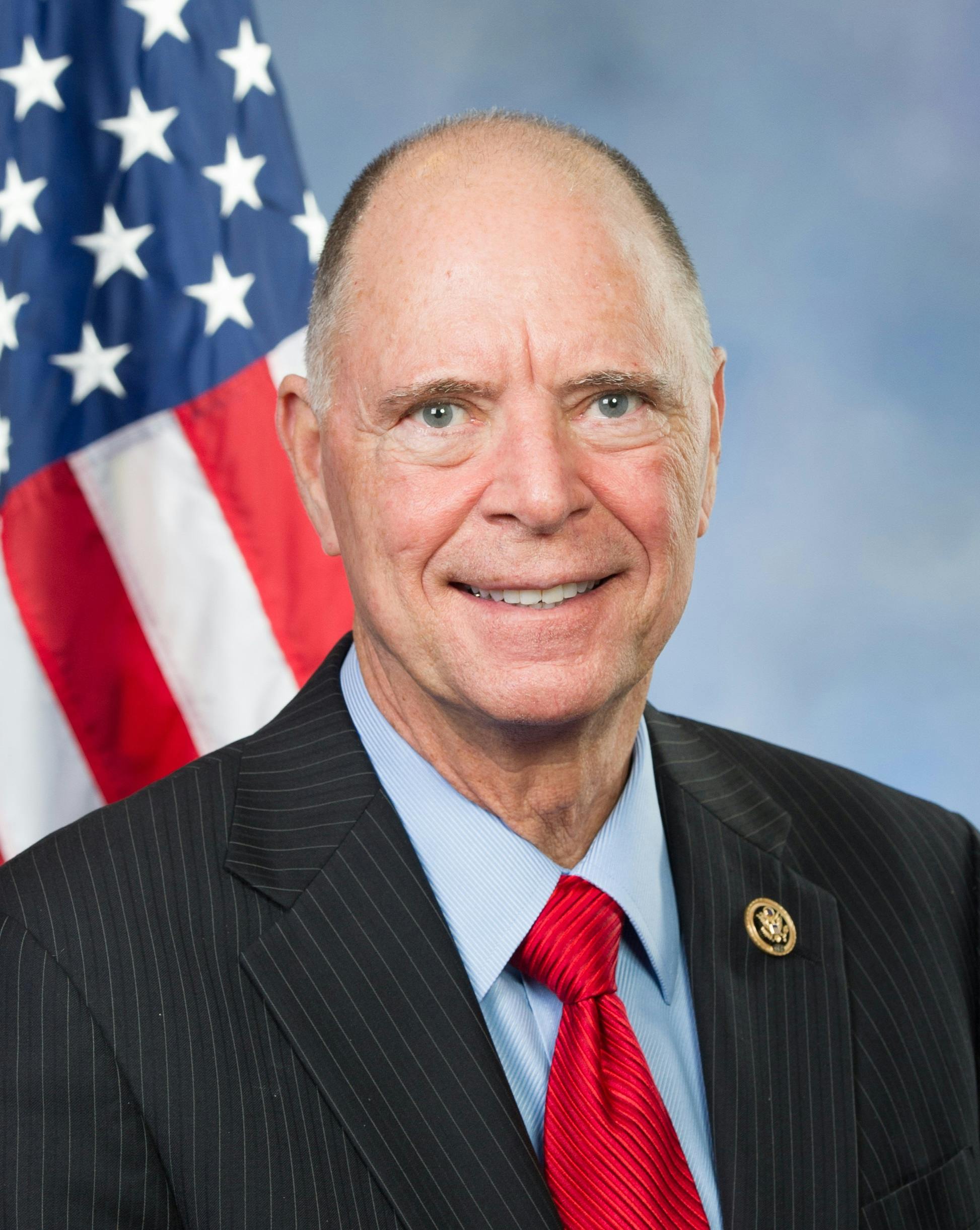

Daniel Webster

Rep from Florida (R)

Mark Amodei

Rep from Nevada (R)

August Pfluger II

Rep from Texas (R)

Brendan Boyle

Rep from Pennsylvania (D)

Suzan DelBene

Rep from Washington (D)

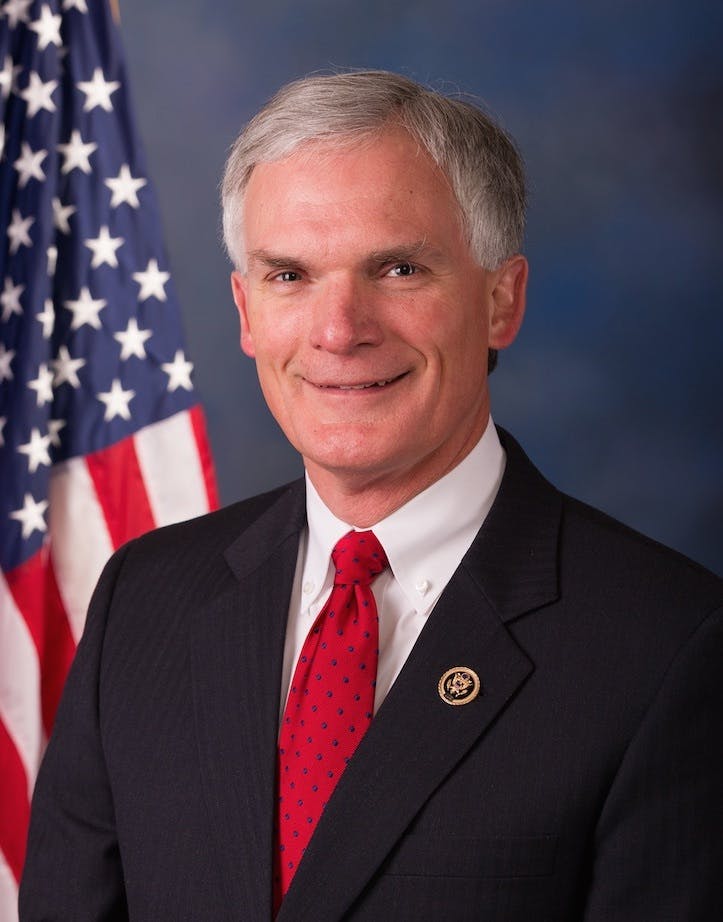

Sam Graves Jr.

Rep from Missouri (R)

Brian Fitzpatrick

Rep from Pennsylvania (R)

Mike Thompson

Rep from California (D)

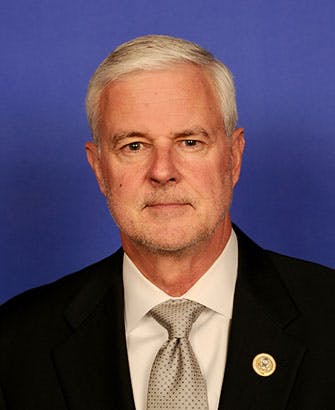

Mike Rogers

Rep from Alabama (R)

Carol Miller

Rep from West Virginia (R)

Pete Stauber

Rep from Minnesota (R)

Jim Baird

Rep from Indiana (R)

Lauren Boebert

Rep from Colorado (R)

Tim Ryan

Rep from Ohio (D)

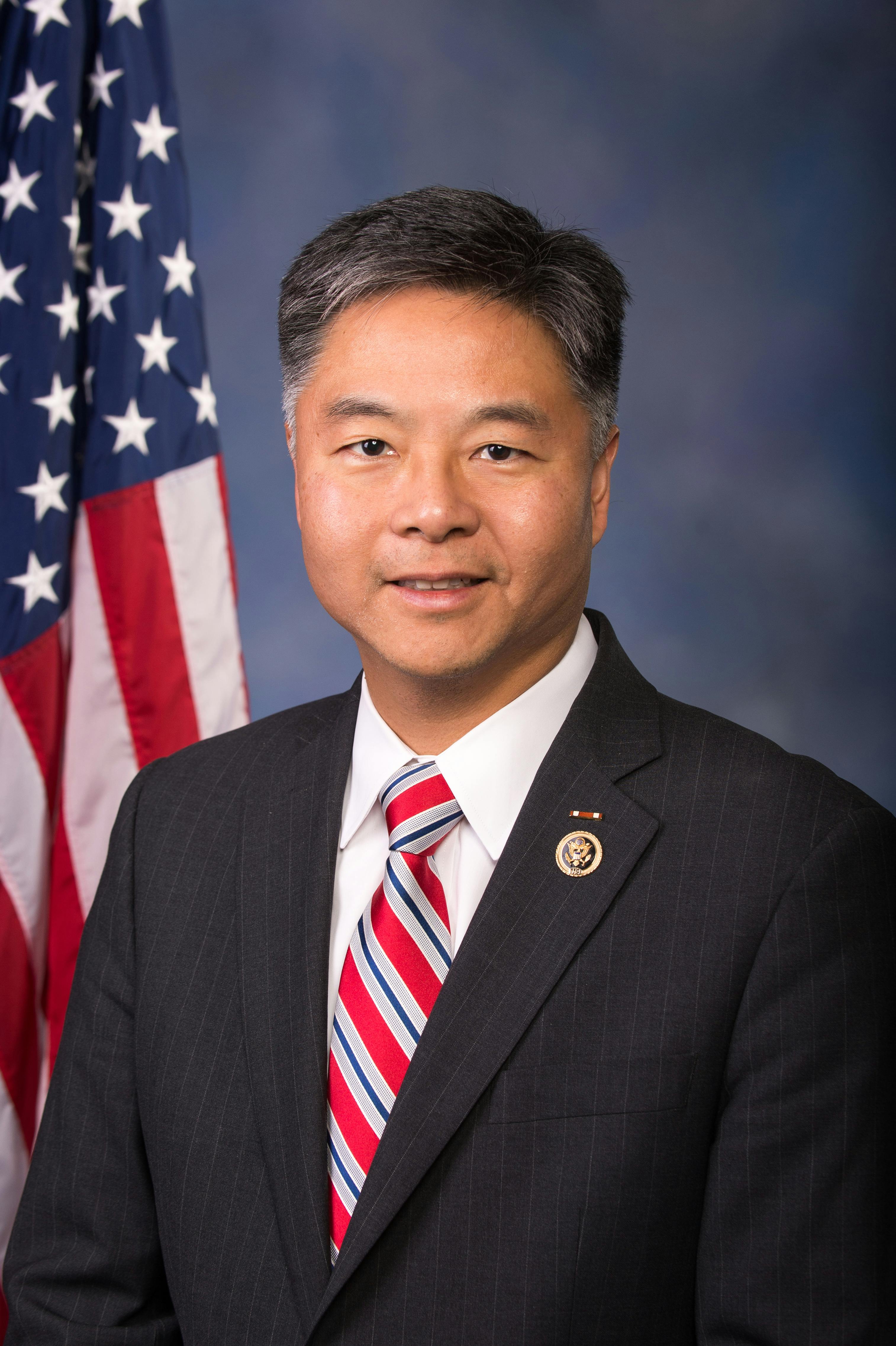

Ted Lieu

Rep from California (D)

Mike Simpson

Rep from Idaho (R)

Virginia Foxx

Rep from North Carolina (R)

Dave Joyce

Rep from Ohio (R)

Larry Bucshon

Rep from Indiana (R)

Hal Rogers

Rep from Kentucky (R)

Pat Ryan

Rep from New York (D)

Salud Carbajal

Rep from California (D)

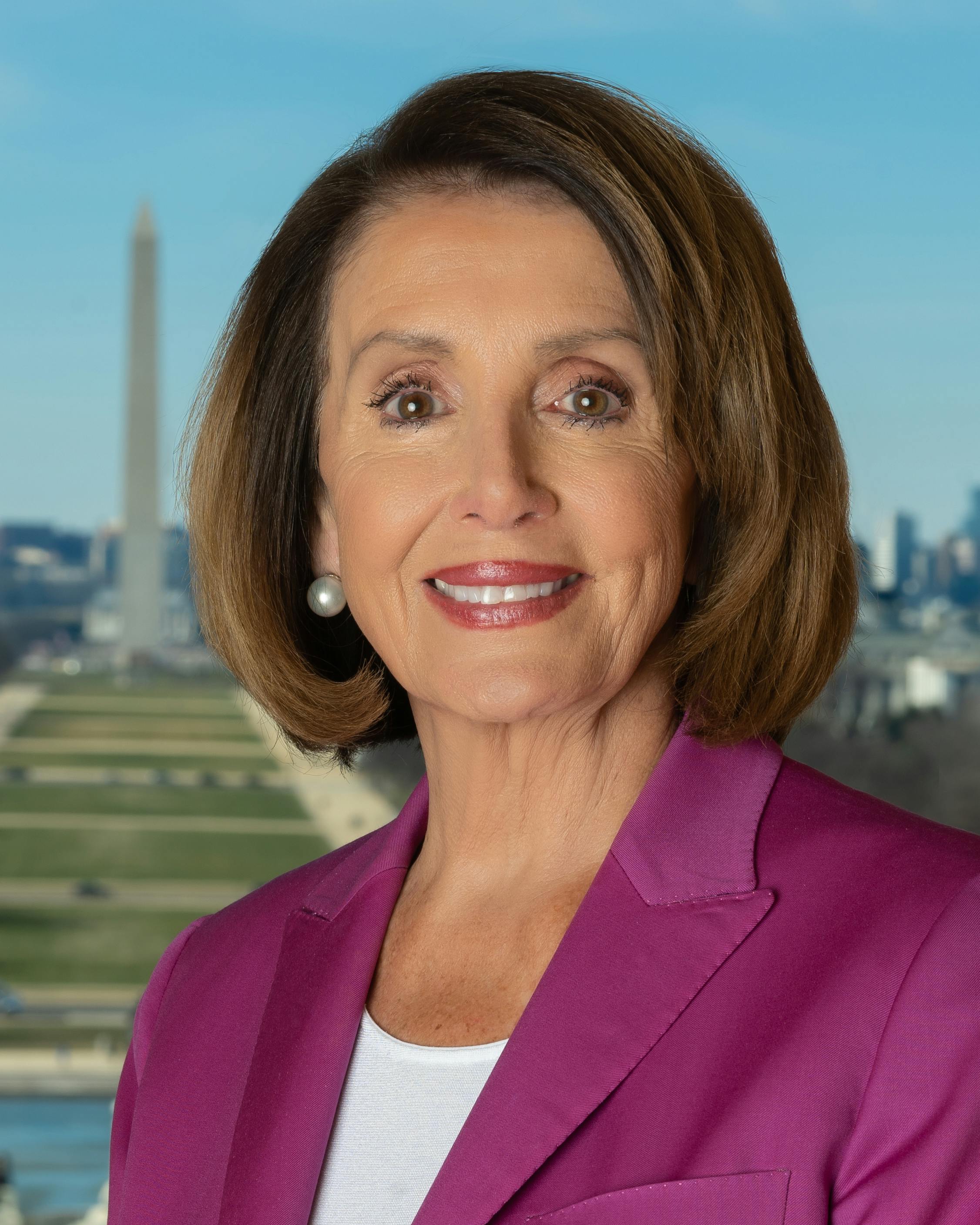

Nancy Pelosi

Rep from California (D)

Gary Palmer

Rep from Alabama (R)

Chris Pappas

Rep from New Hampshire (D)

Jared Golden

Rep from Maine (D)

Greg Pence

Rep from Indiana (R)

Adrian Smith

Rep from Nebraska (R)

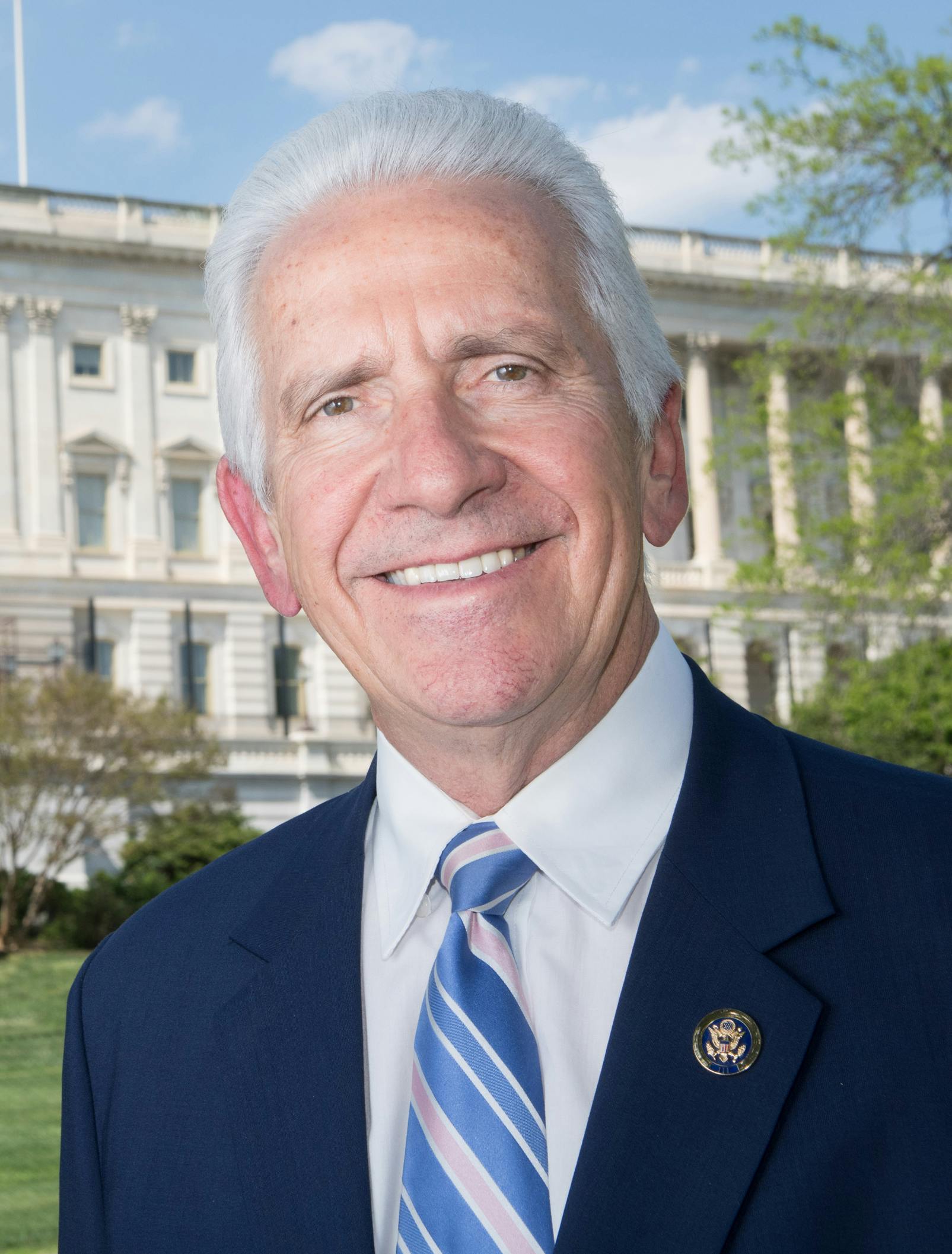

Jim Costa

Rep from California (D)

Jim Jordan

Rep from Ohio (R)

Jimmy Panetta

Rep from California (D)

John Joyce

Rep from Pennsylvania (R)

Dean Phillips

Rep from Minnesota (D)

James Comer

Rep from Kentucky (R)

Brad Schneider

Rep from Illinois (D)

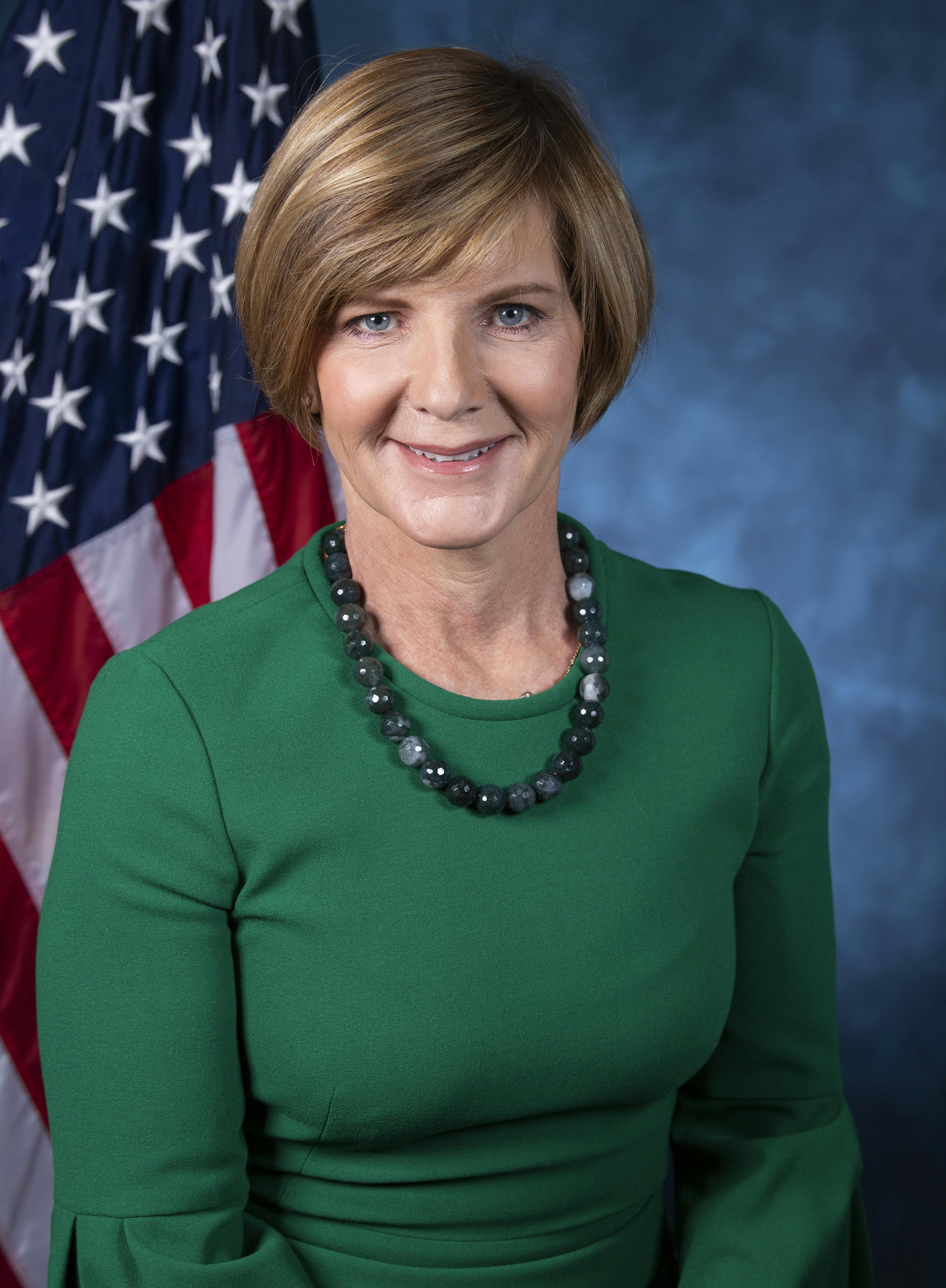

Mikie Sherrill

Cliff Bentz

Rep from Oregon (R)

Ami Bera

Rep from California (D)

Mike Turner

Rep from Ohio (R)

Dan Newhouse

Rep from Washington (R)

Marilyn Strickland

Rep from Washington (D)

Joe Wilson

Rep from South Carolina (R)

Greg Stanton

Rep from Arizona (D)

John Rutherford

Rep from Florida (R)

Jimmy Gomez

Rep from California (D)

Lucy McBath

Rep from Georgia (D)

Jay Obernolte

Rep from California (R)

Ron Estes

Rep from Kansas (R)

Marc Veasey

Rep from Texas (D)

Raul Ruiz

Rep from California (D)

Lou Correa

Rep from California (D)

Tim Walberg

Rep from Michigan (R)

John Carter

Rep from Texas (R)

Thomas Suozzi

Rep from New York (D)

Pete Aguilar

Rep from California (D)

Susie Lee

Rep from Nevada (D)

Greg Murphy

Rep from North Carolina (R)

Jake LaTurner

Rep from Kansas (R)

Zoe Lofgren

Rep from California (D)

Lois Frankel

Rep from Florida (D)

Drew Ferguson IV

Rep from Georgia (R)

Bill Posey

Rep from Florida (R)

Jeff Duncan

Rep from South Carolina (R)

Doug LaMalfa

Rep from California (R)

Debbie Lesko

Rep from Arizona (R)

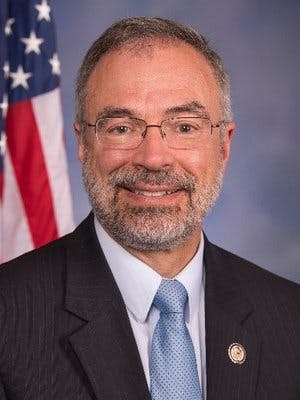

Anthony Gonzalez

Rep from Ohio (R)

Michelle Steel

Rep from California (R)

Cathy McMorris Rodgers

Rep from Washington (R)

Mike Garcia

Rep from California (R)

Michael Waltz

Rep from Florida (R)

Brad Wenstrup

Rep from Ohio (R)

Annie Kuster

Rep from New Hampshire (D)

Jerry Carl Jr

Rep from Alabama (R)

Doug Lamborn

Rep from Colorado (R)

Anna Eshoo

Rep from California (D)

Kelly Armstrong

Rep from North Dakota (R)

Kay Granger

Rep from Texas (R)

Madison Cawthorn

Rep from North Carolina (R)

Abigail Spanberger

Susan Wild

Rep from Pennsylvania (D)

Mary Peltola

Rep from Alaska (D)

Michael Burgess

Rep from Texas (R)

Trey Hollingsworth

Rep from Indiana (R)

Garret Graves

Rep from Louisiana (R)

Kevin McCarthy

Rep from California (R)

Kevin Brady

Rep from Texas (R)

Stacey Plaskett

Rep from Virgin Islands (D)

Mondaire Jones

Rep from New York (D)

Anti-Crypto Representatives

Brad Sherman

Rep from California (D)

Stephen Lynch

Rep from Massachusetts (D)

.jpeg&w=3840&q=75)

Don Beyer Jr.

Rep from Virginia (D)

Sylvia Garcia

Rep from Texas (D)

Sean Casten

Rep from Illinois (D)

Frank Pallone Jr

Rep from New Jersey (D)

Jared Huffman

Rep from California (D)

Bill Foster

Rep from Illinois (D)

Steve Cohen

Rep from Tennessee (D)

Al Green

Rep from Texas (D)

Chuy García

Rep from Illinois (D)

Rashida Tlaib

Rep from Michigan (D)

Norma Torres

Rep from California (D)

Mark Pocan

Rep from Wisconsin (D)

Nikema Williams

Rep from Georgia (D)

Maxine Waters

Rep from California (D)

David Scott

Rep from Georgia (D)

Joaquin Castro

Rep from Texas (D)

Nydia Velázquez

Rep from New York (D)

Emanuel Cleaver II

Rep from Missouri (D)

Juan Vargas

Rep from California (D)

Ilhan Omar

Rep from Minnesota (D)

Mary Scanlon

Rep from Pennsylvania (D)

Lloyd Doggett

Rep from Texas (D)

Ayanna Pressley

Rep from Massachusetts (D)

Jahana Hayes

Rep from Connecticut (D)

Jamie Raskin

Rep from Maryland (D)

Joyce Beatty

Rep from Ohio (D)

Melanie Stansbury

Rep from New Mexico (D)

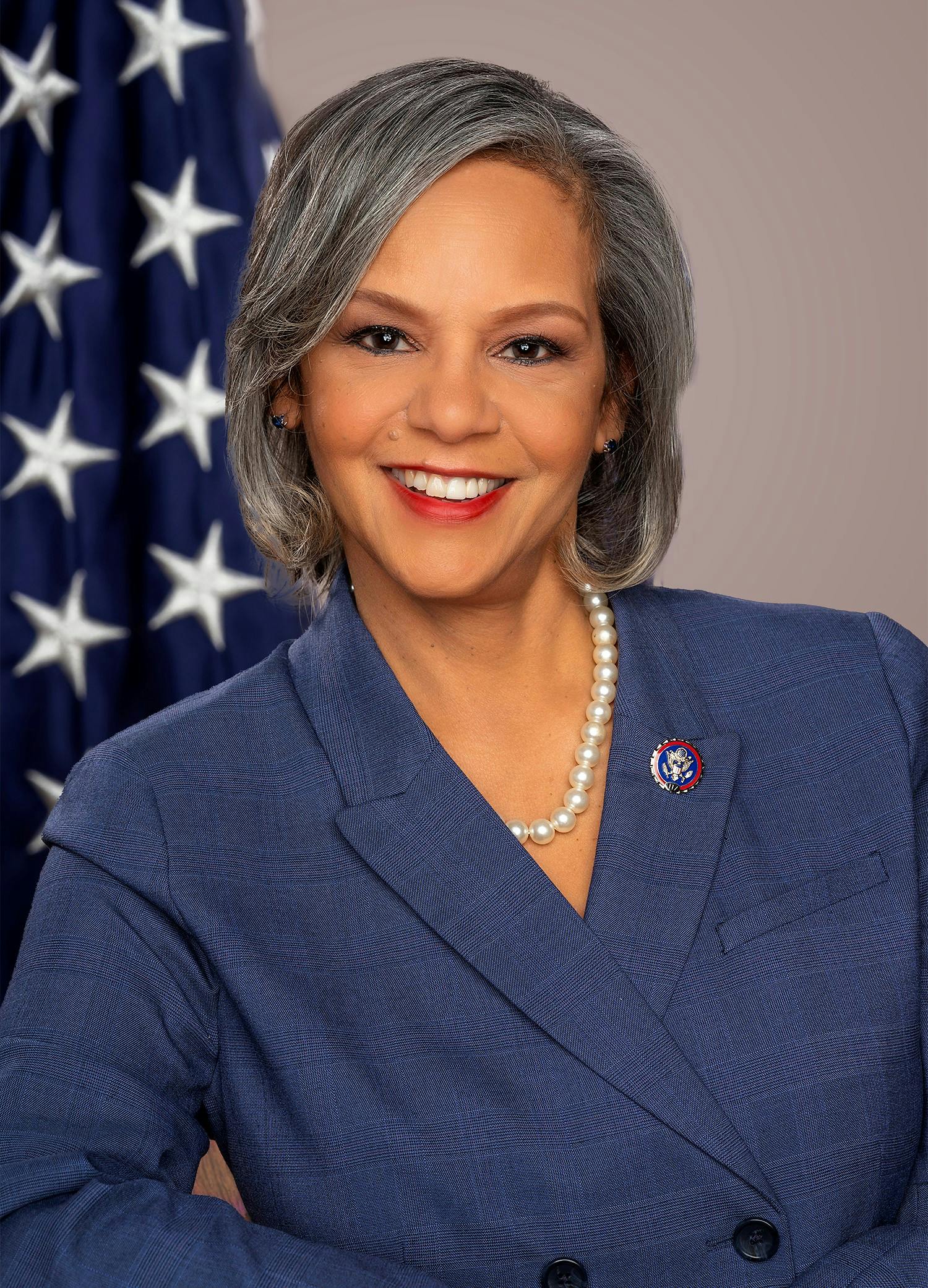

Frederica Wilson

Rep from Florida (D)

Jan Schakowsky

Rep from Illinois (D)

Sharice Davids

Rep from Kansas (D)

Bonnie Watson Coleman

Rep from New Jersey (D)

Pramila Jayapal

Rep from Washington (D)

Diana DeGette

Rep from Colorado (D)

Linda Sánchez

Rep from California (D)

Jerry Nadler

Rep from New York (D)

Sanford Bishop Jr.

Rep from Georgia (D)

Paul Tonko

Rep from New York (D)

Betty McCollum

Rep from Minnesota (D)

Chellie Pingree

Rep from Maine (D)

Alma Adams

Rep from North Carolina (D)

John Larson

Rep from Connecticut (D)

Scott Perry

Rep from Pennsylvania (R)

Rosa DeLauro

Rep from Connecticut (D)

Troy Carter Sr.

Rep from Louisiana (D)

Shontel Brown

Rep from Ohio (D)

Donald Norcross

Rep from New Jersey (D)

Steny Hoyer

Rep from Maryland (D)

Sara Jacobs

Rep from California (D)

Richard Neal

Rep from Massachusetts (D)

Joe Neguse

Rep from Colorado (D)

Mark Takano

Rep from California (D)

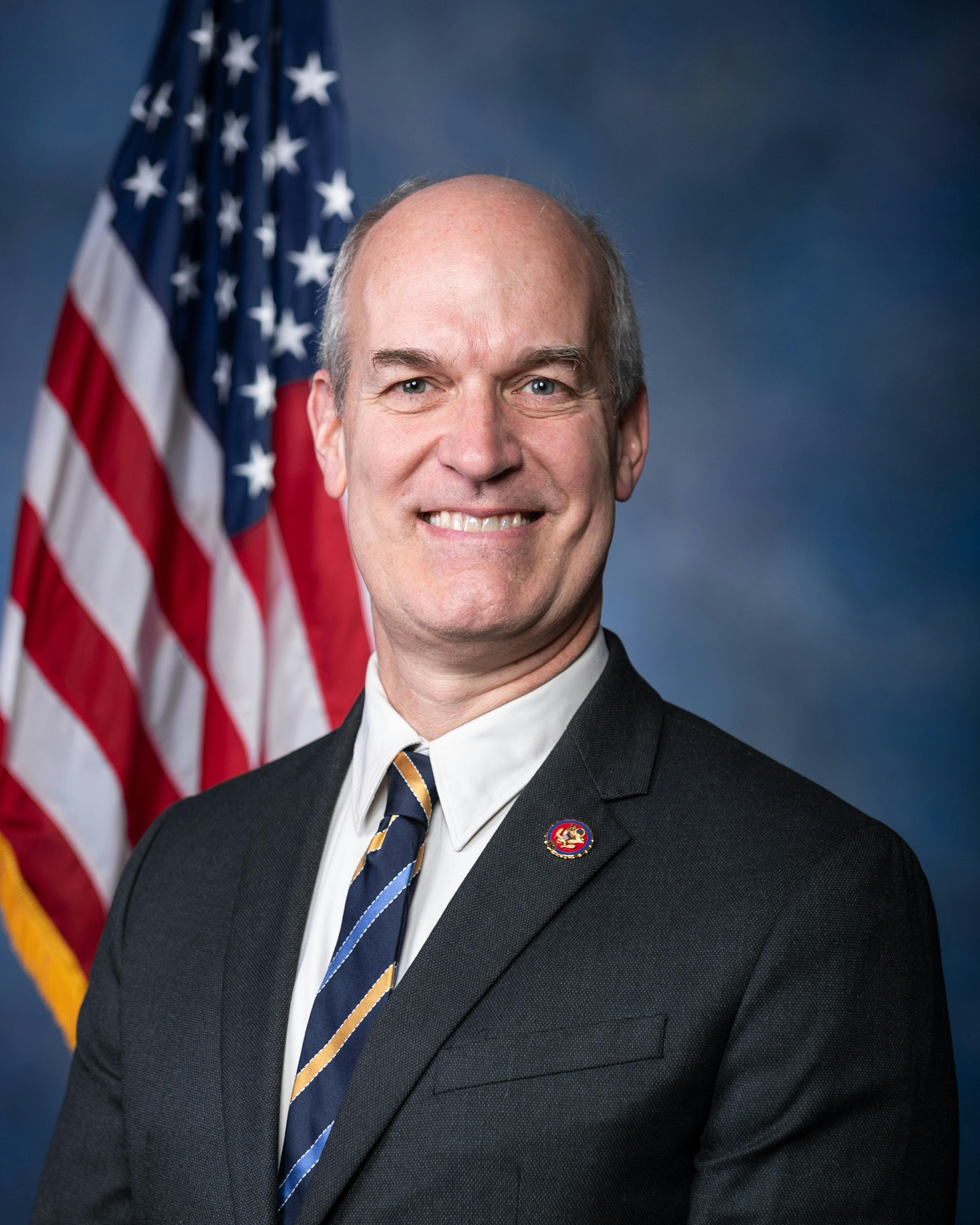

Adam Smith

Rep from Washington (D)

Alexandria Ocasio-Cortez

Rep from New York (D)

Bobby Scott

Rep from Virginia (D)

Joe Courtney

Rep from Connecticut (D)

Lauren Underwood

Rep from Illinois (D)

Jim Clyburn

Rep from South Carolina (D)

Deborah Ross

Rep from North Carolina (D)

Judy Chu

Rep from California (D)

Marcy Kaptur

Rep from Ohio (D)

Danny Davis

Rep from Illinois (D)

Matt Rosendale

Rep from Montana (R)

Yvette Clarke

Rep from New York (D)

Veronica Escobar

Rep from Texas (D)

Gerry Connolly

Rep from Virginia (D)

Bill Keating

Rep from Massachusetts (D)

Jason Crow

Rep from Colorado (D)

Jim McGovern

Rep from Massachusetts (D)

Madeleine Dean

Rep from Pennsylvania (D)

Frank Mrvan

Rep from Indiana (D)

Kathy Castor

Rep from Florida (D)

Bennie Thompson

Rep from Mississippi (D)

Mark DeSaulnier

Rep from California (D)

Ed Case

Rep from Hawaii (D)

Teresa Leger Fernandez

Rep from New Mexico (D)

Debbie Dingell

Rep from Michigan (D)

John Garamendi

Rep from California (D)

Lizzie Fletcher

Rep from Texas (D)

Katie Porter

Rep from California (D)

Joe Morelle

Rep from New York (D)

Kweisi Mfume

Rep from Maryland (D)

Peter Welch

Senator from Vermont (D)

Nanette Barragán

Rep from California (D)

Hank Johnson

Rep from Georgia (D)

Suzanne Bonamici

Rep from Oregon (D)

Gwen Moore

Rep from Wisconsin (D)

André Carson

Rep from Indiana (D)

Dwight Evans

Rep from Pennsylvania (D)

David Trone

Rep from Maryland (D)

Dutch Ruppersberger

Rep from Maryland (D)

Barbara Lee

Rep from California (D)

Jennifer Wexton

Rep from Virginia (D)

Kathy Manning

Rep from North Carolina (D)

Matt Cartwright

Rep from Pennsylvania (D)

Bill Pascrell Jr.

Rep from New Jersey (D)

Peter Meijer

Rep from Michigan (R)

Derek Kilmer

Rep from Washington (D)

Grace Napolitano

Rep from California (D)

John Sarbanes

Rep from Maryland (D)

Cori Bush

Rep from Missouri (D)

Tony Cárdenas

Rep from California (D)

Dan Kildee

Rep from Michigan (D)

Jamaal Bowman

Rep from New York (D)

Alan Lowenthal

Rep from California (D)

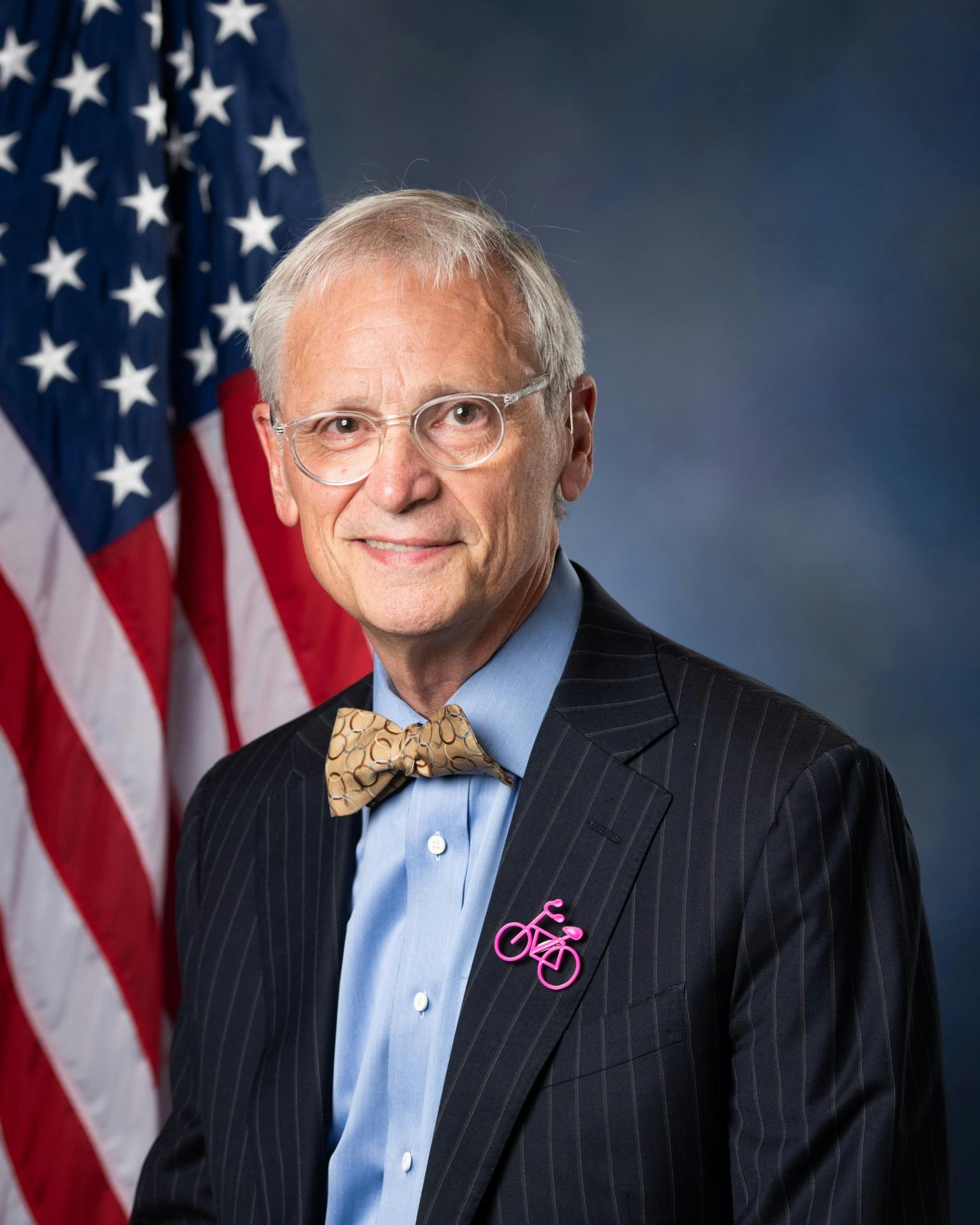

Earl Blumenauer

Rep from Oregon (D)

John Katko

Rep from New York (R)

Carolyn Bourdeaux

Rep from Georgia (D)

Recent Stances By Representatives On Crypto

Neutral Representatives

Jake Auchincloss

Rep from Massachusetts (D)

Marjorie Greene

Rep from Georgia (R)

Jim Himes

Rep from Connecticut (D)

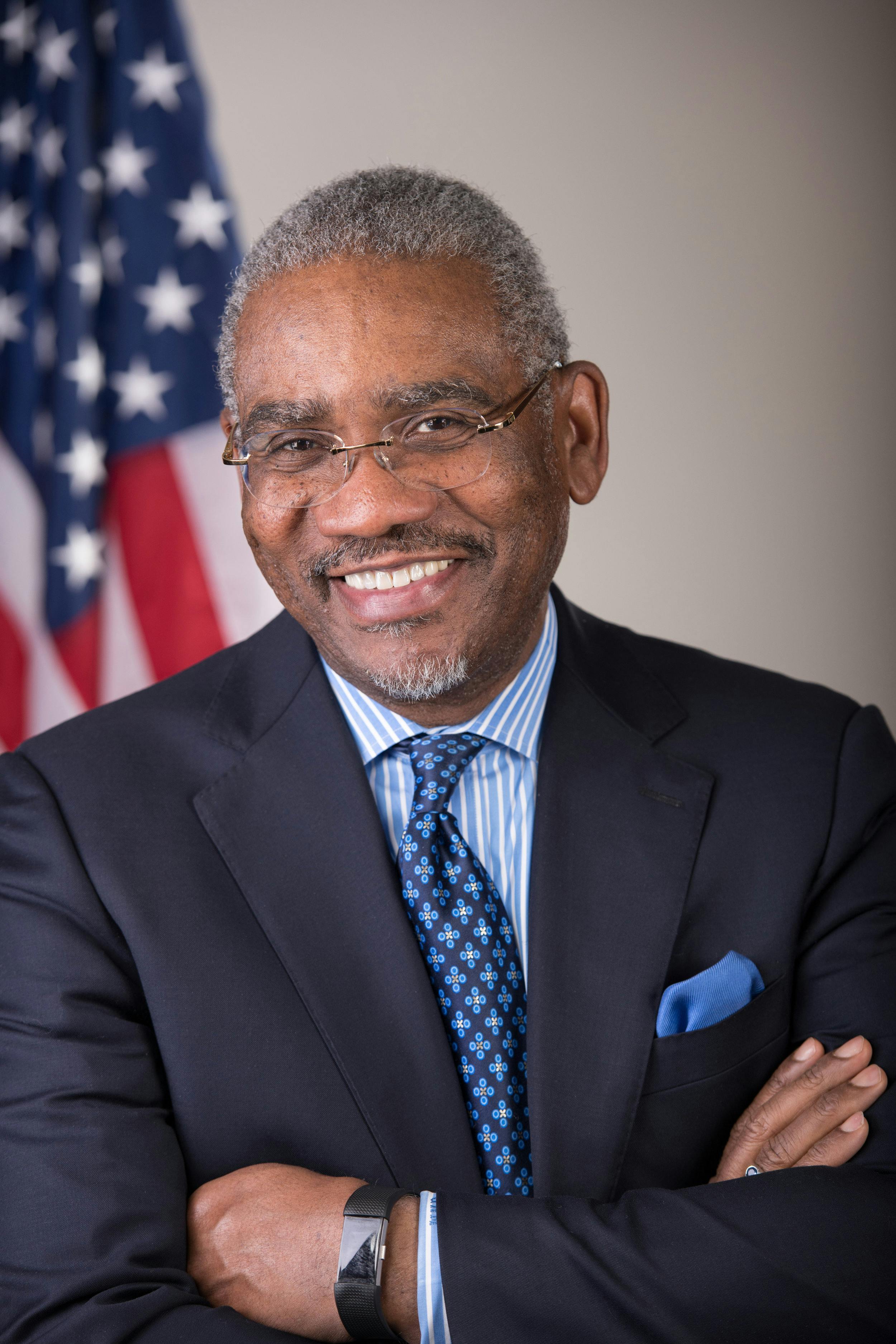

Gregory Meeks

Rep from New York (D)

Michael Cloud

Rep from Texas (R)

Chip Roy

Rep from Texas (R)

Lisa Blunt Rochester

Senator from Delaware (D)

Andy Biggs

Rep from Arizona (R)

Eric Swalwell

Rep from California (D)

Andy Harris

Rep from Maryland (R)

Scott Peters

Rep from California (D)

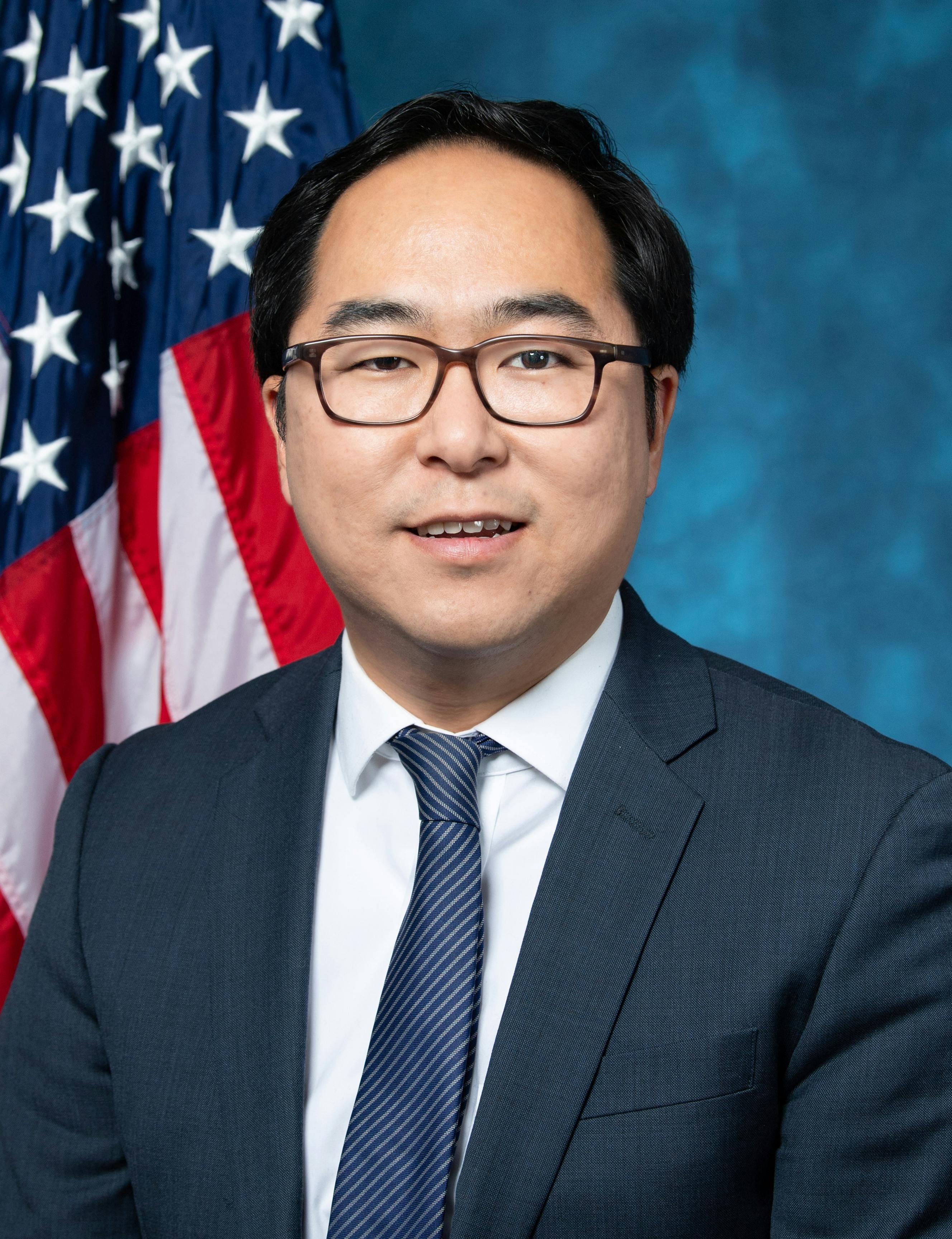

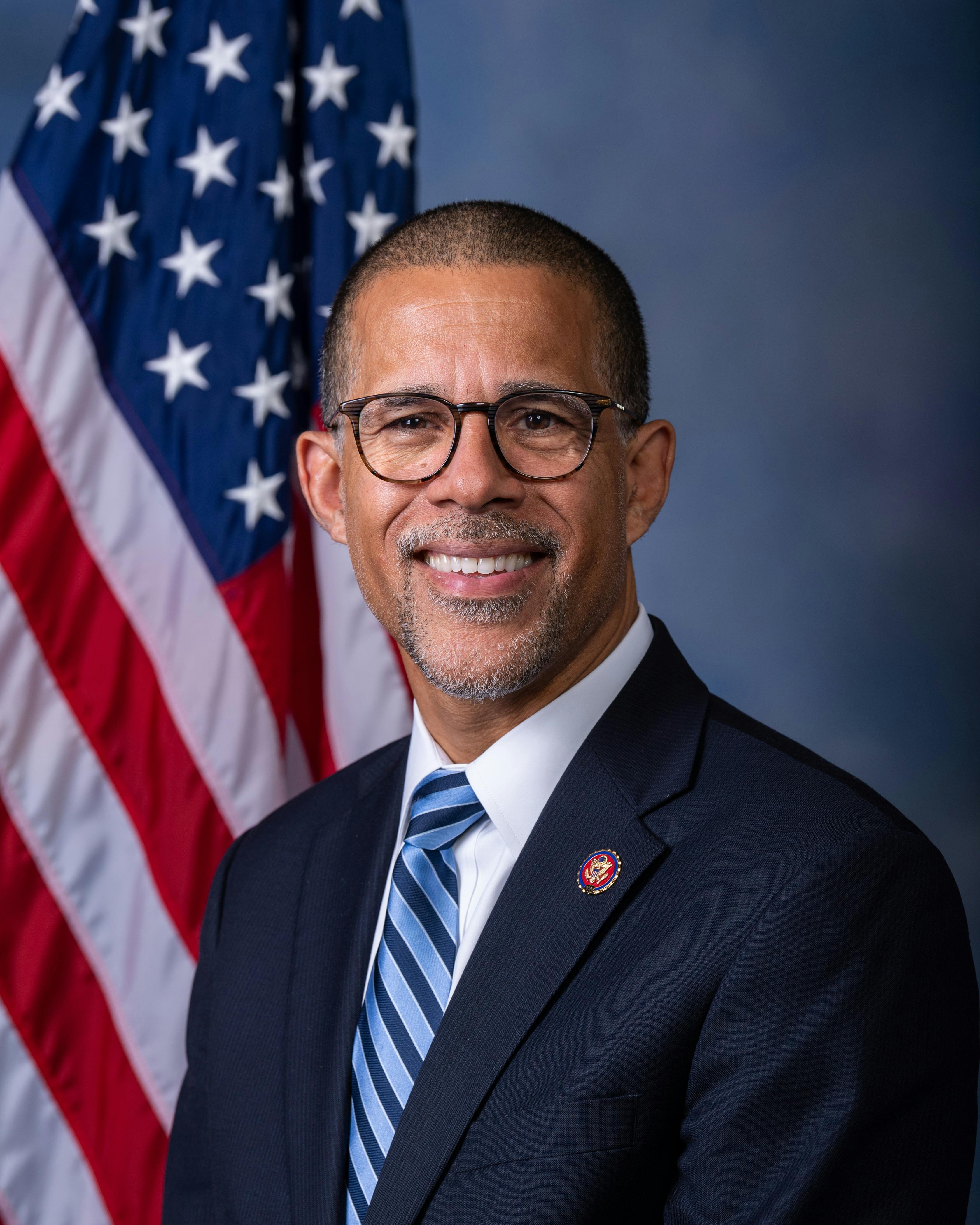

Andy Kim

Senator from New Jersey (D)

Robin Kelly

Rep from Illinois (D)

Morgan Griffith

Rep from Virginia (R)

Doris Matsui

Rep from California (D)

Lori Trahan

Rep from Massachusetts (D)

Hakeem Jeffries

Rep from New York (D)

Austin Scott

Rep from Georgia (R)

Grace Meng

Rep from New York (D)

Rick Larsen

Rep from Washington (D)

Julia Brownley

Rep from California (D)

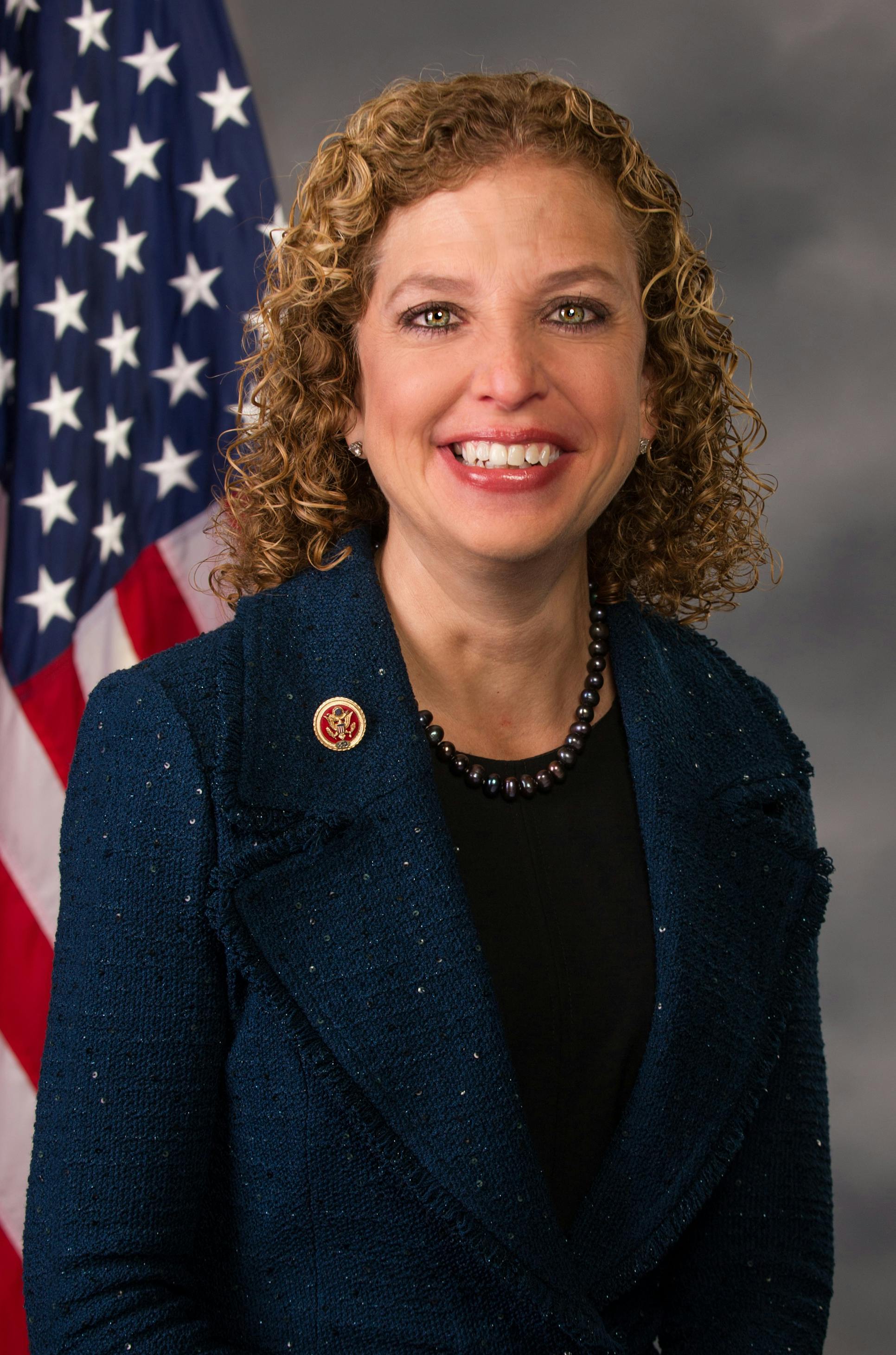

Debbie Wasserman Schultz

Rep from Florida (D)

Dina Titus

Rep from Nevada (D)

Mike Quigley

Rep from Illinois (D)

Russ Fulcher

Rep from Idaho (R)

Adriano Espaillat

Rep from New York (D)

Katherine Clark

Rep from Massachusetts (D)

Sheila Cherfilus-McCormick

Rep from Florida (D)

Antonio Delgado

Rep from New York (D)

Jim Langevin

Rep from Rhode Island (D)

Al Lawson

Rep from Florida (D)

Lee Zeldin

Rep from New York (R)

Andy Levin

Rep from Michigan (D)

Anthony Brown

Rep from Maryland (D)

Sean Maloney

Rep from New York (D)

G. K. Butterfield

Rep from North Carolina (D)

David Price

Rep from North Carolina (D)

Jaime Herrera Beutler

Rep from Washington (R)

Donald Payne Jr.

Rep from New Jersey (D)

Albio Sires

Rep from New Jersey (D)

Mike Doyle

Rep from Pennsylvania (D)

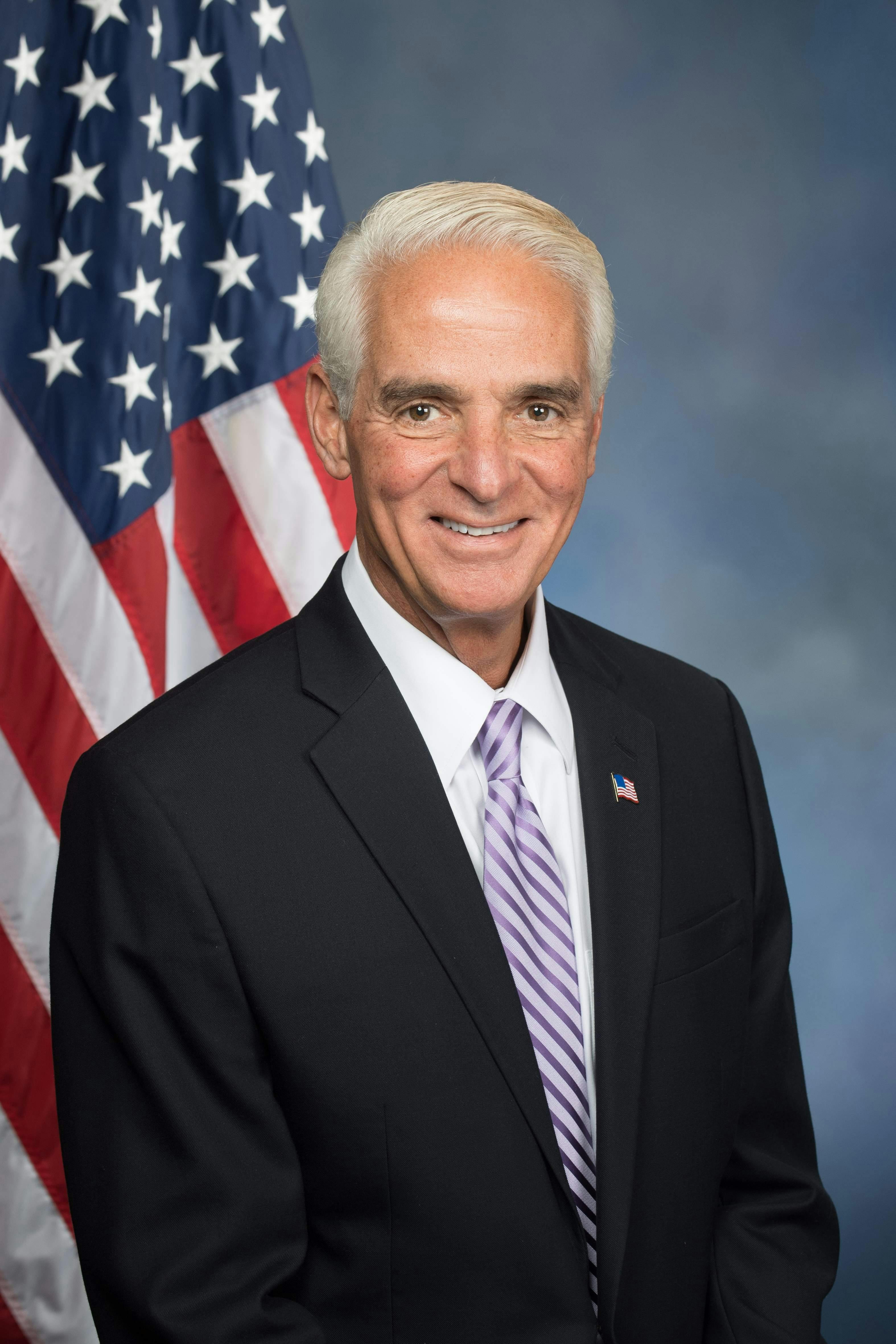

Charlie Crist

Rep from Florida (D)

Conor Lamb

Rep from Pennsylvania (D)

CR

Cedric Richmond

Rep from Louisiana (D)

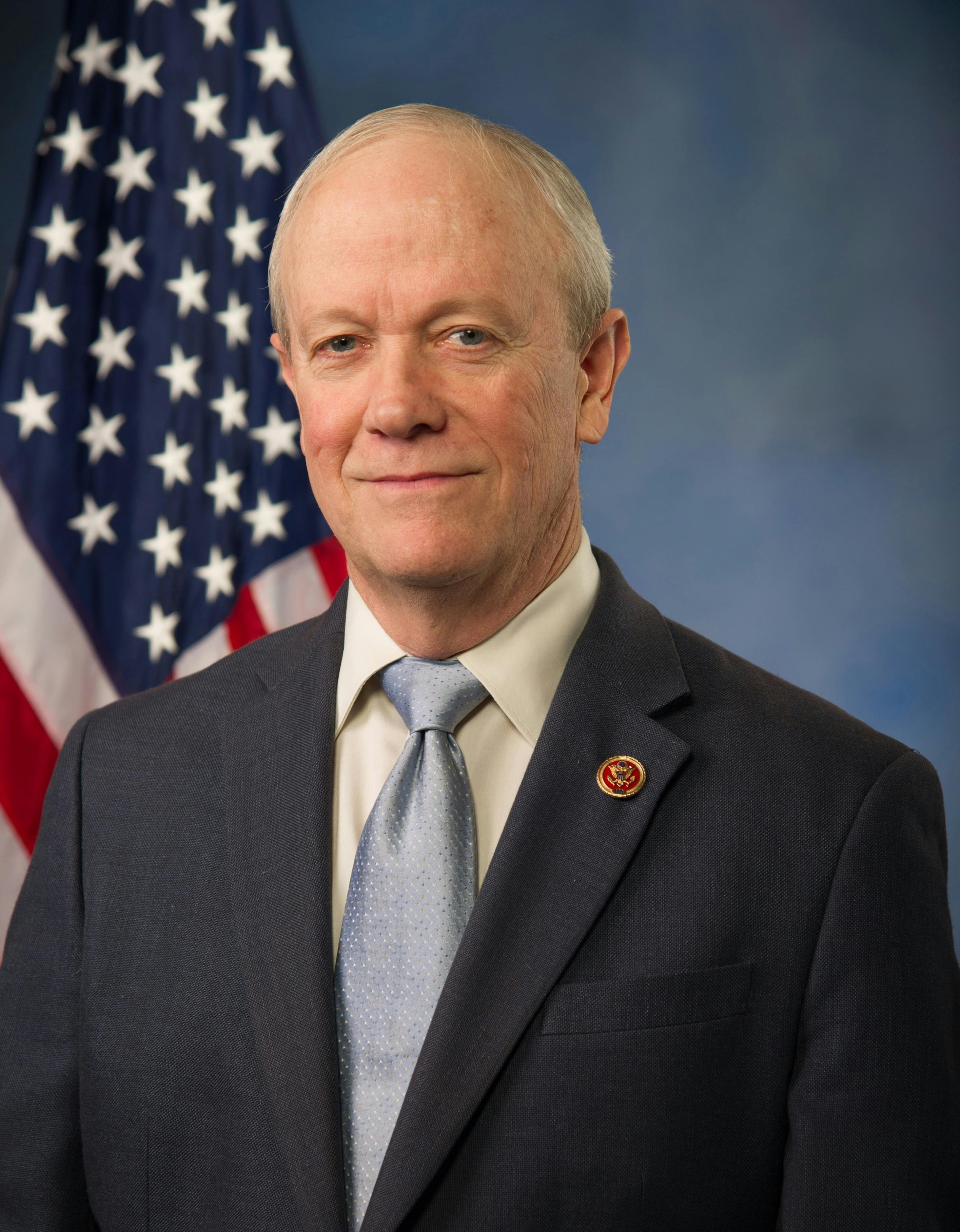

Bob Gibbs

Rep from Ohio (R)

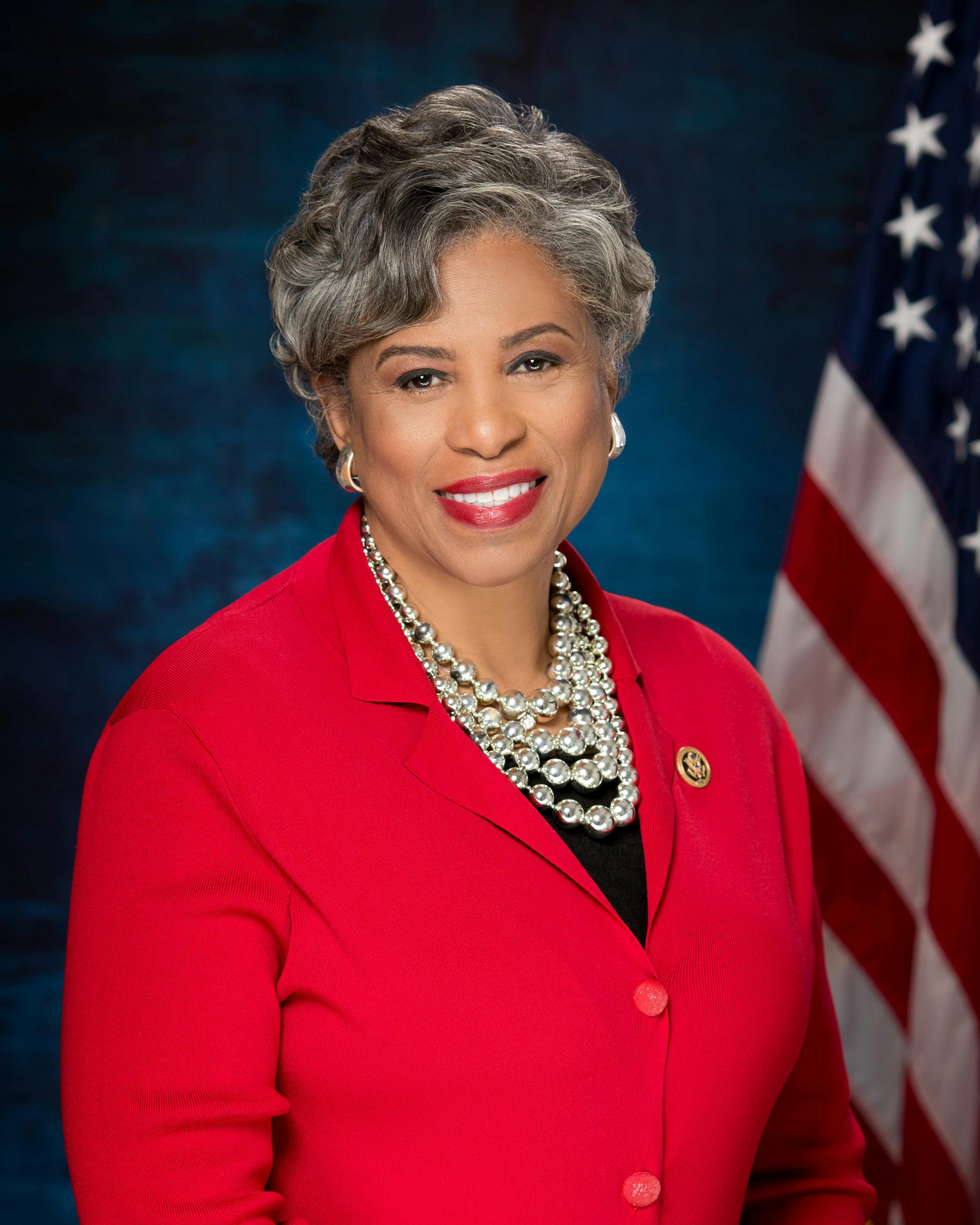

Brenda Lawrence

Rep from Michigan (D)

Raúl Grijalva

Rep from Arizona (D)

Vicky Hartzler

Rep from Missouri (R)

Karen Bass

Rep from California (D)

Jerry McNerney

Rep from California (D)

Filemon Vela

Rep from Texas (D)

MF

Marcia Fudge

Rep from Ohio (D)

JS

Joe Sempolinski

Rep from New York (R)

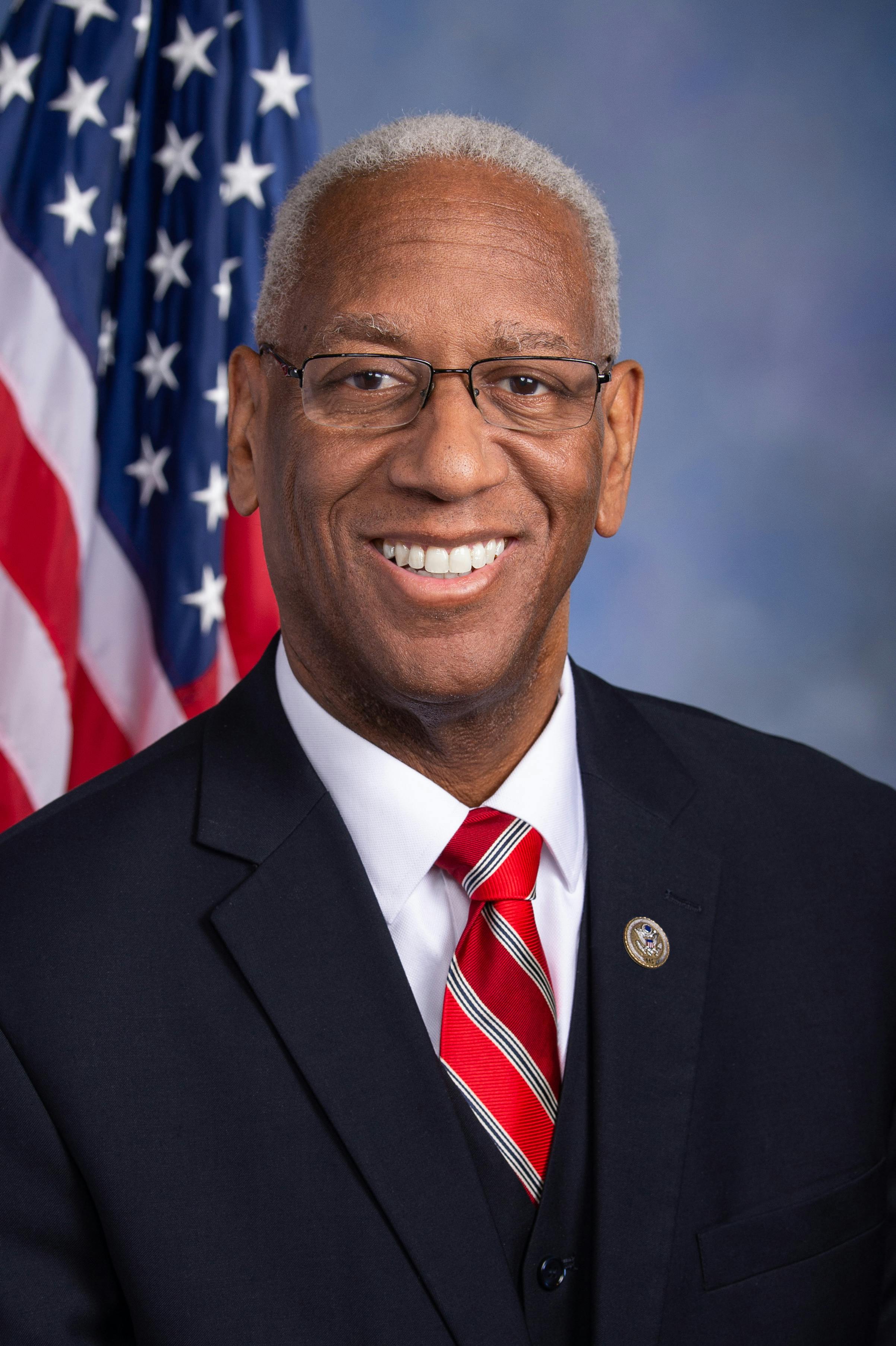

Donald McEachin

Rep from Virginia (D)

Ron Kind

Rep from Wisconsin (D)

Ann Kirkpatrick

Rep from Arizona (D)

Stephanie Murphy

Rep from Florida (D)

Mo Brooks

Rep from Alabama (R)

Brian Higgins

Rep from New York (D)

Kai Kahele

Rep from Hawaii (D)

Yvette Herrell

Rep from New Mexico (R)

Mike Gallagher

Rep from Wisconsin (R)

Jody Hice

Rep from Georgia (R)

Bobby Rush

Rep from Illinois (D)

Fred Upton

Rep from Michigan (R)

Val Demings

Rep from Florida (D)

Steven Palazzo

Rep from Mississippi (R)

Louie Gohmert

Rep from Texas (R)

Don Young

Rep from Alaska (R)

Bill Johnson

Rep from Ohio (R)

Ed Perlmutter

Rep from Colorado (D)

Jackie Walorski

Rep from Indiana (R)

Cheri Bustos

Rep from Illinois (D)

Amata Radewagen

Rep from American Samoa (R)

Fred Keller

Rep from Pennsylvania (R)

Jackie Speier

Rep from California (D)

MS

Michael San Nicolas

Rep from Guam (D)

Liz Cheney

Rep from Wyoming (R)

Tom O'Halleran

Rep from Arizona (D)

GS

Gregorio Sablan

Rep from Northern Mariana Islands (D)

Adam Kinzinger

Rep from Illinois (R)

Ted Deutch

Rep from Florida (D)

Van Taylor

Rep from Texas (R)

Chris Stewart

Rep from Utah (R)

Chris Jacobs

Rep from New York (R)

Kurt Schrader

Rep from Oregon (D)

Lucille Roybal-Allard

Rep from California (D)

Sheila Jackson Lee

Rep from Texas (D)

Kathleen Rice

Rep from New York (D)

Marie Newman

Rep from Illinois (D)

Jim Hagedorn

Rep from Minnesota (R)

David McKinley

Rep from West Virginia (R)

Rodney Davis

Rep from Illinois (R)

Jenniffer González-Colón

Rep from Puerto Rico (R)

Peter DeFazio

Rep from Oregon (D)

John Yarmuth

Rep from Kentucky (D)

Steve Chabot

Rep from Ohio (R)

Tom Reed

Rep from New York (R)

RW

Ron Wright

Rep from Texas (R)

Tom Malinowski

Rep from New Jersey (D)

Mayra Flores

Rep from Texas (R)

Tom Rice

Rep from South Carolina (R)

Billy Long

Rep from Missouri (R)

David Cicilline

Rep from Rhode Island (D)

Eddie Johnson

Rep from Texas (D)

DH

Debra Haaland

Rep from New Mexico (D)

Eleanor Norton

Rep from District of Columbia (D)

Carolyn Maloney

Rep from New York (D)

SS

Steve Stivers

Rep from Ohio (R)

Devin Nunes

Rep from California (R)

Ken Buck

Rep from Colorado (R)

Elaine Luria

Rep from Virginia (D)

AH

Alcee Hastings

Rep from Florida (D)

Jeff Fortenberry

Rep from Nebraska (R)

CC

Connie Conway

Rep from California (R)

Jim Cooper

Rep from Tennessee (D)

Cindy Axne

Rep from Iowa (D)

Securing US elections

Securing US elections

BREAKING CRYPTO NEWS

BREAKING CRYPTO NEWS