Is The Bill "CLARITY Act" Crypto Friendly?

Description:

The "Digital Asset Market Clarity Act of 2025," or "CLARITY Act of 2025," establishes a regulatory framework for digital commodities, granting the CFTC exclusive jurisdiction over spot market transactions and related entities like exchanges, brokers, and dealers. It aims to differentiate digital commodities from securities, introduce a "mature blockchain system" concept for regulatory exemptions, and protect individual self-custody rights.

Date Introduced:

2025-05-29

Status:

Introduced and Sponsored

Stance on Crypto:

Very Pro-Crypto

Links:

Primary Analysis:

Primary Analysis:

This bill addresses regulatory uncertainty by clearly defining the roles of federal agencies and adapting existing rules to reflect the unique nature of blockchain-based systems.

- Clarifies Regulatory Boundaries: Sets clear standards to determine whether a digital asset is regulated by the SEC as an investment contract asset or by the CFTC as a digital commodity. This provides legal certainty for developers, investors, and exchanges.

- Grants CFTC Spot Market Authority: The bill gives the CFTC oversight of digital commodity spot markets, closing a key regulatory gap. This authority allows the agency to monitor trading activity and enforce fair practices. It reflects a consistent priority across multiple administrations, from Obama to Biden to Trump.

- Updates SEC Oversight: Adjusts registration and disclosure requirements under current securities laws to account for the distinct features of digital assets, ensuring investor protection while encouraging responsible innovation.

- Creates a Clear Path for Token Launches: Provides a four-year regulatory window for new token projects to raise up to $75 million per year under SEC supervision. As these projects decentralize and the underlying networks mature, they gain broader access to secondary markets.

- Strong Consumer Protections: The bill requires developers to disclose project ownership, governance, and structure. It also mandates that brokers, dealers, and exchanges register, provide customer disclosures, segregate assets, and operate transparently to prevent conflicts of interest.

- Strengthens National Security: The bill supports U.S. leadership in digital finance by ensuring blockchain innovation can happen domestically under a clear regulatory framework, rather than being pushed offshore.

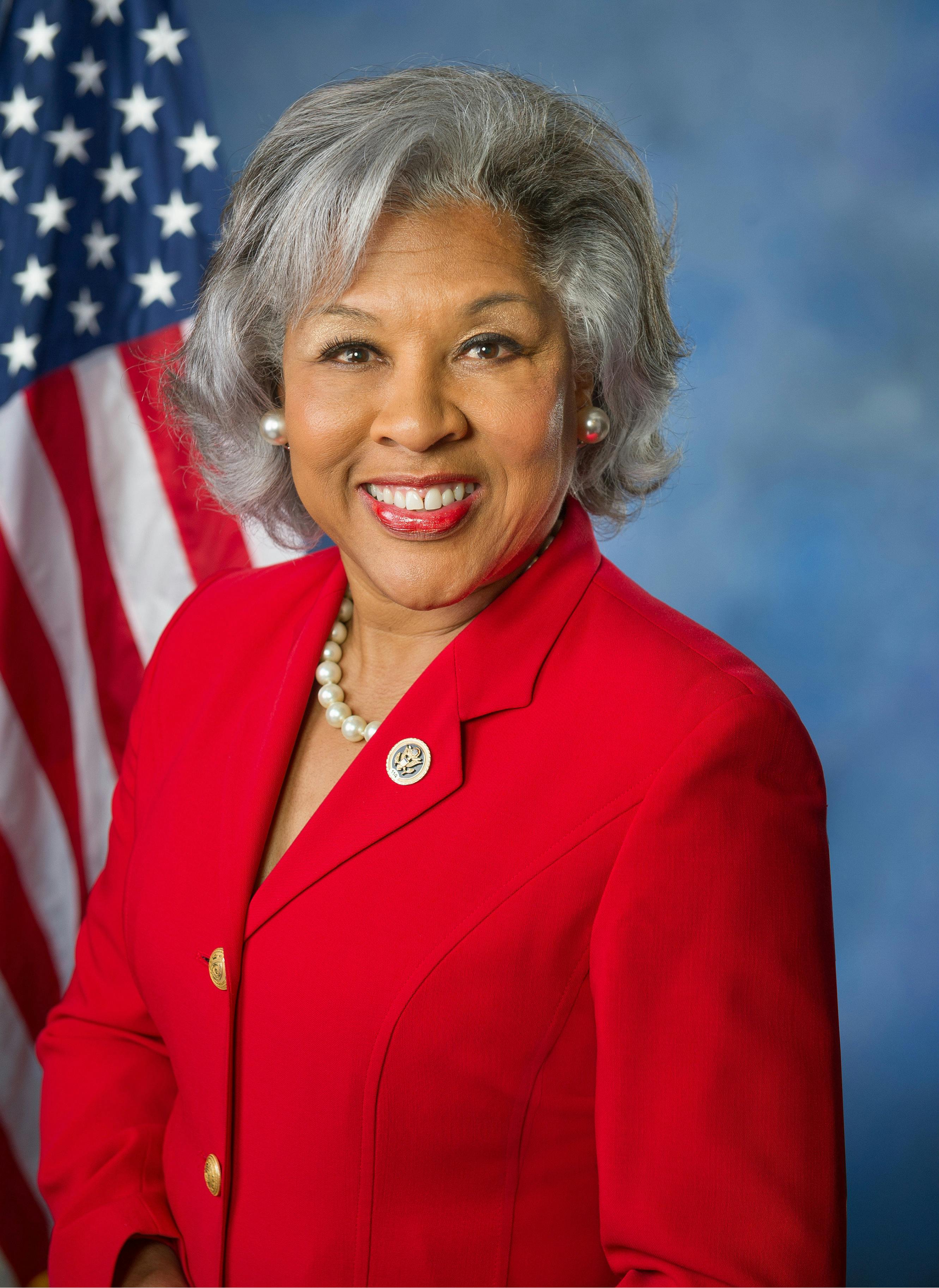

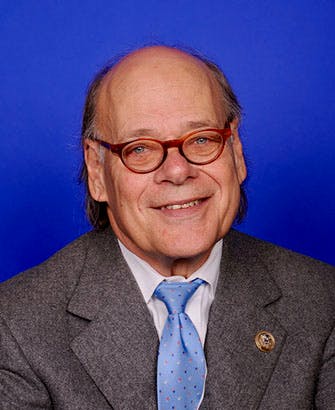

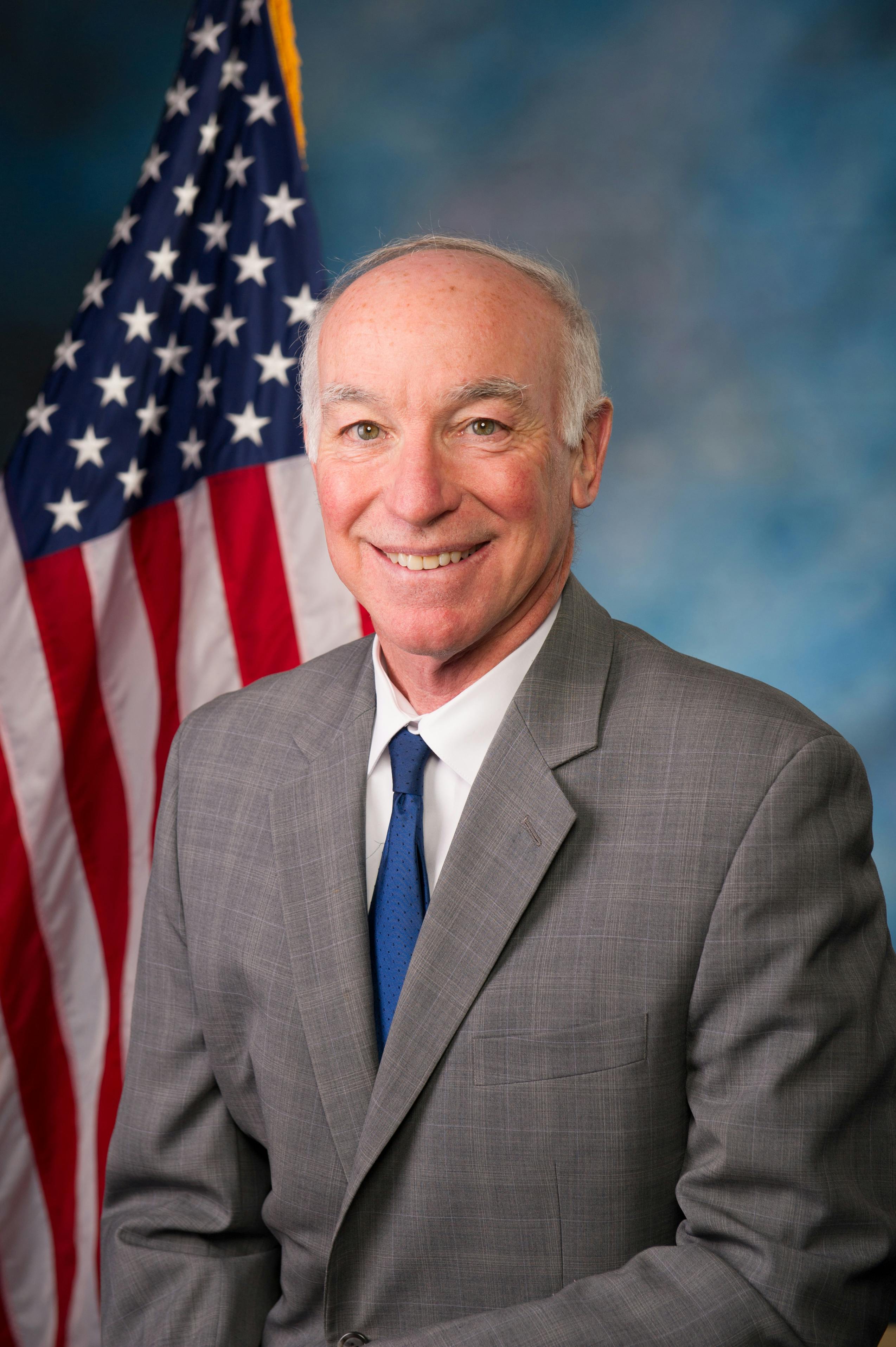

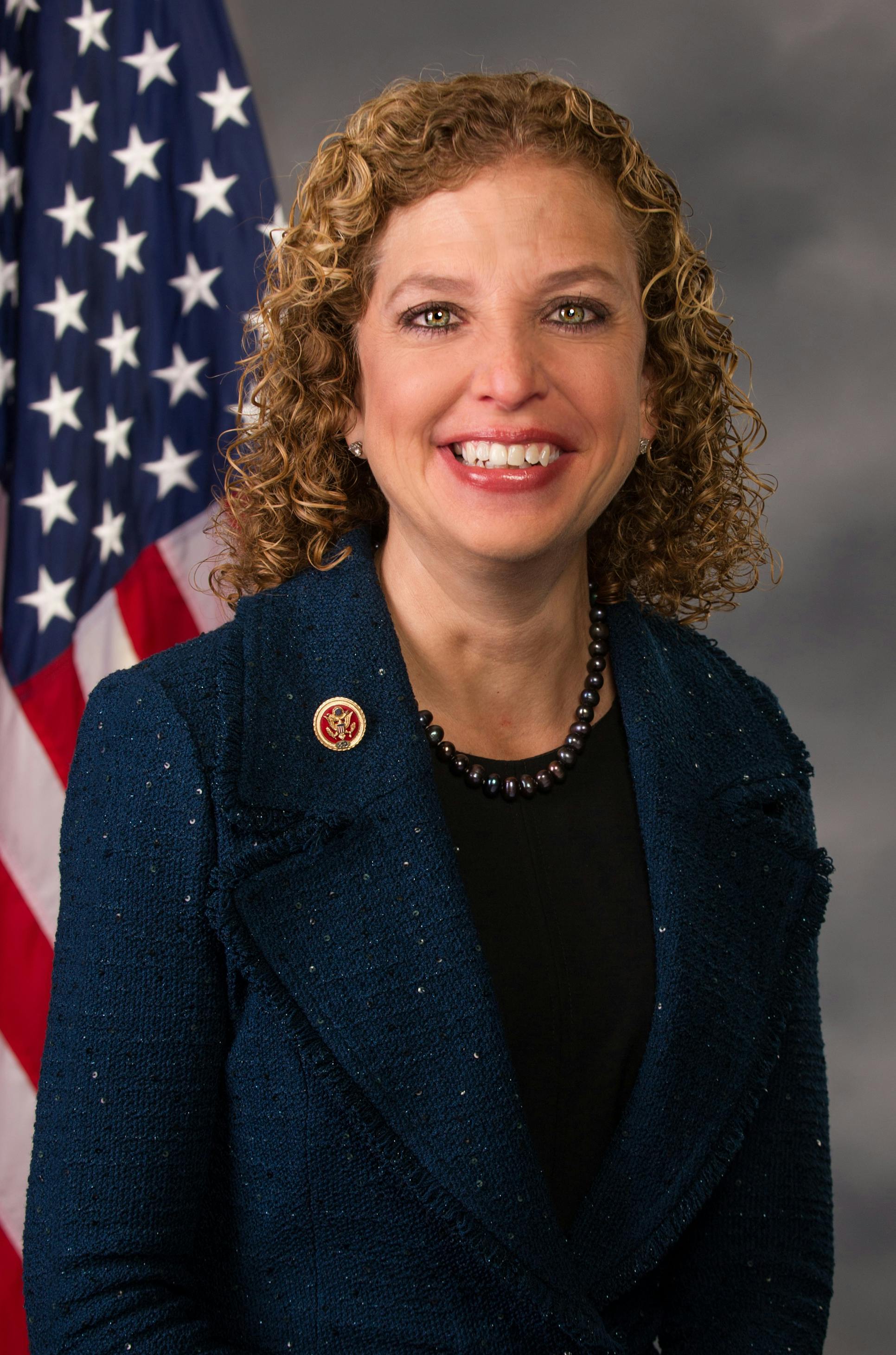

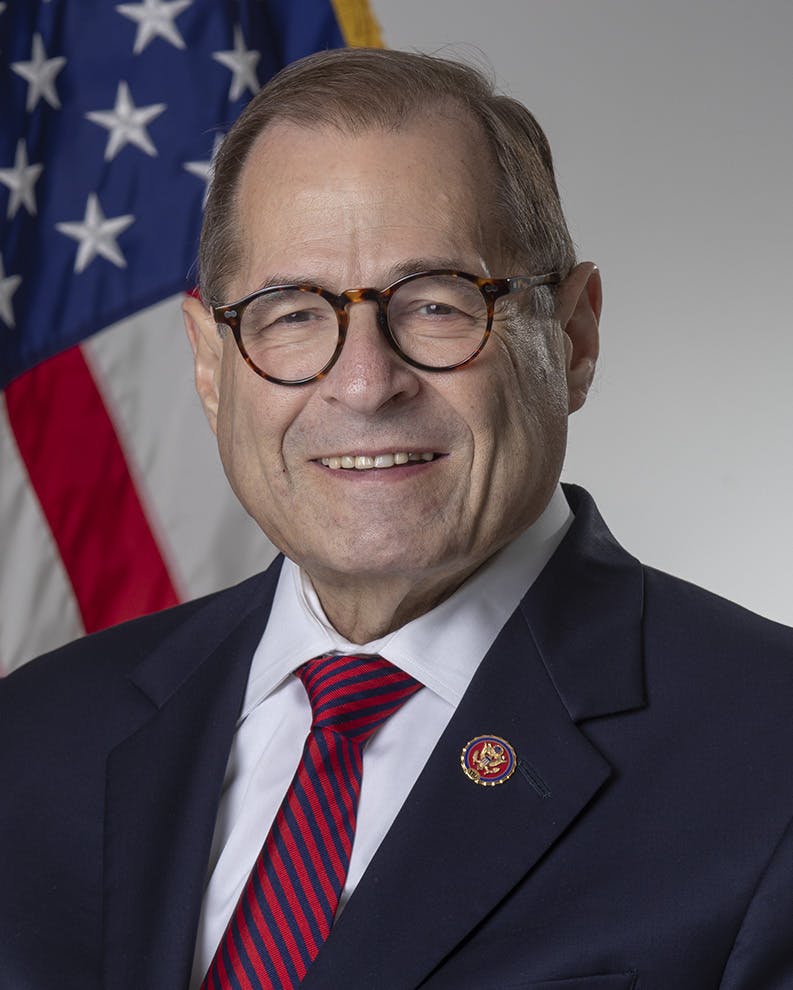

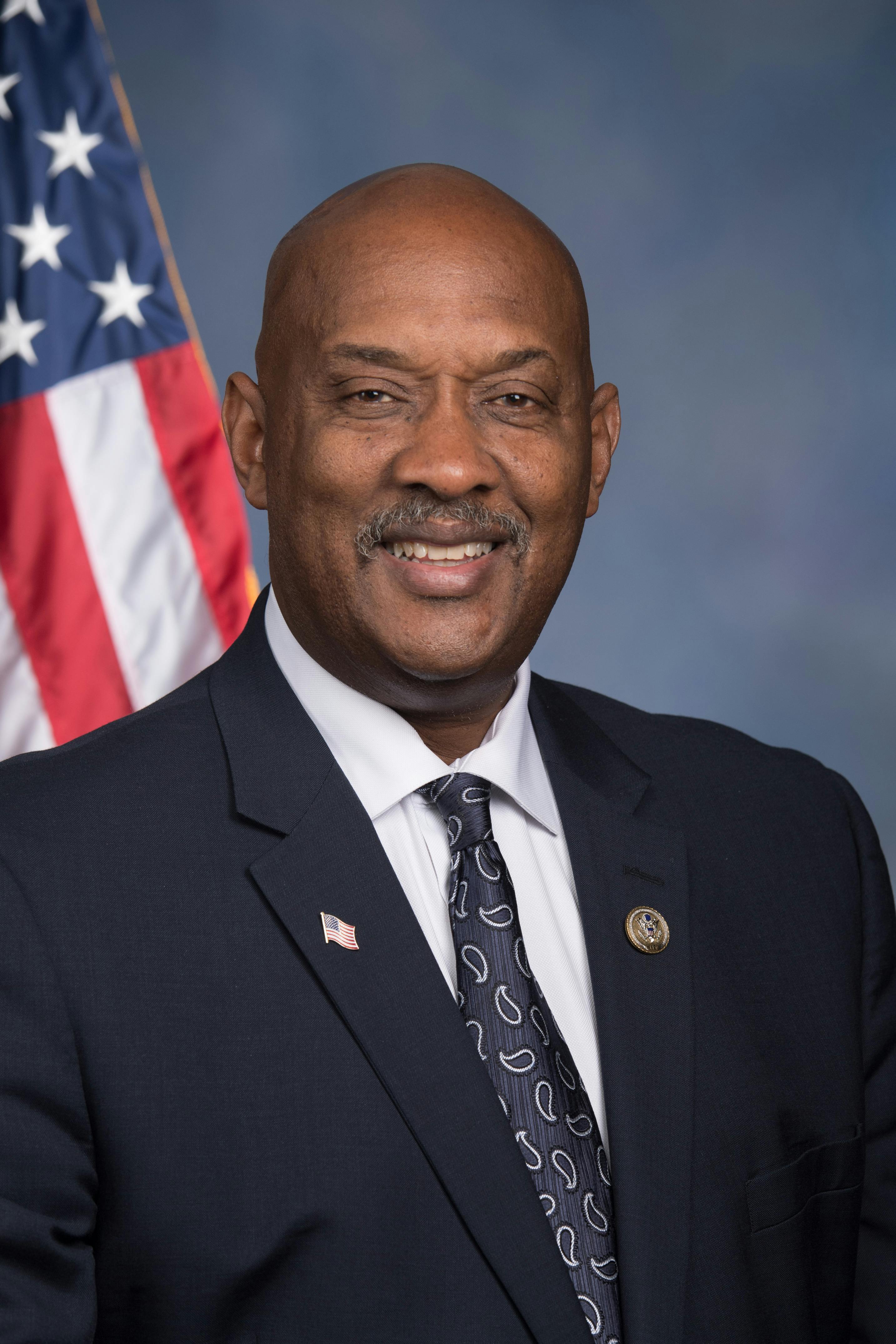

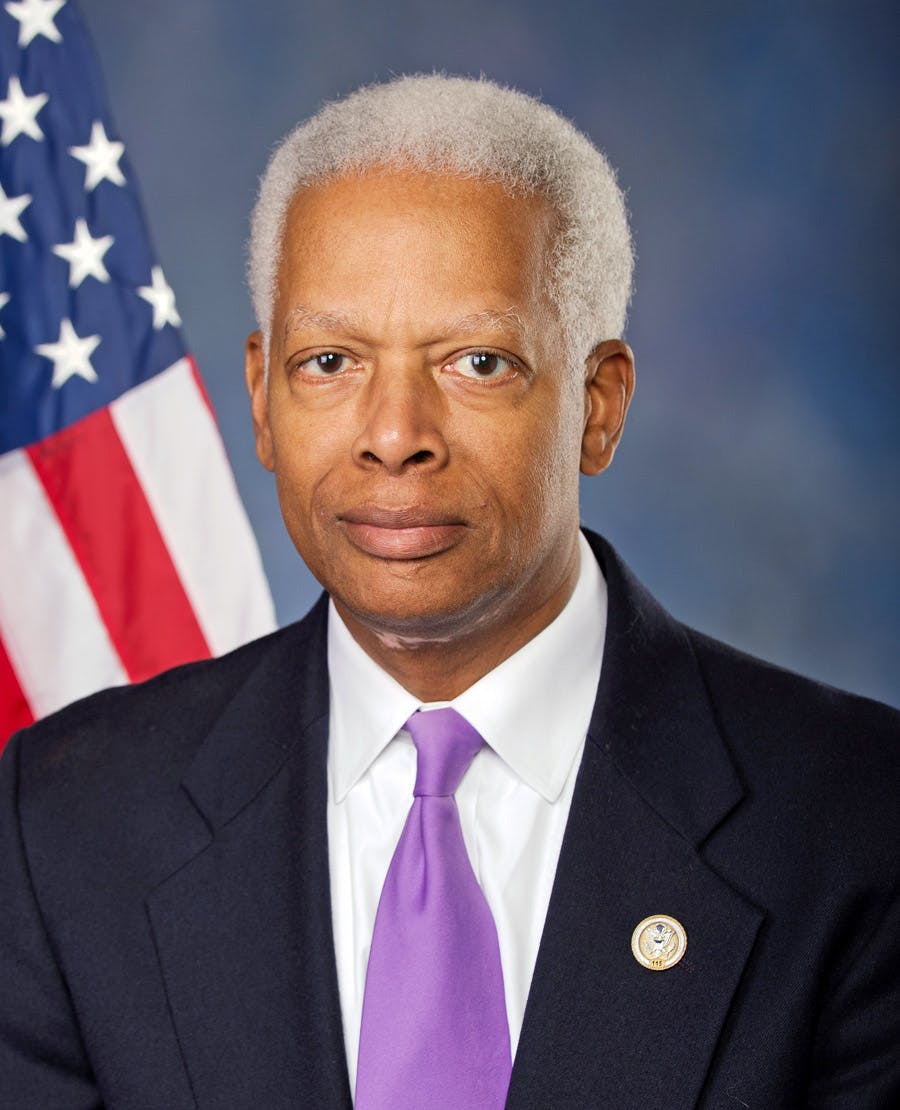

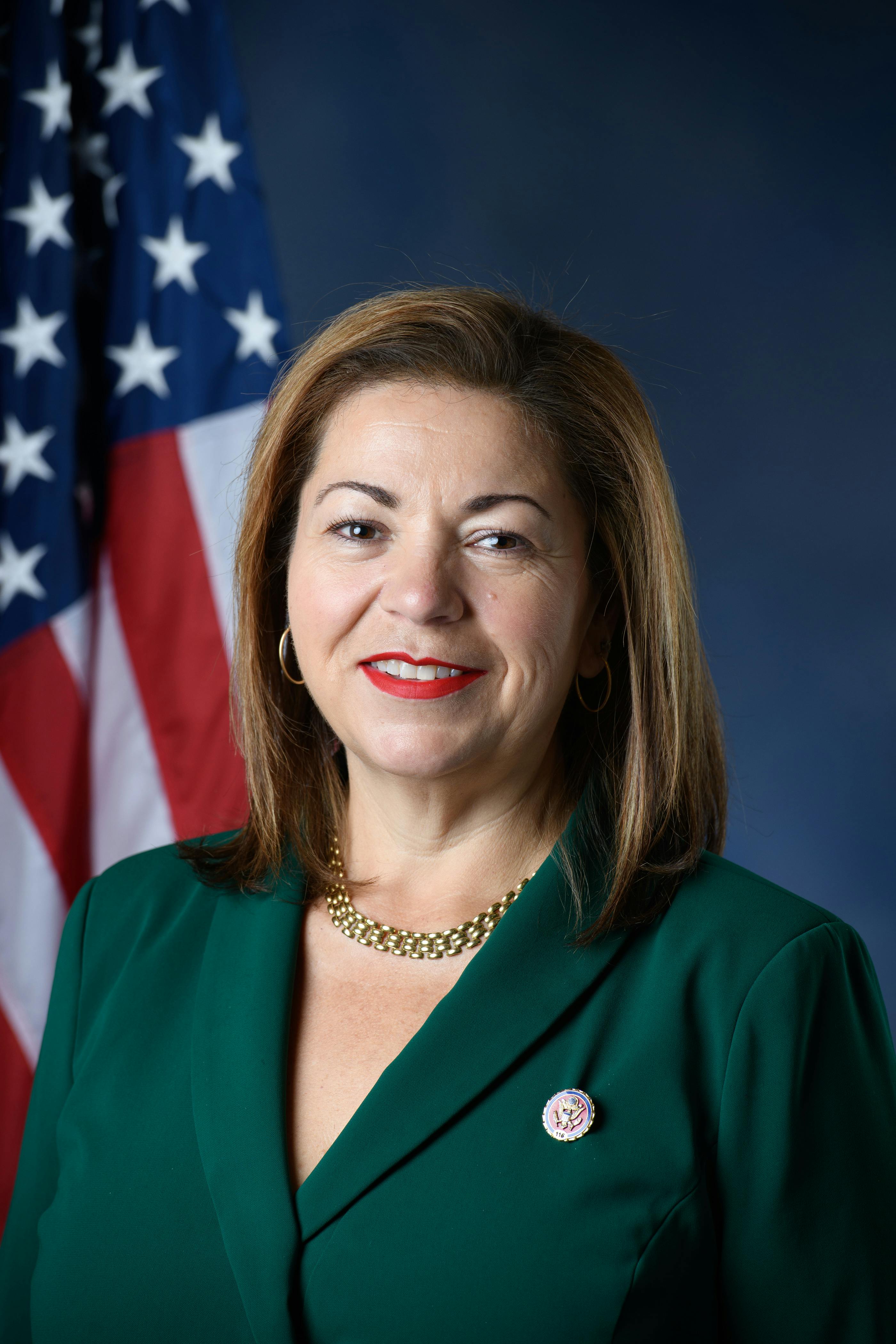

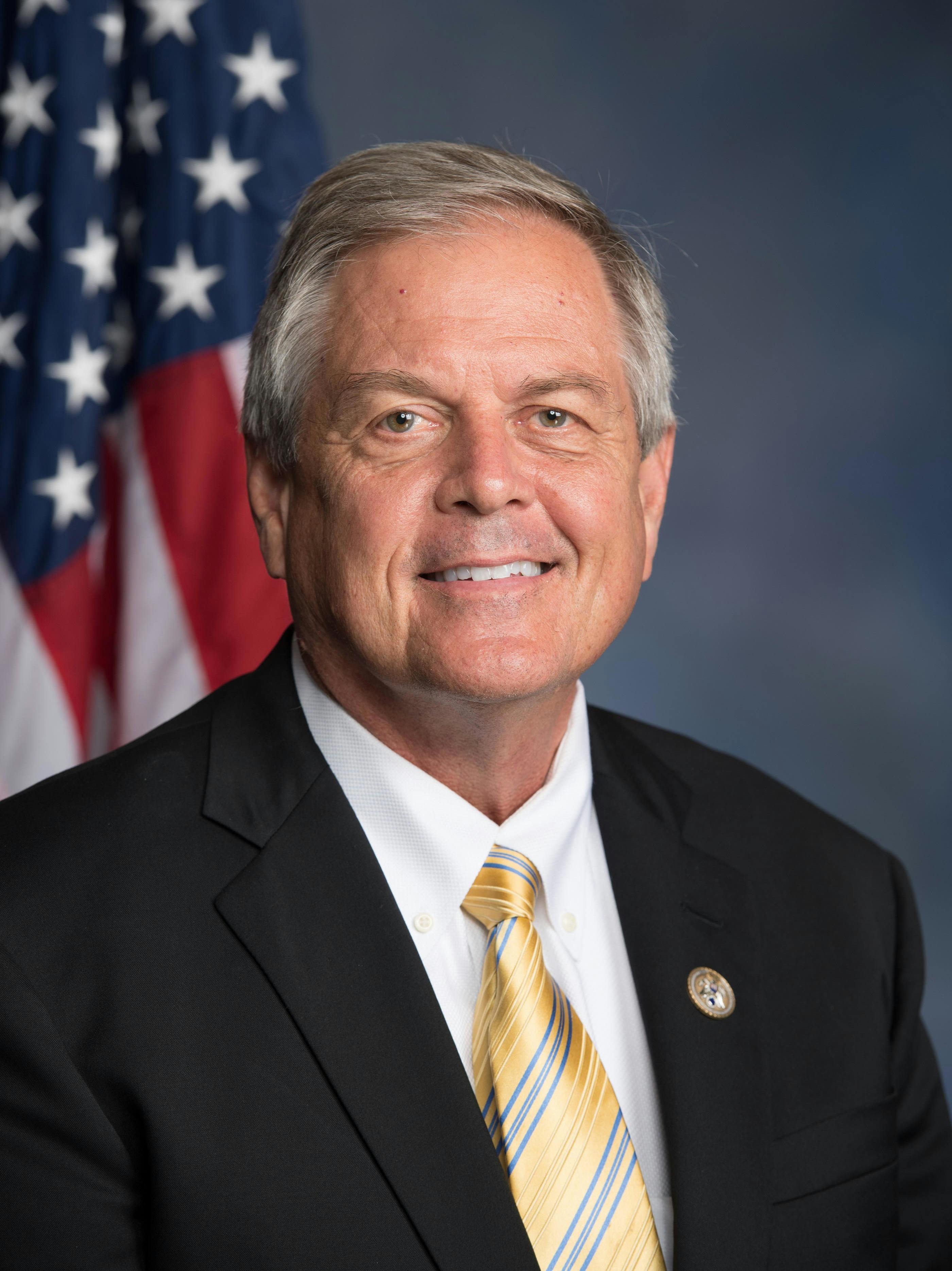

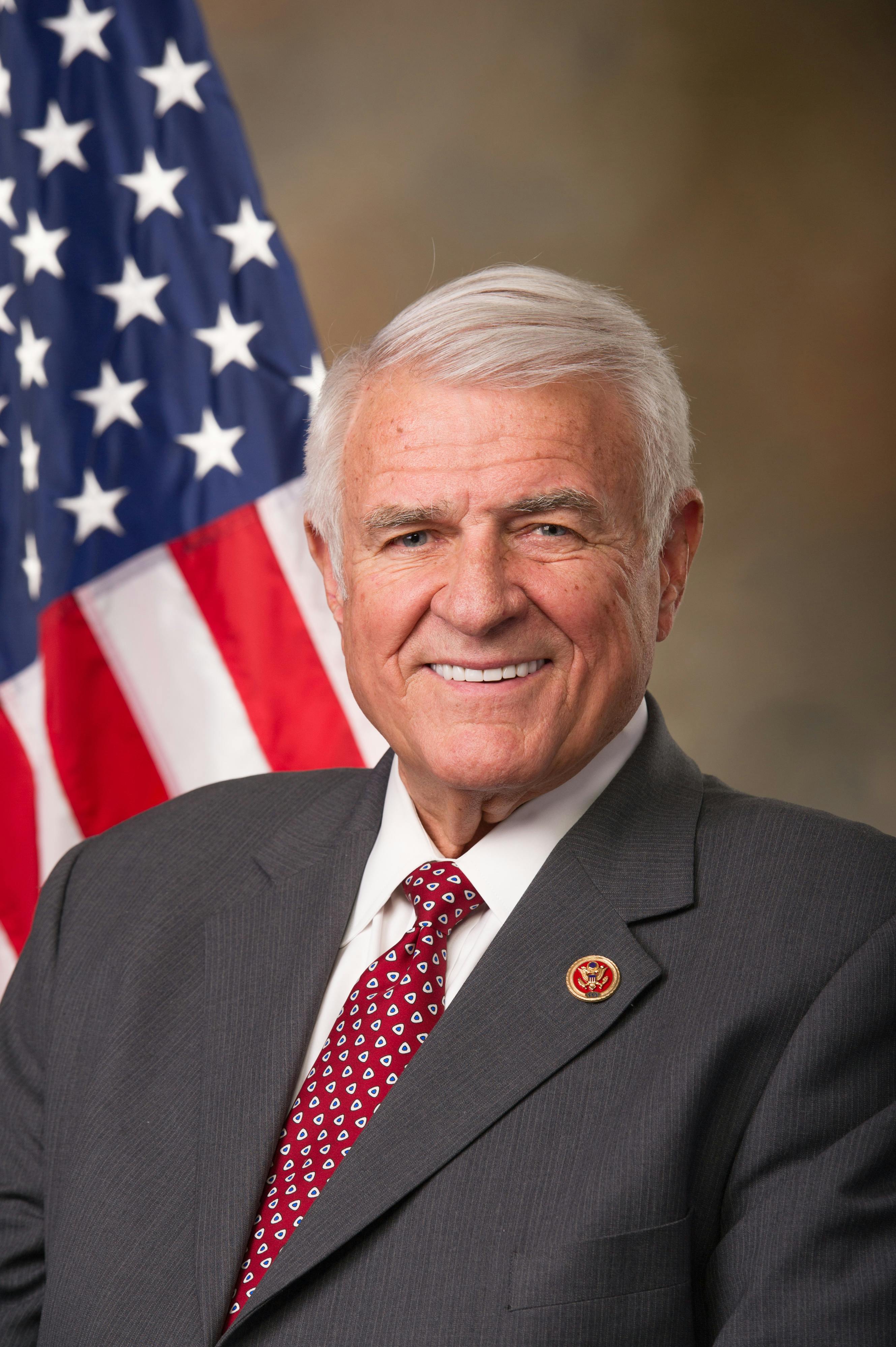

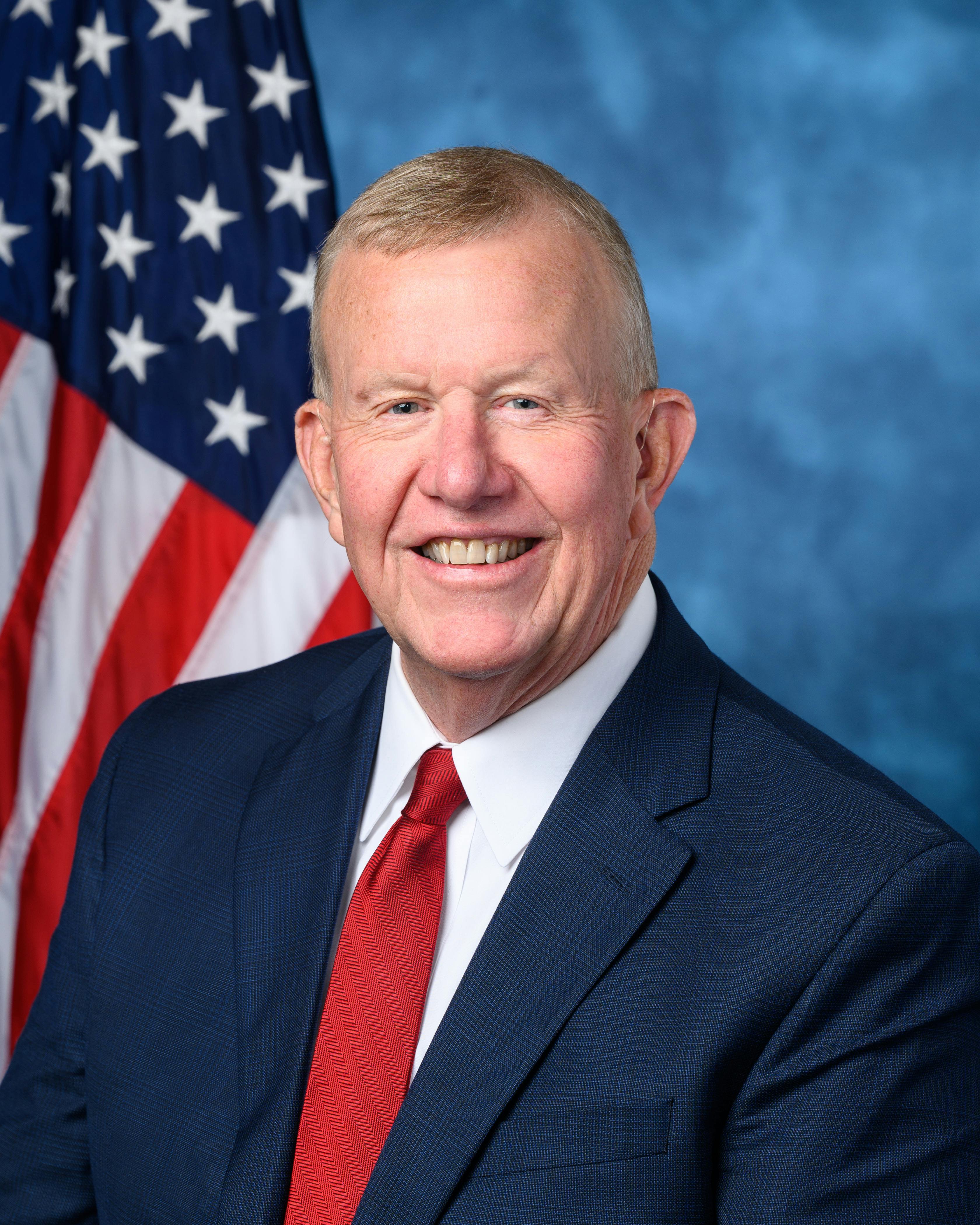

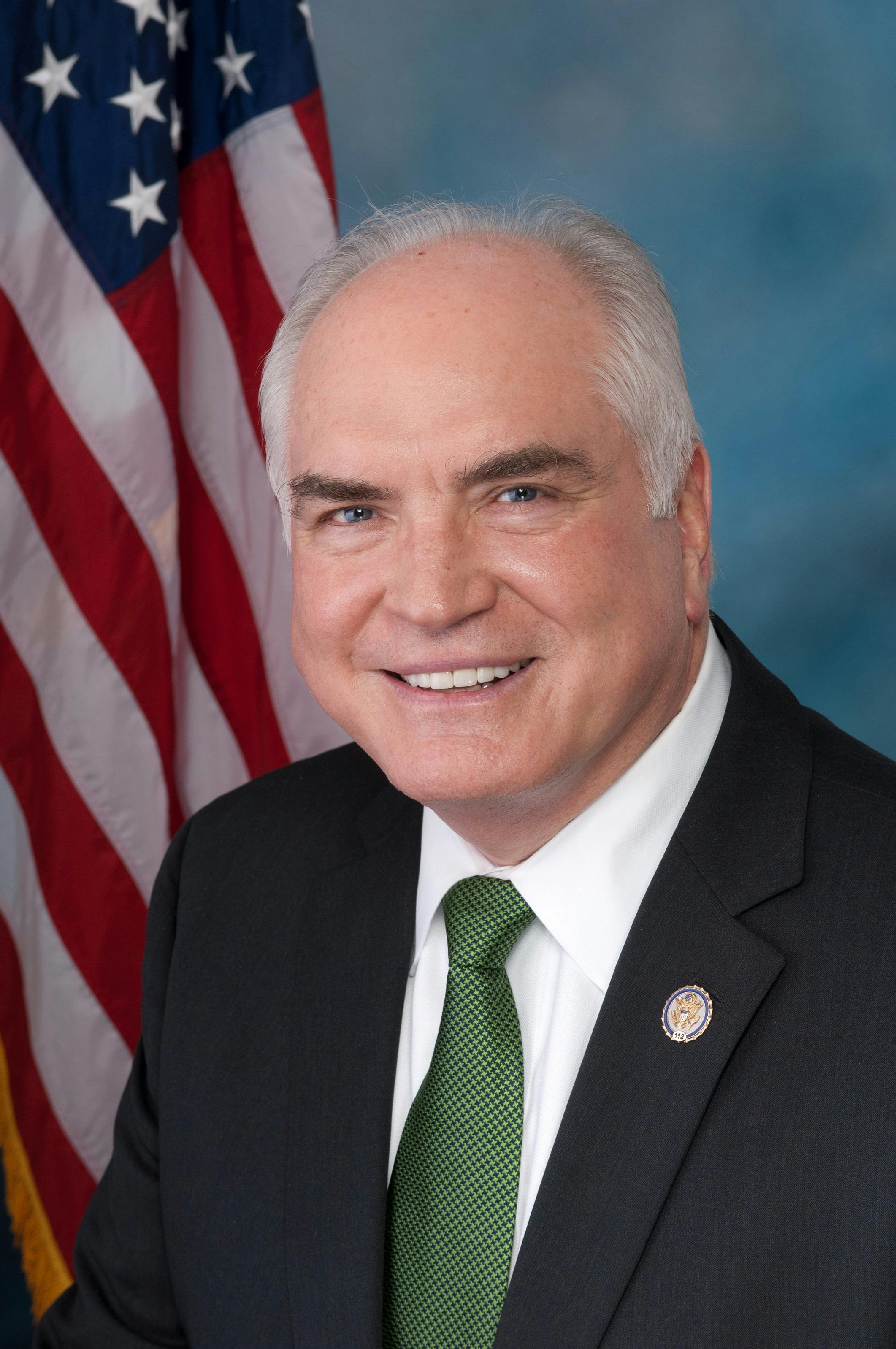

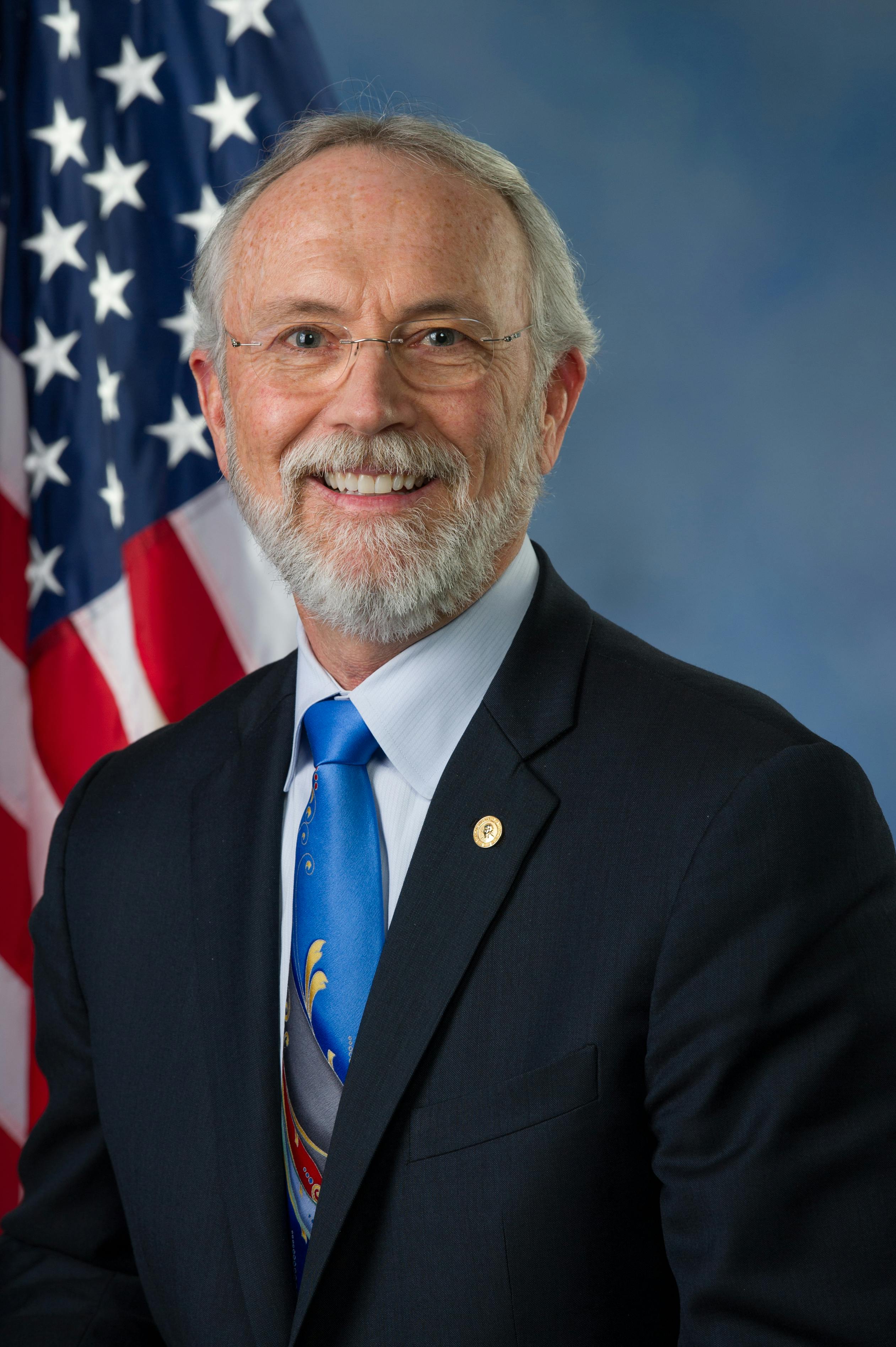

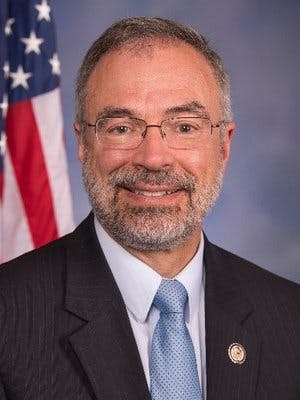

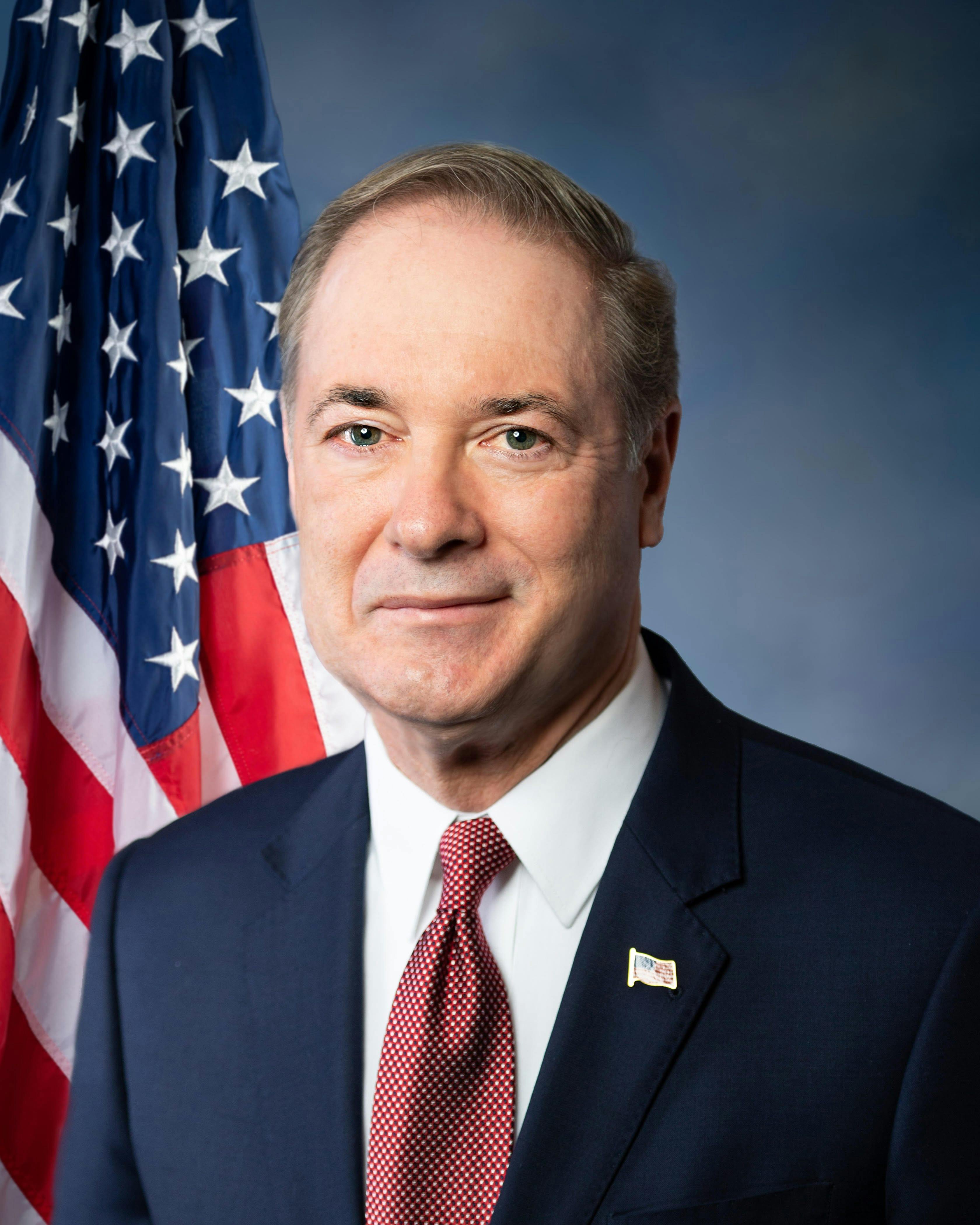

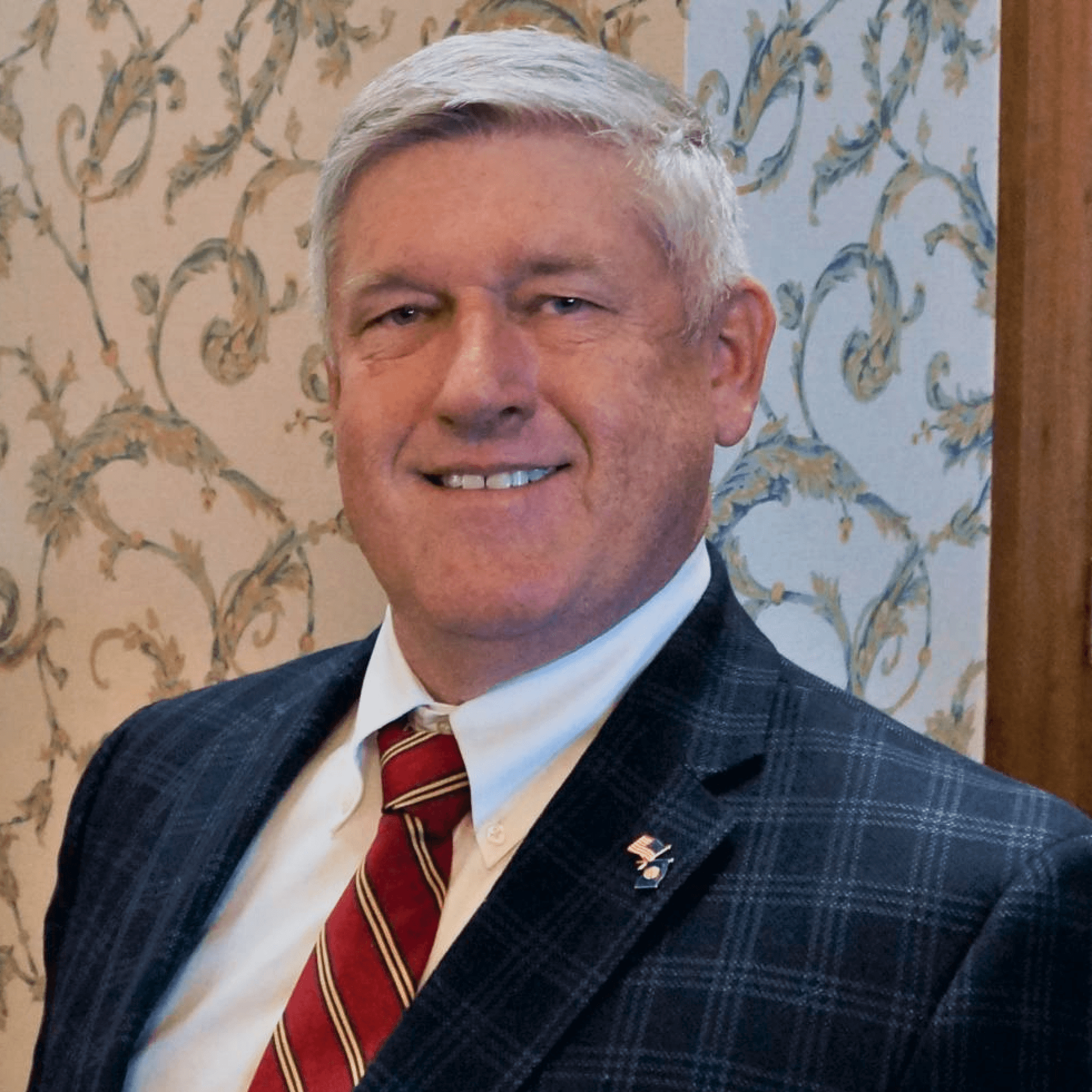

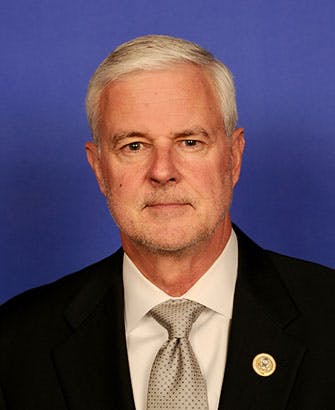

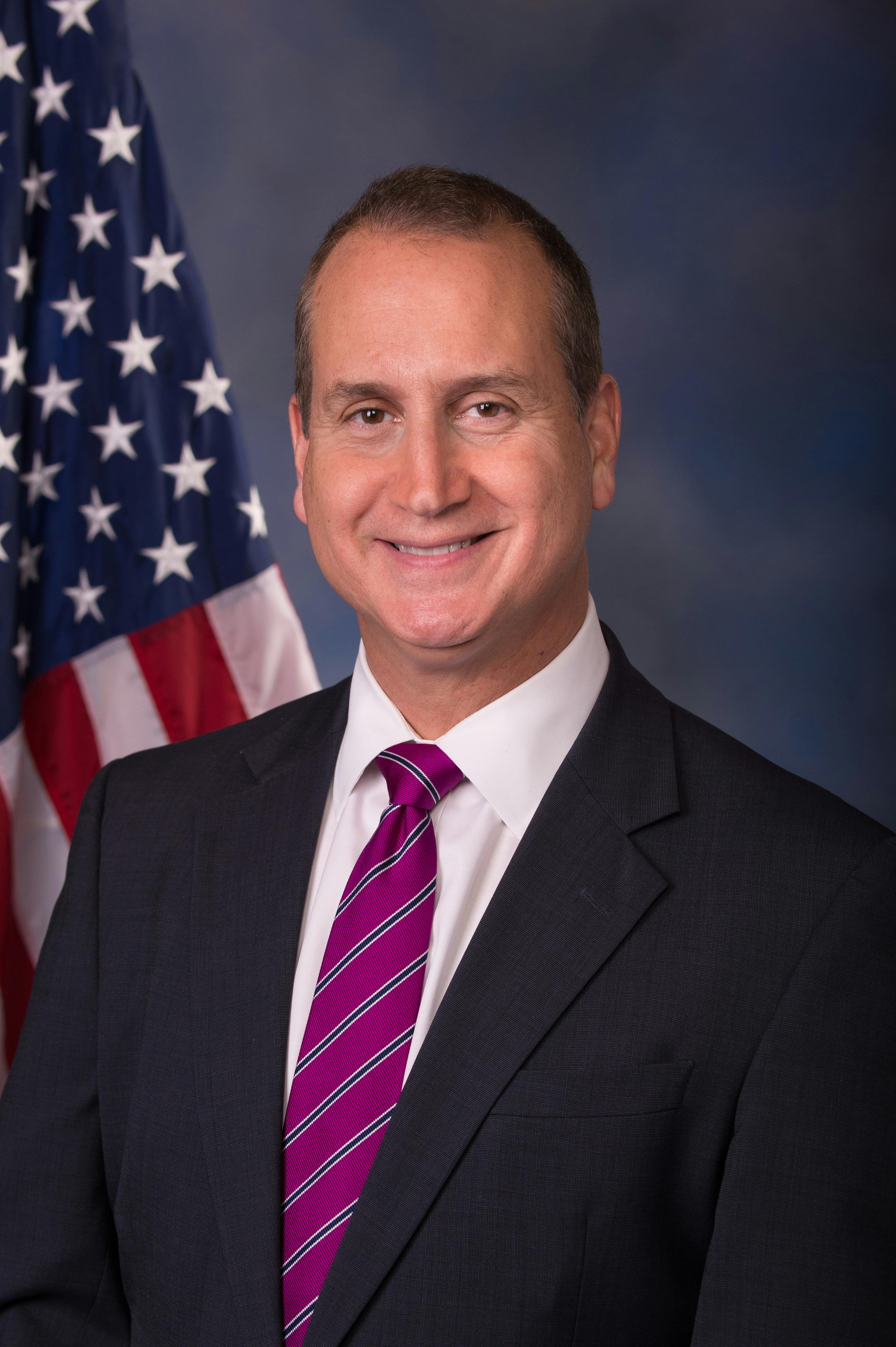

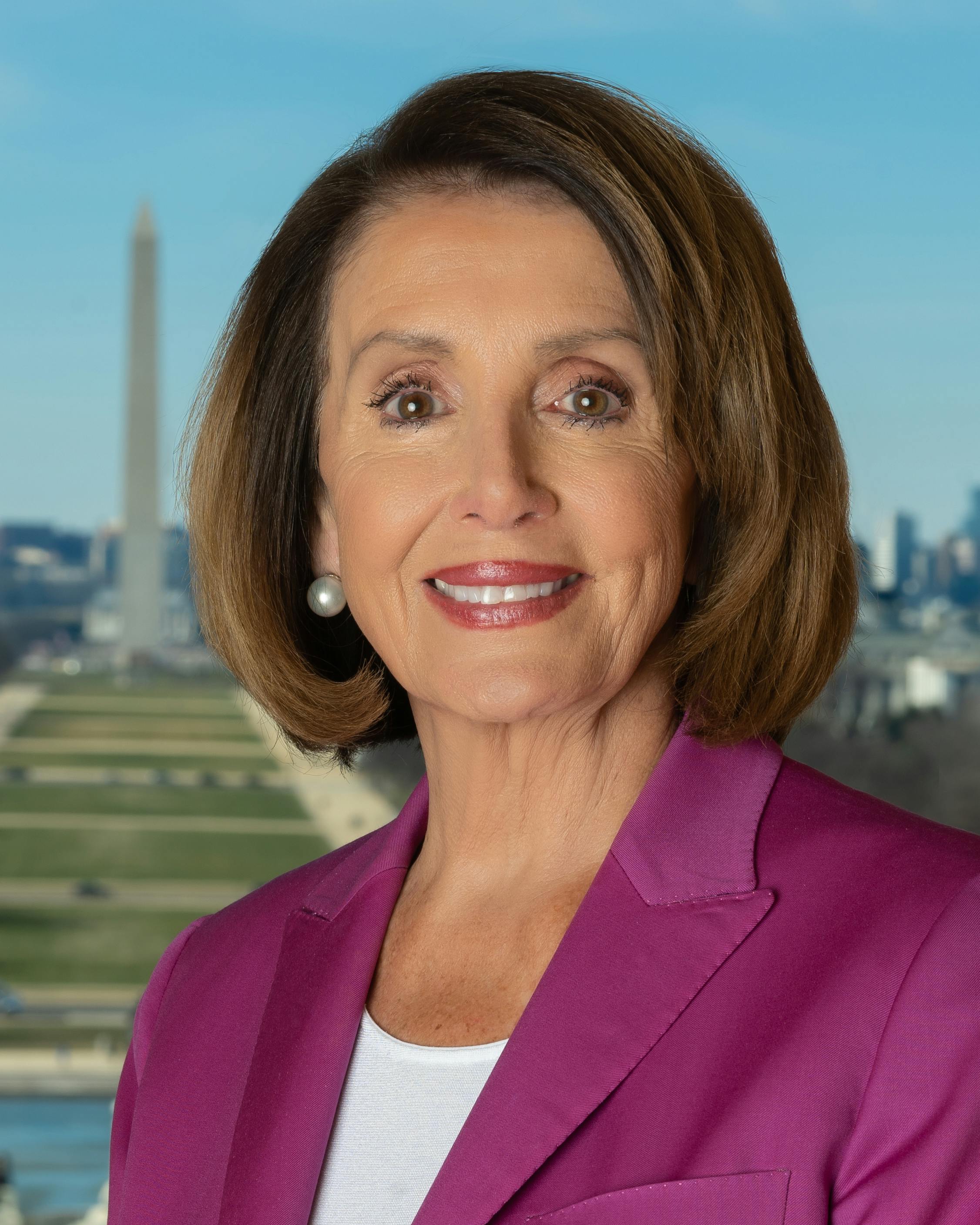

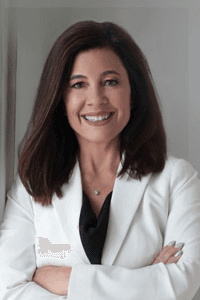

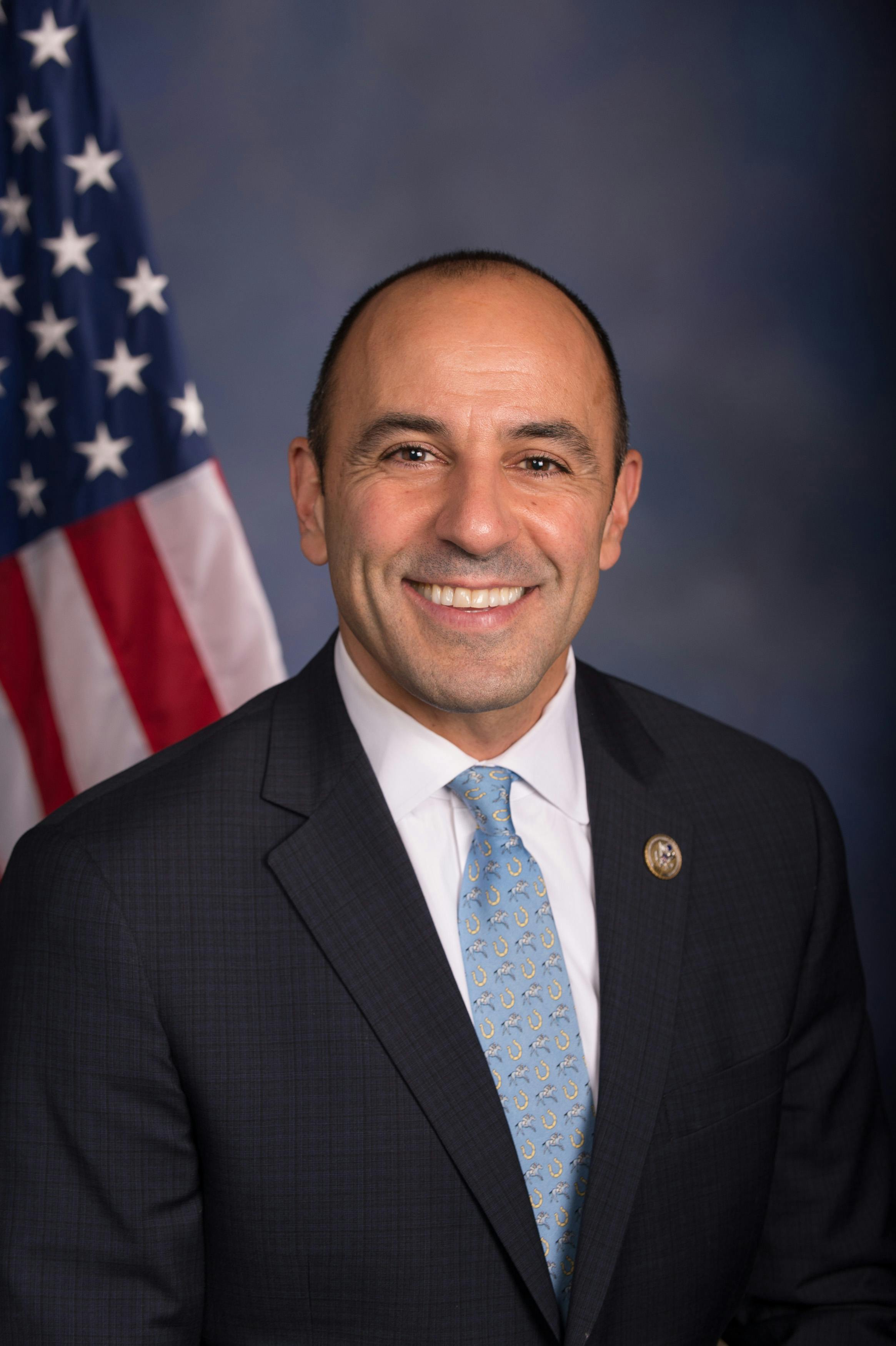

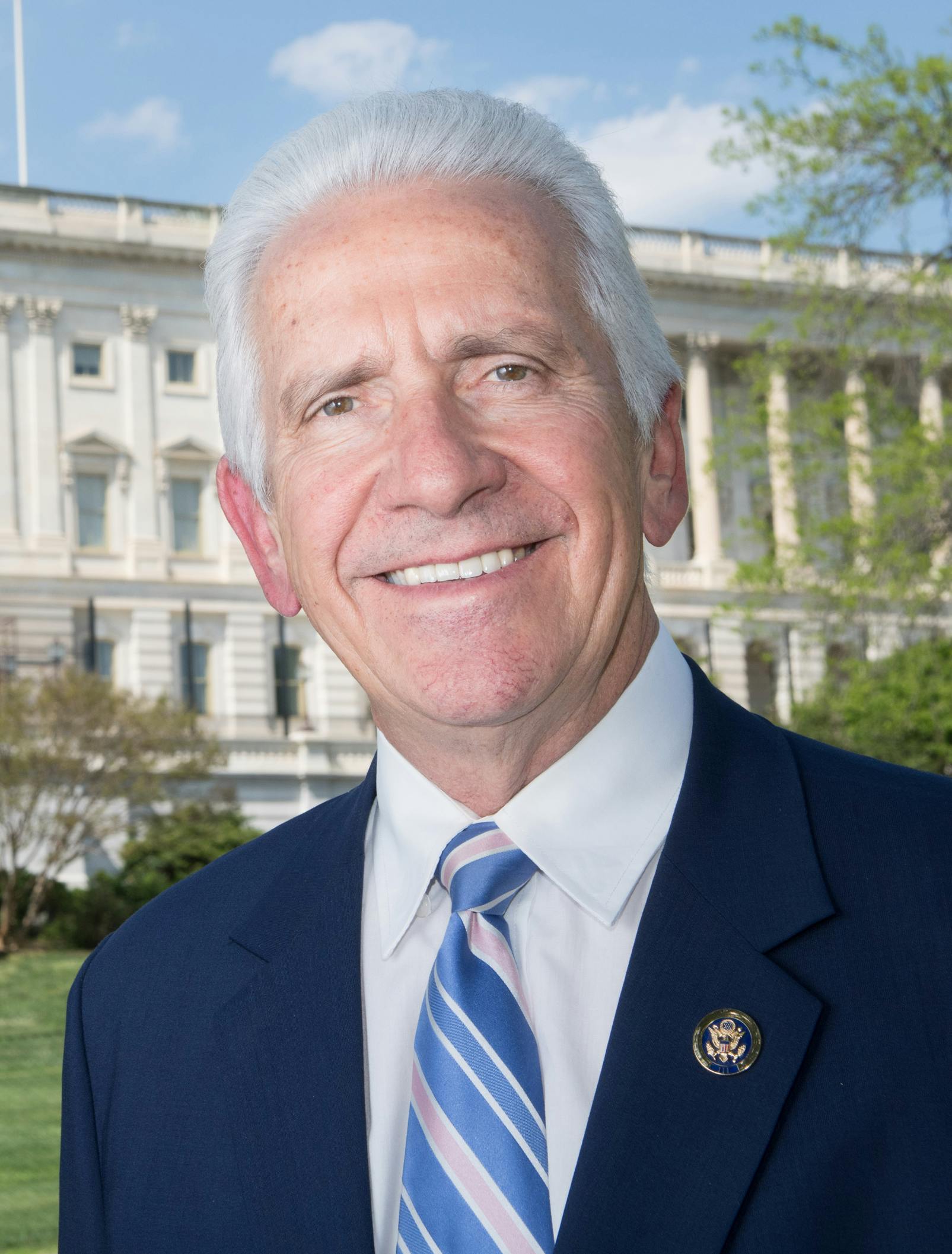

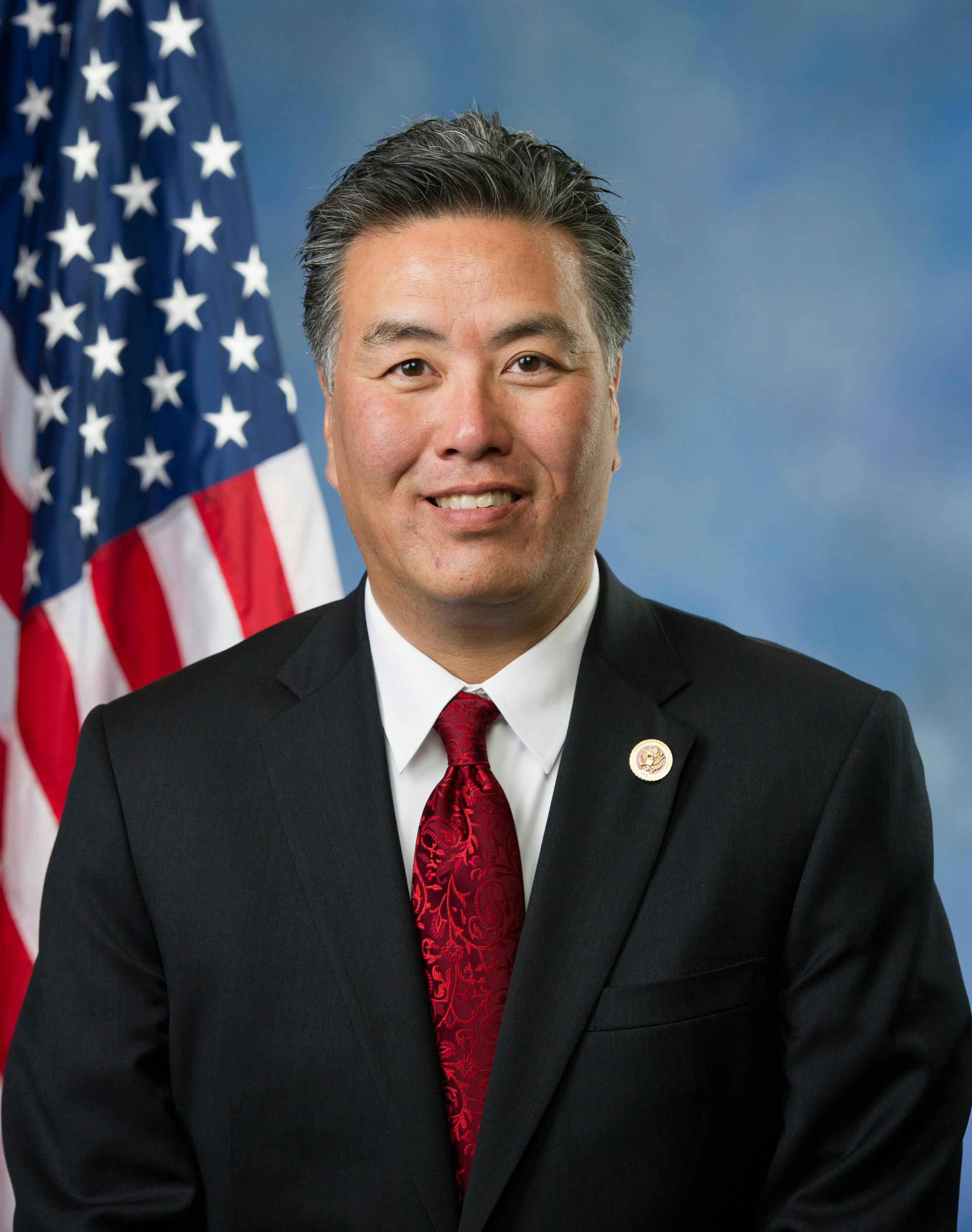

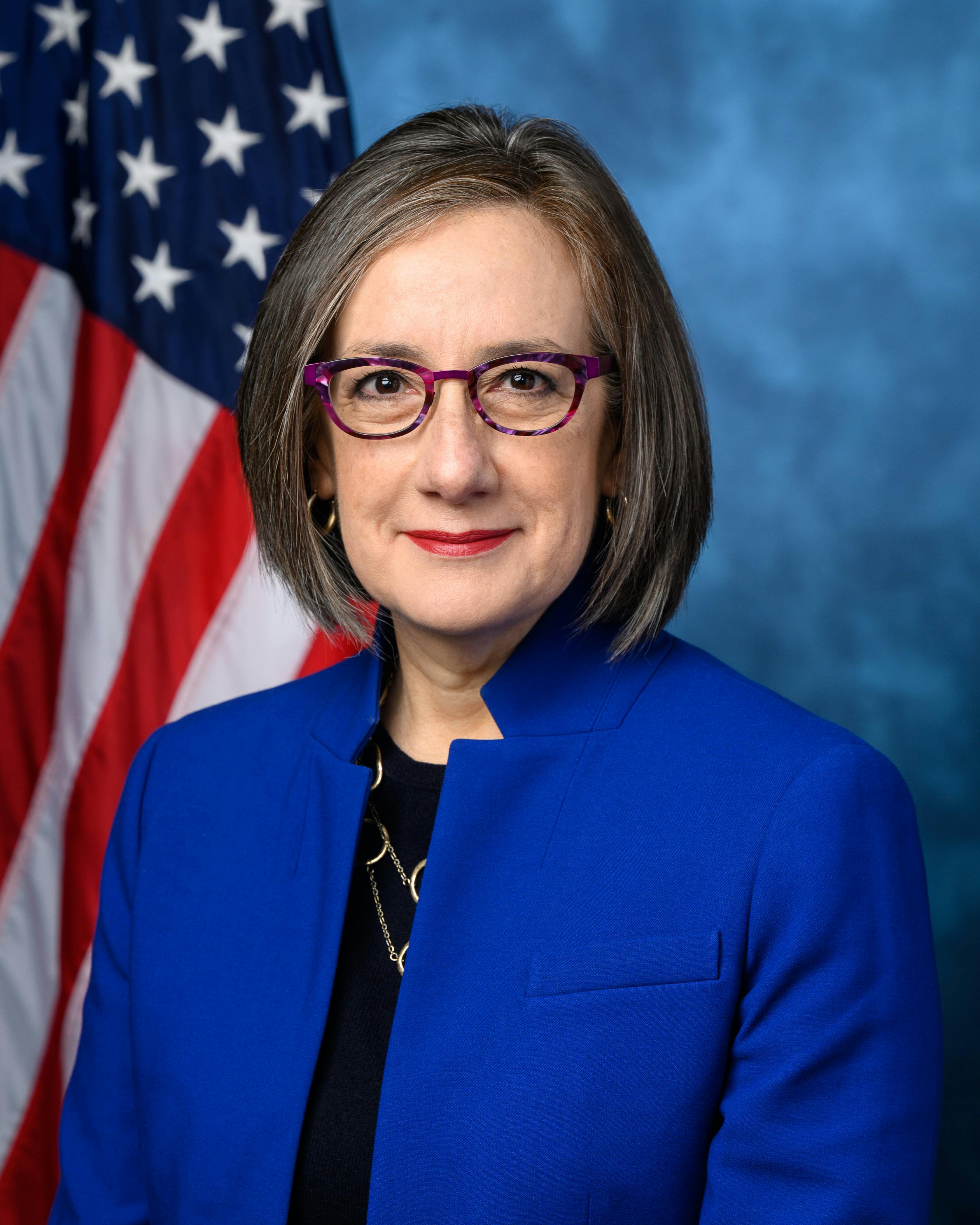

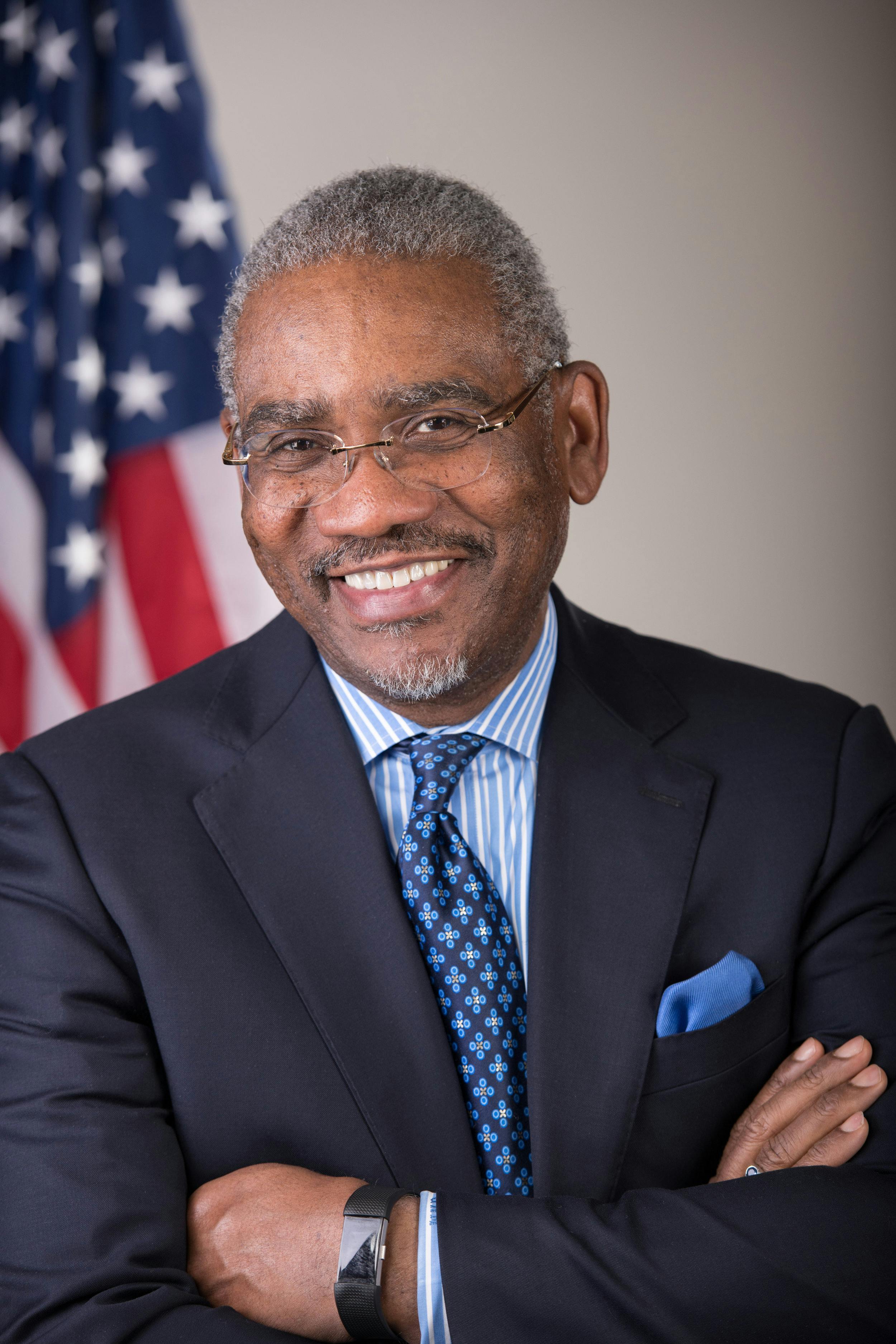

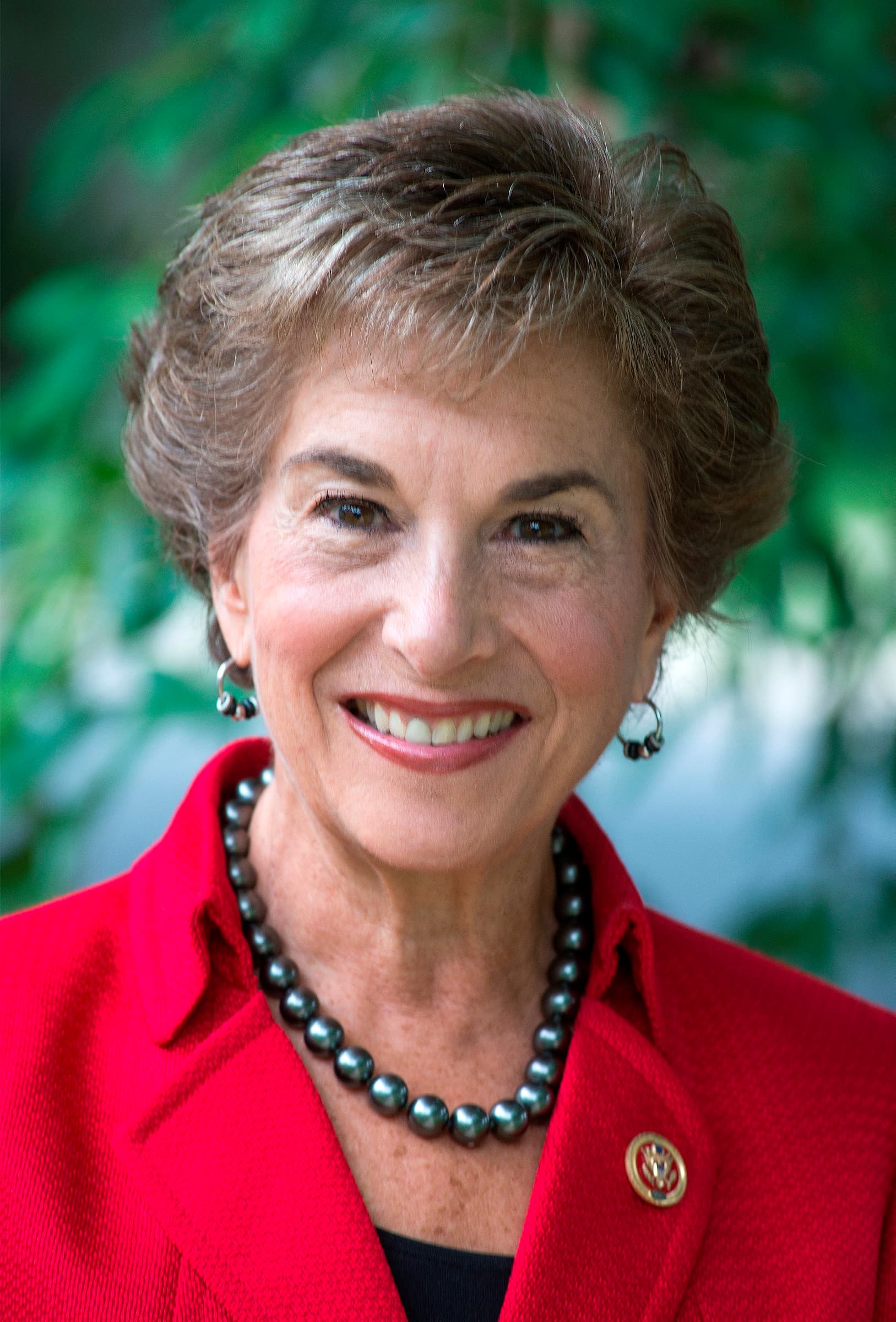

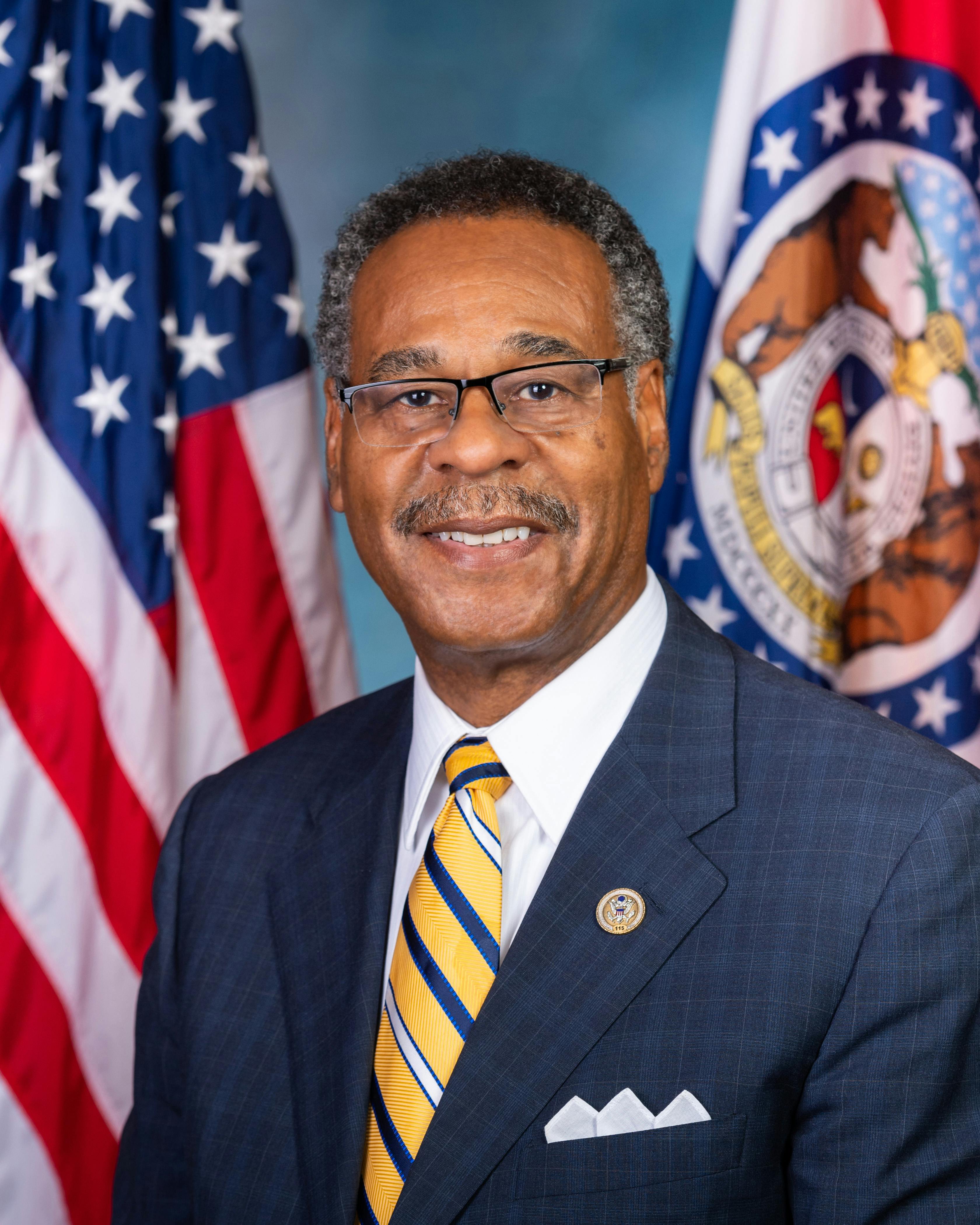

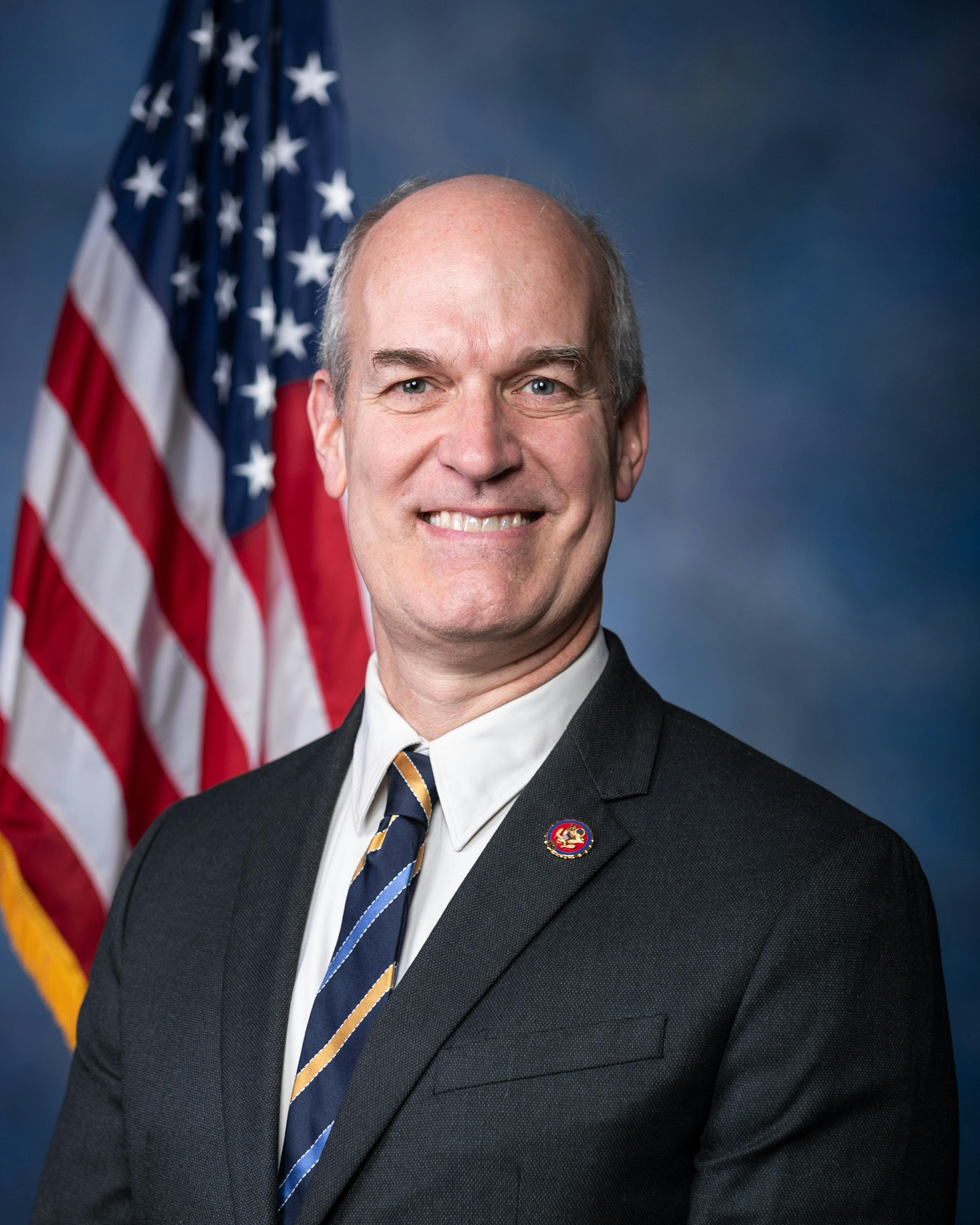

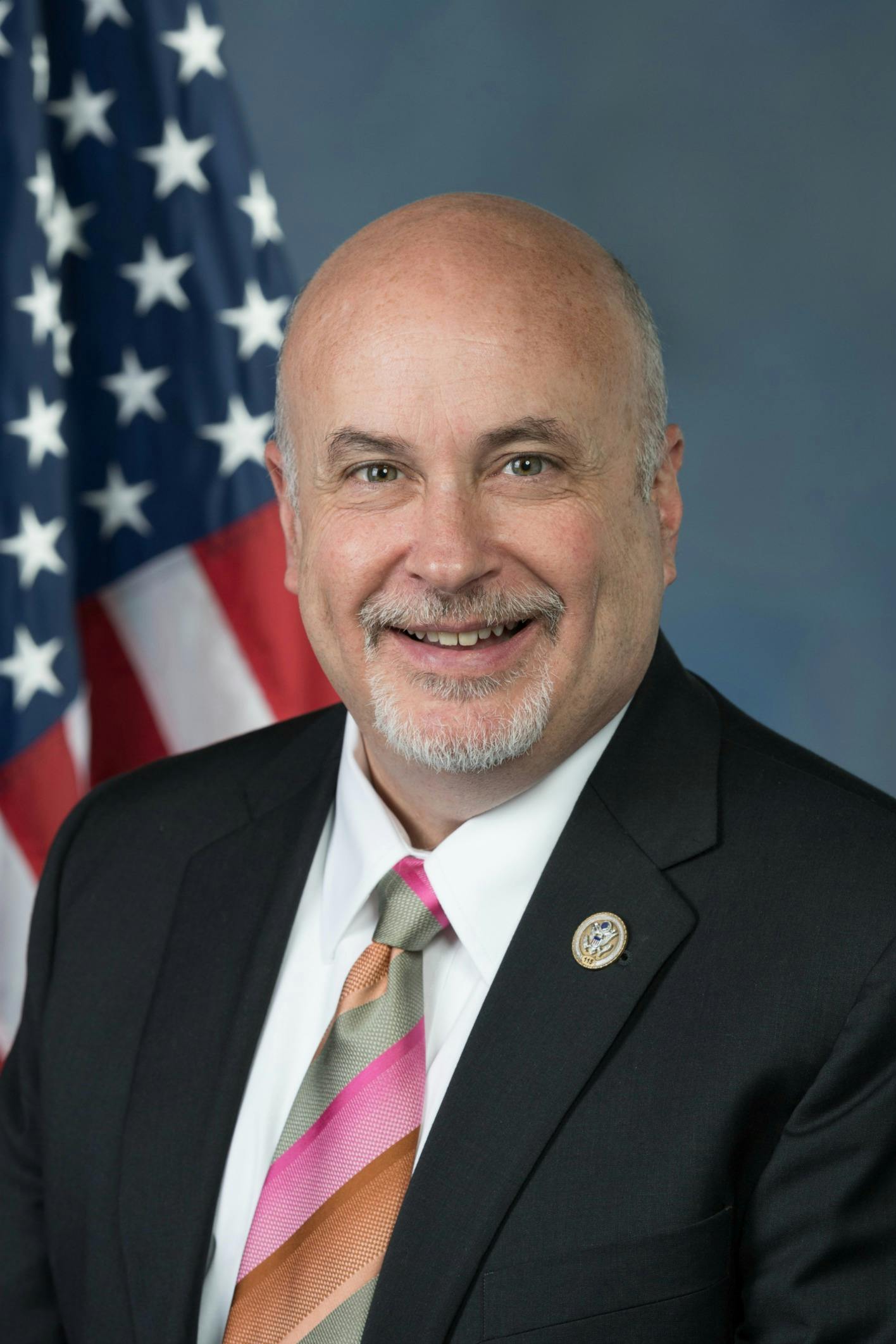

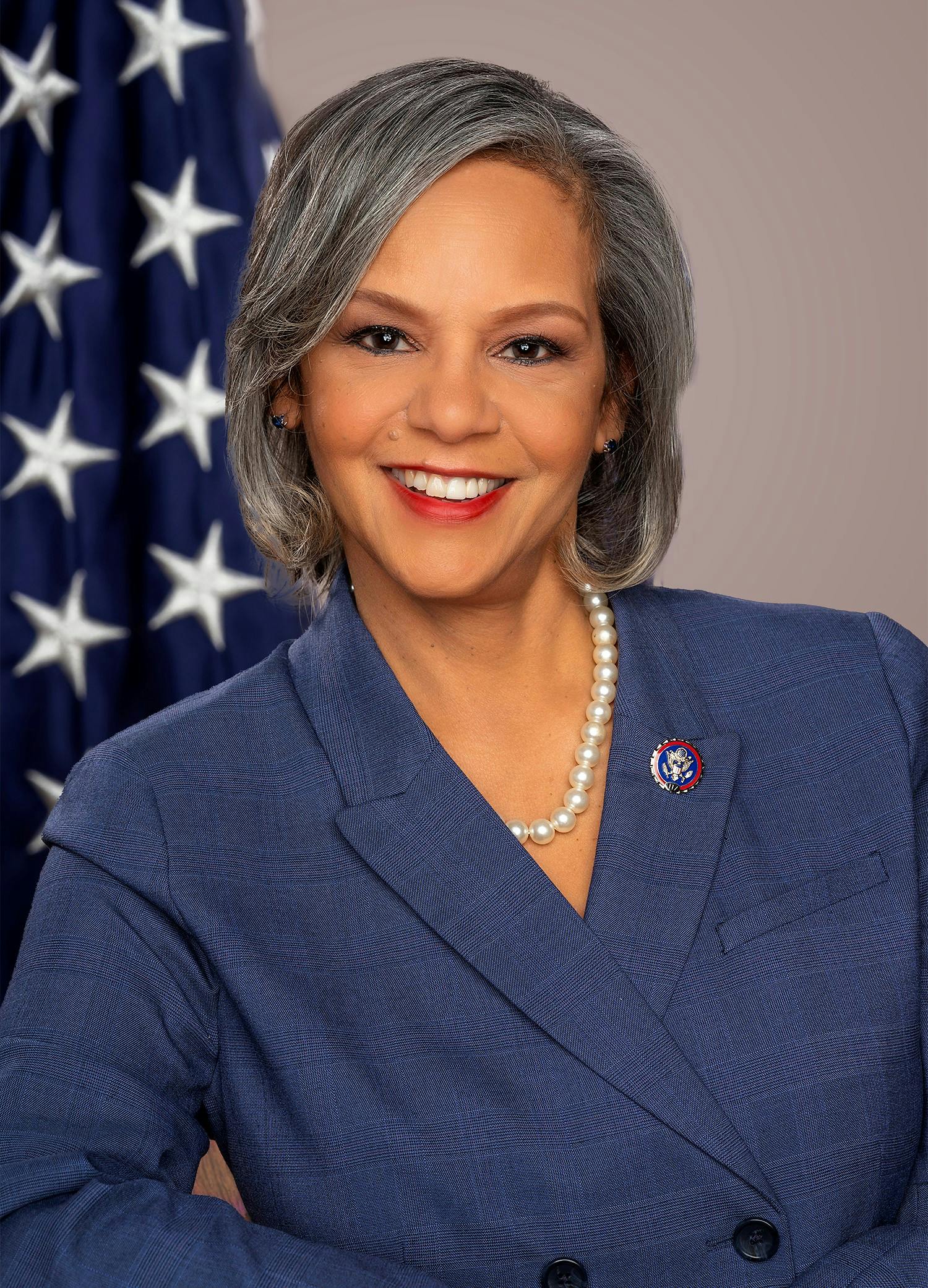

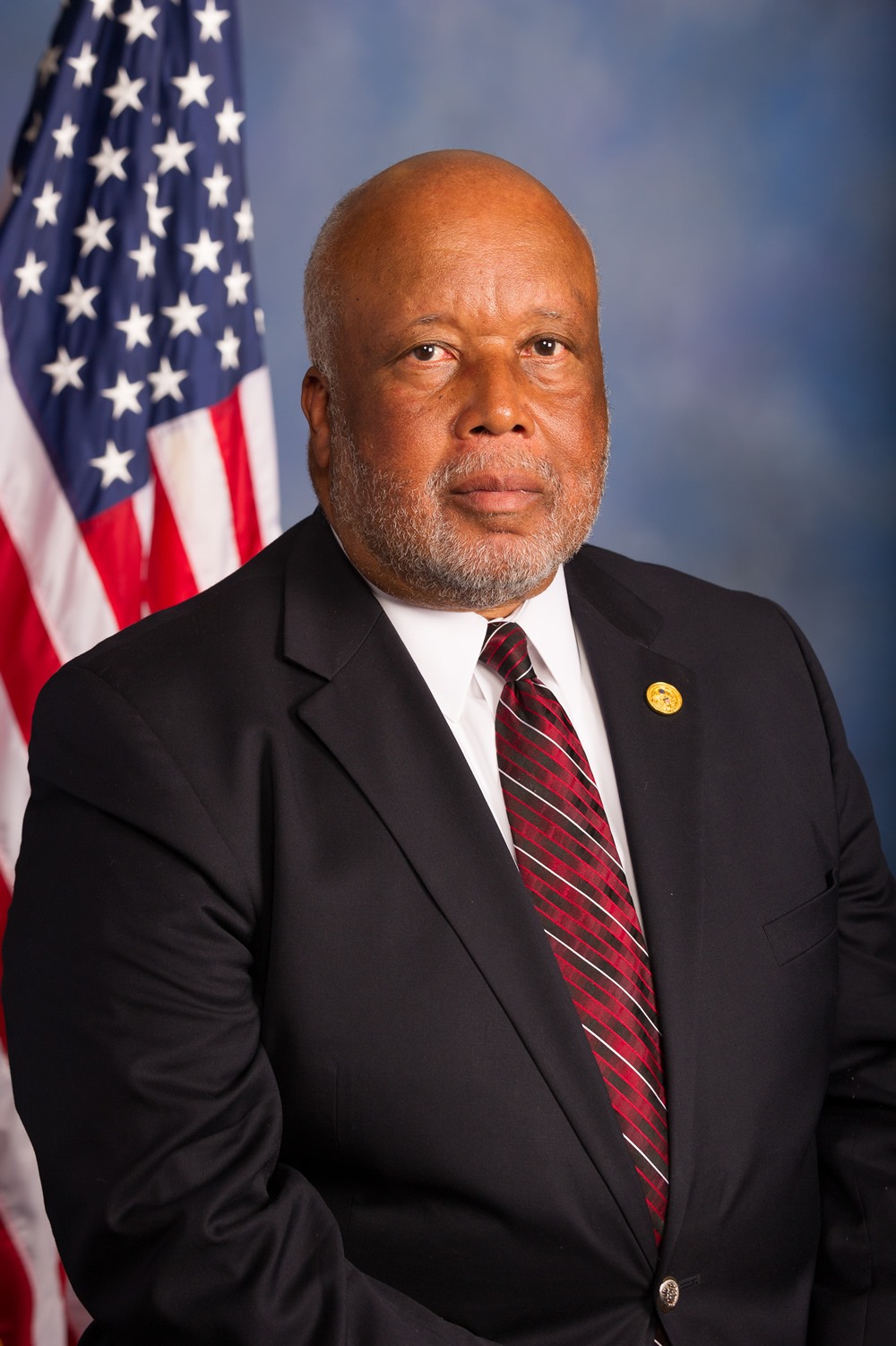

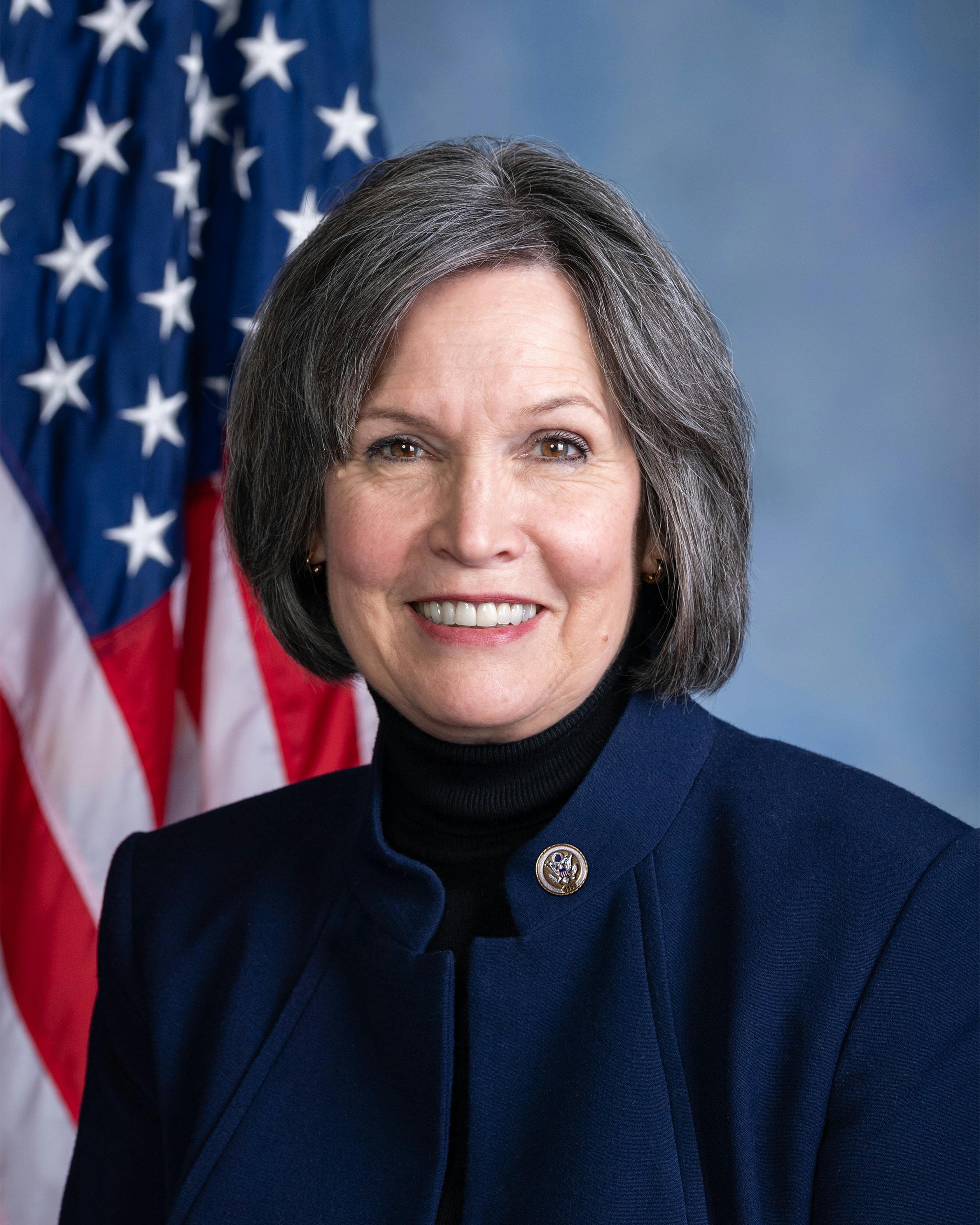

Congress members who support this bill

Cosponsors

Voted For

Republicans

Democrats

Voted Against

Additional Analysis

No additional analysis for this bill yet

.jpeg&w=3840&q=75)